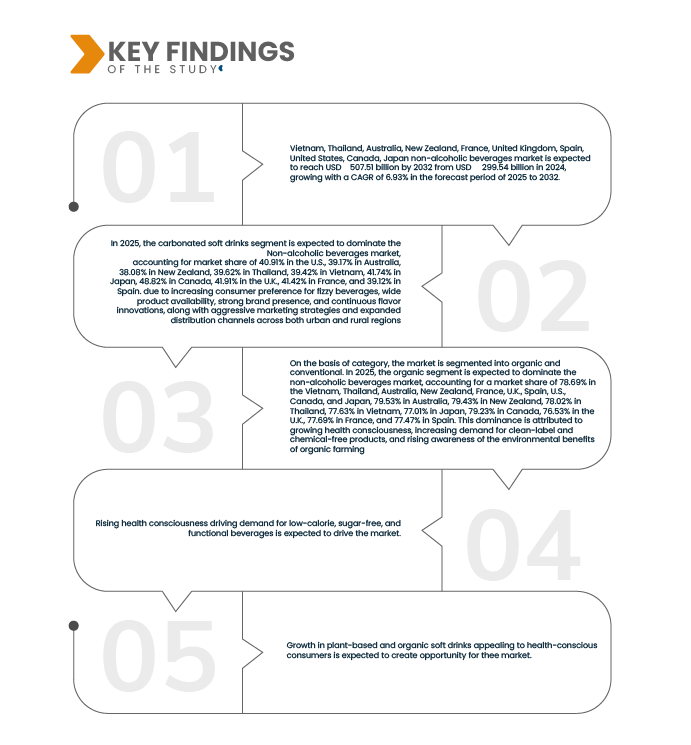

Rising health consciousness is playing a pivotal role in driving the demand for low-calorie, sugar-free, and functional beverages worldwide. Increasing awareness about lifestyle-related diseases such as obesity, type 2 diabetes, and heart conditions has led consumers to re-evaluate their dietary habits, particularly their sugar and calorie intake. This trend is especially pronounced among urban populations, fitness enthusiasts, and younger demographics such as millennials and Gen Z, who are actively seeking beverages that align with their wellness goals.

The shift toward preventive healthcare and clean-label consumption has fuelled the demand for beverages that go beyond simple hydration. Consumers are now opting for products that are sugar-free, low in calories, and fortified with health-promoting ingredients such as vitamins, antioxidants, probiotics, and adaptogens. Functional beverages, including electrolyte drinks, herbal teas, plant-based drinks, and probiotic waters, are increasingly recognized as essential components of a healthy lifestyle.

Access Full Report @ https://www.databridgemarketresearch.com/reports/vietnam-thailand-australia-new-zealand-france-uk-spain-us-canada-and-japan-non-alcoholic-beverages-market

Data Bridge market research analyzes that The Vietnam, Thailand, Australia, New Zealand, France, U.K., Spain, U.S., Canada, and Japan Non-Alcoholic Beverages Market is expected to reach USD 507.51 Billion by 2032 from USD 299.54 Billion in 2024, growing with a substantial CAGR of 6.9% in the forecast period of 2025 to 2032.

Key Findings of the Study

Rising Urbanization and Evolving Lifestyles Driving Demand for Ready-To-Drink Beverages

Rapid urbanization has significantly transformed consumer lifestyles, marked by busier schedules, longer commutes, and the rise of dual-income households. With limited time for traditional meal preparation, consumers are increasingly turning to convenient, on-the-go options. Non-alcoholic ready-to-drink (RTD) beverages have emerged as a preferred choice, offering instant hydration and nutrition without the need for preparation.

Today’s modern consumers—especially millennials and Gen Z—seek products that seamlessly blend functionality, health benefits, and convenience. A wide array of non-alcoholic RTD options, including bottled juices, iced teas, coffees, dairy-based drinks, plant-based alternatives, and functional wellness beverages, caters to these evolving preferences. These products are often available in portable packaging with extended shelf life, making them ideal for consumption at home, during commutes, or at the gym.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2025 to 2032

|

|

Base Year

|

2024

|

|

Historic Years

|

2023 (Customizable to 2018-2022)

|

|

Quantitative Units

|

Revenue in USD Billion

|

|

Segments Covered

|

Type (Carbonated Soft Drinks, Bottled Water, Juice-Based Beverages, Coffee and Tea-Based Beverages, Functional Beverages, Dairy-Based Beverages, Plant-Based Beverages, Non-Alcoholic Spirits & Mocktails), Category (Organic and Conventional), Product Type (Ready To Drink and Powdered), Packaging Type (Bottles, Cans, Tetra Packs, Pouches, Bag-In-Box, Miniature Bottles, Concentrate Bottles, and Others), Age Group (Teens (13–18 Years), Young Adults (19–35 Years), Adults (36–55 Years), Seniors (56+ Years), and Others), Functional Need (Social Substitutes For Alcohol, Energy, Relaxation & Sleep, Gut Health, Hydration, Mood Enhancement, Recovery, Immunity Support, Anti-Aging/Beauty, Weight Management, Luxury/Indulgent Experience, and Others), Certification & Labeling (Vegan, Sugar-Free, Clean Label, Gluten-Free, Non-GMO, No Artificial Flavors, Organic, Kosher, Halal, Fair Trade, and Others), Price Range (Mass (<USD 1.00), Mid-Range (USD 1.00–4.99), Premium (USD 5.00–9.99), and Luxury (USD 25.00+)), Brand( Branded and Private Label), Distribution Channel (Off-Trade, On-Trade, and Others)

|

|

Countries Covered

|

Vietnam, Thailand, Australia, New Zealand, France, U.K., Spain, U.S., Canada, and Japan

|

|

Market Players Covered

|

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

|

Segment Analysis

The Vietnam, Thailand, Australia, New Zealand, France, U.K., Spain, U.S., Canada, and Japan Non-Alcoholic Beverages Market is segmented into Ten notable segments based on type, category, product type, packaging type, age group, functional need, certification & labeling, price range, brand and distribution channel.

- On the basis of type, the market is segmented into carbonated soft drinks, bottled water, juice-based beverages, coffee and tea-based beverages, functional beverages, dairy-based beverages, plant-based beverages, non-alcoholic spirits & mocktails.

In 2025, the carbonated soft drinks segment is expected to dominate the market

In 2025, the carbonated soft drinks segment is expected to dominate the Non-alcoholic beverages market, accounting for market share of 40.91% in the U.S., 39.17% in Australia, 38.08% in New Zealand, 39.62% in Thailand, 39.42% in Vietnam, 41.74% in Japan, 48.82% in Canada, 41.91% in the U.K., 41.42% in France, and 39.12% in Spain. due to increasing consumer preference for fizzy beverages, wide product availability, strong brand presence, and continuous flavor innovations, along with aggressive marketing strategies and expanded distribution channels across both urban and rural regions.

- On the basis of category, the market is segmented into organic and conventional.

In 2025, the organic segment is expected to dominate the market

In 2025, the organic segment is expected to dominate the non-alcoholic beverages market, accounting for a market share of 78.69% in the Vietnam, Thailand, Australia, New Zealand, France, U.K., Spain, U.S., Canada, and Japan, 79.53% in Australia, 79.43% in New Zealand, 78.02% in Thailand, 77.63% in Vietnam, 77.01% in Japan, 79.23% in Canada, 76.53% in the U.K., 77.69% in France, and 77.47% in Spain. This dominance is attributed to growing health consciousness, increasing demand for clean-label and chemical-free products, and rising awareness of the environmental benefits of organic farming.

- On the basis of product type, the market is segmented into ready to drink and powdered.

In 2025, the ready to drink segment is expected to dominate the market

In 2025, the ready to drink segment is expected to dominate the non-alcoholic beverages market, accounting for a market share of 88.67% in the U.S., 85.69% in Australia, 89.16% in New Zealand, 83.61% in Thailand, 83.25% in Vietnam, 77.36% in Japan, 89.04% in Canada, 76.76% in the U.K., 77.94% in France, and 77.71% in Spain. due to rising demand for convenience, busy lifestyles, and the increasing availability of functional beverage options

- On the basis of packaging type, the market is segmented into bottles, cans, tetra packs, pouches, bag-in-box, miniature bottles, concentrate bottles, and others.

In 2025, the bottles segment is expected to dominate the market

In 2025, the bottles segment is expected to dominate the non-alcoholic beverages market, accounting for a market share of 45.06% in the U.S., 45.35% in Australia, 47.78% in New Zealand, 46.73% in Thailand, 45.10% in Vietnam, 48.44% in Japan, 46.70% in Canada, 47.04% in the U.K., 50.40% in France, and 49.39% in Spain. due to their widespread availability, cost-effectiveness, reusability, and compatibility with various beverage types. Additionally, increasing demand for PET bottles driven by convenience and lightweight packaging further contributes to the segment’s leading market share.

- On the basis of age group, the market is segmented into Young Adults (19–35 Years), Adults (36–55 Years), Teens (13–18 Years), Seniors (56+ Years).

In 2025, the Young Adults (19–35 Years) segment is expected to dominate the market

In 2025, the Young Adults (19–35 Years) segment is expected to dominate the non-alcoholic beverages market, accounting for a market share of 50.89% in the U.S., 50.47% in Australia, 52.47% in New Zealand, 53.16% in Thailand, 51.79% in Vietnam, 53.19% in Japan, 51.93% in Canada, 52.11% in the U.K., 54.50% in France, and 53.96% in Spain. due to increasing consumption of trendy and flavored beverages, strong influence of social media marketing, growing preference for convenient and ready-to-drink options, and rising awareness of health and functional drink benefits.

- On the basis of functional need, the market is segmented into social substitutes for alcohol, energy, relaxation & sleep, gut health, hydration, mood enhancement/focus enhancement drinks, recovery, immunity support, anti-aging / beauty, weight management, luxury/indulgent experience, and others.

In 2025, the social substitutes for alcohol segment are expected to dominate the market

In 2025, the social substitutes for alcohol segment is expected to dominate the non-alcoholic beverages market, accounting for a market share of 20.31% in the U.S., 25.77% in Australia, 25.95% in New Zealand, 30.12% in Thailand, 28.18% in Vietnam, 30.12% in Japan, 22.80% in Canada, 28.08% in the U.K., 36.32% in France, and 33.41% in Spain. due to growing health consciousness, increasing demand for mindful drinking alternatives, rise in sober-curious consumers, and the popularity of non-alcoholic options that replicate the social experience of alcohol.

- On the basis of certification & labeling, the market is segmented into vegan, sugar-free, clean label, gluten-free, non-GMO, no artificial flavors, organic, kosher, halal, fair trade, and others.

In 2025, the vegan segment is expected to dominate the market

In 2025, the vegan segment is expected to dominate the non-alcoholic beverages market, accounting for a market share of 25.98% in the U.S., 32.14% in Australia, 29.89% in New Zealand, 35.96% in Thailand, 34.07% in Vietnam, 35.51% in Japan, 27.62% in Canada, 33.86% in the U.K., 39.87% in France, and 37.83% in Spain. due to rising consumer demand for transparency, increasing preference for minimally processed ingredients, and growing awareness regarding the health impact of synthetic additives and preservatives.

- On the basis of price range, the market is segmented into Mid-Range (USD 1.00–4.99). Premium (USD 5.00–9.99), Luxury (USD 25.00+), Mass (<USD 1.00).

In 2025, the Mid-Range (USD 1.00–4.99) segment is expected to dominate the market

In 2025, the Mid-Range (USD 1.00–4.99) segment is expected to dominate the non-alcoholic beverages market, accounting for a market share of 60.08% in the U.S., 45.60% in Australia, 61.70% in New Zealand, 49.10% in Thailand, 47.30% in Vietnam, 48.35% in Japan, 61.24% in Canada, 46.75% in the U.K., 49.34% in France, and 48.75% in Spain. due to its affordability, wide consumer base, and strong presence across both retail and online distribution channels.

- On the basis of brand, the market is segmented into branded and private-label.

In 2025, the branded segment is expected to dominate the market

In 2025, the branded segment is expected to dominate the non-alcoholic beverages market, accounting for a market share of 84.47% in the U.S., 82.79% in Australia, 84.82% in New Zealand, 81.48% in Thailand, 80.83% in Vietnam, 83.72% in Japan, 84.82% in Canada, 83.14% in the U.K., 83.56% in France, and 83.49% in Spain. due to strong consumer trust, consistent product quality, wide brand recognition, and aggressive marketing and promotional strategies by key players.

- On the basis of distribution channel, the market is segmented into off-trade, on-trade, and others.

In 2025, the off-trade segment is expected to dominate the market

In 2025, the off-trade segment is expected to dominate the non-alcoholic beverages market, accounting for a market share of 72.53% in the U.S., 72.42% in Australia, 73.71% in New Zealand, 71.84% in Thailand, 70.92% in Vietnam, 75.18% in Japan, 73.43% in Canada, 74.45% in the U.K., 75.75% in France, and 75.62% in Spain. due to the growing popularity of at-home consumption, expansion of retail chains, and increasing availability of functional beverages through supermarkets, convenience stores, and online platforms.

Major Players

Coca Cola Company (U.S.), PepsiCo (U.S.), Kraft Heinz (U.S.), ASAHI GROUP HOLDINGS, LTD. (Japan), SUNTORY HOLDINGS LIMITED (Japan), Unilever (U.K./Netherlands), KEURIG DR PEPPER INC. (U.S.), Monster Energy Company (U.S.), Nestlé (Switzerland), Britvic Limited (U.K.), ITO EN, LTD. (Japan), F&N Foods Pte Ltd. (Singapore), Red Bull (Austria), Industries Lassonde inc (Canada), AJE group (Peru), Refresco Holding (Netherlands), Hint Inc. (U.S.), Hain Celestial (U.S.), Danone (France), National Beverage Corp. (U.S.), Polar Beverages (U.S.), AriZona Beverages USA (U.S.), AG Barr (U.K.), Parle Agro (India), Talking Rain Beverage Co. (U.S.), Ocean Spray (U.S.), Tata Consumer Products Limited (India), Spindrift Beverage Co (U.S.), Reed's, Inc. (U.S.), and Bai (U.S.) and among others.

Market Developments

- In January 2025, Red Bull introduced Red Bull Zero, a zero-sugar energy drink crafted with monk fruit and other natural sweeteners. Designed for health-conscious consumers, the new variant delivers the brand’s signature energy boost with a distinct, cleaner taste profile. This launch expands Red Bull’s non-alcoholic, sugar-free product portfolio.

As per Data Bridge Market Research analysis:

For more detailed information about the Vietnam, Thailand, Australia, New Zealand, France, U.K., Spain, U.S., Canada, and Japan Non-Alcoholic Beverages Market report, click here – https://www.databridgemarketresearch.com/reports/vietnam-thailand-australia-new-zealand-france-uk-spain-us-canada-and-japan-non-alcoholic-beverages-market