The growing demand for processed, frozen, and temperature-sensitive food products is driven by rapid urbanization, changing lifestyles, and rising consumer preference for convenience. As more people balance busy work schedules with limited time for meal preparation, ready-to-cook and ready-to-eat products have become increasingly popular. Frozen foods, in particular, offer longer shelf life without compromising nutritional value, making them a reliable choice for households and foodservice providers.

Additionally, advancements in food processing and cold-chain logistics have improved product quality, safety, and availability across regions. The expansion of supermarkets, online grocery platforms, and efficient delivery networks has further increased access to temperature-sensitive items such as dairy, meat, seafood, and specialty beverages. Health-focused consumers are also opting for minimally processed options that maintain freshness through refrigeration rather than preservatives. Together, these factors have created sustained growth for the processed and frozen food sector, encouraging manufacturers to innovate and invest in better preservation technologies to meet rising global demand.

Access Full Report @ https://www.databridgemarketresearch.com/reports/bangladesh-cold-chain-market

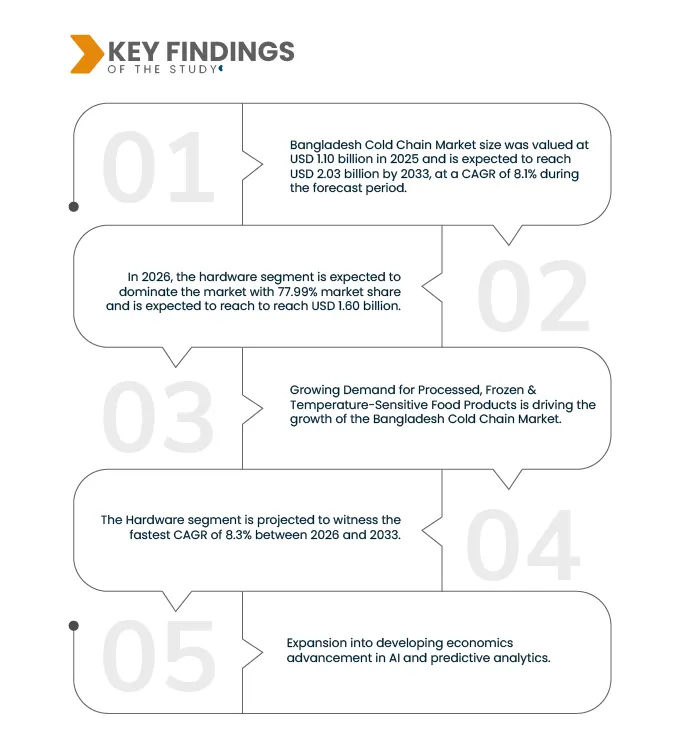

Data Bridge market research analyzes that The Bangladesh Cold Chain Market size was valued at USD 1.10 billion in 2025 and is expected to reach USD 2.03 billion by 2033, at a CAGR of 8.1% during the forecast period

Key Findings of the Study

Rising Export Potential for Seafood, Agri-Products & Frozen Foods

The rising export potential for seafood, agri-products, and frozen foods is being driven by strong global demand, improved supply-chain capabilities, and the increasing preference for high-quality, safe, and sustainably sourced food products. Many countries are expanding their import volumes as consumers seek diverse dietary options and year-round availability of items that may not be locally produced. Seafood exports are growing particularly fast due to heightened demand for protein-rich, healthy foods, supported by advancements in aquaculture and better quality-control systems. Similarly, agricultural products such as fruits, vegetables, grains, and spices are witnessing significant export growth as nations rely on global sourcing to meet seasonal shortages and rising consumption. The frozen food segment is also benefiting from innovations in freezing technologies that preserve taste, texture, and nutritional value, making these products more attractive to international buyers. Enhanced cold-chain logistics, modern processing facilities, and compliance with international safety standards have enabled exporters to maintain product integrity over long distances. At the same time, trade agreements and government incentives are opening new markets and reducing export barriers. E-commerce and international retail chains further boost visibility and accessibility for exporters. As a result, the combined export potential of seafood, agri-products, and frozen foods continues to rise, offering substantial opportunities for producers, processors, and global distributors.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2026 to 2033

|

|

Base Year

|

2025

|

|

Historic Years

|

2024 (Customizable to 2018-2023)

|

|

Quantitative Units

|

Revenue in USD Millions

|

|

Segments Covered

|

By Components (Hardware, Software), By Type Of Goods/Critical Attribute (Foodstuffs, General Goods, Dangerous Goods (Including Hazardous Chemicals), Others), By Temperature Type (Chilled, Frozen), By TECHNOLOGY (Vapor Compression, Programmable Logic Controller (PLC), Blast Freezing, Cryogenic Systems, Evaporative Cooling, Other Technologies), By Payload Size (Large (32–66 L), Medium (21–29 L), Small (10–17 L), X-Small (3–8 L), Petite (0.9–2.7 L), Others), By Operation ( Domestic, International), By Customer Type ( B2B, E-Commerce & Last-Mile Delivery, B2C), ), By Business Model (Asset-Based Carriers, Brokerage & 3PL, Others), By Distance ( 50 – 100 Miles, 101 – 200 Miles, 201 – 500 Miles, More Than 500 Miles), By Service type (Transportation, Warehousing And Distribution, Freight Forwarding, Others)

|

|

Countries Covered

|

Bangladesh

|

|

Market Players Covered

|

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

|

Segment Analysis

The Bangladesh Cold Chain Market is segmented into ten notable segments based on the Components, Type of Goods/Critical Attribute, Temperature Type, Technology, Payload Size, Operation, Customer Type, Business Model, Distance, Service Type

- On the basis of Components, the Cold Chain Market is segmented into Hardware and Software

In 2026, the Hardware segment is expected to dominate the market

In 2026, the hardware segment is expected to dominate the market with 77.99% share due to the increasing demand for advanced monitoring and control systems that ensure precise temperature and environmental management across the Cold Chain. The growing focus on food safety, pharmaceutical integrity, and efficient supply chain operations is driving investments in sophisticated hardware solutions such as refrigerated vehicles, IoT-enabled sensors, and data loggers.

- On the basis of Type of Goods/Critical Attribute, the Cold Chain Market is segmented into Foodstuffs, General Goods, Dangerous Goods (Including Hazardous Chemicals), Others

In 2026, the Foodstuffs segment is expected to dominate the market

In 2026, the Foodstuffs segment is expected to dominate the market with 58.28% share due to the rapid growth of Bangladesh’s agriculture and aquaculture sectors, increasing urban consumption of fresh and frozen foods, and rising consumer preference for safe, high-quality perishables. The expansion of modern retail formats including supermarkets, hypermarkets, and online grocery platforms has significantly increased the need for reliable temperature-controlled transport and storage.

- On the basis of Temperature Type, the Cold Chain Market is segmented into Chilled, Frozen

In 2026, the Chilled segment is expected to dominate the market

In 2026, the Chilled is expected to dominate the market with 58.31% share due to the growing demand for fresh agricultural produce, dairy products, beverages, and ready-to-eat foods that require controlled yet moderate temperature conditions rather than deep freezing. Bangladesh’s expanding urban population and the rapid rise of modern retail outlets—such as supermarkets, convenience stores, and quick-commerce platforms are driving higher consumption of fresh fruits, vegetables, milk, yogurt, juices, and other chilled items

- On the basis of Technology, the Cold Chain Market is segmented into Vapor Compression, Programmable Logic Controller (PLC), Blast Freezing, Cryogenic Systems, Evaporative Cooling, Other Technologies

In 2026, the Vapor Compression segment is expected to dominate the market

In 2026, the Vapor Compression segment is expected to dominate the market with 41.39% share adoption across cold storage warehouses, refrigerated trucks, and commercial refrigeration systems throughout Bangladesh. Vapor compression technology is preferred because it offers high energy efficiency, reliable cooling performance, and cost-effectiveness compared to advanced methods such as cryogenic or blast freezing, which require higher capital and operational expenses. The technology’s compatibility with both large Enterprises such as multinational logistics providers, large retail chains, and manufacturing companies—and small & medium Enterprises (SMEs), including regional 3PL/4PL providers and last-mile e-commerce players, further strengthens its market presence

- On the basis of Payload Size, the Cold Chain Market is segmented into Large (32–66 L), Medium (21–29 L), Small (10–17 L), X-Small (3–8 L), Petite (0.9–2.7 L), Others

In 2026, the Large (32–66 L) segment is expected to dominate the market

In 2026, the Large (32–66 L) segment is expected to dominate the market with 33.64% share by its extensive use across key Cold Chain applications such as pharmaceutical distribution, vaccine transportation, dairy and meat logistics, and long-distance movement of perishable food products. Large payload containers offer greater storage capacity, longer temperature retention, and improved thermal insulation, making them ideal for bulk shipments and high-volume commercial operations. Their ability to maintain stable temperatures for extended periods is crucial for Bangladesh’s expanding food processing industry, cross-border exports, and nationwide pharmaceutical supply chains

- On the basis of Operation, the Cold Chain Market is segmented into Domestic, International

In 2026, the Domestic segment is expected to dominate the market

In 2026, the Domestic segment is expected to dominate the market with 69.67% share to the rising demand for temperature-controlled logistics within the country’s expanding food, pharmaceutical, and agricultural sectors. Bangladesh has a fast-growing internal supply chain for perishable goods such as dairy, meat, seafood, fruits, vegetables, and ready-made food products, all of which require reliable short- to mid-distance Cold Chain transportation s

- On the basis of Customer type, the Cold Chain Market is segmented into B2B, E-Commerce & Last-Mile Delivery, B2C

In 2026, the B2B segment is expected to dominate the market

In 2026, the B2B segment is expected to dominate the market share 71.59% due to the strong dependence of key industries—such as food processing, pharmaceuticals, agriculture, seafood, and manufacturing—on large-scale, temperature-controlled logistics services. Businesses across these sectors require consistent and reliable Cold Chain solutions for bulk transportation, storage, and distribution to maintain product quality and comply with safety standards data

- On the basis of Business Model, the Cold Chain Market is segmented into Asset-Based Carriers, Brokerage & 3PL, Others

In 2026, the Asset-Based Carriers segment is expected to dominate the market

In 2026, the Asset-Based Carriers segment is expected to dominate the market with 61.47% share due to their strong control over critical Cold Chain infrastructure, including refrigerated trucks, cold storage facilities, temperature-controlled containers, and specialized handling equipment. These companies offer higher reliability, consistent service quality, and better temperature monitoring capabilities, which are essential for sectors such as pharmaceuticals, dairy, meat, seafood, and fresh produce

- On the basis of Distance, the Cold Chain Market is segmented into 50 – 100 Miles, 101 – 200 Miles, 201 – 500 Miles, More Than 500 Miles

In 2026, the 50 – 100 Miles segment is expected to dominate the market

In 2026, the 50 – 100 Miles segment is expected to dominate the market with 41.31% share due to its extensive use across B2B, E-Commerce & Last-Mile Delivery, B2C key Cold Chain applications such as pharmaceutical distribution, vaccine transportation, dairy and meat logistics, and long-distance movement of perishable food products. Large payload containers offer greater storage capacity, longer temperature retention, and improved thermal insulation, making them ideal for bulk shipments and high-volume commercial operations. Their ability to maintain stable temperatures for extended periods is crucial for Bangladesh’s expanding food processing industry, cross-border exports, and nationwide pharmaceutical supply chains

- On the basis of Service Type, the Cold Chain Market is segmented into transportation, warehousing and distribution, freight forwarding, others

In 2026, the transportation segment is expected to dominate the market

In 2026, the transportation segment is expected to dominate the market with 44.61% share due to the rapid expansion of temperature-sensitive industries such as pharmaceuticals, dairy, fisheries, and fresh produce, which rely heavily on reliable refrigerated logistics. Growing urbanization, rising demand for online grocery and food delivery, and the increasing need for safe vaccine and pharmaceutical distribution further boost the requirement for specialized reefer trucks and advanced vehicle-based Cold Chain solutions.

Major Players

Yusen Logistics Global Management Co., Ltd. (Japan), Transcom Limited(Bangladesh), Bangladesh Limited (Nippon Express Holdings) (Bangladesh),Bcl Cold Storage Limited (India), Nabil Cold Storage (Bangladesh).

Market Developments

- In May 2025, Nippon Express strengthened its footprint in Bangladesh’s cold-chain logistics sector by acquiring a 20% stake in Cold Chain Bangladesh Limited (CCBL). CCBL is a local logistics provider known for its expertise in temperature-controlled storage and transportation, operating a network of refrigerated warehouses and specialized cold-chain vehicles. By partnering with CCBL, Nippon Express gains direct access to established cold-chain infrastructure, enabling the company to improve the movement, handling, and distribution of perishable products such as food items, pharmaceuticals, and other temperature-sensitive goods within Bangladesh. This strategic investment supports Nippon Express’s goal of enhancing service quality and reliability while integrating advanced cold-chain solutions into its broader logistics operations.

- In July 2025, Yusen Logistics began exclusive negotiations to acquire Walden Health, a European logistics company specializing in temperature-controlled healthcare and pharmaceutical logistics. This potential acquisition, if finalized, would considerably strengthen Yusen’s presence in the cold-chain sector by enhancing its capabilities in managing sensitive healthcare products across global supply chains. Expanding into pharmaceutical logistics aligns with the growing demand for reliable, temperature-controlled transportation of medicines and vaccines worldwide.

As per Data Bridge Market Research analysis:

For more detailed information about the Bangladesh Cold Chain Market report, click here – https://www.databridgemarketresearch.com/reports/bangladesh-cold-chain-market