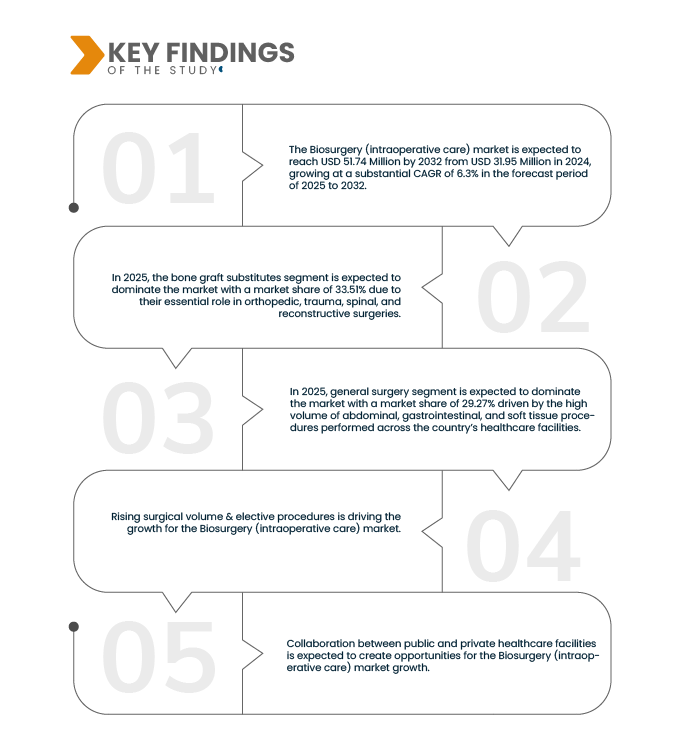

Over the past several years, rising surgical volumes and the expansion of elective procedures have become key drivers of growth in the Dominican Republic biosurgery (intraoperative care) market. Whether in public or private settings, healthcare providers are increasingly performing more surgeries ranging from orthopedics, ophthalmology, general surgery, cosmetic and reconstructive procedures, to increasingly complex minimally invasive interventions. This growth is fueled by efforts to reduce surgical backlogs created during the COVID-19 pandemic, coupled with greater investment in healthcare infrastructure, greater medical tourism inflows, and government policy support. As surgical throughput increases, demand for intraoperative care consumables, advanced devices, disposables, imaging support, hemostasis, and intraoperative monitoring tools rises in parallel. In such an environment, the more elective procedures a system schedules, and the higher the baseline surgical volume, the more the biosurgery sector is leveraged—making surgical volume and elective procedures foundational growth levers for the intraoperative care market in the Dominican Republic.

Access Full Report @ https://www.databridgemarketresearch.com/reports/dominican-republic-biosurgery-intraoperative-care-market

Data Bridge market research analyzes that the Dominican Republic Biosurgery (Intraoperative Care) Market is expected to reach USD 51.73 Million by 2032 from USD 31.95 Million by 2024, growing at a CAGR of 6.3% in the forecast period of 2025 to 2032.

Key Findings of the Study

Clinical Shift On Blood-Loss Reduction & Patient Outcomes

The Dominican Republic's biosurgery and intraoperative care market is experiencing significant growth, driven by a clinical shift towards reducing blood loss and enhancing patient outcomes. This paradigm emphasizes Patient Blood Management (PBM) strategies, aiming to minimize the need for blood transfusions and associated complications. The World Health Organization (WHO) updated its guidance on implementing PBM in 2025, highlighting its cost-effectiveness and role in improving patient outcomes. Additionally, advancements in intraoperative autologous blood donation (IABD) have proven effective in reducing transfusion needs and perioperative morbidity.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2025 to 2032

|

|

Base Year

|

2024

|

|

Historic Years

|

2023 (Customizable to 2018-2022)

|

|

Quantitative Units

|

Revenue in USD

|

|

Segments Covered

|

By Product Type (Bone Graft Substitutes, Hemostatic Agents, Surgical Sealants & Adhesives, Soft Tissue Attachments, Adhesion Barriers, Bone Morphogenetic Proteins (BMPs) and Staple-Line Reinforcemen), Application (General Surgery, Orthopedic Surgery, Cardiovascular Surgery, Neurological Surgery, Urology, Gynecology, Dental & Oral Surgery, Trauma & Emergency Care and Others), Source (Biological, Synthetic and Plant-Based), End User (Hospitals, Ambulatory Surgical Centers, Clinics, Sports Medicine Centers, Research And Academic Institutes, Others), Distribution Channel (Direct Tender, Retail Sales and Others)

|

|

Countries Covered

|

Dominican Republic

|

|

Market Players Covered

|

Johnson & Johnson (U.S.), Medtronic (U.S.), Baxter International Inc. (U.S.), Stryker Corporation (U.S.), B. Braun SE (Germany), Orthofix Medical Inc. (U.S.), BD (U.S.), Tech Medical Group Inc. (U.S.), Integra LifeSciences Corporation (U.S.), Smith+Nephew (U.K.), Bioventus (U.S.), Regenity (U.S.), FzioMed, Inc. (U.S.), Artivion, Inc. (U.S.), Teleflex Incorporated (U.S.), MERIL (India), Hemostasis, LLC (U.S.), Geistlich Pharma AG (Switzerland), Baumer SA (Switzerland), Zimmer Biomet (U.S.), DeRoyal Industries, Inc. (U.S.), Advanced Medical Solutions Group plc. (U.K.), Fin-ceramica Faenza s.p.a. (Italy), medzell (Eightwe Digital Transformations Pvt. Ltd) (India), GDT Dental Implants (U.S.)

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

|

Segment Analysis

The Dominican Republic Biosurgery (Intraoperative Care) Market is segmented into five notable categories on the basis of product type, application, source, end user, and distribution channel.

- On the basis of product type, the market is segmented into bone graft substitutes, hemostatic agents, surgical sealants & adhesives, soft tissue attachments, adhesion barriers, Bone Morphogenetic Proteins (BMPs), staple-line reinforcement.

In 2025, the bone graft substitutes segment is expected to dominate the market

In 2025, the bone graft substitutes segment is expected to dominate the market with a market share of 33.51% due to their essential role in orthopedic, trauma, spinal, and reconstructive surgeries. Bone graft substitutes are widely used as alternatives to autografts and allografts, offering benefits such as reduced surgical time, lower risk of donor-site complications, and enhanced patient recovery. These products—available in biological, synthetic, and composite forms—provide osteoconductive, osteoinductive, and osteogenic properties that promote effective bone regeneration. Their increasing adoption in both elective and emergency procedures, especially within orthopedic surgery and trauma care, is driving robust demand across public hospitals, private surgical centers, and sports medicine facilities. The growing preference for minimally invasive bone grafting solutions and the rise of medical tourism in orthopedic care further support the segment’s leading position in the intraoperative biosurgery landscape.

- On the basis of application, the market is segmented into general surgery, orthopedic surgery, cardiovascular surgery, neurological surgery, urology, gynecology, dental & oral surgery, trauma & emergency care, others.

In 2025, general surgery segment is expected to dominate the market with a market

In 2025, general surgery segment is expected to dominate the market with a market share of 29.27% driven by the high volume of abdominal, gastrointestinal, and soft tissue procedures performed across the country’s healthcare facilities. Biosurgical products such as hemostatic agents, surgical sealants, and adhesion barriers are widely used in general surgery to minimize intraoperative bleeding, prevent post-operative adhesions, and support tissue repair. The segment benefits from ongoing investments in hospital infrastructure, the expansion of surgical programs in both public and private sectors, and increased adoption of minimally invasive techniques. As surgical case complexity rises due to an aging population and a growing burden of chronic diseases, the demand for effective intraoperative biosurgery solutions in general surgery continues to grow—reinforced by surgeon preference for products that improve outcomes, reduce operative time, and lower the risk of complications.

- On the basis of source, the market is segmented into biological, synthetic, plant-based.

In 2025, the biological segment is expected to dominate the market

In 2025, the biological segment is expected to dominate the market with a market share of 52.28% owing to its superior biocompatibility, regenerative properties, and effectiveness in promoting natural tissue healing. Biological products, derived from human, animal, or recombinant sources, are extensively used in applications such as bone graft substitutes, soft tissue repair, and adhesion prevention. Their ability to integrate seamlessly with the patient’s own tissues and stimulate cellular growth makes them highly preferred in complex surgical procedures across orthopedics, general surgery, and cardiovascular surgery. Increasing awareness among surgeons about the benefits of biological materials, alongside advancements in processing techniques that enhance safety and shelf-life, are driving strong demand in both public and private healthcare settings. The segment’s growth is further supported by rising investments in regenerative medicine and expanding clinical applications within the country.

- On the basis of end-user, the market is segmented into hospitals, ambulatory surgical centers, clinics, sports medicine centers, research and academic institutes, others.

In 2025, the hospital segment is expected to dominate the market with a market

In 2025, the hospital segment is expected to dominate the market with a market share of 50.79% as hospitals remain the primary venues for complex surgical procedures requiring advanced intraoperative biosurgical products. Public and private hospitals are investing significantly in upgrading their surgical infrastructure, expanding operating room capacity, and adopting cutting-edge technologies to improve patient outcomes. Hospitals utilize a wide range of biosurgery products—including hemostatic agents, surgical sealants, and bone graft substitutes across multiple specialties such as general surgery, orthopedics, cardiovascular, and trauma care. The presence of intensive care units and specialized surgical teams further drives demand for high-quality, ready-to-use biosurgical solutions. Additionally, government tenders and hospital procurement policies prioritize the availability of effective biosurgery products, reinforcing hospitals’ leading role in market consumption.

- On the basis of distribution channel, the market is segmented into direct tender, retail sales, others.

In 2025, the direct tender segment is expected to dominate the market with a market

In 2025, the direct tender segment is expected to dominate the market with a market share of 57.14% as it serves as a primary procurement channel for public hospitals and government healthcare facilities. Through direct tendering, hospitals and health authorities acquire large volumes of biosurgical products such as hemostatic agents, surgical sealants, and bone graft substitutes at competitive prices, ensuring consistent supply for complex surgical procedures. This procurement method enables streamlined purchasing processes, transparency, and cost-effectiveness, which are critical for budget-constrained public healthcare systems. The increasing focus on improving surgical outcomes and infection control across public hospitals is boosting demand for biosurgery products sourced via direct tenders, making this segment integral to the overall market growth.

Major Players

Johnson & Johnson (U.S.), Medtronic (U.S.), Baxter International Inc. (U.S.), Stryker Corporation (U.S.), B. Braun SE (Germany), Orthofix Medical Inc. (U.S.), BD (U.S.), Tech Medical Group Inc. (U.S.), Integra LifeSciences Corporation (U.S.), Smith+Nephew (U.K.), Bioventus (U.S.), Regenity (U.S.), FzioMed, Inc. (U.S.), Artivion, Inc. (U.S.), Teleflex Incorporated (U.S.), MERIL (India), Hemostasis, LLC (U.S.), Geistlich Pharma AG (Switzerland), Baumer SA (Switzerland), Zimmer Biomet (U.S.), DeRoyal Industries, Inc. (U.S.), Advanced Medical Solutions Group plc. (U.K.), Fin-ceramica Faenza s.p.a. (Italy), medzell (Eightwe Digital Transformations Pvt. Ltd) (India), GDT Dental Implants (U.S.).

Market Developments

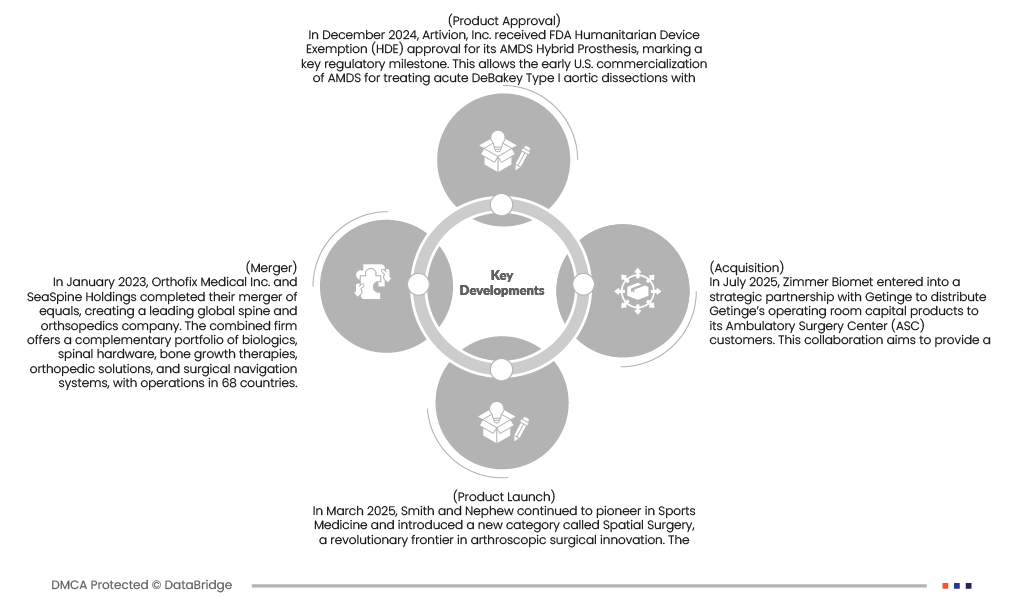

- In December 2024, Artivion, Inc. received FDA Humanitarian Device Exemption (HDE) approval for its AMDS Hybrid Prosthesis, marking a key regulatory milestone. This allows the early U.S. commercialization of AMDS for treating acute DeBakey Type I aortic dissections with malperfusion—representing roughly 40% of such cases. The device also holds Breakthrough and Humanitarian Use Designation due to its life-saving potential in a rare, high-risk condition. This development strengthens Artivion’s leadership in the structural heart and aortic surgery market, expands its clinical footprint, and paves the way for broader Premarket Approval (PMA) coverage in the future.

- In March 2025, Smith and Nephew continued to pioneer in Sports Medicine and introduced a new category called Spatial Surgery, a revolutionary frontier in arthroscopic surgical innovation. The TESSA Spatial Surgery System, or Tracking Enabled Spatial Surgery Assistant, combines personalized operative planning with a real-time, tracking enabled device, using advanced imaging and augmented reality guidance to assist surgeons in decision-making.

- In July 2025, Zimmer Biomet entered into a strategic partnership with Getinge to distribute Getinge’s operating room capital products to its Ambulatory Surgery Center (ASC) customers. This collaboration aims to provide a comprehensive solution for ASC customers, combining Zimmer Biomet's surgical robotics and implant offerings with Getinge's infection control and surgical portfolio.

As per Data Bridge Market Research analysis:

For more detailed information about the Dominican Republic Biosurgery (Intraoperative Care) Market report, click here – https://www.databridgemarketresearch.com/reports/dominican-republic-biosurgery-intraoperative-care-market