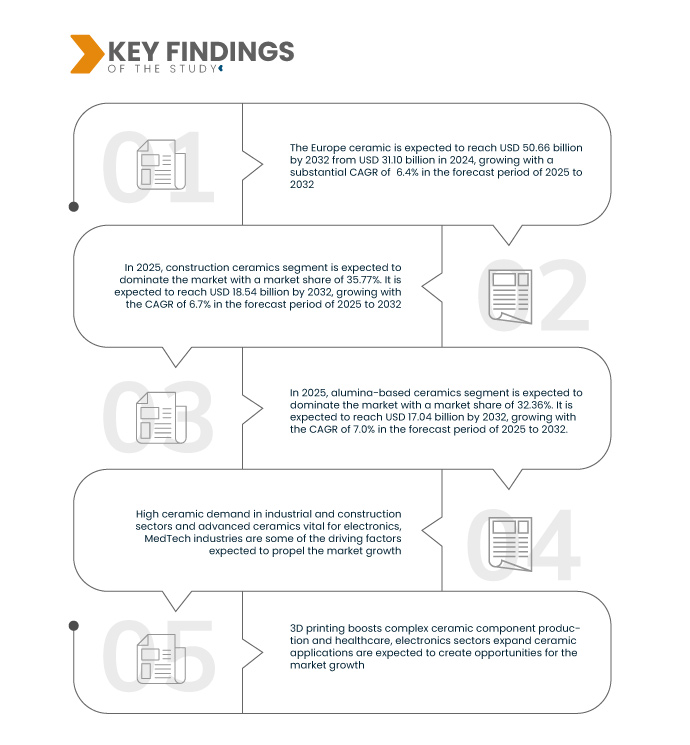

The European ceramics market is witnessing strong momentum, largely propelled by the resurgence of industrial production and sustained growth in the construction sector. Ceramic materials are increasingly favored for their durability, chemical resistance, thermal stability, and aesthetic versatility, making them indispensable in both functional and decorative applications.

In the construction industry, ceramic tiles, sanitaryware, bricks, and cladding materials are in high demand due to their long life cycle and minimal maintenance needs. With ongoing infrastructure upgrades and housing developments across Western and Southern Europe, the need for high-quality building materials is intensifying. Countries like Germany, France, Italy, and Spain are leading in tile consumption for both residential refurbishments and commercial installations, supported by rising urbanization and housing renovations. On the industrial side, technical ceramics are gaining wider application across automotive, aerospace, and machinery manufacturing. Their superior performance in high-temperature and corrosive environments positions them as ideal substitutes for metal components, especially in electric vehicles, aerospace turbines, and semiconductors. According to industry estimates, Europe’s advanced ceramics segment is set to grow steadily over the next five years, driven by innovation in materials like alumina, zirconia, and silicon carbide

Access Full Report @ https://www.databridgemarketresearch.com/reports/europe-ceramic-market

Data Bridge market research analyzes that the Europe Ceramics Market is expected to reach USD 50.66 billion by 2032 from USD 31.10 billion in 2024, growing with a substantial CAGR of 6.4% in the forecast period of 2025 to 2032.

Key Findings of the Study

Advanced Ceramics Vital for Electronics, Medtech Industries

Europe’s advanced ceramics segment is experiencing rapid growth, fueled by their critical role in high-tech industries such as electronics and medical technology. These materials offer exceptional thermal resistance, electrical insulation, biocompatibility, and structural strength—making them indispensable across a range of precision-driven applications.

In electronics, advanced ceramics such as alumina, zirconia, and silicon nitride are widely used in substrates, semiconductors, capacitors, and thermal management components. As the demand for miniaturized and high-performance electronic devices increases, particularly in the consumer electronics and automotive sectors, ceramic components are becoming integral to next-generation circuit design. Europe’s focus on electric vehicles (EVs) and 5G infrastructure is further accelerating the adoption of ceramic insulators and heat-dissipating components. In the medtech sector, advanced ceramics are being used for dental implants, joint replacements, and surgical tools due to their biocompatibility, corrosion resistance, and long lifespan. Zirconia-based ceramics, for instance, are now preferred for high-load-bearing orthopedic applications. The European medical device market—valued at over EUR 160 billion—is witnessing steady growth, with ceramics playing a pivotal role in innovative and implantable solutions.

Furthermore, European R&D institutions and manufacturers are increasingly collaborating on next-gen ceramic composites for emerging applications in biotechnology, imaging, and microelectronics. Governments across the EU are supporting this shift through funding programs under Horizon Europe and related initiatives targeting advanced manufacturing

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2025 to 2032

|

|

Base Year

|

2024

|

|

Historic Years

|

2023 (Customizable to 2018-2022)

|

|

Quantitative Units

|

Revenue in USD Billion

|

|

Segments Covered

|

By Product Type (Construction Ceramics, Technical & Advanced Ceramics, Sanitary Ware Ceramics, Tableware & Cookware Ceramics, Pottery & Decorative Ceramics, Others), By Material Type (Alumina-Based Ceramics, Silica-Based Ceramics, Zirconia-Based Ceramics, Silicon Carbide (SiC) Ceramics, Magnesium Silicate Ceramics, Titanium-Based Ceramics, Boron Carbide Ceramics, Others), By Manufacturing Technology (Dry Pressing (Uniaxial/Isostatic Pressing), Slip Casting, Injection Molding, Extrusion, Additive Manufacturing, Hot Isostatic Pressing (HIP), Others)

|

|

Countries Covered

|

Germany, Italy, France, Spain, Poland, Netherlands, Romania, Czech Republic, Sweden, Austria, Belgium, Denmark, Finland, Greece, Hungary, Ireland, Lithuania, Luxembourg, Malta, Portugal, Slovakia, Slovenia, Bulgaria, Croatia, Republic of Cyprus, Latvia, Estonia

|

|

Market Players Covered

|

Saint‑Gobain Ceramic Materials (France), 3M (U.S), Mohawk Industries, Inc. (U.S), Corning Incorporated (U.S), Villeroy & Boch (Germany), Kyocera Corporation (Japan), Morgan Advanced Materials (United Kingdom), PORCELANOSA Grupo A.I.E. (Spain)

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

|

Segment Analysis

The Europe ceramic market is segmented into three segments based on product type, material type and manufacturing technology.

- On the basis of product type, the market is segmented into construction ceramics, technical & advanced ceramics, sanitary ware ceramics, tableware & cookware ceramics, pottery & decorative ceramics, others.

In 2025, the construction ceramics segment is expected to dominate the market

In 2025, construction ceramics segment is expected to dominate the market with a market share of 35.77% share due to the strong demand for ceramic tiles, sanitaryware, and bricks driven by Europe’s emphasis on sustainable construction, energy-efficient buildings, and renovation of aging infrastructure across residential and commercial sectors

- On the basis of material type, the market is segmented into alumina-based ceramics, silica-based ceramics, zirconia-based ceramics, silicon carbide (SiC) ceramics, magnesium silicate ceramics, titanium-based ceramics, boron carbide ceramics, others

In 2025, the alumina-based ceramics segment is expected to dominate the market

In 2025, alumina-based ceramics segment is expected to dominate the market with a market share of 32.36%. share due to its superior thermal stability, excellent mechanical strength, and widespread applicability across sectors such as electronics, automotive, and medical devices, particularly in high-performance components like substrates, cutting tools, and bio-implants

- On the basis of manufacturing technology, the market is segmented into dry pressing (uniaxial/isostatic pressing), slip casting, injection molding, extrusion, additive manufacturing, hot isostatic pressing (HIP), others.

In 2025, the dry pressing (uniaxial/isostatic pressing) segment is expected to dominate the market

In 2025, the dry pressing (uniaxial/isostatic pressing) segment is expected to dominate the market with a market share of 29.37%. share due to its cost-effective scalability, high production efficiency, and suitability for mass production of uniform, high-density ceramic components widely used in construction tiles, electrical insulators, and technical ceramics across Europe

Major Players

Saint‑Gobain Ceramic Materials (France), 3M (U.S), Mohawk Industries, Inc. (U.S), Corning Incorporated (U.S), Villeroy & Boch (Germany), Kyocera Corporation (Japan), Morgan Advanced Materials (United Kingdom), PORCELANOSA Grupo A.I.E. (Spain).

Market Developments

- On April, Johnson Tiles announced a management buyout from Norcros plc, making it a standalone UK business. The company plans to shift to a fully outsourced model, leading to the proposed closure of its Stoke-on-Trent manufacturing facility. Despite this, Johnson Tiles will continue designing in the UK and sourcing globally to maintain quality, ethical standards, and strong market presence.

- In January 2025, Pure Lithium and Saint‑Gobain Ceramics signed a joint development agreement to accelerate the production of lithium‑selective, water‑blocking membranes for both lithium extraction and next-generation lithium‑metal battery applications

- In March, Corning introduced Corning ® Gorilla ® Glass Ceramic, a groundbreaking transparent glass-ceramic cover material engineered to offer significantly enhanced drop resistance on rough surfaces—surviving over ten one-meter drops on asphalt compared to standard aluminosilicate glass fragility.

- In May, CeramTec expanded its product lineup for electronic components with the introduction of Rubalit® 798, a high-purity 98% aluminium oxide ceramic substrate engineered for superior performance in thermal management and electrical insulation applications.

- In March, the company showcased its latest CeramSense® ultrasonic sensor technology at Sensor+Test 2025 in Nuremberg—a cutting-edge range of flow‐metering sensors combining ceramic substrates with ultrasonic capabilities for enhanced precision and durability in flow measurement systems.

As per Data Bridge Market Research analysis:

For more detailed information about the Europe Ceramics Market report, click here – https://www.databridgemarketresearch.com/reports/europe-ceramic-market