Mercado mundial de bebidas a base de leche, por producto (leche de origen animal y leche de origen vegetal), sabor (con sabor y sin sabor/natural), naturaleza (orgánico y convencional), canal de distribución (minorista en tienda y minorista fuera de tienda): tendencias de la industria y pronóstico hasta 2030.

Análisis y tamaño del mercado de bebidas a base de leche

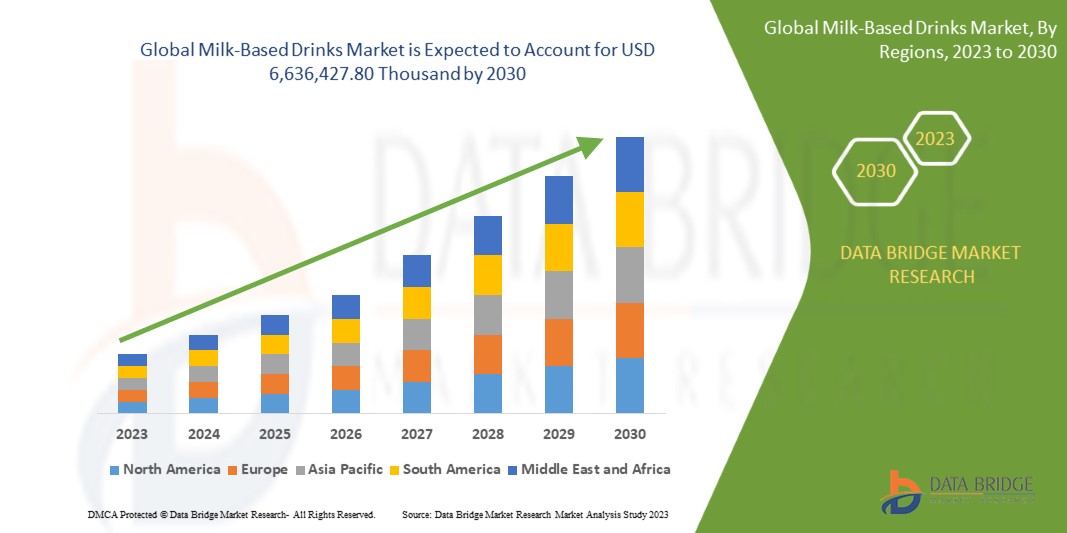

Se espera que el mercado mundial de bebidas a base de leche crezca significativamente en el período de pronóstico de 2023 a 2030. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 4,4% en el período de pronóstico de 2023 a 2030 y se espera que alcance los USD 6.636.427,80 mil para 2030. El principal factor que impulsa el crecimiento del mercado es la creciente conciencia del consumidor con respecto a la salud y el bienestar y la creciente popularidad de la comodidad y los estilos de vida acelerados.

El informe del mercado mundial de bebidas a base de leche proporciona detalles sobre la participación de mercado, los nuevos desarrollos y el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de segmentos de ingresos emergentes, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado, contáctenos para obtener un informe de analista. Nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2023 a 2030 |

|

Año base |

2022 |

|

Años históricos |

2021 (Personalizable para 2015 - 2020) |

|

Unidades cuantitativas |

Ingresos en miles de USD |

|

Segmentos cubiertos |

Producto (leche de origen animal y leche de origen vegetal), sabor (con sabor y sin sabor/natural), naturaleza (orgánica y convencional), canal de distribución (minorista en tienda y minorista fuera de tienda) |

|

Países cubiertos |

EE. UU., Canadá, México, Alemania, Italia, Reino Unido, España, Francia, Bélgica, Países Bajos, Suiza, Rusia, Turquía y resto de Europa, India, China, Japón, Australia y Nueva Zelanda, Corea del Sur, Singapur, Tailandia, Indonesia, Malasia, Filipinas, resto de Asia-Pacífico, Brasil, Argentina, resto de Sudamérica, Emiratos Árabes Unidos, Arabia Saudita, Sudáfrica, Egipto, Israel y resto de Oriente Medio y África |

|

Actores del mercado cubiertos |

Califia Farms, LLC, MOOALA BRANDS, LLC., Chobani, LLC., Simple FOODS Co., Ltd., TURM-Sahne GmbH, Sanitarium, Arla Foods amba, RUDE HEALTH, Danone SA, Nestlé, THE HERSHEY COMPANY, Oatly Inc, YEO HIAP SENG LTD, Valsoia SpA y GCMMF, entre otros. |

Definición de mercado

El mercado de bebidas a base de leche se refiere al segmento de la industria centrado en la producción, distribución y consumo de bebidas derivadas principalmente de la leche. Este mercado abarca una amplia gama de productos, entre los que se incluyen leche de vaca, alternativas a la leche de origen vegetal, batidos de sabores y bebidas especiales de café y té. Está influenciado por las preferencias de los consumidores en cuanto a sabor, conciencia de la salud y opciones dietéticas, y las empresas compiten para innovar y satisfacer las cambiantes demandas de los consumidores.

Dinámica del mercado mundial de bebidas a base de leche

Conductores

- La creciente popularidad de la comodidad y los estilos de vida acelerados

En los últimos años, un cambio notable en las preferencias de los consumidores hacia la comodidad y el consumo sobre la marcha ha impulsado el crecimiento de varias industrias, incluido el mercado mundial de bebidas a base de leche. Esta tendencia es una respuesta al acelerado estilo de vida moderno, donde los consumidores buscan opciones nutritivas y ricas en proteínas que se puedan consumir cómodamente en cualquier momento. Las bebidas a base de leche ofrecen una solución al combinar los beneficios nutricionales de las proteínas, el calcio y las vitaminas con la comodidad de las bebidas portátiles y preenvasadas. La urbanización, los horarios más ocupados, los desplazamientos más largos y las mayores demandas laborales han provocado un cambio significativo en el comportamiento de los consumidores. Como resultado, los consumidores buscan cada vez más productos que se adapten a su acelerada vida, haciendo de la comodidad una prioridad máxima. Además, la escasez de tiempo ha impulsado a los consumidores a buscar soluciones rápidas y fáciles para sus necesidades nutricionales. Los patrones de alimentación tradicionales han evolucionado, y el consumo de snacks y sobre la marcha se ha vuelto más común.

En el acelerado mundo actual, los desayunos tradicionales que se sirven sentados en la mesa suelen sustituirse por opciones para llevar. Las bebidas a base de leche, especialmente las fortificadas con nutrientes, se comercializan como un sustituto rápido y nutritivo del desayuno. Ofrecen una opción de comida equilibrada para las personas que tienen prisa por llegar al trabajo o a la escuela.

El auge del comercio electrónico ha permitido a los consumidores pedir bebidas lácteas en línea, lo que aumenta aún más la comodidad. Los servicios de suscripción entregan estos productos en la puerta de los hogares de los consumidores a intervalos regulares, lo que les permite ahorrar tiempo y esfuerzo en la compra de alimentos.

Las bebidas a base de leche suelen estar enriquecidas con otros nutrientes, vitaminas y minerales esenciales, lo que las convierte en una opción completa de refrigerio o reemplazo de comida para llevar.

El mercado mundial de bebidas a base de leche está experimentando un sólido crecimiento debido a la creciente prevalencia de estilos de vida orientados a la comodidad y a estar siempre en movimiento. Las bebidas a base de leche han surgido como una solución conveniente y nutritiva, ya que los consumidores priorizan las opciones portátiles y ricas en nutrientes que se adaptan a sus apretadas agendas. Se espera que el creciente consumo de bebidas a base de leche impulse el crecimiento del mercado a nivel mundial.

- Aumentar la conciencia del consumidor sobre la salud y el bienestar

En los últimos años, se ha producido un cambio significativo en las preferencias de los consumidores hacia estilos de vida más saludables y una mayor conciencia nutricional. Este cambio ha impulsado una tendencia creciente en el consumo de dietas ricas en proteínas, lo que posteriormente ha impulsado el crecimiento del mercado. La proteína es un componente clave de las bebidas a base de leche y se alinea con las dietas centradas en las proteínas que prefieren muchos consumidores preocupados por la salud.

Las bebidas lácteas ricas en proteínas, que suelen comercializarse como opciones de recuperación muscular o de reemplazo de comidas, están dirigidas a personas que buscan aumentar su ingesta de proteínas por diversas razones de salud y estado físico. El creciente enfoque en la salud y el bienestar ha llevado a los consumidores a buscar opciones dietéticas que respalden sus objetivos de fitness y su bienestar general. La proteína es un macronutriente fundamental que desempeña un papel crucial en la reparación y el mantenimiento de los músculos y las funciones corporales generales. Las personas están incorporando dietas ricas en proteínas a sus rutinas diarias a medida que se vuelven más proactivas en el manejo de su salud. Las bebidas a base de leche se están adaptando a diversas dietas de estilo de vida, como el vegetarianismo, el flexitarianismo y las dietas cetogénicas. Las marcas ofrecen alternativas como la leche de almendras , la leche de soja y opciones sin lactosa para satisfacer estas preferencias dietéticas.

Los consumidores son cada vez más conscientes del valor nutricional de las bebidas que consumen, incluidas las bebidas a base de leche. Muchos consumidores perciben la leche como una fuente de nutrientes esenciales como calcio, vitamina D , proteínas y diversas vitaminas y minerales. Esta conciencia impulsa la demanda de bebidas a base de leche como una opción conveniente y nutritiva.

A medida que la población mundial envejece, se hace cada vez más hincapié en mantener la salud y el bienestar a lo largo de la vida. Las bebidas a base de leche enriquecidas con nutrientes importantes para el envejecimiento, como la vitamina B12 y el calcio, pueden resultar atractivas para este grupo demográfico.

La creciente atención de los consumidores a la salud y el bienestar, junto con la comodidad y la diversidad que ofrecen estas bebidas, ha llevado a su adopción generalizada. Para aprovechar estas tendencias de salud y bienestar, los fabricantes y comercializadores de bebidas a base de leche deben alinear sus ofertas de productos, estrategias de marketing y mensajes con las cambiantes preferencias de los consumidores en materia de salud. Por lo tanto, se espera que la creciente tendencia de las dietas saludables y ricas en proteínas impulse el crecimiento del mercado.

Oportunidad

- La creciente preferencia por las opciones dietéticas veganas y basadas en plantas

Se ha producido un cambio notable en las preferencias alimentarias hacia alternativas basadas en plantas, ya que los consumidores se vuelven cada vez más conscientes de la salud y el medio ambiente. Este cambio está creando un entorno favorable para el crecimiento del mercado, ya que estos productos satisfacen las necesidades y preferencias de esta base de consumidores en constante evolución.

La creciente demanda de dietas veganas y basadas en plantas está impulsando la innovación en el segmento de las bebidas a base de leche. Los fabricantes están desarrollando una amplia gama de fuentes de proteínas de origen vegetal, como la proteína de guisante , la proteína de soja y la proteína de arroz , para satisfacer las diferentes preferencias de los consumidores. El mercado está siendo testigo del surgimiento de bebidas especializadas a base de leche dirigidas a segmentos de consumidores específicos, como deportistas, entusiastas del fitness y personas con restricciones dietéticas. Las opciones a base de plantas están ganando popularidad entre estos segmentos debido a sus beneficios nutricionales.

Los fabricantes están respondiendo a las preferencias cambiantes de los consumidores innovando y diversificando sus ofertas de productos, ampliando su presencia minorista y educando a los consumidores sobre los beneficios de la nutrición basada en plantas. El mercado mundial de bebidas a base de leche está bien posicionado para prosperar y contribuir al panorama cambiante de la industria de alimentos y bebidas a medida que la tendencia hacia las dietas basadas en plantas sigue creciendo. Se espera que la creciente demanda de dietas veganas y basadas en plantas brinde oportunidades significativas para el crecimiento del mercado.

Restricciones/Desafíos

- Normas y reglamentos estrictos sobre bebidas a base de leche

Las normas y reglamentaciones estrictas relativas a las bebidas a base de leche pueden presentar desafíos importantes para el crecimiento del mercado y afectar diversos aspectos de la producción, el etiquetado, la comercialización y la distribución.

Muchos países tienen normas estrictas que rigen la composición y el etiquetado de las bebidas a base de leche. Estas normas suelen exigir listas de ingredientes precisas y completas, información nutricional y declaraciones de alérgenos. Garantizar el cumplimiento puede ser complicado, en particular cuando se formulan bebidas a base de leche con sabores añadidos, fortificaciones o ingredientes alternativos como componentes sin lactosa.

Para garantizar la seguridad de las bebidas lácteas, es necesario cumplir con normas de calidad estrictas, que incluyen criterios microbiológicos y químicos, límites de contaminantes y requisitos específicos de pasteurización o tratamiento térmico. Cumplir con estas normas puede resultar costoso, ya que puede requerir inversiones en medidas de control de calidad e instalaciones de prueba.

Las reglamentaciones suelen exigir prácticas estrictas de seguridad e higiene en las instalaciones de procesamiento de leche. Mantener estos estándares requiere inversiones constantes en infraestructura, equipos, capacitación de los empleados y protocolos de saneamiento. El incumplimiento de estos requisitos puede dar lugar a multas costosas o retiradas de productos del mercado.

Las regulaciones ambientales afectan cada vez más a la industria de las bebidas lácteas. Las regulaciones relacionadas con los materiales de envasado, la eliminación de residuos y las emisiones de carbono pueden exigir cambios en los procesos de producción y las estrategias de abastecimiento.

En conclusión, las estrictas normas y regulaciones en el mercado mundial de bebidas lácteas generan desafíos complejos de cumplimiento que pueden afectar la formulación de productos, el control de calidad, el etiquetado, la comercialización y el comercio internacional. Las empresas que operan en esta industria deben invertir en conocimientos legales y regulatorios. Estos esfuerzos de cumplimiento pueden aumentar los costos operativos y afectar las estrategias de mercado, lo que hace que el cumplimiento normativo sea un desafío importante en este sector.

- Aumento de la intolerancia a la lactosa y alergias a los productos lácteos

La creciente intolerancia a la lactosa y las alergias a los productos lácteos suponen un importante obstáculo para el crecimiento del mercado. Estas afecciones son cada vez más frecuentes y pueden actuar como obstáculos de diversas maneras.

Los consumidores se están volviendo más cautelosos con respecto al consumo de productos lácteos a medida que aumenta la conciencia sobre la intolerancia a la lactosa y las alergias a los productos lácteos. Muchas personas con estas afecciones experimentan molestias digestivas, reacciones alérgicas u otros problemas de salud cuando consumen productos lácteos. Esto ha provocado una disminución en la demanda de bebidas tradicionales a base de leche.

Las personas intolerantes a la lactosa y alérgicas a los productos lácteos buscan alternativas a los lácteos, como la leche de almendras, la leche de soja y la leche de avena , que no provocan reacciones adversas. Este cambio en las preferencias de los consumidores ha impulsado el crecimiento de la industria de la leche vegetal, desviando la cuota de mercado de las bebidas tradicionales a base de leche.

Los fabricantes de bebidas a base de leche deben invertir en el desarrollo de alternativas sin lactosa o sin lácteos para satisfacer las necesidades de los consumidores intolerantes a la lactosa y alérgicos a los lácteos. Crear productos que imiten el sabor y la textura de los lácteos y que mantengan una etiqueta limpia puede ser un desafío y costoso, lo que dificulta la expansión del mercado.

Existen estrictas normas de etiquetado para proteger a los consumidores con alergias. Los fabricantes deben etiquetar con precisión sus productos y los riesgos de contaminación cruzada son una preocupación. Cumplir con estos requisitos reglamentarios puede añadir complejidad y costos a la producción, lo que puede afectar los precios y la competitividad.

La sensibilización sobre la intolerancia a la lactosa y las alergias a los productos lácteos es un proceso continuo. Los fabricantes pueden tener que invertir en campañas educativas para informar a los consumidores sobre sus opciones sin lactosa o sin lácteos, lo que puede resultar costoso y demandar mucho tiempo.

En conclusión, la creciente incidencia de la intolerancia a la lactosa y las alergias a los productos lácteos es un obstáculo importante para el mercado mundial de bebidas lácteas. Las empresas deben adaptarse desarrollando alternativas adecuadas, cumpliendo con las normas de etiquetado y educando a los consumidores para prosperar en este panorama cambiante.

Acontecimientos recientes

- En agosto de 2023, Chobani, LLC, una empresa de alimentos y bebidas de última generación conocida por su yogur griego , presentó Chobani Oatmilk Pumpkin Spice, una bebida de avena rica y cremosa con sabor a calabaza y especias elaborada con las bondades de la avena integral. La última incorporación a la gama de calabazas de la marca es apta para veganos, una buena fuente de calcio y perfecta para los entusiastas de la calabaza y las especias que buscan bebidas de otoño que no comprometan la calidad ni el sabor.

- En enero de 2023, Oatly Inc, la empresa de bebidas de avena más grande y original del mundo, y Ya YA Foods Corporation, un fabricante por contrato líder de una amplia gama de productos alimenticios y bebidas asépticos, anunciaron una asociación híbrida estratégica a largo plazo en América del Norte. En esta asociación híbrida, Oatly seguirá produciendo su base de avena patentada en las instalaciones de Ogden, Utah, y Fort Worth, Texas, que luego se transferirá a Ya YA Foods para envasarla en conjunto en productos Oatly en cada ubicación.

- En noviembre de 2021, Arla Foods amba dio a conocer su nueva estrategia quinquenal, destacando su firme compromiso con la producción lechera sostenible y la expansión empresarial responsable. En los próximos cinco años, la empresa está preparada para aumentar sus inversiones en más del 40%, superando los 4.000 millones de euros. Estas inversiones se destinarán a iniciativas de sostenibilidad, digitalización, adopción de tecnologías de producción innovadoras y desarrollo de productos. Además, la empresa planea aumentar su dividendo a más de 1.000 millones de euros, lo que demuestra su dedicación a apoyar a sus propietarios ganaderos en su camino hacia la sostenibilidad.

- En septiembre de 2021, Valsoia SpA firmó un acuerdo con Green Pro International BV, que posee el 100% de las acciones de Swedish Green Food Company AB, para la adquisición del 100% del capital social de la empresa sueca, especializada en la importación y distribución de productos 100% vegetales en el territorio europeo.

- En marzo de 2021, Hershey India Pvt Ltd, parte de THE HERSHEY COMPANY, desarrolló Sofit Plus, una bebida fortificada con proteínas vegetales exclusivamente para su iniciativa social "Nourishing Minds". La bebida, diseñada para satisfacer las necesidades nutricionales de los niños desfavorecidos, fue desarrollada por Hershey India en colaboración con IIT-Bombay, Sion Hospital y la ONG Annamrita.

Alcance del mercado mundial de bebidas a base de leche

El mercado mundial de bebidas a base de leche se divide en cuatro segmentos importantes según el producto, el sabor, la naturaleza y el canal de distribución. El crecimiento entre estos segmentos le ayudará a analizar los principales segmentos de crecimiento en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Producto

- Leche de origen animal

- Leche de origen vegetal

En función del producto, el mercado está segmentado en leche de origen animal y leche de origen vegetal.

Sabor

- Sazonado

- Sin sabor/Simple

En función del sabor, el mercado se segmenta en saborizado y sin sabor/simple.

Naturaleza

- Orgánico

- Convencional

On the basis of nature, the market is segmented into organic and conventional.

Distribution Channel

- Store Based Retailer

- Non-Store Retailer

On the basis of distribution channel, the market is segmented into store based retailer and non-store retailer.

Global Milk-Based Drinks Market Regional Analysis/Insights

The global milk-based drinks market is segmented into four notable segments based on product, flavor, nature, and distribution channel.

The countries covered in the global milk-based drinks market report are U.S., Canada, Mexico, Germany, Italy, U.K., Spain, France, Belgium, Netherlands, Switzerland, Russia, Turkey, and Rest of Europe, India, China, Japan, Australia & New Zealand, South Korea, Singapore, Thailand, Indonesia, Malaysia, Philippines, Rest of Asia-Pacific, Brazil, Argentina, Rest of South America, United Arab Emirates, Saudi Arabia, South Africa, Egypt, Israel, and Rest of Middle East and Africa.

Asia-Pacific is expected to dominate the global milk-based drinks market due to the presence of a large production and consumption base in the region. India is expected to dominate the Asia-Pacific region in terms of market share and market revenue due to the ongoing product innovation and the emergence of distinctive and exotic flavors. The U.S. is expected to dominate the North America region due to the growing popularity of convenience and fast-paced lifestyles. Germany is expected to dominate the Europe region due to the increasing consumer consciousness regarding health and well-being.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data point downstream and upstream value chain analysis, technical trends, Porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Global Milk-Based Drinks Market Share Analysis

The global milk-based drinks market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, and technology lifeline curve. The above data points provided are only related to the companies’ focus related to the market.

Algunos de los participantes destacados que operan en el mercado global de bebidas a base de leche son Califia Farms, LLC, MOOALA BRANDS, LLC., Chobani, LLC., Simple FOODS Co., Ltd., TURM-Sahne GmbH, Sanitarium, Arla Foods amba, RUDE HEALTH, Danone SA, Nestlé, THE HERSHEY COMPANY, Oatly Inc, YEO HIAP SENG LTD, Valsoia SpA y GCMMF, entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING POPULARITY OF CONVENIENCE AND FAST-PACED LIFESTYLES

5.1.2 INCREASING CONSUMER CONSCIOUSNESS REGARDING HEALTH AND WELL-BEING

5.1.3 ONGOING PRODUCT INNOVATION AND THE EMERGENCE OF DISTINCTIVE AND EXOTIC FLAVORS

5.2 RESTRAINTS

5.2.1 RISING LACTOSE INTOLERANCE AND DAIRY ALLERGIES

5.2.2 SUPPLY CHAIN DISRUPTIONS DUE TO VARIOUS FACTORS

5.3 OPPORTUNITIES

5.3.1 INCREASING FAVORABILITY OF VEGAN AND PLANT-BASED DIETARY CHOICES

5.4 CHALLENGE

5.4.1 STRINGENT RULES AND REGULATIONS

6 GLOBAL MILK-BASED DRINKS MARKET BY GEOGRAPHY

6.1 OVERVIEW

6.2 ASIA PACIFIC

6.3 NORTH AMERICA

6.4 EUROPE

6.5 SOUTH AMERICA

6.6 MIDDLE EAST & AFRICA

7 GLOBAL MILK-BASED DRINKS MARKET: COMPANY LANDSCAPE

7.1 COMPANY SHARE ANALYSIS: GLOBAL

7.2 COMPANY SHARE ANALYSIS: EUROPE

7.3 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

7.4 COMPANY SHARE ANALYSIS: NORTH AMERICA

7.5 PARTNERSHIPS AND ACQUISITION

7.6 BUSINESS EXPANSION

7.7 NEW PRODUCT LAUNCH

8 SWOT ANALYSIS

9 COMPANY PROFILES

9.1 OATLY INC

9.1.1 COMPANY SNAPSHOT

9.1.2 REVENUE ANALYSIS

9.1.3 COMPANY SHARE ANALYSIS

9.1.4 PRODUCT PORTFOLIO

9.1.5 RECENT DEVELOPMENT

9.2 DANONE S.A.

9.2.1 COMPANY SNAPSHOT

9.2.2 REVENUE ANALYSIS

9.2.3 COMPANY SHARE ANALYSIS

9.2.4 PRODUCT PORTFOLIO

9.2.5 RECENT DEVELOPMENTS

9.3 ARLA FOODS AMBA

9.3.1 COMPANY SNAPSHOT

9.3.2 COMPANY SHARE ANALYSIS

9.3.3 PRODUCT PORTFOLIO

9.3.4 RECENT DEVELOPMENT

9.4 NESTLÉ

9.4.1 COMPANY SNAPSHOT

9.4.2 REVENUE ANALYSIS

9.4.3 COMPANY SHARE ANALYSIS

9.4.4 PRODUCT PORTFOLIO

9.4.5 RECENT DEVELOPMENTS

9.5 GCMMF

9.5.1 COMPANY SNAPSHOT

9.5.2 COMPANY SHARE ANALYSIS

9.5.3 PRODUCT PORTFOLIO

9.5.4 RECENT DEVELOPMENTS

9.6 CALIFIA FARMS, LLC

9.6.1 COMPANY SNAPSHOT

9.6.2 PRODUCT PORTFOLIO

9.6.3 RECENT DEVELOPMENTS

9.7 CHOBANI, LLC

9.7.1 COMPANY SNAPSHOT

9.7.2 PRODUCT PORTFOLIO

9.7.3 RECENT DEVELOPMENTS

9.8 MOOALA BRANDS, LLC.

9.8.1 COMPANY SNAPSHOT

9.8.2 PRODUCT PORTFOLIO

9.8.3 RECENT DEVELOPMENTS

9.9 RUDE HEALTH

9.9.1 COMPANY SNAPSHOT

9.9.2 PRODUCT PORTFOLIO

9.9.3 RECENT DEVELOPMENTS

9.1 SANITARIUM

9.10.1 COMPANY SNAPSHOT

9.10.2 PRODUCT PORTFOLIO

9.10.3 RECENT DEVELOPMENTS

9.11 SIMPLE FOODS CO., LTD.

9.11.1 COMPANY SNAPSHOT

9.11.2 PRODUCT PORTFOLIO

9.11.3 RECENT DEVELOPMENTS

9.12 THE HERSHEY COMPANY

9.12.1 COMPANY SNAPSHOT

9.12.2 REVENUE ANALYSIS

9.12.3 PRODUCT PORTFOLIO

9.12.4 RECENT DEVELOPMENT

9.13 TURM-SAHNE GMBH

9.13.1 COMPANY SNAPSHOT

9.13.2 PRODUCT PORTFOLIO

9.13.3 RECENT DEVELOPMENTS

9.14 VALSOIA S.P.A.

9.14.1 COMPANY SNAPSHOT

9.14.2 REVENUE ANALYSIS

9.14.3 PRODUCT PORTFOLIO

9.14.4 RECENT DEVELOPMENT

9.15 YEO HIAP SENG LTD

9.15.1 COMPANY SNAPSHOT

9.15.2 REVENUE ANALYSIS

9.15.3 PRODUCT PORTFOLIO

9.15.4 RECENT DEVELOPMENTS

10 QUESTIONNAIRE

11 RELATED REPORTS

Lista de Tablas

TABLE 1 GLOBAL MILK-BASED DRINKS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 2 GLOBAL MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 3 GLOBAL PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 4 GLOBAL MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 5 GLOBAL FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 6 GLOBAL MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 7 GLOBAL MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 8 GLOBAL STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 9 GLOBAL NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 10 GLOBAL ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 11 ASIA-PACIFIC MILK-BASED DRINKS MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 12 ASIA-PACIFIC MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 13 ASIA-PACIFIC PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 14 ASIA-PACIFIC MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 15 ASIA-PACIFIC FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 16 ASIA-PACIFIC MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 17 ASIA-PACIFIC MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 18 ASIA-PACIFIC STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 19 ASIA-PACIFIC NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 20 ASIA-PACIFIC ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 21 INDIA MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 22 INDIA PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 23 INDIA MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 24 INDIA FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 25 INDIA MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 26 INDIA MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 27 INDIA STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 28 INDIA NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 29 INDIA ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 30 CHINA MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 31 CHINA PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 32 CHINA MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 33 CHINA FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 34 CHINA MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 35 CHINA MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 36 CHINA STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 37 CHINA NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 38 CHINA ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 39 JAPAN MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 40 JAPAN PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 41 JAPAN MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 42 JAPAN FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 43 JAPAN MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 44 JAPAN MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 45 JAPAN STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 46 JAPAN NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 47 JAPAN ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 48 AUSTRALIA & NEW ZEALAND MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 49 AUSTRALIA & NEW ZEALAND PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 50 AUSTRALIA & NEW ZEALAND MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 51 AUSTRALIA & NEW ZEALAND FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 52 AUSTRALIA & NEW ZEALAND MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 53 AUSTRALIA & NEW ZEALAND MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 54 AUSTRALIA & NEW ZEALAND STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 55 AUSTRALIA & NEW ZEALAND NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 56 AUSTRALIA & NEW ZEALAND ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 57 SOUTH KOREA MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 58 SOUTH KOREA PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 59 SOUTH KOREA MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 60 SOUTH KOREA FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 61 SOUTH KOREA MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 62 SOUTH KOREA MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 63 SOUTH KOREA STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 64 SOUTH KOREA NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 65 SOUTH KOREA ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 66 SINGAPORE MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 67 SINGAPORE PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 68 SINGAPORE MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 69 SINGAPORE FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 70 SINGAPORE MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 71 SINGAPORE MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 72 SINGAPORE STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 73 SINGAPORE NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 74 SINGAPORE ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 75 THAILAND MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 76 THAILAND PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 77 THAILAND MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 78 THAILAND FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 79 THAILAND MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 80 THAILAND MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 81 THAILAND STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 82 THAILAND NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 83 THAILAND ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 84 INDONESIA MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 85 INDONESIA PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 86 INDONESIA MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 87 INDONESIA FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 88 INDONESIA MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 89 INDONESIA MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 90 INDONESIA STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 91 INDONESIA NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 92 INDONESIA ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 93 MALAYSIA MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 94 MALAYSIA PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 95 MALAYSIA MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 96 MALAYSIA FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 97 MALAYSIA MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 98 MALAYSIA MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 99 MALAYSIA STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 100 MALAYSIA NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 101 MALAYSIA ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 102 PHILIPPINES MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 103 PHILIPPINES PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 104 PHILIPPINES MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 105 PHILIPPINES FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 106 PHILIPPINES MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 107 PHILIPPINES MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 108 PHILIPPINES STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 109 PHILIPPINES NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 110 PHILIPPINES ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 111 REST OF ASIA-PACIFIC MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 112 NORTH AMERICA MILK-BASED DRINKS MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 113 NORTH AMERICA MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 114 NORTH AMERICA PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 115 NORTH AMERICA MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 116 NORTH AMERICA FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 117 NORTH AMERICA MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 118 NORTH AMERICA MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 119 NORTH AMERICA STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 120 NORTH AMERICA NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 121 NORTH AMERICA ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 122 U.S. MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 123 U.S. PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 124 U.S. MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 125 U.S. FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 126 U.S. MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 127 U.S. MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 128 U.S. STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 129 U.S. NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 130 U.S. ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 131 CANADA MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 132 CANADA PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 133 CANADA MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 134 CANADA FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 135 CANADA MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 136 CANADA MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 137 CANADA STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 138 CANADA NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 139 CANADA ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 140 MEXICO MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 141 MEXICO PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 142 MEXICO MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 143 MEXICO FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 144 MEXICO MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 145 MEXICO MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 146 MEXICO STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 147 MEXICO NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 148 MEXICO ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 149 EUROPE MILK-BASED DRINKS MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 150 EUROPE MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 151 EUROPE PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 152 EUROPE MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 153 EUROPE FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 154 EUROPE MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 155 EUROPE MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 156 EUROPE STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 157 EUROPE NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 158 EUROPE ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 159 GERMANY MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 160 GERMANY PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 161 GERMANY MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 162 GERMANY FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 163 GERMANY MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 164 GERMANY MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 165 GERMANY STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 166 GERMANY NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 167 GERMANY ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 168 ITALY MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 169 ITALY PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 170 ITALY MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 171 ITALY FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 172 ITALY MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 173 ITALY MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 174 ITALY STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 175 ITALY NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 176 ITALY ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 177 U.K. MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 178 U.K. PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 179 U.K. MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 180 U.K. FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 181 U.K. MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 182 U.K. MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 183 U.K. STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 184 U.K. NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 185 U.K. ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 186 SPAIN MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 187 SPAIN PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 188 SPAIN MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 189 SPAIN FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 190 SPAIN MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 191 SPAIN MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 192 SPAIN STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 193 SPAIN NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 194 SPAIN ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 195 FRANCE MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 196 FRANCE PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 197 FRANCE MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 198 FRANCE FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 199 FRANCE MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 200 FRANCE MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 201 FRANCE STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 202 FRANCE NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 203 FRANCE ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 204 BELGIUM MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 205 BELGIUM PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 206 BELGIUM MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 207 BELGIUM FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 208 BELGIUM MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 209 BELGIUM MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 210 BELGIUM STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 211 BELGIUM NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 212 BELGIUM ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 213 NETHERLANDS MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 214 NETHERLANDS PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 215 NETHERLANDS MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 216 NETHERLANDS FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 217 NETHERLANDS MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 218 NETHERLANDS MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 219 NETHERLANDS STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 220 NETHERLANDS NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 221 NETHERLANDS ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 222 SWITZERLAND MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 223 SWITZERLAND PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 224 SWITZERLAND MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 225 SWITZERLAND FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 226 SWITZERLAND MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 227 SWITZERLAND MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 228 SWITZERLAND STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 229 SWITZERLAND NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 230 SWITZERLAND ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 231 RUSSIA MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 232 RUSSIA PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 233 RUSSIA MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 234 RUSSIA FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 235 RUSSIA MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 236 RUSSIA MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 237 RUSSIA STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 238 RUSSIA NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 239 RUSSIA ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 240 TURKEY MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 241 TURKEY PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 242 TURKEY MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 243 TURKEY FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 244 TURKEY MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 245 TURKEY MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 246 TURKEY STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 247 TURKEY NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 248 TURKEY ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 249 REST OF EUROPE MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 250 SOUTH AMERICA MILK-BASED DRINKS MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 251 SOUTH AMERICA MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 252 SOUTH AMERICA PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 253 SOUTH AMERICA MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 254 SOUTH AMERICA FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 255 SOUTH AMERICA MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 256 SOUTH AMERICA MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 257 SOUTH AMERICA STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 258 SOUTH AMERICA NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 259 SOUTH AMERICA ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 260 BRAZIL MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 261 BRAZIL PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 262 BRAZIL MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 263 BRAZIL FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 264 BRAZIL MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 265 BRAZIL MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 266 BRAZIL STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 267 BRAZIL NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 268 BRAZIL ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 269 ARGENTINA MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 270 ARGENTINA PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 271 ARGENTINA MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 272 ARGENTINA FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 273 ARGENTINA MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 274 ARGENTINA MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 275 ARGENTINA STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 276 ARGENTINA NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 277 ARGENTINA ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 278 REST OF SOUTH AMERICA MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 279 MIDDLE EAST AND AFRICA MILK-BASED DRINKS MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 280 MIDDLE EAST AND AFRICA MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 281 MIDDLE EAST AND AFRICA PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 282 MIDDLE EAST AND AFRICA MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 283 MIDDLE EAST AND AFRICA FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 284 MIDDLE EAST AND AFRICA MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 285 MIDDLE EAST AND AFRICA MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 286 MIDDLE EAST AND AFRICA STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 287 MIDDLE EAST AND AFRICA NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 288 MIDDLE EAST AND AFRICA ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 289 UNITED ARAB EMIRATES MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 290 UNITED ARAB EMIRATES PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 291 UNITED ARAB EMIRATES MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 292 UNITED ARAB EMIRATES FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 293 UNITED ARAB EMIRATES MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 294 UNITED ARAB EMIRATES MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 295 UNITED ARAB EMIRATES STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 296 UNITED ARAB EMIRATES NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 297 UNITED ARAB EMIRATES ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 298 SAUDI ARABIA MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 299 SAUDI ARABIA PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 300 SAUDI ARABIA MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 301 SAUDI ARABIA FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 302 SAUDI ARABIA MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 303 SAUDI ARABIA MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 304 SAUDI ARABIA STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 305 SAUDI ARABIA NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 306 SAUDI ARABIA ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 307 SOUTH AFRICA MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 308 SOUTH AFRICA PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 309 SOUTH AFRICA MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 310 SOUTH AFRICA FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 311 SOUTH AFRICA MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 312 SOUTH AFRICA MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 313 SOUTH AFRICA STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 314 SOUTH AFRICA NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 315 SOUTH AFRICA ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 316 EGYPT MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 317 EGYPT PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 318 EGYPT MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 319 EGYPT FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 320 EGYPT MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 321 EGYPT MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 322 EGYPT STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 323 EGYPT NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 324 EGYPT ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 325 ISRAEL MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 326 ISRAEL PLANT-BASED MILK IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 327 ISRAEL MILK-BASED DRINKS MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 328 ISRAEL FLAVORED IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 329 ISRAEL MILK-BASED DRINKS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 330 ISRAEL MILK-BASED DRINKS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 331 ISRAEL STORED BASED RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 332 ISRAEL NON-STORE RETAILER IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 333 ISRAEL ONLINE IN MILK-BASED DRINKS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 334 REST OF MIDDLE EAST AND AFRICA MILK-BASED DRINKS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

Lista de figuras

FIGURE 1 GLOBAL MILK-BASED DRINKS MARKET: SEGMENTATION

FIGURE 2 GLOBAL MILK-BASED DRINKS MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL MILK-BASED DRINKS MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL MILK-BASED DRINKS MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL MILK-BASED DRINKS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL MILK-BASED DRINKS MARKET: MULTIVARIATE MODELLING

FIGURE 7 GLOBAL MILK-BASED DRINKS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 GLOBAL MILK-BASED DRINKS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 GLOBAL MILK-BASED DRINKS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 GLOBAL MILK-BASED DRINKS MARKET: SEGMENTATION

FIGURE 11 GROWING CONSUMER AWARENESS AND FOCUS ON HEALTH AND WELLNESS IS EXPECTED TO DRIVE THE GROWTH OF THE GLOBAL MILK-BASED DRINKS MARKET IN THE FORECAST PERIOD

FIGURE 12 THE ANIMAL-BASED MILK SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST MARKET SHARE OF THE GLOBAL MILK-BASED DRINKS MARKET IN 2023 AND 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE GLOBAL MILK-BASED DRINKS MARKET

FIGURE 14 GLOBAL MILK-BASED DRINKS MARKET: SNAPSHOT ( 2022)

FIGURE 15 ASIA-PACIFIC MILK-BASED DRINKS MARKET: SNAPSHOT (2022)

FIGURE 16 NORTH AMERICA MILK-BASED DRINKS MARKET: SNAPSHOT (2022)

FIGURE 17 EUROPE MILK-BASED DRINKS MARKET: SNAPSHOT (2022)

FIGURE 18 SOUTH AMERICA MILK-BASED DRINKS MARKET: SNAPSHOT (2022)

FIGURE 19 MIDDLE EAST AND AFRICA MILK-BASED DRINKS MARKET: SNAPSHOT (2022)

FIGURE 20 GLOBAL MILK-BASED DRINKS MARKET: COMPANY SHARE 2022 (%)

FIGURE 21 EUROPE MILK-BASED DRINKS MARKET: COMPANY SHARE 2022 (%)

FIGURE 22 ASIA-PACIFC MILK-BASED DRINKS MARKET: COMPANY SHARE 2022 (%)

FIGURE 23 NORTH AMERICA MILK-BASED DRINKS MARKET: COMPANY SHARE 2022 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.