Bangladesh’s Ready-Made Garments (RMG) sector continues to strengthen its position as one of the world’s leading apparel manufacturing hubs, largely due to its competitive labor costs and the availability of a sizable, skilled workforce. With over four million workers employed in the industry—most of them women—the sector benefits from a stable labor supply that supports mass production, fast order fulfillment, and the scalability required for global buyers. This labor advantage has enabled Bangladesh to consistently maintain lower production expenses compared to competing markets such as Vietnam, India, and China, making the country a preferred destination for brands seeking cost-efficient sourcing without compromising quality.

The presence of a young demographic and continuous employment generation further reinforce the industry’s growth potential. Over the last decade, Bangladesh has worked to improve worker training systems, upgrade industrial zones, and increase labor compliance standards, resulting in a more productive and reliable workforce. International retailers increasingly favor Bangladesh for bulk orders of knitwear and woven garments because the workforce is accustomed to large-scale operations and standardized production processes.

Moreover, national policies focused on labor development and industrial expansion enhance the country’s competitive edge. Government-led training programs, skill enhancement centers, and collaboration with global organizations have helped strengthen worker capabilities, enabling more efficient handling of complex manufacturing tasks. These initiatives contribute to higher output levels, improved product quality, and reduced lead times—key factors that global buyers consider when selecting suppliers

Access Full Report @ https://www.databridgemarketresearch.com/reports/bangladesh-ready-made-garments-market

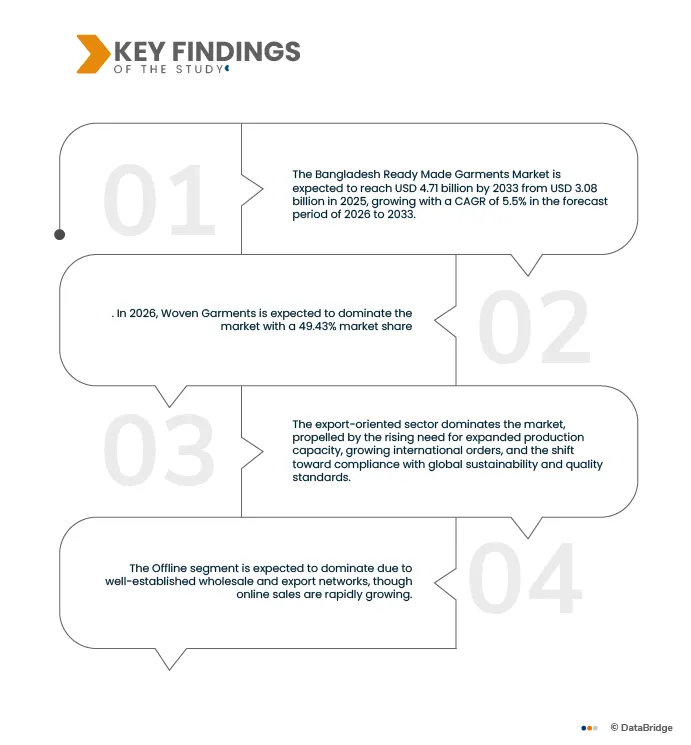

Data Bridge market research analyzes that The Bangladesh Ready Made Garments Market is expected to reach USD 4.71 billion by 2033 from USD 3.08 billion in 2025, growing with a CAGR of 5.5% in the forecast period of 2026 to 2033.

Key Findings of the Study

Strong export demand from major markets such as the EU and US drives continuous expansion

The Bangladesh Ready-Made Garments (RMG) sector continues to experience steady and long-term growth driven by strong demand from two of its largest export destinations—the European Union (EU) and the U.S. (US). These markets consistently account for more than half of Bangladesh’s total apparel exports, creating a stable and predictable demand environment for manufacturers. As global brands prioritize cost efficiency, reliable production, and timely delivery, Bangladesh has emerged as one of the most trusted sourcing hubs for mass-market and mid-range apparel categories.

Bangladesh’s competitive pricing, robust production capacity, and improving compliance standards have reinforced its attractiveness to international buyers. Over the past decade, retailers such as H&M, Inditex, Walmart, Gap, PVH, and Primark have expanded sourcing operations in Bangladesh to meet rising demand for knitwear, denim, outerwear, and basic apparel in their home markets. The EU’s duty-free access under the Everything But Arms (EBA) scheme and Bangladesh’s historically favorable trade relations with the US have further supported this export momentum.

Additionally, shifting global sourcing dynamics are contributing to Bangladesh’s growing prominence. Rising labour costs in China and increasing geopolitical tensions have encouraged Western apparel brands to diversify their supply chains, often directing a larger share of their sourcing to Bangladesh. This redirection of orders has boosted factory utilization rates, encouraged investments in capacity expansion, and strengthened long-term export prospects.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2026 to 2033

|

|

Base Year

|

2025

|

|

Historic Years

|

2024 (Customizable to 2018-2023)

|

|

Quantitative Units

|

Revenue in USD Billion

|

|

Segments Covered

|

By Fiber Type (Single-Mode Fiber (SMF), Multi-Mode Fiber (MMF)), By Network Type (Metro Dark Fiber, Long-Haul Dark Fiber), By Material (Glass Fiber, Plastic Optical Fiber (POF)), By Application (Backhaul Connectivity, Data Center Interconnect (DCI), Enterprise & Private Networks, Long-Haul Transport, Redundancy & Network Resiliency, Others), By End User (BFSI, IT & Telecommunication, Government & Public Sector, Healthcare, Universities & Research Institutes, Media & Entertainment, Industrial & Manufacturing, Others), By Sales Channel (Direct Sales, Indirect Sales)

|

|

Countries Covered

|

Bangladesh

|

|

Market Players Covered

|

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include industry analysis & futuristic scenario, penetration and growth prospect mapping, competitor key pricing strategies (prominent players), technology analysis, company profiling, competitive analysis.

|

Segment Analysis

The Bangladesh ready made garments market is segmented into seven notable segments based on the product type, product construction, fiber type, business model, price, consumer group and factory size.

- On the basis of product type, the Bangladesh market is segmented into Apparel and Accessories.

In 2026, the Apparel segment is expected to dominate the market

In 2026, the Apparel segment is expected to dominate the market with a market share of 93.37% due to country’s strong specialization in large-scale apparel manufacturing, its globally competitive production costs, and the steady international demand for Bangladesh-made clothing. Continued expansion of export-oriented factories, improvements in compliance standards, and increased investment in modern machinery further reinforce the dominance of the apparel category across key global sourcing markets.

- On the basis of product construction, the market is segmented into Woven Garments, Knit Garments, Composite or Blended, Non-Woven or Technical.

In 2026, the woven garments segment is expected to dominate the market

In 2026, woven garments segment dominates the market with a market share of 49.43% due to Bangladesh’s long-established expertise in producing woven items such as shirts, trousers, jackets, and denim products. Strong backward linkage industries, reliable export performance, and steady orders from major global brands support growth. Upgrades in fabric sourcing, finishing, and quality control systems also strengthen Bangladesh’s competitiveness in woven garment manufacturing compared to other apparel-producing countries.

- On the basis of fiber type, the market is segmented into Natural Fibers, Man-Made Fibers, Specialty Fibers, and Others.

In 2026, the natural fiber segment is expected to dominate the market

In 2026, the natural fiber segment is expected to dominate the market with a market share of 63.93% as the global demand for breathable, comfortable, and eco-friendly textile materials continues to rise. Bangladesh’s long history of cotton-based garment production, strong mill infrastructure, and the affordability of natural fibers reinforce this dominance. Additionally, shifting consumer preferences toward sustainable clothing and brand commitments to environmentally responsible sourcing further accelerate growth in natural fiber-based apparel manufacturing.

- On the basis of businees model, the market is segmented into offline and online.

In 2026, the offline segment is expected to dominate the market

In 2026, the offline segment is expected to dominate the market with a market share of 86.13% as Bangladesh’s ready-made garment sector continues to rely heavily on traditional, relationship-driven wholesale channels and long-standing contracts with international buyers. Most export transactions still occur through established physical networks, including buying houses and factory-brand partnerships. The limited penetration of digital supply-chain platforms also contributes to offline channels maintaining their strong operational and commercial influence across the industry.

- On the basis of price, the market is segmented into Low-Cost or Mass, Mid-Market Branded, Premium Fast Fashion, and Luxury & Designer.

In 2026, the Low-Cost or Mass segment is expected to dominate the market

In 2026, the Low-Cost or Mass segment is expected to dominate the market with a market share of 56.46% as Bangladesh remains a leading global hub for affordable garment production. Competitive labor costs, high-volume manufacturing capacities, and efficient supply-chain processes enable producers to supply large quantities at accessible prices. International retailers seeking cost-effective sourcing continue to prioritize Bangladesh, while the country’s strength in producing value-driven basics and essentials reinforces this segment’s commanding market position.

- On the basis of consumer group, the market is segmented into Women, Men, and Kids.

In 2026, the women group segment is expected to dominate the market

In 2026, the women group segment is expected to dominate the market with a market share of 46.97% due to the strong global demand for women’s fashion categories, including dresses, tops, denim, and intimate apparel. Brands and retailers consistently source women’s wear from Bangladesh because of the country’s ability to offer diverse styles, competitive pricing, and reliable quality. Growing fashion trends, frequent product refresh cycles, and expanded design capabilities further drive the dominance of women’s apparel manufacturing.

- On the basis of factory size, the market is segmented into Mega Factories with Large Workforce, Large-Scale Factories, and Small and Medium Enterprises (SMEs).

In 2026, the mega factories with large workforce segment is expected to dominate the market

In 2026, the Mega Factories with Large Workforce segment is expected to dominate the market with a market share of 48.99% due to their ability to handle high-volume orders, meet strict compliance requirements, and consistently deliver to major global brands. These large-scale facilities benefit from advanced technology, strong production planning systems, and enhanced sustainability practices. Their capacity to offer integrated operations from cutting to finishing makes them preferred partners for buyers seeking reliability, scale, and faster lead times.

Major Players

Ananta Group (Bangladesh), Asian Apparels Ltd. (Bangladesh), Pacific Jeans Pacific Jeans, Bitopi Group Pacific Jeans, Fakir Apparels Ltd (Bangladesh), among others.

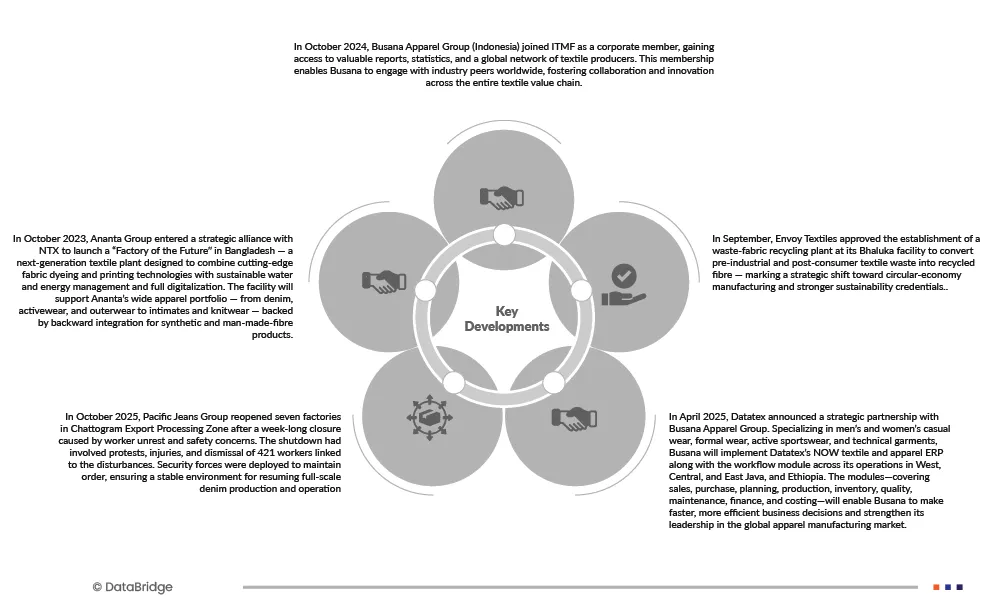

Market Developments

- In November 2025, Masco Group inaugurated the Concept Knitting Ltd Administrative Building, marking a key milestone in the company’s journey of innovation and excellence. The new facility reflects Masco Group’s commitment to advanced infrastructure, talent development, and operational efficiency, further strengthening its capabilities to deliver world-class apparel solutions and enhance competitiveness.

- In September 2025, Envoy Textiles approved the establishment of a waste-fabric recycling plant at its Bhaluka facility to convert pre-industrial and post-consumer textile waste into recycled fibre marking a strategic shift toward circular economy manufacturing sustainability credentials.

- In 2025, Ha-Meem Group partnered with global interlining manufacturer Wendler Inside to drive sustainable manufacturing practices, marking a push toward environmentally responsible garment production.

For more detailed information about the Bangladesh Ready Made Garments Market report, click here – https://www.databridgemarketresearch.com/reports/bangladesh-ready-made-garments-market