Growing health consciousness in Mexico—driven by preventive-health awareness, government campaigns, digital access to nutrition information and rising interest in immunity, fitness and overall wellness—is significantly boosting demand for dietary supplements. Consumers across age groups are shifting toward proactive self-care, increasing the use of vitamins, minerals, herbal extracts, probiotics and functional nutrition products. This strong focus on preventive wellbeing is expected to sustain market growth, particularly for brands that align with wellness narratives and education-focused marketing.

Access Full Report @ https://www.databridgemarketresearch.com/reports/mexico-dietary-supplements-market

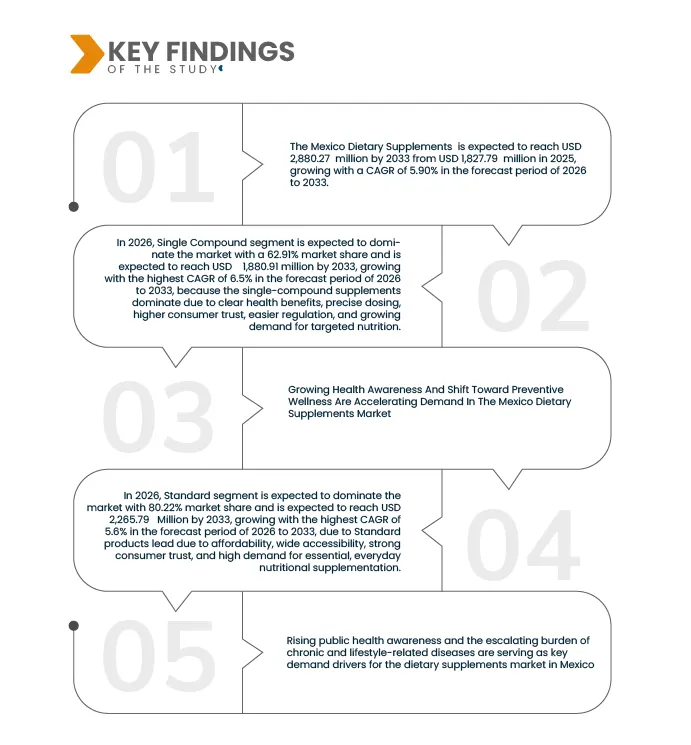

Data Bridge market research analyzes that Mexico Dietary Supplements Market is expected to reach USD 2,880.27 million by 2033 from USD 1,827.79 million in 2025, growing with a substantial CAGR of 5.90% in the forecast period of 2026 to 2033.

Key Findings of the Study

Increase in Chronic Disease Burden

Rising public health awareness and the escalating burden of chronic and lifestyle-related diseases are serving as key demand drivers for the dietary supplements market in Mexico. As consumers become more mindful of preventive healthcare, nutrition optimisation and immune support, demand for vitamins, minerals, functional foods and herbal supplements is expanding. Concurrently, elevated rates of obesity, diabetes, hypertension and micronutrient deficiencies are prompting individuals to adopt supplementation as part of self-care strategies. These developments are broadening the target audience for dietary supplements and increasing willingness to invest in wellness-oriented products across demographic segments.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2026 to 2033

|

|

Base Year

|

2025

|

|

Historic Years

|

2024 (Customizable to 2018-2023)

|

|

Quantitative Units

|

Revenue in USD million

|

|

Segments Covered

|

By product (vitamins, minerals, probiotics & prebiotic, protein, botanicals, fatty acids, amino acids, co-enzyme, lipids, carotenoids, nucleotides, others), type (single compound, and blended/ fortified), product category (standard, and personalized), source type (plant based, animal based, and others), nature (conventional, and organic), form (nutraceutical products, soft gels, powders, gummies & jellies, liquids, premixes), function (general well-being, immunity, sports nutrition, digestive health, heart health, weight management, bone and joint health, skin health, hair health, nail health, others), end user (women, men, senior citizens, children), distribution channel (store based retail, and online based retail)

|

|

Countries Covered

|

|

|

Market Players Covered

|

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

|

Segment Analysis

The Mexico dietary supplements market is segmented into nine notable segments based on, product, type, product category, source type, nature, form, function, end user, distribution channel.

- On the basis of Product, the Mexico dietary supplements market is segmented into vitamins, minerals, probiotics & prebiotic, protein, botanicals, fatty-acids, amino acids, co-enzyme, lipids, carotenoids, nucleotides, others.

In 2026, the Vitamins segment is expected to dominate the market

In 2026, the Vitamins segment is expected to dominate the market with a market share of 30.02% and is expected to reach 824.69 million by 2033, growing with the CAGR of 5.2% in the forecast period 2026 to 2033.

- On the basis of Type, market is segmented into single compound, blended/ fortified.

In 2026, the Single Compound segment is expected to dominate the market

- In 2026, the Single Compound is expected to dominate the market with a market share of 62.91% and is expected to reach 1,880.91 million by 2033, growing with the CAGR of 6.5% in the forecast period 2026 to 2033.

- On the basis of Product Category, Mexico dietary supplements market is segmented into standard, personalized. In 2026, the standard segment is expected to dominate the market with a market share of 80.03% and is expected to reach 2,265.79 million by 2033, growing with the CAGR of 5.6% in the forecast period 2026 to 2033.

- On the basis of Source Type, the Mexico dietary supplements market is segmented into plant based, animal based, others. In 2026, the Plant Based segment is expected to dominate the market with a market share of 62.80% and is expected to reach 1,773.60 million by 2033, growing with the CAGR of 5.6% in the forecast period 2026 to 2033.

- On the basis of Nature, Mexico dietary supplements market is segmented into conventional and organic. In 2026, the conventional segment is expected to dominate the market with a market share of 81.83% and is expected to reach 2,369.72 million by 2033, growing with the CAGR of 6.0% in the forecast period 2026 to 2033.

- On the basis of form, the Mexico dietary supplements market is segmented into nutraceutical products, soft gels, powders, gummies & jellies, liquids, and premixes. In 2026, the nutraceutical products segment is expected to dominate the market with a market share of 47.91% and is expected to reach 1,355.44 million by 2033, growing with the CAGR of 5.6% in the forecast period 2026 to 2033.

- On the basis of Function, the Mexico dietary supplements market is segmented into general well-being, immunity, sports nutrition, digestive health, heart health, weight management, bone and joint health, skin health, hair health, nail health, others. In 2026, the general well-being segment is expected to dominate the market with a market share of 28.31% and is expected to reach 804.66 million by 2033, growing with the CAGR of 5.7% in the forecast period 2026 to 2033.

- On the basis of End User, the Mexico dietary supplements market is segmented into women, men, senior citizens and children. In 2026, the women segment is expected to dominate the market with a market share of 35.40% and is expected to reach 1,008.85 million by 2033, growing with the CAGR of 5.7% in the forecast period 2026 to 2033.

- On the basis of Distribution Channel, the Mexico dietary supplements market is segmented into store based retail and online based retail. In 2026, the store-based retail segment is expected to dominate the market with a market share of 68.52% and is expected to reach 1,917.60 million by 2033, growing with the CAGR of 5.5% in the forecast period 2026 to 2033.

Major Players

NESTLÉ (Switzerland), HERBALIFE (United States), GNC (GENERAL NUTRITION CENTERS) (United States), OPTIMUM NUTRITION, INC. (United States), NOW FOODS (United States), and among others.

Latest Developments in Mexico Dietary Supplements Market

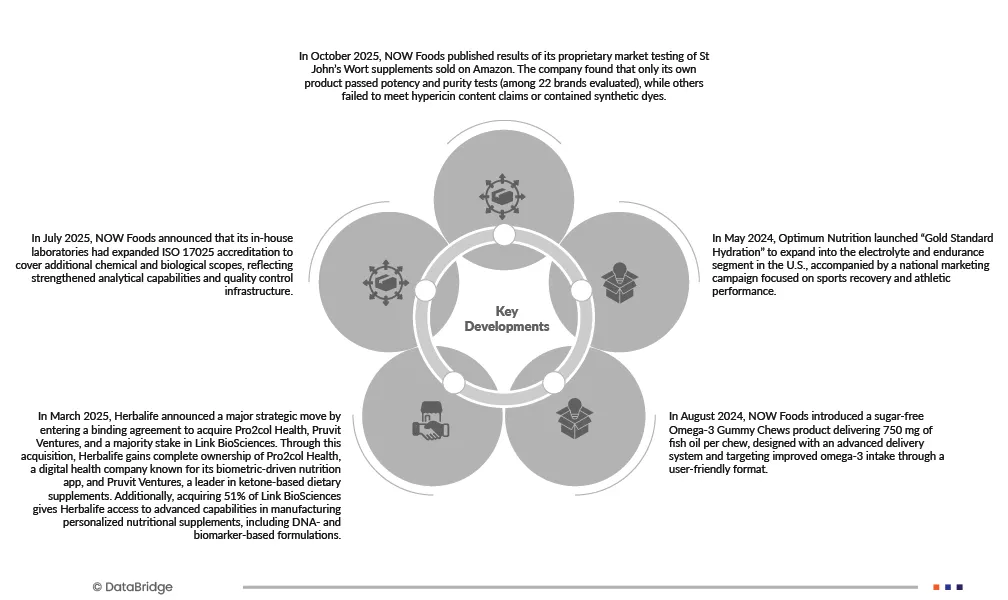

- In October 2025, NOW Foods published results of its proprietary market testing of St John’s Wort supplements sold on Amazon. The company found that only its own product passed potency and purity tests (among 22 brands evaluated), while others failed to meet hypericin content claims or contained synthetic dyes.

- In July 2025, NOW Foods announced that its in-house laboratories had expanded ISO 17025 accreditation to cover additional chemical and biological scopes, reflecting strengthened analytical capabilities and quality control infrastructure.

- In March 2025, Herbalife announced a major strategic move by entering a binding agreement to acquire Pro2col Health, Pruvit Ventures, and a majority stake in Link BioSciences. Through this acquisition, Herbalife gains complete ownership of Pro2col Health, a digital health company known for its biometric-driven nutrition app, and Pruvit Ventures, a leader in ketone-based dietary supplements. Additionally, acquiring 51% of Link BioSciences gives Herbalife access to advanced capabilities in manufacturing personalized nutritional supplements, including DNA- and biomarker-based formulations. This combined deal strengthens Herbalife’s shift toward personalized, tech-enabled nutrition, allowing the company to blend digital wellness tools with tailored supplement solutions and expand its next-generation product portfolio.

- In August 2024, NOW Foods introduced a sugar-free Omega-3 Gummy Chews product delivering 750 mg of fish oil per chew, designed with an advanced delivery system and targeting improved omega-3 intake through a user-friendly format.

- In May 2024, Optimum Nutrition launched “Gold Standard Hydration” to expand into the electrolyte and endurance segment in the U.S., accompanied by a national marketing campaign focused on sports recovery and athletic performance.

As per Data Bridge Market Research analysis:

Geographically, the countries covered in the Mexico dietary supplements market report are Mexico

For more detailed information about the Mexico dietary supplements market report, click here – https://www.databridgemarketresearch.com/reports/mexico-dietary-supplements-market