The reverse logistics market offers significant benefits, including cost reduction through product returns optimization, reduced waste, and enhanced customer satisfaction. The dominating segment in this market is the e-commerce sector. E-commerce's rapid growth has increased product returns, making efficient reverse logistics crucial. E-retailers leverage reverse logistics to streamline return processes, reduce return-related costs, and refurbish or resell returned items. This sector's dominance is driven by its need for effective product returns management, making it a key player in the evolution of reverse logistics strategies.

Access Full Report @ https://www.databridgemarketresearch.com/reports/global-reverse-logistics-market

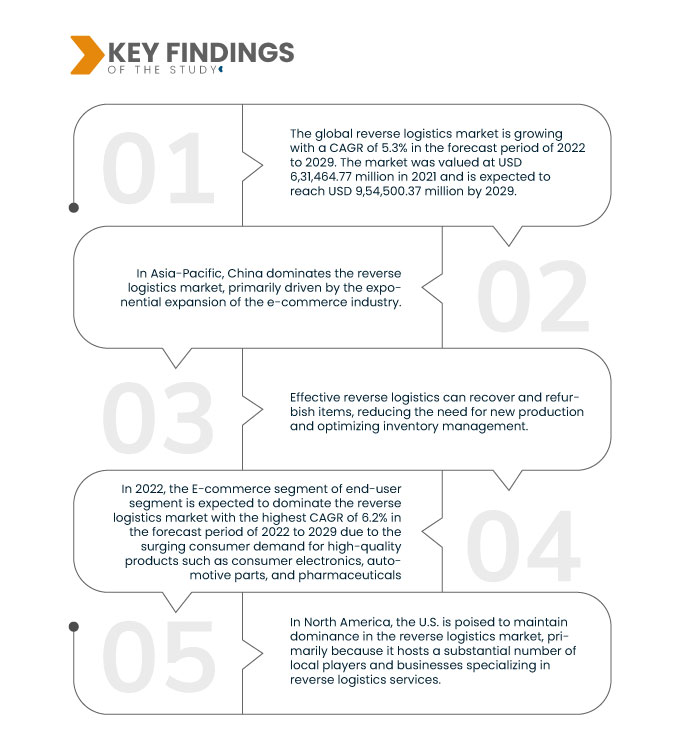

Data Bridge Market Research analyses that the Global Reverse Logistics Market is growing with a CAGR of 5.3% in the forecast period of 2022 to 2029. The market was valued at USD 6,31,464.77 million in 2021 and is expected to reach USD 9,54,500.37 million by 2029. Government regulations are becoming stricter regarding product returns, recycling, and waste management. To remain compliant and avoid penalties, businesses must implement efficient reverse logistics practices to manage product returns, reduce waste, and meet environmental standards.

Key Findings of the Study

Sustainability and environmental concerns are expected to drive the market's growth rate

The increasing awareness of environmental concerns is compelling companies to adopt effective reverse logistics strategies. This includes responsible disposal and recycling of products to minimize the environmental footprint. Consumers are increasingly eco-conscious, demanding sustainable practices from businesses. Implementing robust reverse logistics not only reduces ecological impact but also resonates positively with customers, enhancing brand reputation. Thus, the imperative to address environmental issues is a driving force behind the adoption of eco-friendly reverse logistics practices.

Report Scope and Market Segmentation

Report Metric

|

Details

|

Forecast Period

|

2022 to 2029

|

Base Year

|

2021

|

Historic Years

|

2020 (Customizable to 2014-2019)

|

Quantitative Units

|

Revenue in USD Million, Volumes in Units, Pricing in USD

|

Segments Covered

|

Return Type (Returns, End-Of-Life, Remanufacturing, Refurbishing, Unsold Goods, Rentals and Leasing, Repairs and Maintenance, Delivery Failure, Returns Avoidance, Packaging, and Others), Component (Return Policy And Procedure (RPP), Remanufacturing Or Refurbishment (ROR) and Waste Disposal (WAD)), Service Type (Transportation, Warehousing, Replacement Management, Reselling, Refund Management Authorization and Others), End-User (E-Commerce, Retail, Automotive, Consumer Electronics, Pharmaceutical, Reusable Packaging, Textile And Garments, Luxury Goods and Others)

|

Countries Covered

|

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

|

Market Players Covered

|

C.H. Robinson Worldwide, Inc. (U.S.), Deutsche Post DHL Group (Germany), FedEx (U.S.), Core Logistic Private Limited (India), Schenker AG (Germany), Kintetsu World Express, Inc. (Japan), YUSEN LOGISTICS CO., LTD. (Japan), LogiNext Solutions Inc (U.S.), NFI Industries (U.S.), ReverseLogix (U.S.), Indev Group of companies (India), Safexpress Pvt. Ltd. (India), Optoro, Inc. (U.S.), Reverse Logistics Group (Austria), DGS Translogistics India Pvt. Ltd. (India), ShipWizard (U.S.), Woodfield Distribution, LLC (U.S.), United Parcel Service of America, Inc. (U.S.), XPO Logistics, Inc (U.S.), IBM Corporation (U.S.)

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

|

Segment Analysis:

The global reverse logistics market is segmented on the basis of the return type, components, service type, and end-user.

On the basis of the return type, the global reverse logistics market is segmented into returns, returns avoidance, remanufacturing, refurbishing, packaging, unsold goods, end-of-life, delivery failure, rentals and leasing, repairs and maintenance, and others. In 2022, the returns segment is expected to dominate the reverse logistics market with the highest CAGR of 6.1% in the forecast period of 2022 to 2029. This shift is attributed to the surging popularity of online platforms and the e-commerce industry, driving increased consumer product demand

In 2022, the returns segment of return type segment is expected to dominate the global reverse logistics market during the forecast period of 2022-2029

In 2022, the returns sector is expected to dominate the reverse logistics market with the highest CAGR of 6.1% in the forecast period of 2022 to 2029. This shift is attributed to the surging popularity of online platforms and the e-commerce industry, driving increased consumer product demand. Notably, one in three online products gets returned, fueling the growth of this segment due to the imperative need for efficient returns management.

- On the basis of components, the global reverse logistics market is segmented into return policy and procedure (RPP), remanufacturing or refurbishment (ROR), and waste disposal (WAD). In 2022, the return policy and procedure (RPP) sector is anticipated to dominate the reverse logistics market growing with the highest CAGR of 5.8% in the forecast period of 2022 to 2029. This trend is influenced by the rapid expansion of the e-commerce industry, resulting in heightened consumer product demand.

In 2022, the return policy and procedure (RPP) segment of components segment is expected to dominate the global reverse logistics market during the forecast period of 2022-2029

In 2022, the return policy and procedure (RPP) sector is anticipated to dominate the reverse logistics market growing with the highest CAGR of 5.8% in the forecast period of 2022 to 2029. This trend is influenced by the rapid expansion of the e-commerce industry, resulting in heightened consumer product demand and subsequently, an increased incidence of product returns when items do not meet consumer expectations. Reverse logistics providers are crucial players in implementing effective return policies and procedures.

- On the basis of service type, the global reverse logistics market is segmented into transportation, warehousing, reselling, replacement management, refund management authorization, and others. In 2022, the transportation segment is poised to dominate the reverse logistics market with the highest CAGR of 5.9% in the forecast period of 2022 to 2029.. This trend is driven by the rapid growth of the e-commerce sector, which has led to increased demand for consumer products requiring efficient transportation to end consumers. Transportation plays a pivotal role in reverse logistics, ensuring the timely and secure delivery of products, making it a critical component of the industry.

- 최종 사용자 기준으로 글로벌 역물류 시장은 섬유 및 의류, 전자상거래, 자동차, 제약, 가전제품, 소매, 명품, 재사용 가능 포장재 등으로 세분화됩니다. 2022년에는 전자상거래 부문이 가전제품, 자동차 부품, 제약 등 고품질 제품에 대한 소비자 수요 급증에 힘입어 2022년부터 2029년까지 연평균 성장률 6.2%라는 가장 높은 성장률을 기록하며 역물류 시장을 주도할 것으로 예상됩니다. 이러한 수요는 주로 빠르게 성장하는 전자상거래 플랫폼을 통해 발생하며, 제품 품질 및 배송 기준 유지의 중요성을 강조합니다.

주요 플레이어

Data Bridge Market Research는 다음 회사를 글로벌 역물류 시장의 주요 글로벌 역물류 시장 주체로 인식합니다.CH Robinson Worldwide, Inc.(미국), Deutsche Post DHL Group(독일), FedEx(미국), Core Logistic Private Limited(인도), Schenker AG(독일), Kintetsu World Express, Inc.(일본), YUSEN LOGISTICS CO., LTD.(일본), LogiNext Solutions Inc(미국), NFI Industries(미국), ReverseLogix(미국).

시장 개발

- 2022년 1월, FedEx는 마이크로소프트와 파트너십을 맺고 물류 서비스(logistics-as-a-service) 솔루션을 출시하여 물류 역량을 강화했습니다. 주요 목표는 끊임없이 변화하는 기술 트렌드와 물류 혁신에 적응할 수 있는 회사의 역량을 강화하는 것이었습니다. 이러한 협력을 통해 FedEx는 기술 발전 속에서도 경쟁력과 민첩성을 유지하고, 현대 물류 환경의 증가하는 수요를 충족하는 동시에 고객에게 효율적이고 혁신적인 솔루션을 제공하고자 했습니다.

- 2021년 1월, 쉔커(Schenker AG)는 홍콩과학기술단지공사(HKSTP)와 아시아 최초의 첨단 제조 시설 건립을 위한 10년 계약을 체결했습니다. 이 최첨단 시설은 자동화 및 지능형 물류 솔루션을 갖추고 있습니다. 이 파트너십을 통해 DB 쉔커는 글로벌 입지를 강화할 뿐만 아니라, 혁신적이고 미래 지향적인 공급망 솔루션에 대한 헌신을 통해 글로벌 물류 분야의 선두주자로 자리매김할 수 있었습니다.

지역 분석

지리적으로 주요 글로벌 역물류 시장 보고서에서 다루는 국가는 다음과 같습니다. 북미에서는 미국, 캐나다, 멕시코, 유럽에서는 독일, 프랑스, 영국, 네덜란드, 스위스, 벨기에, 러시아, 이탈리아, 스페인, 터키, 유럽의 기타 유럽 국가, 중국, 일본, 인도, 한국, 싱가포르, 말레이시아, 호주, 태국, 인도네시아, 필리핀, 아시아 태평양(APAC)의 기타 아시아 태평양(APAC), 사우디아라비아, UAE, 남아프리카 공화국, 이집트, 이스라엘, 중동 및 아프리카(MEA)의 일부인 기타 중동 및 아프리카(MEA), 남미의 일부인 기타 남미.

Data Bridge Market Research 분석에 따르면:

아시아 태평양 지역은 2022년부터 2029년까지의 예측 기간 동안 글로벌 역물류 시장을 지배할 것입니다.

아시아 태평양 지역에서는 전자상거래 산업의 기하급수적인 성장에 힘입어 중국이 역물류 시장을 장악하고 있습니다. 온라인 쇼핑의 급증으로 효율적인 제품 반품 및 재활용 프로세스에 대한 수요가 더욱 커졌습니다. 또한, 자동차 및 가전제품 부문에 대한 대규모 투자는 기업들이 제품 반품, 재활용 및 재제조를 효율적으로 관리하기 위해 노력함에 따라 역물류 수요를 더욱 증가시켜 중국이 이 지역 시장의 강자로 자리매김하고 있습니다.

북미는 2022년부터 2029년까지의 예측 기간 동안 글로벌 역방향 물류 시장을 지배할 것으로 예상됩니다.

북미 지역에서 미국은 역물류 시장에서 주도권을 유지할 태세를 갖추고 있습니다. 역물류 서비스를 전문으로 하는 현지 업체와 기업이 상당수 존재하기 때문입니다. 이처럼 광범위한 업계 참여자 네트워크와 성숙한 물류 인프라는 미국을 제품 반품, 재활용 및 재제조를 효율적으로 관리하는 선두 주자로 자리매김하게 함으로써 시장에서의 탁월한 입지를 더욱 공고히 합니다.

미국 환각제 시장 보고서 에 대한 자세한 내용은 여기를 클릭하세요 - https://www.databridgemarketresearch.com/reports/global-reverse-logistics-market