In Europe, demand for refurbished products continues to rise, driven by strong consumer adoption of second-hand electronics and growing environmental awareness. Consumers increasingly choose refurbished smartphones, laptops, and household appliances as cost-effective and sustainable alternatives to new products. This shift is reinforced by Germany’s stringent environmental regulations, including the Packaging Act and Extended Producer Responsibility policies, which promote waste reduction, reuse, and responsible product lifecycle management. As a result, consumers are more inclined to participate in circular economy practices. Additionally, Germany hosts a highly mature e-commerce resale ecosystem, supported by well-established online marketplaces, retailer-backed trade-in programs, and specialized recommerce platforms. These digital channels ensure easy access to certified refurbished goods, transparent quality standards, and secure transactions, thereby strengthening consumer confidence. Together, these factors have created a robust and sustained demand for refurbished products across key categories, solidifying Germany as one of Europe’s most advanced recommerce markets.

For instance,

- in June 2025, Recommerce Group and Euronics started strategic partnership enables thousands of used devices to be collected in-store or online, processed via DEKRA-certified workflows, and returned to the market with a multi-point inspection and two-year warranty.

- In December 2024, the UK government introduced regulatory proposals requiring major online marketplaces, including Amazon and eBay, to take greater responsibility for the recycling of waste electrical and electronic equipment (WEEE). This measure is aimed at promoting circular economy practices by ensuring that returned or discarded electronics are properly collected, refurbished, or recycled, rather than ending up in landfills. By holding platforms accountable for the end-of-life management of products sold through their sites, the initiative strengthens reverse-logistics systems, encourages partnerships with certified refurbishers, and increases the supply of recoverable electronics.

- In February 2024, Vodafone, together with Recommerce Group, released the 6th edition of the Recommerce Barometer, revealing that European consumers are increasingly embracing refurbished smartphones. More than 43% of Europeans reported having already owned a second‑hand phone up from 42% the previous year while over 52% expressed willingness to buy one in the future.

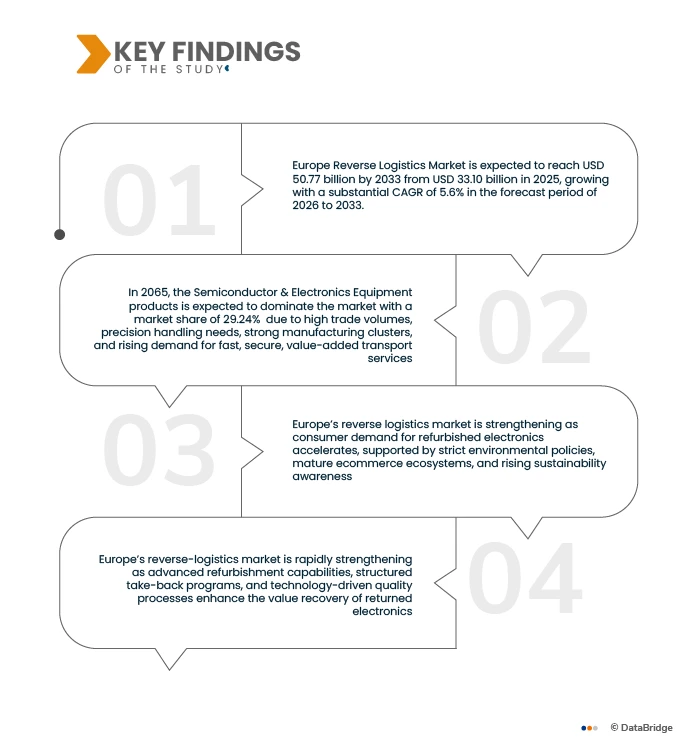

Europe’s reverse logistics market is strengthening as consumer demand for refurbished electronics accelerates, supported by strict environmental policies, mature recommerce ecosystems, and rising sustainability awareness. Regulatory actions in the UK and Germany, along with strategic partnerships like Recommerce–Euronics and industry insights from Vodafone, are boosting device recovery, refurbishment, and resale. Together, these developments reinforce circular economy growth and ensure a stable, expanding supply of high-quality refurbished products across Europe.

Access Full Report @ https://www.databridgemarketresearch.com/reports/europe-reverse-logistics-market

Data Bridge market research analyzes that Europe Reverse Logistics Market is expected to reach USD 50.77 billion by 2033 from USD 33.10 billion in 2025, growing with a substantial CAGR of 5.6% in the forecast period of 2026 to 2033.

Key Findings of the Study

Well-Established Logistics Networks, Refurbishment Expertise in Electronics & Appliances

The Europe reverse-logistics market is supported by robust logistics networks and advanced refurbishment capabilities, enabling the efficient processing and redistribution of returned goods. Returned electronics, smartphones, laptops, and household appliances are directed to specialized refurbishment centers, where they undergo rigorous testing, data wiping, and reconditioning, ensuring that products meet high-quality standards and regain consumer trust. Technological innovations in diagnostic tools, repair protocols, and quality assurance processes have further strengthened confidence in refurbished devices. Retailers and online marketplaces actively collaborate to streamline the flow of returns, integrating take-back schemes, trade-in programs, and resale channels into a seamless recommerce ecosystem. Notable examples include dedicated refurbishment centers operated by major electronics retailers, as well as partnerships with recommerce platforms such as Envirofone, which consolidate returned devices and resell them across digital marketplaces. These coordinated efforts optimize supply efficiency, maintain consistent product quality, and reinforce the UK’s growing reverse-logistics sector.

For Instance,

- In September 2025, Back Market expanded its UK operations by launching a dedicated repair platform for smartphones and tablets, providing both subscription-based and on-demand repair services. This initiative strengthens the company’s recommerce infrastructure by creating a structured pathway for returned or damaged devices to be efficiently recovered and refurbished rather than discarded. Through rigorous diagnostic testing, quality repairs, and secure data management, devices are restored to resale-ready condition, ensuring high product standards and consumer confidence.

- In May 2025, Recommerce Group introduced its “Forward Trade-In” solution, a model designed to secure a predictable and continuous supply of used electronic devices for refurbishment. Under this program, customers purchasing a new smartphone or electronic device are offered a guaranteed future buy-back price at the time of purchase. When the consumer later returns the device, it is automatically routed into Recommerce’s certified refurbishment pipeline, where it undergoes diagnostic testing, repair, and quality certification.

Europe’s reverse-logistics market is rapidly strengthening as advanced refurbishment capabilities, structured take-back programs, and technology-driven quality processes enhance the value recovery of returned electronics. Initiatives like Back Market’s dedicated UK repair platform and Recommerce Group’s Forward Trade-In model ensure steady device inflows, higher refurbishment standards, and greater consumer trust. Together, these developments create a resilient, efficient, and scalable recommerce ecosystem across the region.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2026 to 2033

|

|

Base Year

|

2025

|

|

Historic Years

|

2024 (Customizable to 2018-2023)

|

|

Quantitative Units

|

Revenue in USD Billion

|

|

Segments Covered

|

By Product Type (Semiconductor & Electronics Equipment, Automotive Components & EV Charging Equipment, Medical & Healthcare Equipment, Industrial Power Supplies, Automation & Robotics Equipment.), By Service Type ( Collection, Recycling, Refurbishment, Resale), By Distribution Channel ( B2B, B2C)

|

|

Countries Covered

|

Europe

|

|

Market Players Covered

|

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include innovation tracker and strategic analysis, technological advancements, climate change scenario, supply chain analysis, value chain analysis, vendor selection criteria, PESTLE Analysis, Porter Analysis, patent analysis, industry eco-system analysis, raw material coverage, tariffs and their impact on market, regulation coverage, consumer buying behavior, brand outlook, cost analysis breakdown, and regulatory framework.

|

Segment Analysis

The Europe Reverse Logistics Market is segmented into three notable segments which are product type, Service Type, and distribution channel.

- On the basis of Product Type, market is segmented into Semiconductor & Electronics Equipment, Automotive Components & EV Charging Equipment, Medical & Healthcare Equipment, Industrial Power Supplies, Automation & Robotics Equipment.

In 2026, the Semiconductor & Electronics Equipment segment is expected to dominate the market

In 2065, the Semiconductor & Electronics Equipment products is expected to dominate the market with a market share of 29.24% due to high trade volumes, precision handling needs, strong manufacturing clusters, and rising demand for fast, secure, value-added transport services.

- On the basis of Service Type, Market is segmented into Collection, Recycling, Refurbishment, Resale.

In 2026, the Collection segment is expected to dominate the market

In 2026, the Collection segment is expected to dominate the market with a market share of 35.85% due to efficient pickup networks, streamlined return handling, and rapid consolidation of goods enable faster processing, lower costs, and seamless integration across reverse-logistics operations.

- On the basis of Distribution channel, Europe Reverse Logistics Market is segmented into B2B, B2C.

In 2026, the B2C segment is expected to dominate the market

In 2026, the B2C segment is expected to dominate the market with a market share of 81.73% due to manufacturers, wholesalers, and retailers rely on large-scale, efficient transport networks to manage bulk shipments, streamline supply chains, and support cross-border trade.

Major Players

DB SCHENKER (Germany), DHL SUPPLY CHAIN / DEUTSCHE POST DHL (DHL GROUP) (Germany), KUEHNE + NAGEL (Switzerland), GEODIS (France), RHENUS LOGISTICS SE & CO. KG (Germany),and among others..

Latest Developments in Reverse Logistics Market

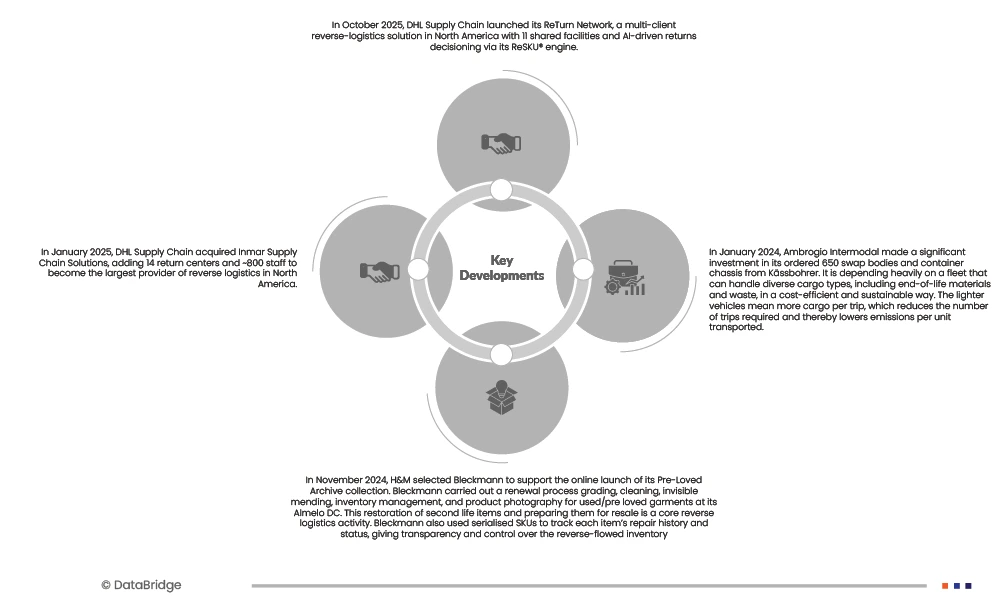

- In October 2025, DHL Supply Chain launched its ReTurn Network, a multi-client reverse-logistics solution in North America with 11 shared facilities and AI-driven returns decisioning via its ReSKU® engine.

- In January 2025, DHL Supply Chain acquired Inmar Supply Chain Solutions, adding 14 return centers and ~800 staff to become the largest provider of reverse logistics in North America.

- In November 2024, H&M selected Bleckmann to support the online launch of its Pre-Loved Archive collection. Bleckmann carried out a renewal process grading, cleaning, invisible mending, inventory management, and product photography for used/pre loved garments at its Almelo DC. This restoration of second life items and preparing them for resale is a core reverse logistics activity. Bleckmann also used serialised SKUs to track each item’s repair history and status, giving transparency and control over the reverse-flowed inventory

- In January 2024, Ambrogio Intermodal made a significant investment in its ordered 650 swap bodies and container chassis from Kässbohrer. It is depending heavily on a fleet that can handle diverse cargo types, including end-of-life materials and waste, in a cost-efficient and sustainable way. The lighter vehicles mean more cargo per trip, which reduces the number of trips required and thereby lowers emissions per unit transported.

As per Data Bridge Market Research analysis:

Geographically, the countries covered in the Europe Reverse Logistics Market report are Italy, U.K., Germany, France, Spain, Belgium, Netherlands, Poland, Russia, Denmark, Sweden, Switzerland, Turkey and Rest of Europe.

Germany is the dominating Country in Europe Reverse Logistics Market

Germany dominates the European logistics market due to its highly developed infrastructure, strategic central location, and strong industrial base. The country hosts Europe’s largest highway network, world-class rail freight systems, and major logistics hubs such as Hamburg, Frankfurt, and Duisburg—the world’s largest inland port. Germany’s export-driven economy, led by automotive, machinery, chemicals, and electronics sectors, generates high freight volumes and consistent logistics demand. Its logistics workforce is among the most skilled in Europe, supported by advanced digitalization, automation, and Industry 4.0 adoption. Additionally, the presence of leading global logistics companies—like DHL, DB Schenker, and Rhenus—further strengthens Germany’s market leadership.

Germany is expected to be the fastest growing Country in Europe Reverse Logistics Market

Germany is experiencing strong growth in the reverse-logistics market due to its highly developed industrial base, advanced recycling infrastructure, and strict environmental regulations that promote responsible product returns and resource recovery. The country’s circular-economy policies—such as the Packaging Act and WEEE directives—encourage manufacturers and retailers to invest heavily in return management, refurbishment, and material recovery systems. Germany also benefits from world-class logistics networks, skilled labor, and strong technology adoption in automation, sorting, and tracking. Major global logistics providers, including DHL, DB Schenker, and Rhenus, operate extensive reverse-logistics hubs in the country, further accelerating market maturity and capacity expansion.

For more detailed information about the Europe Reverse Logistics Market report, click here – https://www.databridgemarketresearch.com/reports/europe-reverse-logistics-market