The U.S. geogrid market is experiencing strong momentum driven by the growing emphasis on sustainability in construction practices and the rising investments in infrastructure development across the country. With an increasing focus on environmentally responsible building methods, geogrids are being widely adopted for their ability to enhance soil stabilization, reduce the need for raw materials, and extend the lifespan of structures such as roads, embankments, and retaining walls. Federal and state-level initiatives promoting sustainable infrastructure, along with funding for large-scale transportation and public works projects, are further propelling the use of advanced geosynthetic materials. The integration of geogrids supports durability and environmental compliance, making them a preferred choice for modern infrastructure projects. This growing alignment between sustainability goals and infrastructure investment directly drives the demand and expansion of the U.S. geogrid market.

Access Full Report @ https://www.databridgemarketresearch.com/reports/us-geogrid-market

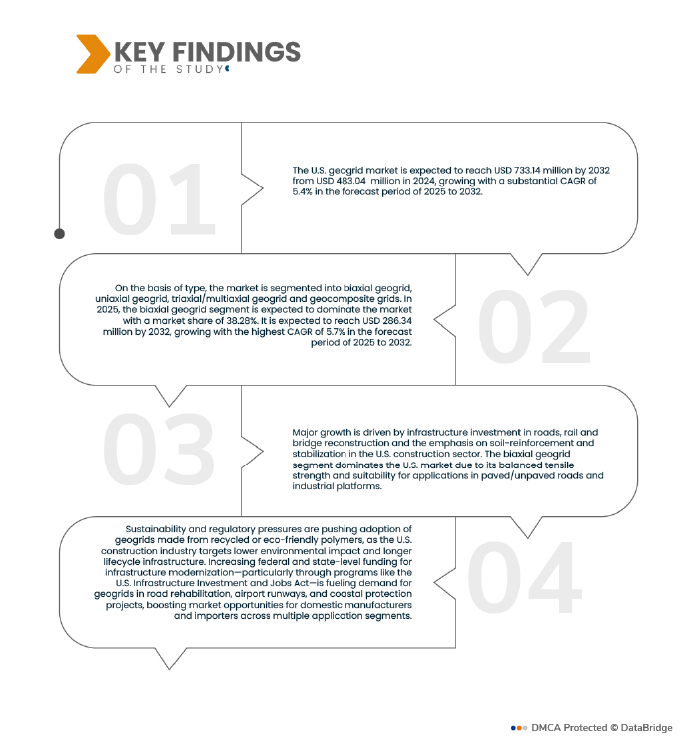

Data Bridge market research analyzes that the U.S. Geogrid Market expected to reach USD 733.14 Million by 2032 from USD 483.04 Million in 2024, growing with a substantial CAGR of 5.4% in the forecast period of 2025 to 2032.

Key Findings of the Study

Increasing Need for Geogrids due to Natural Disaster Mitigation

The U.S. geogrid market is experiencing significant growth due to the rising frequency of natural disasters, including floods, landslides, and soil erosion. These events have underscored the crucial need for effective soil stabilization and erosion control measures, prompting the widespread adoption of geogrids in infrastructure and construction projects. Geogrids are increasingly used to reinforce slopes, embankments, retaining walls, and other vulnerable areas, providing long-term stability and reducing the risk of catastrophic failure. As climate-related events become more frequent and severe, the demand for reliable geosynthetic solutions continues to rise across both public and private projects. This heightened focus on disaster resilience and preventive infrastructure strongly drives the expansion of the U.S. geogrid market.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2025 to 2032

|

|

Base Year

|

2024

|

|

Historic Years

|

2023 (Customizable to 2018-2022)

|

|

Quantitative Units

|

Revenue in USD

|

|

Segments Covered

|

Product Type (Biaxial Geogrid, Uniaxial Geogrid, Triaxial/Multiaxial Geogrid and Geocomposite Grids), Material (Polypropylene (PP), High-Density Polyethylene (HDPE) , Polyester (PET) and Polyvinyl Alcohol (PVA)), Function (Reinforcement, Stabilization And Base Confinement, Separation And Load Transfer, Asphalt Reinforcement/Reflection Crack Control, Erosion Control and Slope Stability and Others), Application (Roads And Highways, Railways And Ballast Stabilization, Retaining Walls and Steep Slopes, Airport Runways and Aprons, Landfill And Waste Containment, Ports, Marine, And Coastal, Mining Haul Roads and Yards and Others), End Use (Public Infrastructure Agencies (Dots, Municipalities), Commercial And Industrial Construction, Residential And Landscaping, Oil, Gas, And Energy, Mining And Quarrying and Others), Distribution Channel (Direct and Indirect)

|

|

Countries Covered

|

U.S.

|

|

Market Players Covered

|

Tensar (U.S.), Officine Maccaferri Spa (Italy), Solmax (Canada), HUESKER (Germany), Strata Systems, Inc. (U.S.), WINFAB (U.S.), Cell-Tek Geosynthetics, LLC. (U.S.), Titan Environmental (U.S.), ACE Geosynthetics Inc. (U.S.), Earth Retention (U.S.), Leggett & Platt (U.S.), Carthage Mills (U.S.), Ferguson Enterprises, LLC. (U.S.), White Cap Supply Holdings, LLC. (U.S.), US Fabrics, Inc. (U.S.), Lone Star Lining Company (U.S.), IWT Cargo-Guard (U.S.).

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include innovation tracker and strategic analysis, technological advancements, climate change scenario, supply chain analysis, value chain analysis, vendor selection criteria, PESTLE Analysis, Porter Analysis, patent analysis, industry eco-system analysis, raw material coverage, tariffs and their impact on market, regulation coverage, consumer buying behavior, brand outlook, cost analysis breakdown, and regulatory framework.

|

Segment Analysis

The U.S. geogrid market is segmented into six segments based on type, material, function, application, end use, and distribution channel.

- On the basis of type, U.S. geogrid market has been segmented into biaxial geogrid, uniaxial geogrid, triaxial/multiaxial geogrid and geocomposite grids.

In 2025, biaxial geogrid segment is expected to dominate the U.S. geogrid market

In 2025, biaxial geogrid segment is expected to dominate the U.S. geogrid market with 38.28% market share.

- On the basis of material, U.S. geogrid market has been segmented into Polypropylene (PP), High-Density Polyethylene (HDPE), Polyester (PET), and Polyvinyl Alcohol (PVA).

In 2025, Polypropylene (PP) segment is expected to dominate the U.S. geogrid market

In 2025, Polypropylene (PP) segment is expected to dominate the U.S. geogrid market with 44.66% market share

- On the basis of function, U.S. geogrid market has been segmented into reinforcement, stabilization and base confinement, separation and load transfer, asphalt reinforcement/reflection crack control, erosion control and slope stability, and others.

In 2025, reinforcement segment is expected to dominate the U.S. geogrid market

In 2025, reinforcement segment is expected to dominate the U.S. geogrid market with 36.81% market share

- On the basis of application, U.S. geogrid market has been segmented into roads and highways, railways and ballast stabilization, retaining walls and steep slopes, airport runways and aprons, landfill and waste containment, ports, marine, and coastal, mining haul roads and yards, and others.

In 2025, roads and highways segment is expected to dominate the U.S. geogrid market

In 2025, roads and highways segment is expected to dominate the U.S. geogrid market with 34.55% market share

- On the basis of end use, U.S. geogrid market has been segmented into public infrastructure agencies (dots, municipalities), commercial and industrial construction, residential and landscaping, oil, gas, and energy, mining and quarrying, others.

In 2025, public infrastructure agencies (dots, municipalities) segment is expected to dominate the U.S. geogrid market

In 2025, public infrastructure agencies (dots, municipalities) segment is expected to dominate the U.S. geogrid market with 44.62% market share

- On the basis of distribution channel, the U.S. geogrid market has been segmented into direct and indirect.

In 2025, the direct segment is expected to dominate the U.S. geogrid market

In 2025, the direct segment is expected to dominate the U.S. geogrid market with 68.98% market share

Major Players

Tensar (U.S.), Officine Maccaferri Spa (Italy), Solmax (Canada), HUESKER (Germany), Strata Systems, Inc. (U.S.), WINFAB (U.S.), Cell-Tek Geosynthetics, LLC. (U.S.), Titan Environmental (U.S.), ACE Geosynthetics Inc. (U.S.), Earth Retention (U.S.), Leggett & Platt (U.S.), Carthage Mills (U.S.), Ferguson Enterprises, LLC. (U.S.), White Cap Supply Holdings, LLC. (U.S.), US Fabrics, Inc. (U.S.), Lone Star Lining Company (U.S.), IWT Cargo-Guard (U.S.).

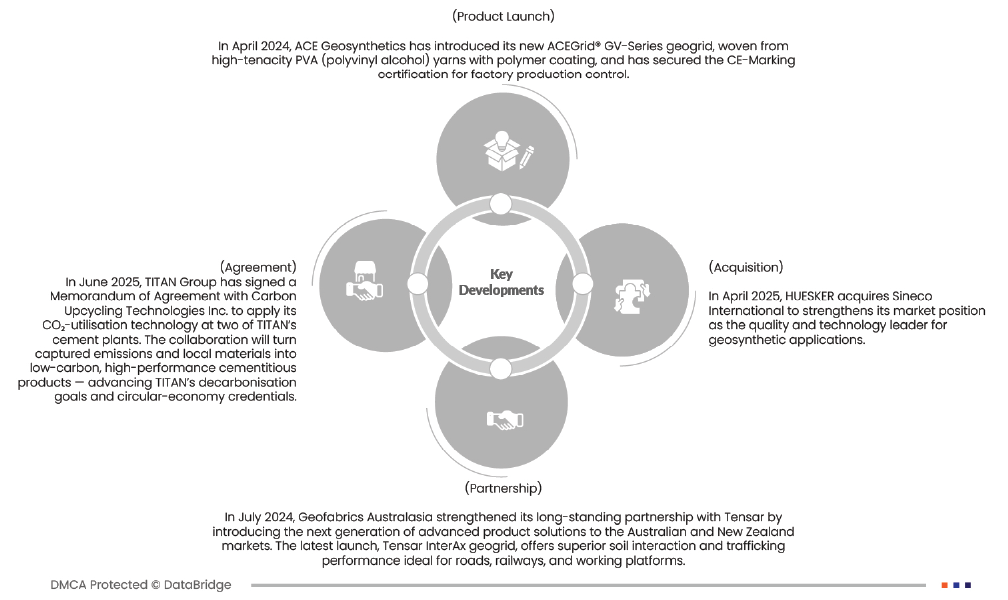

Market Developments

- In July 2024, Tensar, in partnership with Geofabrics Australasia, strengthened its long-standing collaboration by introducing the next generation of advanced product solutions to the Australian and New Zealand markets. The latest launch, the Tensar InterAx geogrid, delivers superior soil interaction and trafficking performance ideal for roads, railways, and working platforms.

- In July 2025, Maccaferri completed the acquisition of CPT Group, an Italian company specialised in advanced mechanised tunnelling technologies and robotic prefabrication systems for underground infrastructure.

- In September 2025, Maccaferri signed a distribution agreement with Tubosider to distribute Tubosider solutions on the global market, expanding and strengthening its infrastructure offering with high-performance products that are perfectly complementary to its engineering technologies.

- In June 2025, Solmax launched the Performance Materials platform, integrating the legacy and expertise of TenCate Geosynthetics and Propex into a unified platform that delivers high-performance technical textiles.

- In April 2025, HUESKER acquires Sineco International to strengthen its market position as the quality and technology leader for geosynthetic applications.

As per Data Bridge Market Research analysis:

For more detailed information about the U.S. geogrid market report, click here – https://www.databridgemarketresearch.com/reports/us-geogrid-market