The increased prevalence of chronic diseases is a significant health concern. Chronic diseases are long-term conditions that progress slowly and require ongoing medical attention and management. These diseases can significantly impact the quality of life of individuals and place a substantial burden on healthcare systems.

Capillary and venous blood collection is a common method to obtain small blood samples for various diagnostic tests, such as blood glucose monitoring for diabetes management or any other blood test.

For instance,

In 2019, According to data from the Global Burden of Disease, the leading causes of death and disability in India are Non-Communicable Diseases (NCDs) or chronic diseases. These include cardiovascular diseases, diabetes, chronic respiratory diseases, cancer, and mental health disorders

In May 2021, according to the World Health Organization (WHO), the prevalence of chronic diseases, including cardiovascular diseases, diabetes, chronic respiratory diseases, cancer, and mental health disorders, has been increasing in China with National Health Systems Resource Centre (NHSRC), the burden of non-communicable diseases is 53%

Access Full Report @ https://www.databridgemarketresearch.com/reports/asia-pacific-blood-collection-and-sampling-devices-market

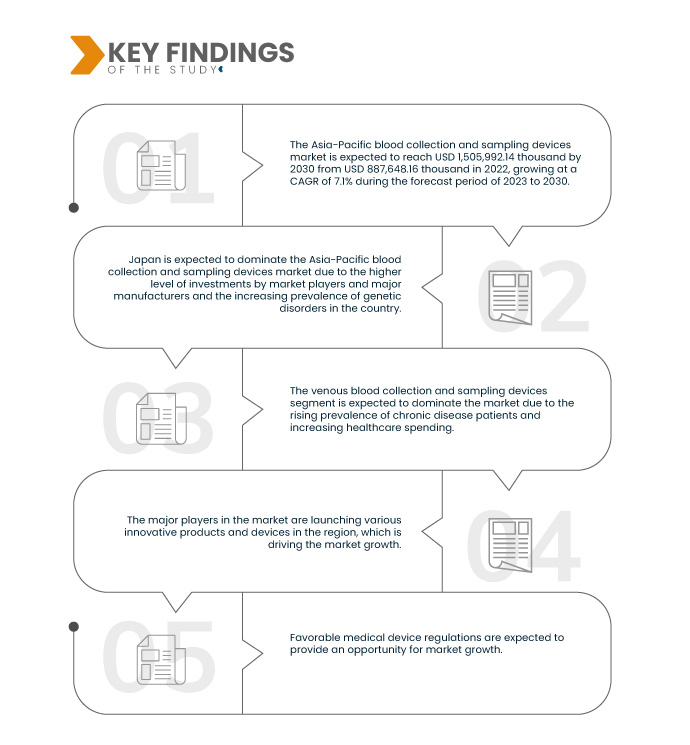

Data Bridge Market Research analyzes that the Asia-Pacific Blood Collection and Sampling Devices Market is expected to reach USD 1,825.06 million by 2032 from USD 985.91 million in 2024, growing with the CAGR of 8.3% in the forecast period of 2025 to 2032.

Key Findings of the Study

Increased Prevalence Of Chronic Diseases

Increased Prevalence of Chronic Diseases is a significant driver in the growth of the Blood Collection and Sampling Devices market, particularly in Japan and other countries in the Asia-Pacific region. The trend of rising chronic conditions, such as diabetes, cardiovascular diseases, and hypertension, is contributing to the growing demand for regular diagnostic testing. As more individuals suffer from these long-term health issues, healthcare providers are increasingly relying on blood collection and sampling devices to monitor and manage these conditions. As the burden of chronic diseases increases, healthcare systems are becoming more reliant on accurate, consistent, and frequent testing, which requires advanced blood collection and sampling devices. These devices are essential for early detection, disease management, and ongoing monitoring of chronic conditions, as regular blood tests help in tracking the progression of diseases, adjusting treatments, and improving patient outcomes.

In response to this trend, medical device manufacturers are focusing on developing innovative blood collection technologies that ensure better patient comfort, higher accuracy, and quicker results. In addition, the trend towards preventive healthcare further amplifies the need for blood tests as individuals seek early diagnosis and monitoring, thus propelling the demand for blood collection devices in both hospitals and home-care settings.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2025 to 2032

|

|

Base Year

|

2024

|

|

Historic Year

|

2023 (Customizable 2016-2021)

|

|

Quantitative Units

|

Revenue in USD billion

|

|

Segments Covered

|

By Product (Venous Blood Collection and Sampling Devices and Capillary Blood Collection and Sampling Devices)

|

|

Countries Covered

|

China, Japan, India, South Korea, Australia, Singapore, Thailand, Malaysia, Indonesia, Philippines, and Rest of Asia-Pacific

|

|

Market Players Covered

|

BD (U.S.), TERUMO BCT, INC. (Japan), Thermo Fisher Scientific Inc. (U.S.), Cardinal Health (U.S.), Owen Mumford Ltd (United Kingdom), Abbott (U.S.), Nipro Europe Group Companies (Japan), Greiner Bio-One International GmbH (Austria), SARSTEDT AG & Co. KG (Germany), Bio-Rad Laboratories, Inc. (U.S.), ICU Medical, Inc. (U.S.), CML Biotech (India), Narang Medical Limited (India), Hindustan Syringes & Medical Devices Ltd (India), Sparsh Mediplus (India), and B. Braun Medical Ltd (Germany)

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

|

Segment Analysis

Asia-Pacific blood collection and sampling devices market is segmented into one notable segments which are based on product

- On the basis of product, the market is segmented into venous blood collection and sampling devices and capillary blood collection and sampling devices

In 2025, the venous blood collection and sampling devices segment is expected to dominate the market with a market share of 61.79%

In 2025, the venous blood collection and sampling devices segment is expected to dominate the market with a market share of 61.79% due to rising prevalence of chronic diseases such as diabetes, cardiovascular disorders, and cancer has increased the need for regular blood tests, boosting demand for venous blood collection devices.

Major Players

Data Bridge Market Research analyzes BD (U.S.), TERUMO BCT, INC. (Japan), Thermo Fisher Scientific Inc. (U.S.), Cardinal Health (U.S.), Owen Mumford Ltd (U.K.) as the major market players of the market.

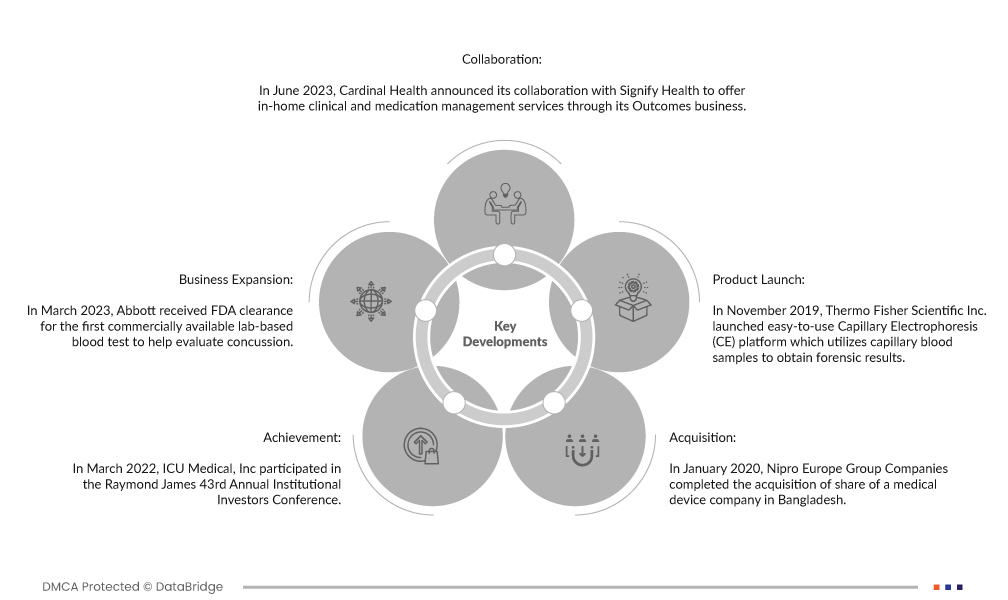

Market Development

- In September 2024, Abbott and Seed Global Health are partnering to enhance maternal and child healthcare in Malawi. Their initiative includes establishing a Maternal Health Center of Excellence at Queen Elizabeth Central Hospital, focusing on training health workers to improve care quality and sustainability

- In September 2024, BD completed its acquisition of Edwards Lifesciences' Critical Care product group, renaming it BD Advanced Patient Monitoring. This move expanded BD's portfolio with advanced monitoring technologies and AI-enabled clinical tools, enhancing its smart connected care solutions and supporting future innovations in patient care

- In March 2024, Medtronic has received FDA approval for its latest Evolut FX+ TAVR system, designed to treat symptomatic severe aortic stenosis. This new generation features a modified diamond-shaped frame that offers larger coronary access windows, enhancing catheter maneuverability while maintaining the exceptional valve performance and strength associated with the Evolut platform

- In March 2024, Abbott has extended its partnership with Real Madrid and the Real Madrid Foundation through the 2026-27 season, focusing on combating childhood malnutrition and promoting healthy habits. The collaboration has provided extensive nutrition education and screening for millions of children worldwide

- In November 2023, Boston Scientific Corporation concluded its acquisition of Relievant Medsystems on November 17, 2023, adding the Intracept Intraosseous Nerve Ablation System to its chronic pain portfolio. The acquisition, costing USD 850 million upfront plus contingent payments, expands access to vertebrogenic pain treatment through national coverage, benefiting over 150 million lives

- In November 2023, BD and Bio Farma signed a memorandum of understanding to combat tuberculosis in Indonesia by providing access to BD's TB diagnostics. This collaboration aimed to optimize the supply chain and enhance TB diagnosis, aligning with Indonesia’s goal to eliminate the disease by 2030

- In September 2023, Boston Scientific Corporation announced it had entered into an agreement to acquire Relievant Medsystems, Inc.for USD 850 million upfront, plus contingent payments. The acquisition, expected to close in early 2024, aimed to enhance Boston Scientific's chronic low back pain treatment portfolio with the Intracept system

Regional Analysis

Geographically, the countries covered in the Asia-Pacific Blood Collection And Sampling Devices market report are the China, India, Japan, South Korea, Australia, Singapore, Indonesia, Thailand, Malaysia, Philippines, and Rest of Asia-Pacific.

As per Data Bridge Market Research analysis:

China is the dominant country in the Asia-Pacific Blood Collection And Sampling Devices market during the forecast period of 2025 to 2032

China is expected to dominate the market due to its large aging population, high prevalence of cardiovascular diseases, and increased government investments in healthcare infrastructure and technology.

For more detailed information about the Asia-Pacific Blood Collection And Sampling Devices market report, click here – https://www.databridgemarketresearch.com/reports/asia-pacific-blood-collection-and-sampling-devices-market