The Asia-Pacific Electric Vehicle Lithium-Ion Battery Recycling Market is witnessing substantial growth due to the increasing number of EVs, there is a rising demand for effective battery recycling solutions to manage end-of-life batteries responsibly. Pyrometallurgical and hydrometallurgical methods are employed for recycling. Stringent environmental regulations and sustainability initiatives further boost the market. The growing focus on resource recovery and the emergence of innovative recycling technologies are expected to shape the market's future trajectory

Access Full Report @ https://www.databridgemarketresearch.com/reports/asia-pacific-electric-vehicle-lithium-ion-battery-recycling-market

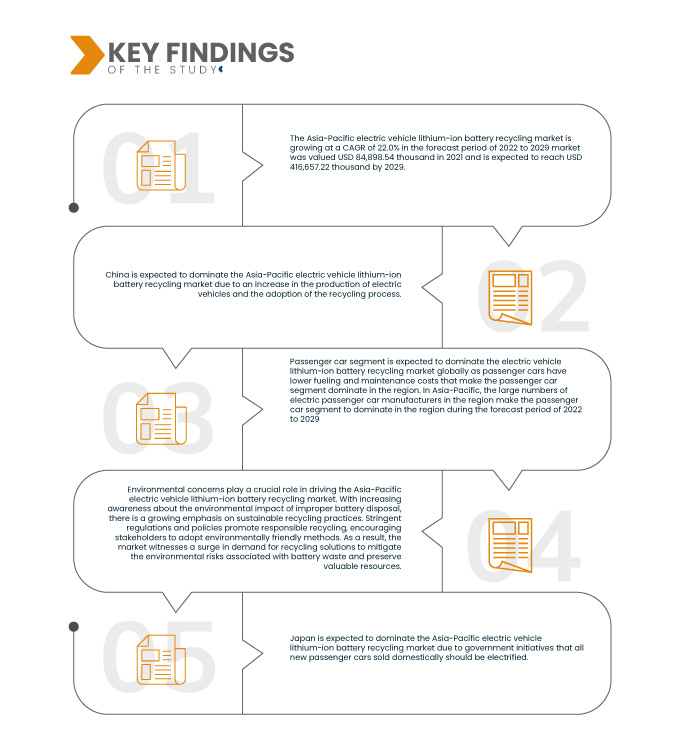

Data Bridge Market Research analyses that the Asia-Pacific electric vehicle lithium-ion battery recycling market is growing at a CAGR of 22.0% in the forecast period of 2022 to 2029 market was valued at USD 84,898.54 thousand in 2021 and is expected to reach USD 4,16,657.22 thousand by 2029. The growing adoption of electric vehicles in Asia-Pacific increases the number of end-of-life lithium-ion batteries, driving demand for recycling solutions to manage battery waste sustainably and recover valuable materials.

Key Findings of the Study

Critical need for resource conservation is expected to drive the market's growth rate

The Asia-Pacific electric vehicle lithium-ion battery recycling market is driven by the critical need for resource conservation. Lithium, cobalt, nickel, and other valuable metals used in lithium-ion batteries are finite and essential for battery production. Recycling these batteries allows for the recovery and reuse of these valuable materials, reducing the dependence on new mining and extraction, which can be environmentally harmful. As electric vehicle adoption surges in the region, recycling becomes imperative to preserve these scarce resources, promoting sustainability, and ensuring a more responsible approach to managing battery waste.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2022 to 2029

|

|

Base Year

|

2021

|

|

Historic Years

|

2020 (Customizable to 2014-2019)

|

|

Quantitative Units

|

Revenue in USD thousand, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Process (Pyrometallurgical, Hydrometallurgical, Others), Application (Passenger Car, Commercial Vehicle),

|

|

Countries Covered

|

China, India, South Korea, Japan, Australia, New Zealand, Singapore, Thailand, Malaysia, Philippines, Indonesia, Rest Of Asia-Pacific

|

|

Market Players Covered

|

Neometals (Australia), Glencore (Switzerland), FORTUM (Finland) Gem Co. Ltd. (China), Brunp Recycle Technology Co. Ltd. (A subsidiary of CATL) (China), Tata Chemicals Ltd. (India), Ganfeng Lithium (China), Umicore (Belgium)

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

|

Segment Analysis:

Asia-Pacific electric vehicle lithium-ion battery recycling market is segmented on the basis of process and application.

- On the basis of process, the Asia-Pacific electric vehicle lithium-ion battery recycling market is segmented into pyrometallurgical, hydrometallurgical, and others. In 2022, the pyrometallurgical segment is expected to dominate the electric vehicle lithium-ion battery recycling market globally as the pyrometallurgical process allows a short-process chain and less environmental impact, which increases its demand globally in the forecast period of 2022 to 2029.

In 2022, the pyrometallurgical segment is expected to dominate the electric vehicle lithium-ion battery recycling market

In 2022, the pyrometallurgical segment is expected to dominate the electric vehicle lithium-ion battery recycling market due to its short-process chain and lower environmental impact, driving its global demand. In the Asia-Pacific region, particularly in China and India, the rise in electric vehicle production and recycling adoption has further increased the demand for pyrometallurgical recycling, making it the dominant method in the region. It’s efficiency and environmental benefits make it an attractive choice for managing end-of-life lithium-ion batteries in the forecast period of 2022 to 2029.

- On the basis of application, Asia-Pacific electric vehicle lithium-ion battery recycling market is segmented into passenger car and commercial vehicle. In 2022, the passenger car segment is expected to dominate the electric vehicle lithium-ion battery recycling market globally as passenger cars have lower fueling and maintenance costs that make the passenger car segment dominate in the region. In Asia-Pacific, the large numbers of electric passenger car manufacturers in the region make the passenger car segment dominate in the region during the forecast period of 2022 to 2029

In 2022, the passenger car segment is expected to dominate the electric vehicle lithium-ion battery recycling market

In 2022, the passenger car segment is expected to dominate the electric vehicle lithium-ion battery recycling market due to lower fueling and maintenance costs, making electric passenger cars more popular. In the Asia-Pacific region, the dominance of the passenger car segment is further reinforced by the presence of numerous electric passenger car manufacturers. As more consumers opt for electric passenger cars, the demand for battery recycling in this segment increases, solidifying its dominance in the region in the forecast period of 2022 to 2029.

Major Players

Data Bridge Market Research recognizes the following companies as the major Asia-Pacific electric vehicle lithium-ion battery recycling market players in Asia-Pacific electric vehicle lithium-ion battery recycling market are Neometals (Australia), Glencore (Switzerland), FORTUM (Finland) Gem Co. Ltd. (China), Brunp Recycle Technology Co. Ltd. (A subsidiary of CATL) (China), Tata Chemicals Ltd. (India)

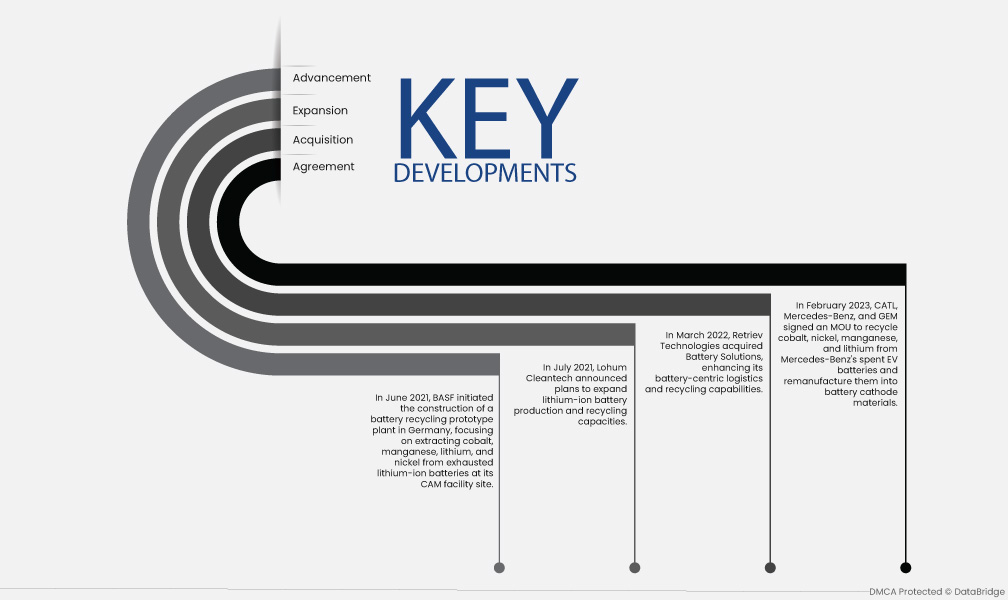

Market Developments

- In February 2023, CATL, Mercedes-Benz, and GEM signed an MOU to recycle cobalt, nickel, manganese, and lithium from Mercedes-Benz's spent EV batteries and remanufacture them into battery cathode materials.

- In March 2022, Retriev Technologies acquired Battery Solutions, enhancing its battery-centric logistics and recycling capabilities.

- In July 2021, Lohum Cleantech announced plans to expand lithium-ion battery production and recycling capacities.

- In June 2021, BASF initiated the construction of a battery recycling prototype plant in Germany, focusing on extracting cobalt, manganese, lithium, and nickel from exhausted lithium-ion batteries at its CAM facility site.

Regional Analysis

Geographically, the countries covered in the Asia-Pacific electric vehicle lithium-ion battery recycling market report are U.S., Japan, China, South Korea, Australia, India, Singapore, Thailand, Malaysia, Indonesia, Philippines, and the rest of Asia-Pacific.

As per Data Bridge Market Research analysis:

China is the dominant region in Asia-Pacific electric vehicle lithium-ion battery recycling market during the forecast period 2022 - 2029

China dominate the market due to its significant increase in electric vehicle production and adoption of the recycling process. As the world's largest electric vehicle market, China generates a substantial volume of end-of-life lithium-ion batteries, creating a pressing need for recycling solutions. The Chinese government's emphasis on environmental sustainability and resource conservation has led to supportive policies and incentives for battery recycling initiatives. Additionally, the country's robust manufacturing capabilities and investment in recycling infrastructure further strengthen its position in the market.

Japan is estimated to be the fastest growing region in Asia-Pacific electric vehicle lithium-ion battery recycling market in the forecast period 2022 - 2029

Japan is expected to dominate the market due to ambitious government initiatives aimed at electrifying the automotive industry. The Japanese government has set targets that all new passenger cars sold domestically should be electrified, driving a rapid increase in electric vehicle adoption. As the demand for electric vehicles rises, so does the need for sustainable battery recycling. Japan's commitment to green technology and circular economy principles has prompted the development of advanced recycling technologies and strong regulatory support for battery recycling efforts, solidifying its leadership in the Asia-Pacific region.

For more detailed information about the Asia-Pacific electric vehicle lithium-ion battery recycling market report, click here – https://www.databridgemarketresearch.com/reports/asia-pacific-electric-vehicle-lithium-ion-battery-recycling-market