Clear aligners have found applications in orthodontic treatment, addressing issues such as misaligned teeth and bite problems. Their key features include near-invisibility, customizability, and comfort. Clear aligners are discreet and made from transparent materials, offering a subtle treatment option. They are tailored to each patient's unique dental structure, gradually shifting teeth into their desired position. These aligners are also removable, allowing for easy oral hygiene and flexibility in daily life, making them a popular choice for orthodontic correction.

Access Full Report @ https://www.databridgemarketresearch.com/reports/brazil-clear-aligners-market

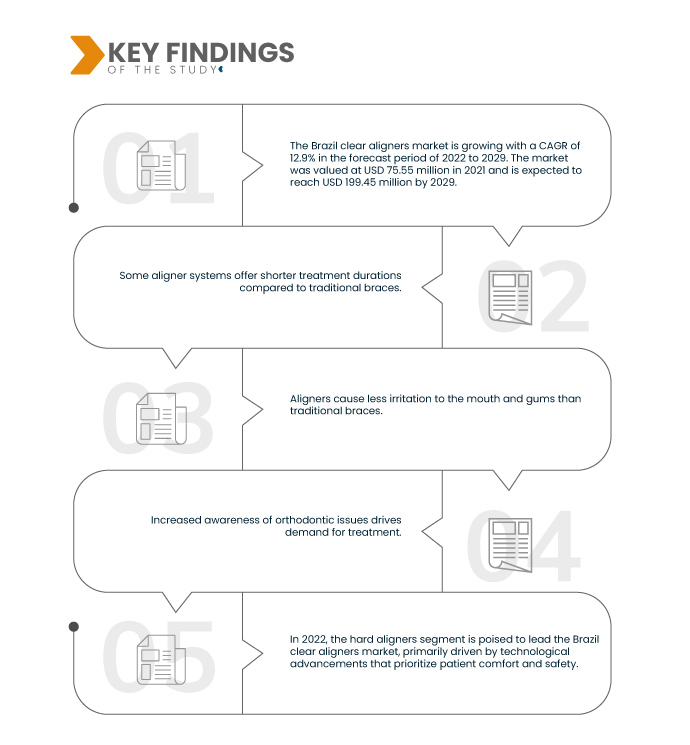

Data Bridge Market Research analyses that the Brazil Clear Aligners Market is growing with a CAGR of 12.9% in the forecast period of 2022 to 2029. The market was valued at USD 75.55 million in 2021 and is expected to reach USD 199.45 million by 2029. Clear aligners offer enhanced comfort compared to traditional braces, as they don't have sharp edges or wires that can cause irritation. This increased comfort promotes better patient compliance, as individuals are more likely to wear them consistently throughout their treatment.

Key Findings of the Study

Digital advancements are expected to drive the market's growth rate

The integration of digital scanning and 3D printing has revolutionized the production of clear aligners. Digital scanning enables precise and non-invasive impressions of a patient's teeth, eliminating the need for traditional molds. These digital impressions are then used in 3D printing to create customized aligners with exceptional accuracy. This technological advancement streamlines the manufacturing process, reduces errors, and allows for faster production, resulting in a more efficient and patient-specific approach to orthodontic treatment.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2022 to 2029

|

|

Base Year

|

2021

|

|

Historic Years

|

2020 (Customizable to 2014-2019)

|

|

Quantitative Units

|

Revenue in USD Million, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Product Type (Hard Aligners, Soft Aligners, And Medium Aligners), Design (Trimline, Cut-Outs, Power Ridges, Bite Ramps, And Others), Materials (Polyethylene Terephthalate Glycol-Modified (PET-G), Thermoplastic Polyurethane (TPU), And Others), Application (Crowded Teeth, Overbites, Underbites, Diastema, Open Bites, Misaligned Primary (Baby) Teeth, And Others), Population Type (Pediatrics And Adult), End-User (Group Dental Clinics, Hospitals, Private Dental Clinics, At-Home, And Others), Distribution Channel (Direct Tender, Online Stores, And Others)

|

|

Countries Covered

|

Brazil

|

|

Market Players Covered

|

G&H Orthodontics (U.S.), Art-Aligner (France), Institut Straumann AG (Switzerland), Cleartek - Continue Sorrindo (Brazil), Crystal Tech Servicos e Comércio de Protese Dentaria LTDA (Brazil), Updentall - Tecnologia em Odontologia Ltda. (Brazil), Align Technology, Inc. (U.S.), SouSmile (Brazil), Esthetic Aligner (Brazil), Compass Dental Diagnosis, Planning, and Prototyping – CNPJ (Brazil), Invisible Aligner (Brazil), SCHEU DENTAL GmbH (Germany)

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

|

Segment Analysis:

The ear aligners market is segmented on the basis of product type, design, materials, application, population type, end user, and distribution channel.

- On the basis of product type, the Brazil clear aligners market is segmented into hard aligners, soft aligners, and medium aligners. In 2022, the hard aligners segment is poised to lead the Brazil clear aligners market, primarily driven by technological advancements that prioritize patient comfort and safety.

In 2022, the hard aligners segment of the product type segment is expected to dominate the Brazil clear aligners market during the forecast period of 2022-2029

In 2022, the hard aligners segment is poised to lead the Brazil clear aligners market, primarily driven by technological advancements that prioritize patient comfort and safety. These innovations have enhanced the appeal of hard aligners, making them a preferred choice for individuals seeking orthodontic treatment in Brazil, where these factors hold significant importance.

- On the basis of design, the Brazil clear aligners market is segmented into trimline, cut-outs, power ridges, bite ramps, and others. In 2022, the trimline segment is set to dominate the Brazil clear aligners market, driven by its design that minimizes the risk of aligners impinging on unattached marginal gingiva.

In 2022, the trimline segment of the design segment is expected to dominate the Brazil clear aligners market during the forecast period of 2022-2029

In 2022, the trimline segment is set to dominate the Brazil clear aligners market, driven by its design that minimizes the risk of aligners impinging on unattached marginal gingiva. This design choice enhances patient comfort, making trimline aligners the preferred option for those seeking orthodontic treatment in Brazil, where comfort and safety are significant considerations.

- On the basis of materials, the Brazil clear aligners market is segmented into polyethylene terephthalate glycol-modified (PET-G), thermoplastic polyurethane (TPU), and others. In 2022, the thermoplastic polyurethane (TPU) segment is set to lead the Brazil clear aligners market due to its strength, toughness, and durability, offering reliable performance and long-term wear.

- On the basis of application, the Brazil clear aligners market is segmented into crowded teeth, overbites, underbites, diastema, open bites, misaligned primary (baby) teeth, and others. In 2022, the crowded teeth segment is anticipated to hold the dominant position in the Brazil clear aligners market, driven by a growing patient population experiencing crowded teeth issues.

- On the basis of population type, the Brazil clear aligners market is segmented into paediatrics and adult. In 2022, the adults segment is poised to lead the Brazil clear aligners market, primarily due to the rising number of adults seeking orthodontic treatment in the country.

- On the basis of end user, the Brazil clear aligners market is segmented into group dental clinics, hospitals, private dental clinics, at-home, and others. In 2022, the dominance of the group dental clinics segment in the Brazil clear aligners market can be attributed to the convenience of accessible treatment locations within proximity to patients' homes.

- On the basis of distribution channel, the Brazil clear aligners market is segmented into direct tender, online stores, and others. In 2022, the dominance of the direct tender segment in the Brazil clear aligners market is foreseen because of the wide range of available products for patients, which is predicted to be the driving force behind market leadership.

Major Players

Data Bridge Market Research recognizes the following companies as the Brazil clear aligners market players in Brazil clear aligners market are G&H Orthodontics (U.S.), Art-Aligner (France), Institut Straumann AG (Switzerland), Cleartek - Continue Sorrindo (Brazil), Crystal Tech Servicos e Comércio de Protese Dentaria LTDA (Brazil), Updentall - Tecnologia em Odontologia Ltda. (Brazil).

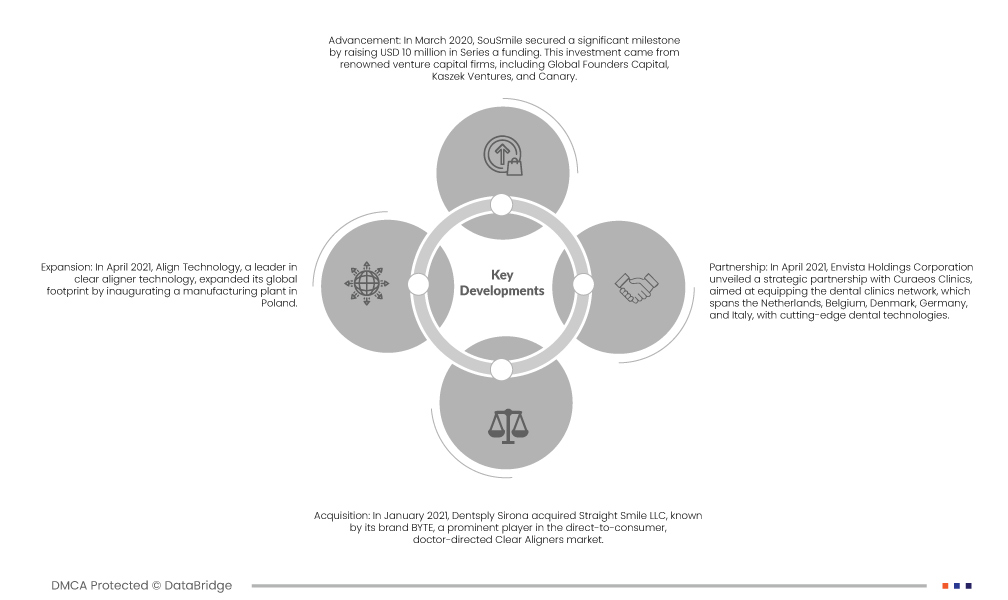

Market Developments

- In March 2020, SouSmile secured a significant milestone by raising USD 10 million in Series a funding. This investment came from renowned venture capital firms, including Global Founders Capital, Kaszek Ventures, and Canary. With this funding round, SouSmile accumulated a total of USD 11.4 million in funding. This financial support is expected to fuel the company's growth and innovation efforts in the field of clear aligners and orthodontic treatment.

- In April 2021, Align Technology, a leader in clear aligner technology, expanded its global footprint by inaugurating a manufacturing plant in Poland. This strategic move enables the company to address a significant and relatively untapped market for its Invisalign products in the European and Middle East & Africa regions. The new manufacturing facility positions Align Technology to meet the growing demand for clear aligners in these markets, enhancing its global presence and accessibility.

- In January 2021, Dentsply Sirona acquired Straight Smile LLC, known by its brand BYTE, a prominent player in the direct-to-consumer, doctor-directed Clear Aligners market. This strategic acquisition bolsters Dentsply Sirona's SureSmile aligner business, enhancing its presence in the orthodontic industry. The move allows the company to offer a wider range of orthodontic solutions and tap into the growing demand for doctor-directed clear aligners, strengthening its competitive position.

- In April 2021, Envista Holdings Corporation unveiled a strategic partnership with Curaeos Clinics, aimed at equipping the dental clinics network, which spans the Netherlands, Belgium, Denmark, Germany, and Italy, with cutting-edge dental technologies. This collaboration underscores Envista's commitment to delivering advanced dental solutions and strengthening its global presence by providing state-of-the-art dental equipment and technologies to a wide network of dental clinics in multiple European countries.

For more detailed information about the Brazil clear aligners market report, click here – https://www.databridgemarketresearch.com/reports/brazil-clear-aligners-market