Brazil is experiencing a strong and accelerating shift toward lightweight corrugated boxes as companies prioritize logistics efficiency, cost optimization, and sustainability across packaging operations. With rising fuel prices, growing domestic consumption, and rapidly expanding e-commerce, businesses are increasingly adopting lighter corrugated materials to reduce transportation costs, increase pallet utilization, and improve handling efficiency. This preference is further supported by Brazil’s push toward a circular economy, where recyclable and low-impact packaging materials are becoming essential for regulatory compliance and brand positioning. As major industries—such as FMCG, agribusiness, electronics, and retail—expand their distribution networks, the need for lightweight, durable, and high-performance corrugated solutions is becoming a critical component of modern supply chains.

Brazil’s increasing focus on operational efficiency, sustainability commitments, and packaging cost reduction is expected to further accelerate demand for lightweight corrugated boxes over the coming years. As manufacturers continue investing in advanced paper technology, high-performance kraftliner, and optimized board design, lightweight corrugated solutions will remain central to Brazil’s logistics, e-commerce, and industrial growth. Rising consumer expectations, environmental regulations, and expanding regional distribution networks will reinforce this shift, positioning lightweight corrugated boxes as a key driver of long-term market expansion

Access Full Report @ https://www.databridgemarketresearch.com/reports/brazil-corrugated-board-packaging-market

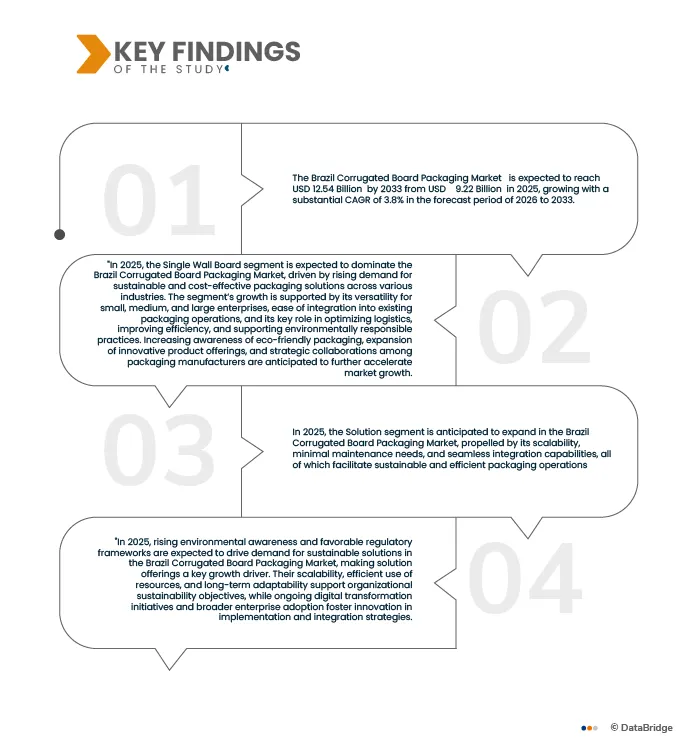

Data Bridge Market Research analyzes that the Brazil Corrugated Board Packagings Market is expected to reach USD 12.54 Billion by 2033 from USD 9.22 Billion in 2025, growing at a substantial CAGR of 3.8% in the forecast period of 2025 to 2033.

Key Findings of the Study

Rising Acquisitions & Collaborations Among Packaging Companies

Brazil’s corrugated packaging market is undergoing consolidation, with leading companies acquiring regional players and forming strategic alliances to expand capacity, enter new geographies, and improve operational efficiency. These collaborations also promote innovation in lightweight materials, digital printing, and supply chain optimization. Such strategic movements not only strengthen the competitive position of major packaging manufacturers but also accelerate technology adoption across the industry, creating new opportunities for product differentiation and service expansion. The surge in acquisitions and partnerships is reshaping the competitive landscape, creating favorable growth avenues for companies focused on innovation and scale expansion.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2026 to 2033

|

|

Base Year

|

2025

|

|

Historic Year

|

2024 (Customizable 2013-2022)

|

|

Quantitative Units

|

Revenue in USD Billion

|

|

Segments Covered

|

Product Type (Single Wall Boards, Double Wall Boards, Triple Wall Boards, Custom and Specialty Boards), by material type (Linerboard, Medium, Allied Materials),), by style (Slotted Box, Telescopes, Folders, Trays, Sheets, Fanfold, Die Cut Bliss, Die Cut Interiors), by end-use (Food & Beverage, Industrial Goods, E-Commerce & Retail, Personal Care & Household Products, Electronics, Pharmaceutical & Healthcare, Others), by Grade (Unbleached Testliner, White-Top Testliner, Unbleached Kraftliner, White-Top Kraftliner, Waste-Based Fluting, Semi-Chemical Fluting), by distribution channel (direct, and retail industry)

|

|

Countries Covered

|

Brazil

|

|

Market Players Covered

|

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework..

|

Segment Analysis

Brazil Corrugated Board Packagings market is segmented into five notable segments which are based on the isotope, sources, therapeutic application, vector type, and end user.

- On the basis of Product Type, Brazil Corrugated Board Packaging market is segmented into Single Wall Boards, Double Wall Boards, Triple Wall Boards, Custom and Specialty Boards

In 2026, the Single Wall Boards segment is expected to dominate the Brazil Corrugated Board Packagings market

In 2026, the Single Wall Boards segment is expected to dominate the market with a market share of 40.03% due to its Growth In E-Commerce Fueling Packaging Demand, And Expansion Of FMCG And Food Processing Industries.

- On the basis of material type, the Brazil Corrugated Board Packaging market is segmented into Linerboard, Medium, and Allied Materials

In 2026, the Linerboard segment is expected to dominate the Brazil Corrugated Board Packagings market

In 2026, the Linerboard segment is expected to dominate the market with a market share of 55.72% due to their increasing adoption driven by rising environmental awareness and government regulations promoting sustainable packaging. The cost-effectiveness of using recycled materials appeals to manufacturers and businesses looking to reduce packaging expenses while meeting eco-friendly standards. Additionally, advancements in recycling technologies have improved the quality and durability of recycled corrugated boxes, making them suitable for a wide range of applications across industries.

- On the basis of Style, the Brazil Corrugated Board Packaging market is segmented into Slotted Box, Telescopes, Folders, Trays, Sheets, Fanfold, Die Cut Bliss, Die Cut Interiors. In 2026, the Slotted Boxes segment is expected to dominate the market with a market share of 26.15%

- On the basis of End-User Industry, the Brazil Corrugated Board Packaging market is segmented into Food & Beverage, Industrial Goods, E-Commerce & Retail, Personal Care & Household Products, Electronics, Pharmaceutical & Healthcare, Others. In 2026, the Food & Beverage segment is expected to dominate the market with a market share of 35.20%

- On the basis of Grade, the Brazil Corrugated Board Packaging market is segmented into Unbleached Testliner, White-Top Testliner, Unbleached Kraftliner, White-Top Kraftliner, Waste-Based Fluting, Semi-Chemical Fluting. In 2026, the Unbleached Testliner segment is expected to dominate the market with a market share of 38.08%

- On the basis of Distribution Channel, the Brazil Corrugated Board Packaging market is segmented into Direct and Indirect. In 2026, the Direct segment is expected to dominate the market with a market share of 59.89%

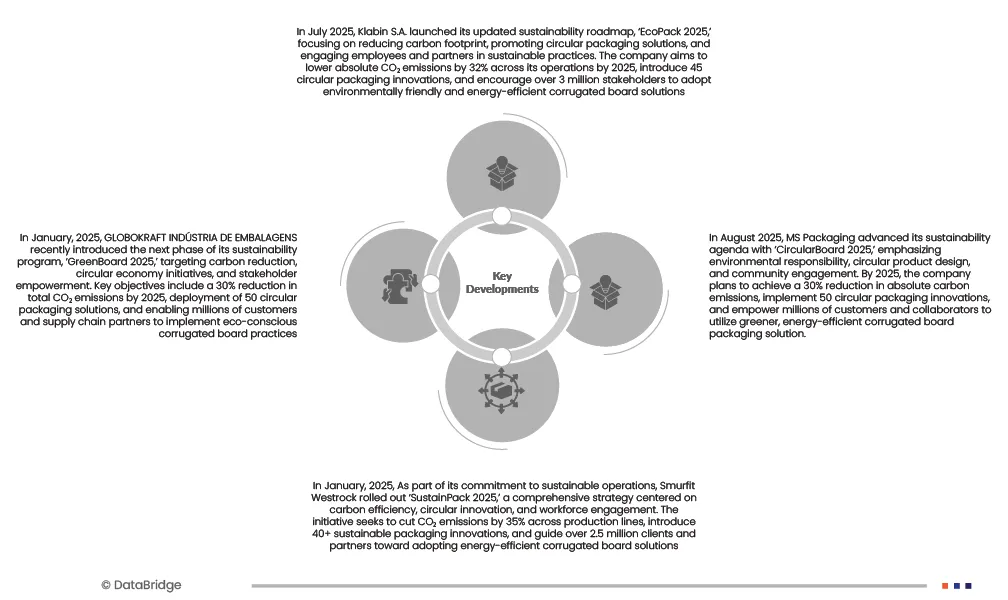

Major Players

Data Bridge Market Research analyzes Klabin S.A. (Brazil), Smurfit Westrock (Ireland), International Paper (U.S.), EMBANOR EMBALAGENS (Brazil), Fastpack Embalagens (Brazil), GLOBOKRAFT INDÚSTRIA DE EMBALAGENS (Brazil) as the major market players of the Brazil Corrugated Board Packagings market.

Regional Analysis

Geographically, the countries covered in the Brazil Corrugated Board Packagings market report is the Brazil.

As per Data Bridge Market Research analysis:

For more detailed information about the Brazil Corrugated Board Packagings market report, click here – https://www.databridgemarketresearch.com/reports/brazil-corrugated-board-packaging-market