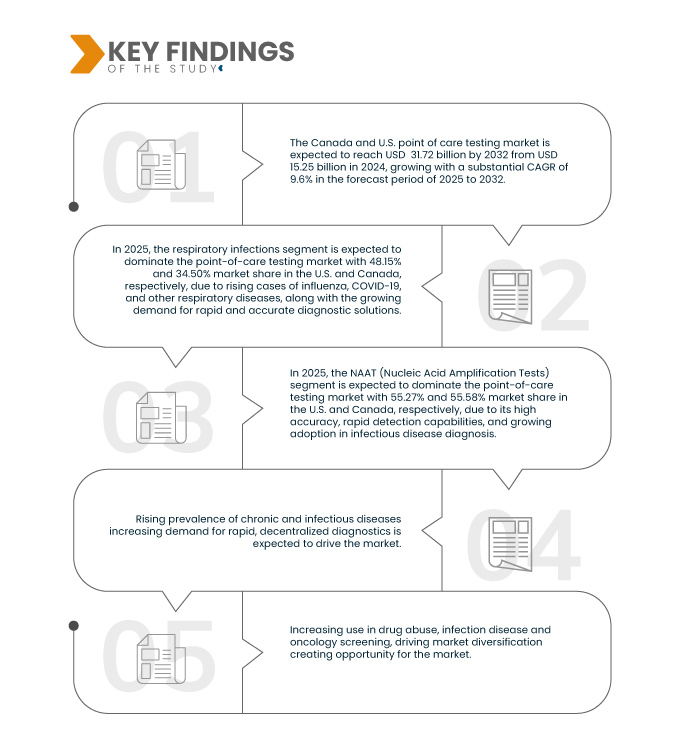

The rising prevalence of chronic and infectious diseases in Canada and the U.S. is creating an urgent need for rapid, decentralized diagnostic solutions that enable timely detection and effective disease management. With increasing cases of conditions such as diabetes, cardiovascular diseases, respiratory infections, and sexually transmitted infections across both countries, traditional centralized laboratory testing is often too slow or inaccessible for many patients—particularly in underserved or rural communities. Point-of-Care Testing (POCT) technologies offer a faster, more convenient alternative by delivering immediate results near the patient, which is critical for initiating prompt treatment, reducing disease progression, and improving overall care outcomes.

Healthcare providers and policymakers in both Canada and the U.S. are increasingly recognizing the value of POCT in addressing the growing disease burden, especially in community health centers, urgent care settings, and remote regions where access to centralized labs is limited. This rising demand is driving public and private investments in advanced diagnostic platforms that support rapid clinical decision-making. Additionally, the COVID-19 pandemic catalyzed widespread adoption of decentralized testing solutions, accelerating the deployment of POCT technologies across hospitals, pharmacies, and other healthcare facilities throughout North America. As health systems continue to focus on accessibility, early detection, and value-based care, the need for efficient, near-patient diagnostics is expected to remain a key growth driver in the market.

Access Full Report @ https://www.databridgemarketresearch.com/reports/canada-and-us-point-of-care-testing-market

Data Bridge market research analyzes that Canada and U.S. Point of Care Testing Market is expected to reach USD 31.72 billion by 2032 from USD 15.24 billion in 2024, growing with a substantial CAGR of 9.6% in the forecast period of 2025 to 2032.

Key Findings of the Study

Increasing use in Drug Abuse, Infectious Disease, and Oncology Screening, Driving Market Diversification

The landscape of healthcare in Canada is undergoing a significant transformation, driven by the increasing adoption of Point-of-Care Testing (POCT). This shift is particularly evident in the diversification of its applications, moving beyond traditional diagnostics into new, high-growth areas. The expansion of POCT into fields like drug abuse, infectious disease, and oncology screening is creating a new paradigm for timely and accessible patient care. This evolution is driven by the demand for faster results, which can lead to more rapid treatment decisions and improved patient outcomes. The ability to perform these tests outside of a centralized laboratory setting, such as in clinics, pharmacies, and even remote locations, is a key enabler of this trend. As technology becomes more sophisticated and user-friendly, the range of conditions that can be screened for at the point of care continues to grow, offering new opportunities for healthcare providers and patients alike. This diversification not only addresses long-standing challenges in healthcare access but also promises to streamline clinical workflows and reduce the burden on traditional laboratory infrastructure.

The U.S. POCT landscape is increasingly embracing diverse screening applications from drug-of-abuse panels to infectious disease detection and oncology biomarkers, broadening its impact across healthcare domains. For instance, home-based infectious disease tests such as SARS-CoV-2 antigen kits have demonstrated substantial cost savings of approximately USD 12.5 million over 60 days—highlighting demand for decentralized testing. Concurrently, advances in oncology diagnostics, for instance, machine learning enhanced blood tests capable of detecting early-stage ovarian cancer with around 92% accuracy, portend a similar expansion in cancer screening via POCT.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2025 to 2032

|

|

Base Year

|

2024

|

|

Historic Years

|

2018-2023 (Customizable to 2013-2017)

|

|

Quantitative Units

|

Revenue in USD Billion

|

|

Segments Covered

|

Product/Disease (Sexually Transmitted Disease (STD), Hepatitis, Respiratory Infections, Gastroenteric Infections, Bloodstream Infections (BSI), Blood Yeast Infections and Others), Method/Technology (Nucleic Acid Amplification Tests (NAAT), Loop-Mediated Isothermal Amplification (LAMP), Microfluidics/ Lab-On-a-Chip and Others), Panel Type (Simplex Assay, Duplex Assay, Triplex Assay, Multiplex Assay (Syndromic Testing)), Testing Location (Laboratory Based Point-of-Care Testing (POCT), At-Home Point-of-Care Testing (POCCT)), End User (Hospitals, Clinics, Laboratories, Home Care, Ambulatory Surgery Centers, Elderly Care Centers and Others), Distribution Channel (Direct Tender, Retail Sales, Online Sales and Others)

|

|

Countries Covered

|

U.S. and Canada

|

|

Market Players Covered

|

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

|

Segment Analysis

The Canada and U.S. point of care testing market is segmented into six segments based on product/disease, method/technology, panel type, testing location, end user and distribution channel.

- On the basis of product/disease, the market is segmented into respiratory infections, gastroenteric infections, Sexually Transmitted Disease (STD), hepatitis, Bloodstream Infections (BSI), Blood Yeast Infections (Fungal BSI), and others

In 2025, the respiratory infections segment is expected to dominate the Canada and U.S. point of care testing market

In 2025, the respiratory infections segment is expected to dominate the market with a market share of 48.15% and 34.50% in U.S. and Canada respectively due to high prevalence and recurrence of respiratory diseases, technological advancements in POC testing, strong healthcare focus on early detection and minimize hospitalization, and the availability of rapid antigen and molecular tests.

- On the basis of method/technology, the market is segmented into NAAT (Nucleic Acid Amplification Tests), LAMP (Loop-Mediated Isothermal Amplification), microfluidics / lab-on-a-chip, and others

In 2025, the NAAT (Nucleic Acid Amplification Tests) segment is expected to dominate the Canada and U.S. point of care testing market

In 2025, the NAAT (Nucleic Acid Amplification Tests) segment is expected to dominate the market with a market share of 55.27% and 55.58% in U.S. and Canada respectively due to broad pathogen coverage and strong adoption accelerated by COVID-19 pandemic, advancements in portable platforms, strong demand for confirmatory testing, growing regulatory support and approval for rapid NAAT kits.

- On the basis of panel type, the market is segmented into simplex assay, multiplex panel (syndromic testing), duplex assay, and triplex assay. In 2025, the simplex assay segment is expected to dominate the market with a market share of 52.50% and 52.38% in U.S. and Canada respectively

- On the basis of testing location, the market is segmented into laboratory-based Point-of-Care-Testing (POCT) and at-home Point-of-Care-Testing (POCT). In 2025, the laboratory based Point-of-Care-Testing (POCT) segment is expected to dominate the market with a market share of 60.13% and 59.87% in U.S. and Canada respectively

- On the basis of end user, the market is segmented into hospitals, home care, clinics, laboratories, diagnostic centers, pathology labs, ambulatory surgery centers, elderly care centers and others. In 2025, the hospitals segment is expected to dominate the market with a market share of 42.86% and 43.28% in U.S. and Canada respectively

- On the basis of distribution channel, the market is segmented into direct tender, retail sales, online sales, and others. In 2025, the direct tender segment is expected to dominate the market with a market share of 44.13% and 43.74% in U.S. and Canada respectively

Major Players

Data Bridge Market Research Analyses Danaher Corporation (U.S.), F. Hoffmann-La Roche Ltd (Switzerland / U.S.), Siemens Healthineers AG (Germany), BD (U.S.), Abbott (U.S.) as the major players operating in the market.

Market Developments

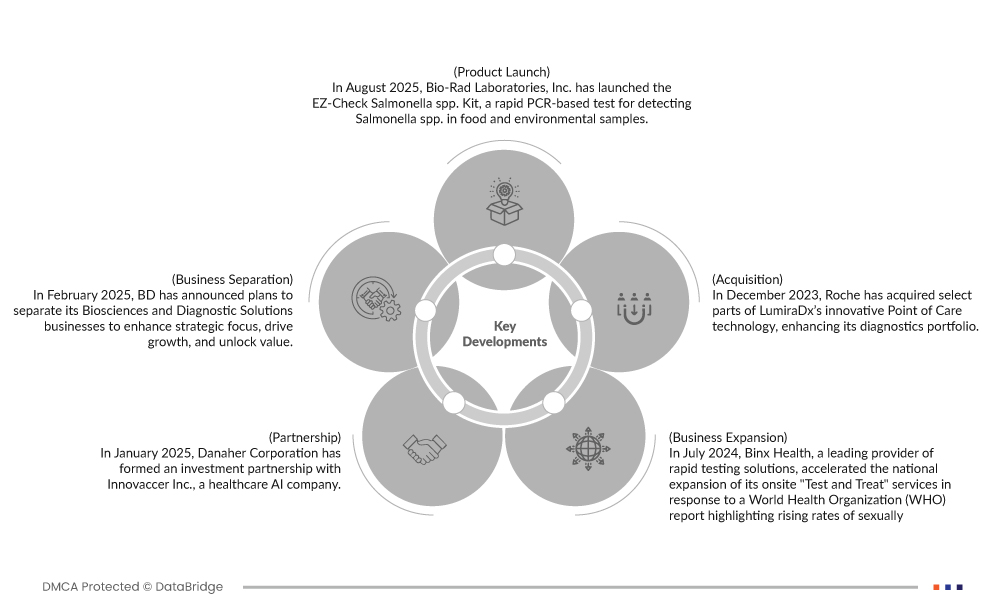

- In August 2025, Bio-Rad Laboratories, Inc. has launched the EZ-Check Salmonella spp. Kit, a rapid PCR-based test for detecting Salmonella spp. in food and environmental samples. The kit offers a streamlined workflow with multiplex amplification and a duplex detection system for enhanced accuracy and simplified setup. It has been validated by AOAC International and certified by AFNOR, confirming its robustness, stability, and reliability across various sample types. Bio-Rad’s iQ-Check Free DNA Removal Solution is also included in the validated workflow

- In February 2025, BD has announced plans to separate its Biosciences and Diagnostic Solutions businesses to enhance strategic focus, drive growth, and unlock value. The move aims to create two independent entities, each better positioned to capitalize on their respective markets. This decision underscores BD's commitment to strengthening its leadership in healthcare innovation while optimizing operational efficiencies for long-term success

- In February 2025, bioMérieux has acquired Neoprospecta, a leading Brazilian company specializing in innovative diagnostic solutions. This acquisition strengthens bioMérieux's presence in the Latin American market, expanding its portfolio in molecular diagnostics and enhancing its ability to offer cutting-edge solutions for infectious diseases, improving patient care and public health outcomes

- In January 2025, Danaher Corporation has formed an investment partnership with Innovaccer Inc., a healthcare AI company. This collaboration aims to accelerate the adoption of precision diagnostics and value-based care by providing healthcare providers with unified patient data and advanced analytics, improving patient outcomes through personalized, timely interventions

- In July 2024, Binx Health, a leading provider of rapid testing solutions, accelerated the national expansion of its onsite "Test and Treat" services in response to a World Health Organization (WHO) report highlighting rising rates of sexually transmitted infections (STIs). The company’s integrated model enables same-day diagnosis and treatment at point-of-care locations, aiming to improve patient outcomes and reduce transmission rates. With a focus on accessibility and speed, Binx Health is partnering with clinics, public health organizations, and universities to scale its footprint across the United States, reinforcing its commitment to addressing urgent public health challenges through innovative diagnostic technology

- In December 2023, Roche has acquired select parts of LumiraDx’s innovative Point of Care technology, enhancing its diagnostics portfolio. This acquisition enables faster, more affordable testing across multiple disease areas. The integration of LumiraDx’s platform will improve patient access to timely, accurate diagnostic results in decentralized healthcare settings globally

As per Data Bridge Market Research analysis:

For more detailed information about the Canada and U.S. Point of Care Testing Market report, click here – https://www.databridgemarketresearch.com/reports/canada-and-us-point-of-care-testing-market