The market for automotive vehicles is growing rapidly in China, especially for passenger vehicles. China's auto market seems to be the world’s biggest, with intelligent functions like internet connectivity and autonomous driving. This is expected to drive sales to increase by 30% by 2025. Although with the growing automotive sales in the country, there is an increase in traffic incidents. The main reason for traffic incidents in China are actions against traffic regulations, including over freight and speed, fatigue driving, and vehicle malfunctions. In recent years, the government has been strengthening large-scale inspections of safety measures during long-distance passenger transportation rush periods, thus containing frequent heavy traffic accidents and effectively controlling the rise in the death toll claimed by traffic accidents. However, in another aspect, the death toll caused by accidents or vehicle collisions has increased with the increase in vehicle population.

Access Full Report @ https://www.databridgemarketresearch.com/reports/china-automotive-tic-market

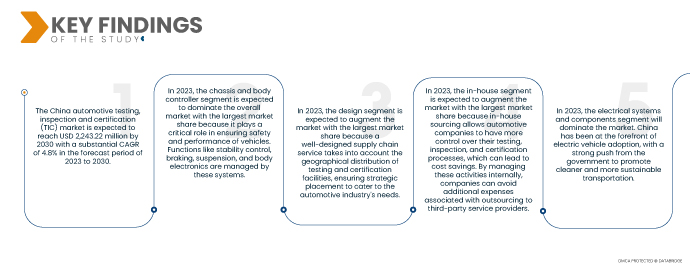

Data Bridge Market Research analyses that the China Automotive Testing, Inspection and Certification (TIC) Market is expected to grow at a CAGR of 4.8% from 2023 to 2030. Government to implement strict and mandatory safety standards to be followed by vehicle manufacturers, which has been increasing over the years.

Key Findings of the Study

Growing prevalence of automotive may drive the market growth

The production and consumption of automobiles centering on passenger ones in China have rapidly increased since the 21st century. The rapid growth of the Chinese economy, the vehicle population, especially passenger vehicles with private cars as the mainstay, has been increasing rapidly. China continues to be the world’s largest vehicle market by annual sales and manufacturing output, with domestic production expected to reach 35 million vehicles by 2025. Based on data from the Ministry of Industry and Information Technology, over 26 million vehicles were sold in 2021, including 21.48 million passenger vehicles, an increase of 7.1% from 2020. Commercial vehicle sales reached 4.79 million units, down 6.6% from 2020.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2023 to 2030

|

|

Base Year

|

2022

|

|

Historic Years

|

2021 (Customizable 2015-2020)

|

|

Quantitative Units

|

Revenue in Million, Pricing in USD

|

|

Segments Covered

|

By Application (Chassis and Body Controller, Cockpit Controller, and Functional Safety), Supply Chain (Design, Production, Distribution, Selling, and Operation), Sourcing Type (In-House and Outsourced), Type (Electrical Systems and Components, Electric Vehicles, Hybrid Electric Vehicles, and Battery Systems, Telematics, Fuels, Fluids and Lubricant, Interior and Exterior Materials and Components, Vehicle Inspection Services, Homologation Testing, Others)

|

|

Countries Covered

|

China

|

|

Market Players Covered

|

Nemko (Norway), DEKRA (Germany), RINA S.p.A.(Italy), NSF (U.S.), Applus+ (Spain), Asia Quality Focus (China), DNV GL (Norway), TÜV SÜD (Germany), TÜV NORD GROUP (Germany), Intertek Group Plc (U.K.), MISTRAS Group (U.S.), SGS Société Générale de Surveillance SA (Switzerland), TÜV Rheinland (Germany), Element Materials Technology (U.K.), The British Standards Institution (u.k.), Veritell Inspection Certification Co., Ltd (China), China Certification and Inspection (Group) Co., Ltd. (China), Eurofins Scientific (Luxembourg) and HQTS Group Ltd.(China) among others.

|

|

Data Points Covered in the Report

|

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

|

Segment Analysis:

The China automotive testing, inspection and certification (TIC) market is segmented into four notable segments which are based on the application, supply chain, sourcing type, and type.

- On the basis of application, the China automotive testing, inspection and certification (TIC) market is segmented into chassis and body controller, cockpit controller and functional safety.

In 2023, the chassis and body controller segment is expected to dominate the China automotive testing, inspection and certification (TIC) market

In 2023, the chassis and body controller segment is expected to dominate the China automotive testing, inspection and certification (TIC) market with a market share of 42.20%. It is expected to dominate the overall market with the largest market share because it plays a critical role in ensuring the safety and performance of vehicles. These systems manage stability control, braking, suspension, and body electronics.

- On the basis of supply chain, the China automotive testing, inspection and certification (TIC) market is segmented into design, production, distribution, selling, and operation.

In 2023, the design segment is expected to dominate the China automotive testing, inspection and certification (TIC) market

In 2023, the design segment is expected to dominate the China automotive testing, inspection and certification (TIC) market with a market share of 34.34%. It is expected to dominate the market with the largest share due to mandatory testing, inspection, and certification requirements at research and development facilities while designing any automotive component, system, or vehicle.

- On the basis of sourcing type, the China automotive testing, inspection and certification (TIC) market is segmented into in-house and outsourced. In 2023, the in-house segment is expected to dominate the China automotive testing, inspection and certification (TIC) market with a market share of 68.55%.

- On the basis of type, the China automotive testing, inspection and certification (TIC) market is segmented into electrical systems and components, electric vehicles, hybrid electric vehicles and battery systems, telematics, fuels, fluids and lubricant, interior and exterior materials and components, vehicle inspection services, homologation testing, and others. In 2023, the electrical systems and components segment is expected to dominate the China automotive testing, inspection and certification (TIC) market with a market share of 26.33%.

Major Players

Data Bridge Market Research recognizes the following companies as the major key players in the China Automotive Testing, Inspection and Certification (TIC) Market Nemko (Norway), DEKRA (Germany), RINA S.p.A.(Italy), NSF (U.S.), Applus+ (Spain), Asia Quality Focus (China), DNV GL (Norway), TÜV SÜD (Germany), TÜV NORD GROUP (Germany), Intertek Group Plc (U.K.), MISTRAS Group (U.S.), SGS Société Générale de Surveillance SA (Switzerland), TÜV Rheinland (Germany), Element Materials Technology (U.K.), The British Standards Institution (u.k.), Veritell Inspection Certification Co., Ltd (China), China Certification and Inspection (Group) Co., Ltd. (China), Eurofins Scientific (Luxembourg), and HQTS Group Ltd.(China) among others.

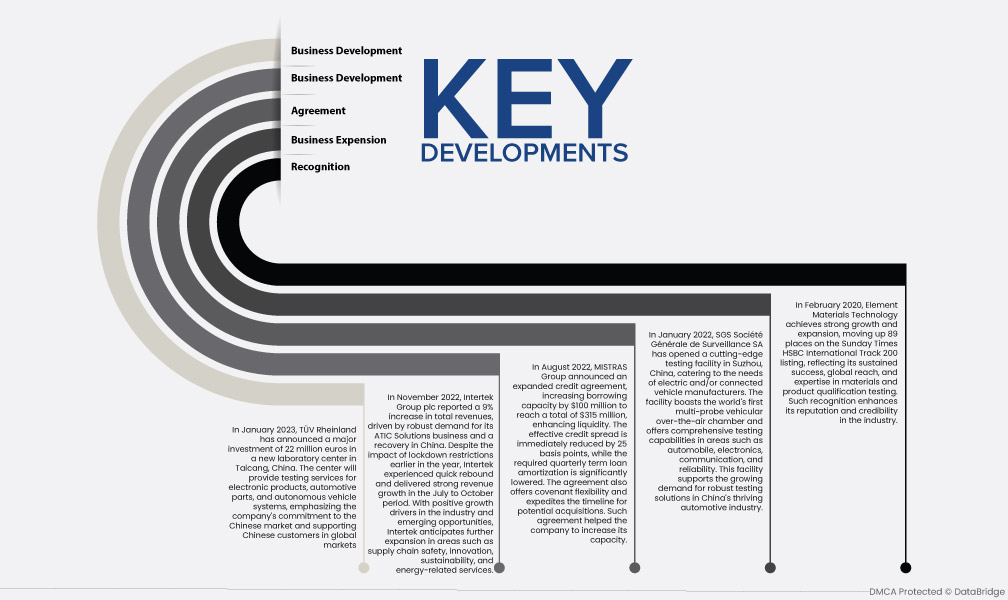

Market Development

- In January 2023, TÜV Rheinland announced a major investment of 22 million euros in a new laboratory center in Taicang, China. The center will provide testing services for electronic products, automotive parts, and autonomous vehicle systems, emphasizing the company's commitment to the Chinese market and supporting Chinese customers in global markets.

- In November 2022, Intertek Group plc reported a 9% increase in total revenues, driven by robust demand for its ATIC Solutions business and a recovery in China. Despite the impact of lockdown restrictions earlier in the year, Intertek experienced a quick rebound and delivered strong revenue growth from July to October. With positive growth drivers in the industry and emerging opportunities, Intertek anticipates further expansion in areas such as supply chain safety, innovation, sustainability, and energy-related services.

- In August 2022, MISTRAS Group announced an expanded credit agreement, increasing borrowing capacity by $100 million to reach $315 million, enhancing liquidity. Twenty-five basis points immediately reduce the effective credit spread, while the required quarterly term loan amortization is significantly lowered. The agreement also offers covenant flexibility and expedites the timeline for potential acquisitions. Such an agreement helped the company to increase its capacity.

- In January 2022, SGS Société Générale de Surveillance SA opened a cutting-edge testing facility in Suzhou, China, catering to the needs of electric and connected vehicle manufacturers. The facility boasts the world's first multi-probe vehicular over-the-air chamber and offers comprehensive automobile, electronics, communication, and reliability testing capabilities. This facility supports the growing demand for robust testing solutions in China's thriving automotive industry.

- In February 2020, Element Materials Technology achieved strong growth and expansion, moving 89 places on the Sunday Times HSBC International Track 200 listing, reflecting its sustained success, global reach, and materials and product qualification testing expertise. Such recognition enhances its reputation and credibility in the industry

For more detailed information about the China automotive testing, inspection and certification (TIC) market report, click here – https://www.databridgemarketresearch.com/reports/china-automotive-tic-market