プレフィルド生理食塩水シリンジの使用は、医療ミスの可能性を大幅に低減し、汚染リスクも軽減するため、現代の医療現場では欠かせない要素となっています。すぐに使用できるソリューションを提供することで手作業による準備が不要なこれらのシリンジは、医療処置の全体的な安全性と効率性を高めます。医療従事者は、特に病院や救急現場などのプレッシャーのかかる環境で生理食塩水を投与するプロセスを効率化するプレフィルドシリンジの利便性の恩恵を受けています。手作業による充填に関連する手順が減ることで、投与量の間違いの可能性が最小限に抑えられるだけでなく、複数回投与のバイアルを使用するときに発生する可能性のある交差汚染を防ぐのにも役立ちます。その結果、プレフィルド生理食塩水シリンジは患者の転帰の改善とケアの水準の向上に貢献し、医療提供者による採用を促進しています。安全性と効率性へのこうした注目の高まりから、市場ではプレフィルド生理食塩水シリンジの需要が高まり、医療機器製品の継続的な進化における重要な要素としての地位を確立しています。

完全なレポートは https://www.databridgemarketresearch.com/reports/emea-prefilled-syringes-marketでご覧いただけます。

データブリッジマーケットリサーチの分析によると、EMEAプレフィルドシリンジ(生理食塩水)市場規模は2023年に1億5,431万米ドルと評価され、2024年から2031年の予測期間中に9.6%のCAGRで成長し、2031年には3億1,452万米ドルに達すると予測されています。

研究の主な結果

院内感染の増加

院内感染の増加は、ヘルスケア市場におけるプレフィルド生理食塩水シリンジの成長に大きなチャンスをもたらしています。従来のパウチ入り生理食塩水は、調製および取り扱い中の汚染リスクにより、院内感染の一因となる可能性があります。病院や医療施設が院内感染の課題にますます取り組むにつれて、患者の安全性を高め、感染リスクを軽減する戦略の実施に重点が置かれるようになっています。プレフィルド生理食塩水シリンジは、滅菌溶液の取り扱いを最小限に抑え、静脈内療法の調製および投与中の汚染の可能性を低減するため、このような状況で魅力的なソリューションを提供します。プレフィルドシリンジを使用することで、医療提供者はプロセスを合理化し、無菌環境に病原体を持ち込む可能性のある不要な手順を排除します。これは、感染リスクが高い脆弱な患者がいる集中治療室や外科病棟などの環境では特に重要です。さらに、市販のプレフィルド生理食塩水シリンジは、一貫した品質と滅菌性を備えており、感染管理プロトコルに準拠しているため、静脈ラインのフラッシュやカテーテルの開存性維持に最適な選択肢となっています。医療従事者や管理者の間で感染予防への意識が高まるにつれ、プレフィルド生理食塩水シリンジは院内感染の削減に向けた積極的なアプローチとなるため、需要が高まると予想されます。

レポートの範囲と市場セグメンテーション

レポートメトリック

|

詳細

|

予測期間

|

2024年から2031年

|

基準年

|

2023

|

歴史的な年

|

2022年(カスタマイズ可能 2016~2021年)

|

定量単位

|

収益(百万米ドル)

|

対象セグメント

|

製品(プラスチック(ポリマー)プレフィルドシリンジおよびガラスプレフィルドシリンジ)、容量(5 ML、10 ML、20 MLなど)、包装(100/箱、120/箱、60/箱など)、用途(がん、糖尿病、多発性硬化症、血栓症、眼科、関節リウマチ、アナフィラキシー、ワクチンなど)、エンドユーザー(医療施設、在宅医療環境、通信販売薬局、製薬会社およびバイオテクノロジー会社など)

|

対象国

|

ドイツ、フランス、イギリス、イタリア、スペイン、ロシア、オランダ、スイス、トルコ、ベルギー、デンマーク、スウェーデン、ポーランド、ノルウェー、フィンランド、その他のヨーロッパ諸国、南アフリカ、サウジアラビア、UAE、バーレーン、クウェート、オマーン、カタール、エジプト、イスラエル、その他の中東およびアフリカ諸国

|

対象となる市場プレーヤー

|

B. Braun SE(ドイツ)、BD(米国)、MedXL Inc.(オランダ)、STI Group(オランダ)、Guerbet(フランス)、テルモ株式会社(日本)、Fresenius Kabi AG(ドイツ)、Polymedicure(インド)、AGUETTANT(フランス)、Anhui Tiankang Medical Technology Co., Ltd.(中国)、Weigao Medical International Co., Ltd(中国)、Medline Industries, LP(米国)、Nipro Medical Corporation(日本)など

|

レポートで取り上げられているデータポイント

|

Data Bridge Market Research がまとめた市場レポートには、市場価値、成長率、セグメンテーション、地理的範囲、主要プレーヤーなどの市場シナリオに関する洞察に加えて、専門家による詳細な分析、患者の疫学、パイプライン分析、価格分析、規制の枠組みも含まれています。

|

セグメント分析

EMEA のプレフィルドシリンジ(生理食塩水)市場は、製品、容量、パッケージ、用途、およびエンドユーザーに基づいて 5 つの主要なセグメントに分類されています。

- 製品に基づいて、EMEAプレフィルドシリンジ(生理食塩水)市場は、プラスチック(ポリマー)プレフィルドシリンジとガラスプレフィルドシリンジに分類されます。

2024年には、プラスチック(ポリマー)プレフィルドシリンジセグメントがEMEAプレフィルドシリンジ(生理食塩水)市場を支配すると予想されています。

2024年には、コスト効率、破損耐性、生物製剤との適合性により、プラスチック(ポリマー)プレフィルドシリンジセグメントが86.14%の市場シェアを獲得し、市場を支配すると予想されています。

- 容量に基づいて、EMEAのプレフィルドシリンジ(生理食塩水)市場は、10 ml、5 ml、20 ml、その他に分類されます。

2024年には、10mlセグメントがEMEAのプレフィルドシリンジ(生理食塩水)市場を支配すると予想されています。

2024年には、大容量の薬剤投与や水分補給療法など、さまざまな用途に対応できる汎用性により、10mlセグメントが43.54%の市場シェアで市場を支配すると予想されています。

- EMEAのプレフィルドシリンジ(生理食塩水)市場は、包装形態に基づいて、100本入り、120本入り、60本入り、その他に分類されています。2024年には、100本入りセグメントが市場シェア39.24%で市場を席巻すると予想されています。

- 用途別に見ると、EMEAのプレフィルドシリンジ(生理食塩水)市場は、がん、糖尿病、多発性硬化症、血栓症、眼科、関節リウマチ、アナフィラキシー、ワクチンなどに区分されています。2024年には、がん分野が26.75%の市場シェアで市場を支配すると予想されています。

- EMEAのプレフィルドシリンジ(生理食塩水)市場は、エンドユーザー別に、医療施設、在宅医療、通信販売薬局、製薬・バイオテクノロジー企業、その他に分類されています。2024年には、医療施設セグメントが市場シェア35.43%で市場を席巻すると予想されています。

主要プレーヤー

この市場の主要プレーヤーとしては、B. Braun SE(ドイツ)、BD(米国)、MedXL Inc.(オランダ)、STI Group(オランダ)などが挙げられます。

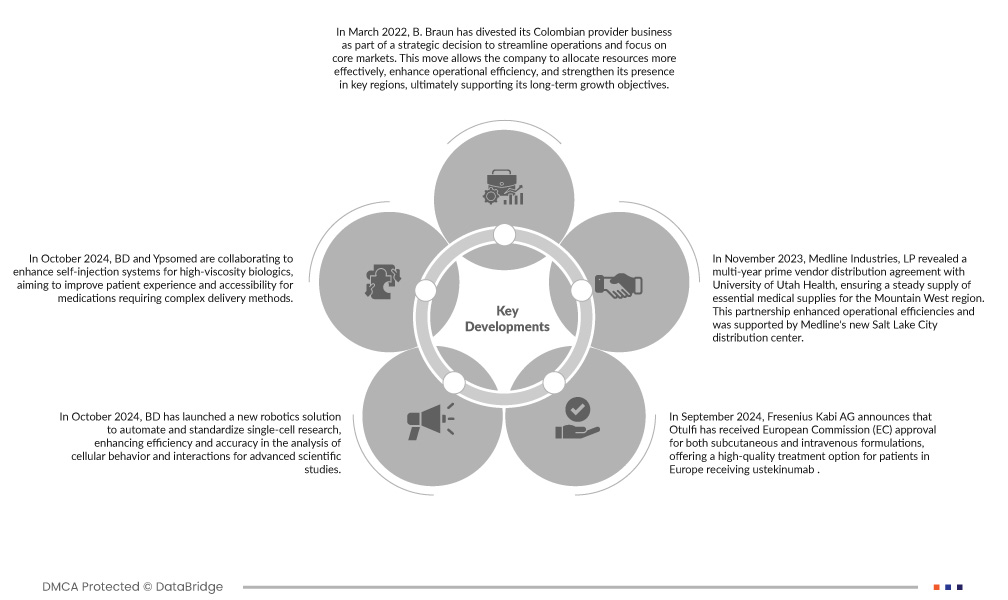

市場動向

- B. Braunは、事業の合理化とコア市場への注力という戦略的決定の一環として、2022年3月にコロンビアのプロバイダー事業を売却しました。この売却により、同社はリソースをより効果的に配分し、業務効率を高め、主要地域におけるプレゼンスを強化し、最終的には長期的な成長目標の達成に貢献します。

- 2024年10月、BDとイプソメッドは、高粘度生物製剤の自己注射システムを強化するために協力し、複雑な投与方法を必要とする薬剤の患者体験とアクセス性を向上させることを目指しています。

- 2024年10月、BDは単一細胞研究を自動化および標準化し、高度な科学研究における細胞の挙動と相互作用の分析の効率と精度を向上させる新しいロボットソリューションを発表しました。

- 2023年11月、メドライン・インダストリーズLPは、ユタ大学保健局との複数年にわたる主要ベンダー流通契約を締結したことを発表しました。これにより、マウンテン・ウェスト地域への必須医療用品の安定供給が確保されます。この提携により業務効率が向上し、メドラインのソルトレイクシティ新配送センターもそのサポート役を果たしました。

- テルモ株式会社は、2022年4月1日付で「ホスピタルカンパニー」を「メディカルケアソリューションズカンパニー」にブランド変更しました。この変更は、在宅医療や個別化医療への移行が進む中で、テルモの5ヵ年成長戦略(GS26)を支えるものです。新ブランド「テルモメディカルケアソリューションズ(TMCS)」は、医療製品における100年にわたる専門知識を活用し、糖尿病治療や薬剤送達技術への展開を通じて、医療の効率性と安全性の向上を目指すテルモのコミットメントを反映しています。

地域分析

地理的に見ると、EMEA プレフィルドシリンジ (生理食塩水) 市場レポートでカバーされている国は、ドイツ、フランス、英国、イタリア、スペイン、ロシア、オランダ、スイス、トルコ、ベルギー、デンマーク、スウェーデン、ポーランド、ノルウェー、フィンランド、その他のヨーロッパ諸国、南アフリカ、サウジアラビア、UAE、バーレーン、クウェート、オマーン、カタール、エジプト、イスラエル、その他の中東およびアフリカ諸国です。

Data Bridge Market Researchの分析によると:

ヨーロッパ地域がEMEAプレフィルドシリンジ(生理食塩水)市場を支配すると予想されている

ヨーロッパ地域は、先進的な医療インフラ、革新的な医療技術の導入率の高さ、そして効果的で信頼性の高い静脈アクセスソリューションの需要を促進する患者中心のケアへの重点の増加により、市場を支配すると予想されています。

EMEAプレフィルドシリンジ(生理食塩水)市場レポートの詳細については、こちらをクリックしてください – https://www.databridgemarketresearch.com/reports/emea-prefilled-syringes-market