In February 2023, CGEP published an article mentioned that in 2022, the European Union experienced a significant setback in its energy sector, with a remarkable loss of 182 terawatt-hours (TWh) in nuclear and hydro generation. The EU's nuclear generation saw a substantial decline of 119 TWh, representing a 17% decrease compared to the previous year, while hydro generation experienced a loss of 63 TWh, marking a 20% reduction. These setbacks are particularly noteworthy given that the EU's total power generation amounts to approximately 2,500 TWh. These developments in the energy sector have raised concerns and warrant close attention within the business community.

Access Full Report @ https://www.databridgemarketresearch.com/reports/europe-data-center-ups-market

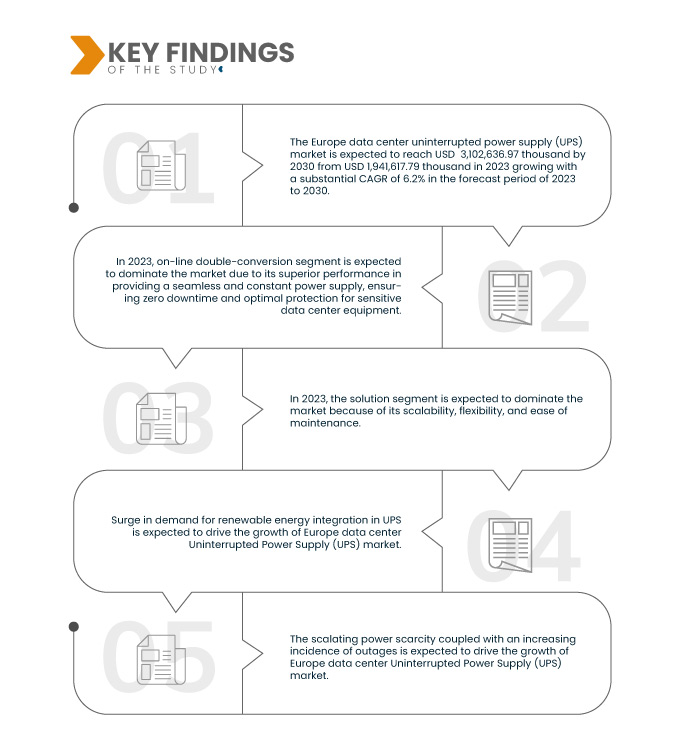

Data Bridge Market Research analyses that the Europe Data Center Uninterrupted Power Supply (UPS) Market is expected to grow at a CAGR of 6.2% in the forecast period of 2023 to 2030 and is expected to reach USD 3,102,636.97 thousand by 2030.

Key Findings of the Study

Surge in Demand for Renewable Energy Integration in UPS

The integration of renewable energy sources, such as solar and wind power into data center operations is gaining traction. UPS systems can play a vital role in ensuring smooth transitions between grid power and renewable sources, maximizing energy efficiency and reducing carbon footprint. The robust growth of the Europe data center Uninterruptible Power Supply (UPS) market is underpinned by a notable surge in the demand for integrating renewable energy sources. As the world transitions towards more sustainable energy solutions, data centers are seeking ways to align with this green trajectory. The integration of renewable energy sources, such as solar and wind power, presents a compelling opportunity to not only reduce the carbon footprint of data center operations but also enhance their resilience.. This trend resonates with the broader corporate commitment to sustainability and aligns with regulatory initiatives aimed at reducing greenhouse gas emissions. As a result, the integration of renewable energy sources in UPS systems has emerged as a significant driver propelling the expansion of the market.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2023 to 2030

|

|

Base Year

|

2022

|

|

Historic Years

|

2021 (Customizable to 2015 - 2020)

|

|

Quantitative Units

|

Revenue in USD Thousand

|

|

Segments Covered

|

Type (On-Line Double-Conversion, Line Interactive, and Passive Standby), Offering (Solution and Services), Capacity (Below 500 KVA, 500-1000 KVA, and Above 1000 KVA), Battery Type (VRLA UPS, Lithium-Ion UPS Flywheel UPS, and Others), Data Center Type (Colocation Data Center, Enterprise Data Center, Cloud and Edge Data Center, and Managed Data Center), Data Center Size (Small, Medium, and Large), Application (Cloud Storage, Data Warehouse, ERP System, File Servers, Application Servers, CRM Systems, and Others), End User (IT & ITES, BFSI, Telecommunications, Manufacturing, Government and Public Sector, Healthcare and Life Sciences, and Media and Entertainment)

|

|

Countries Covered

|

Germany, U.K., France, Netherlands, Italy, Russia, Spain, Turkey, Switzerland, Sweden, Poland, Belgium, Norway, Denmark, Finland, Rest of Europe

|

|

Market Players Covered

|

ABB (Switzerland), Schneider Electric (France), Eaton (Ireland), Vertiv Group Corp (U.S.), Mitsubishi Electric Corporation (Japan), N1 Critical Technologies (A Subsidiary of GENERAL ELECTRIC) (U.S.), Legrand (France), Delta Electronics, Inc.(Taiwan), Huawei Digital Power Technologies Co., Ltd. (A subsidiary of Huawei Technologies Co., Ltd.) (China), Toshiba International Corporation (A subsidiary of TOSHIBA CORPORATION) (Japan), Power Innovations International, Inc. (A subsidiary of LITE-ON Technology Corporation) (U.S.), Inc., SOCOMEC (France), Borri S.p.A. (Italy), RPS Spa (Italy), AEG Power Solutions (The Netherlands), Fuji Electric Co., Ltd. (Japan), Hitachi Hi-Rel Power Electronics Private Limited (A subsidiary of Hitachi Ltd.) (India), Kohler Co. (U.S.), Pillar Power System (A Subsidiary of Langley Holdings plc) (Germany), Cyber Power Systems (USA), Inc. (U.S.), Kehua Data Co., Ltd.(China), ENERSYS (U.S.), Panduit Corp. (U.S.) and among others

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

|

Segment Analysis:

The Europe data center Uninterrupted Power Supply (UPS) market is segmented into eight notable segments which are on the basis of type, offering, capacity, battery type, data center type, data center size, application, and end user.

- On the basis of type, the market is segmented into on-line double-conversion, line interactive, and passive standby.

In 2023, on-line double-conversion segment is expected to dominate the Europe data center Uninterrupted Power Supply (UPS) market

In 2023, on-line double-conversion segment is expected to dominate the market with a 75.80% share due to its superior performance in providing a seamless and constant power supply, ensuring zero downtime and optimal protection for sensitive data center equipment.

- On the basis of offering, the market is segmented into solution and services. In 2023, the solution segment is expected to dominate the market with a 79.95% share.

- On the basis of capacity, the market is segmented into below 500 KVA, 500-1000 KVA and above 1000 KVA. In 2023, below 500 KVA segment is expected to dominate the market with a 41.44% share.

- On the basis of battery type, the market is segmented into VRLA UPS, lithium-ion UPS, flywheel UPS, and others.

In 2023, VRLA UPS segment is expected to dominate the Europe data center Uninterrupted Power Supply (UPS) market

In 2023, VRLA UPS segment is expected to dominate the market with a 91.04% share due to its widespread adoption and proven reliability.

- On the basis of data center type, the market is segmented into colocation data center, enterprise data center, cloud and edge data center and managed data center. In 2023, colocation data center segment is expected to dominate with a 41.98% share.

- On the basis of data center size, the market is segmented into small, medium and large. In 2023, small segment is expected to dominate with a 41.77% share.

- On the basis of application, the market is segmented into cloud storage, data warehouse, ERP system, file servers, application servers, CRM systems and others. In 2023, the cloud storage segment is expected to dominate the market with a 32.45% share.

- On the basis of end user, the market has been segmented into IT & ITES, BFSI, telecommunications, manufacturing, government and public sector, healthcare and life sciences and media and entertainment. In 2023, the IT & ITES segment is expected to dominate with a 34.68% share.

Major Players

Data Bridge Market Research analyzes Delta Electronics, Inc. (Taiwan), ABB (Switzerland), Huawei Digital Power Technologies Co., Ltd. (A subsidiary of Huawei Technologies Co., Ltd.) (China), ENERSYS (U.S.), Hitachi Hi-Rel Power Electronics Private Limited (A subsidiary of Hitachi Ltd.) (India) as the major market players Europe data center Uninterrupted Power Supply (UPS) market.

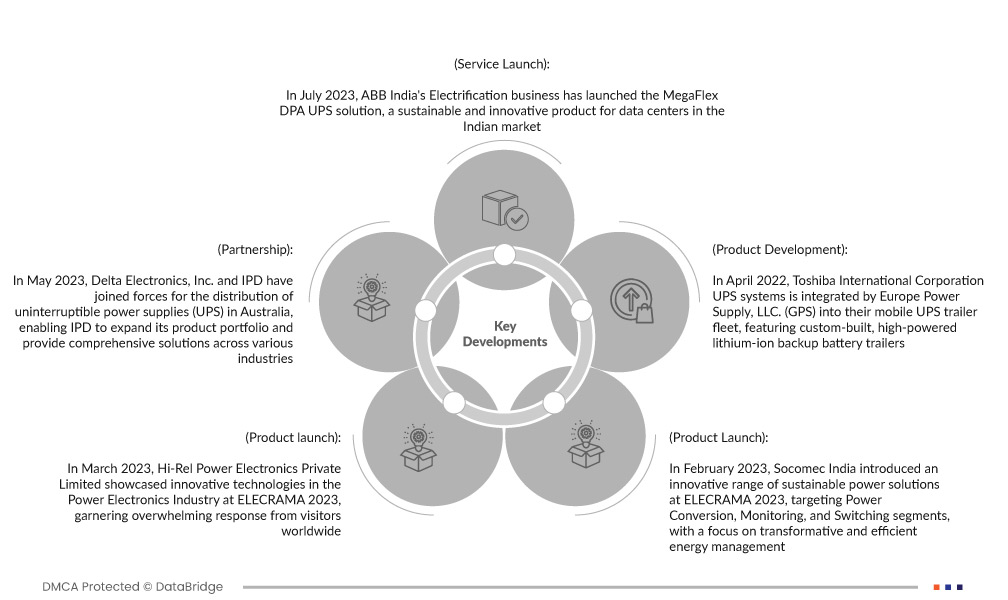

Market Developments

- In July 2023, ABB India's Electrification business has launched the MegaFlex DPA UPS solution, a sustainable and innovative product for data centers in the Indian market. With its reduced footprint, high energy efficiency, and compliance with circularity frameworks, the UPS offers a reliable and scalable power solution for the growing demand in the data center industry. The introduction of MegaFlex DPA supports ABB's commitment to smart and sustainable power technologies, contributing to its Mission to Zero for smart cities and reinforcing its position as a market leader in UPS technology.

- In May 2023, Delta Electronics, Inc. and IPD have joined forces for the distribution of uninterruptible power supplies (UPS) in Australia, enabling IPD to expand its product portfolio and provide comprehensive solutions across various industries. Delta's UPS systems, known for their innovative and intelligent technology, will enhance reliability and efficiency for customers in the Australian market. The partnership between IPD and Delta Electronics marks a significant step in providing cutting-edge power solutions to meet the growing demands of the Australian market, benefitting businesses across different sectors.

- In March 2023, Hi-Rel Power Electronics Private Limited showcased innovative technologies in the Power Electronics Industry at ELECRAMA 2023, garnering overwhelming response from visitors worldwide. The 'Powerhouse' booth featured a diverse range of power electronics products, including UPS. The event provided an excellent platform for interactions with potential buyers and understanding the latest offerings, after three years of pandemic restrictions. Key products displayed included the Industrial UPS System, Stallion Battery Charger, Low Voltage Drives, Medium Voltage Drives, and Grid Tied Solar String Inverters.

- In February 2023, Socomec India introduced an innovative range of sustainable power solutions at ELECRAMA 2023, targeting Power Conversion, Monitoring, and Switching segments, with a focus on transformative and efficient energy management. The Delphys XL 1200kVA/kW UPS and other advanced products showcased demonstrate the company's commitment to providing reliable and sustainable solutions to meet the evolving needs of customers.

- In April 2022, Toshiba International Corporation UPS systems is integrated by Europe Power Supply, LLC. (GPS) into their mobile UPS trailer fleet, featuring custom-built, high-powered lithium-ion backup battery trailers. The addition of Toshiba G9000 and 4400 Series UPS systems enhances critical facility customers' backup power with exceptional safety, flexibility, and durability. By partnering with Europe Power Supply (GPS) and integrating their state-of-the-art UPS systems into GPS's mobile UPS trailer fleet, Toshiba gains enhanced visibility and access to critical facility customers, showcasing the performance, safety, and longevity of their UPS backup power systems in various use cases and applications.

Regional Analysis

Geographically, the countries covered in the Europe data center Uninterrupted Power Supply (UPS) market report are Germany, U.K., France, Netherlands, Italy, Russia, Spain, Turkey, Switzerland, Sweden, Poland, Belgium, Norway, Denmark, Finland, Rest of Europe.

As per Data Bridge Market Research analysis:

Germany is estimated to be dominant and fastest-growing country in the Europe Data Center Uninterrupted Power Supply (UPS) market

Germany is expected to dominate and fastest growing country in the market due to its mature and well-established data center infrastructure. The country houses numerous large-scale data centers catering to diverse industries, driving the demand for reliable UPS systems.

For more detailed information about the Europe Data Center Uninterrupted Power Supply (UPS) market report, click here – https://www.databridgemarketresearch.com/reports/europe-data-center-ups-market