The European dietary supplement market is significantly propelled by a profound and expanding shift in consumer behavior towards greater health awareness and a proactive stance on preventive healthcare. Consumers across the continent are no longer merely seeking remedies for existing ailments but are actively investing in maintaining their well-being and mitigating the risk of future health issues. This evolving mindset, deeply ingrained with a belief in the power of nutrition, has led to a burgeoning demand for dietary supplements that promise to fill nutritional gaps, boost immunity, and support overall vitality. The global health crises of recent years have only amplified this trend, cementing the perceived necessity of nutritional interventions as a cornerstone of personal health management.

Access Full Report @ https://www.databridgemarketresearch.com/reports/europe-dietary-supplements-market

Data Bridge Market Research analyses that the Europe Dietary Supplements Market is expected to reach USD 61.31 billion by 2032 from USD 37.61 billion in 2024, growing with a CAGR of 6.4% in the forecast period of 2025 to 2032.

Key Findings of the Study

Expansion of E-Commerce Platforms

The digital revolution has profoundly reshaped the landscape of the European dietary supplement market, with the robust expansion of e-commerce platforms serving as a powerful growth engine. Online channels offer unparalleled accessibility and convenience, allowing consumers across diverse geographies to browse and purchase a wider selection of products than ever before. For manufacturers, e-commerce represents a transformative direct-to-consumer model, drastically reducing traditional overheads associated with brick-and-mortar retail and enabling highly targeted marketing strategies. This digital evolution is not merely facilitating sales but is fundamentally accelerating market penetration and expanding the reach of dietary supplements to a broader and more diverse demographic across the entire European continent.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2025 to 2032

|

|

Base Year

|

2024

|

|

Historic Years

|

2023 (Customizable from 2018-2023)

|

|

Quantitative Units

|

Revenue in USD Billion

|

|

Segments Covered

|

By Product Type (Vitamin Supplements, Mineral Supplements, Vitamin and Mineral Complexes/Blends Supplements, Protein Based Supplements, Herbal/Plant-Based Supplements, Probiotic Supplements, Omega-3 and Essential Fatty Acid Supplements, Amino Acid Supplements, Fiber-Based Supplements, Prebiotic Supplements, Synbiotic Supplements, Fat Burners and Thermogenic Supplements, and Others), Nature (Conventional and Organic), Product Form (Tablets, Capsules, Soft Gels, Powders, Gummies & Jellies, Liquids, Premixes, and Others), Function (Nutritional Support, Immune System Enhancement, Sports Nutrition, Preventive Health, Heart Health, Digestive Health, Cognitive and Mental Health, Performance Enhancement, Weight Management, Gut Health, Aging Support, Skin Health, Bone and Joint Health, Metabolic Health, Health Maintenance, Hormonal Balance, Immune Health, and Others), Packaging Type (Bottles, Pouches and Sachets, Jars and Containers, Blister Packs, Cans and Tins, and Others), Packaging Size (100 to 250 Grams, 250 to 500 Grams, Less than 100 Grams, 500 to 750 Grams, 750 to 1000 Grams, and More than 1000 Grams) Consumer Demography (Adults (24 to 45 Years), Seniors (Above 45 Years), Youngs (14 to 24 Years), and Kids (Under 14 Years)), Gender (Female, Male, and Uni-Sex), Distribution Channel (Store-Based Retailers and Non-Store Retailers)

|

|

Countries Covered

|

Italy, Germany, France, U.K., Spain, Netherlands, Russia, Switzerland, Belgium, Sweden, Denmark, Finland, Poland, Turkey, and Rest of Europe

|

|

Market Players Covered

|

Nestlé (Switzerland), Abbott (U.S.), Amway Corp. (U.S.), Haleon Group of Companies (U.K.), Herbalife International of America, Inc. (U.S.), Orkla (Norway), FitLife Brands, Inc. (U.S.), Glanbia PLC (Ireland), BioGaia (Sweden), Procter & Gamble (U.S.), Sanofi (France), Evonik Industries AG (Germany), Arkopharma (France), Pharma Nord Inc. (Denmark), Pileje (France), Probi (Sweden), Nature’s Sunshine Products, Inc. (U.S.), Himalaya Wellness Company (India), Perrigo Company plc. (Ireland), Bio-Tech Pharmacal (U.S.), Wörwag Pharma (Germany) among others

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

|

Segment Analysis

The Europe dietary supplements market is categorized into nine notable segments based on product type, nature, product form, function, packaging type, packaging size, consumer demography, gender, and distribution channel.

- On the basis of product type, the Europe dietary supplements market is segmented into Vitamin Supplements, mineral supplements, vitamin and mineral complexes/blends supplements, protein based supplements, herbal/plant-based supplements, probiotic supplements, omega-3 and essential fatty acid supplements, amino acid supplements, fiber-based supplements, prebiotic supplements, symbiotic supplements, fat burners and thermogenic supplements, and others

In 2025, the vitamin supplements segment is expected to dominate the Europe dietary supplements market

In 2025, the vitamin supplements segment is expected to dominate the market with a 22.07% market share, driven by the rising prevalence of vitamin deficiencies across diverse population groups, increasing consumer awareness regarding preventive healthcare, and a growing focus on boosting immunity post the COVID-19 pandemic.

- On the basis of nature, the Europe dietary supplements market is segmented into conventional and organic

In 2025, the conventional segment is expected to dominate the Europe dietary supplements market

In 2025, the conventional segment is expected to dominate the market with a 81.99% market share, driven by its widespread availability, cost-effectiveness, and strong consumer trust built over decades.

- On the basis of product form, the Europe dietary supplements market is segmented into tablets, capsules, soft gels, powders, gummies & jellies, liquids, premixes, and others. In 2025, the tablets segment is expected to dominate the market with a 25.70% market share

- On the basis of function, the Europe dietary supplements market is segmented into nutritional support, immune system enhancement, sports nutrition, preventive health, heart health, digestive health, cognitive and mental health, performance enhancement, weight management, gut health, aging support, skin health, bone and joint health, metabolic health, health maintenance, hormonal balance, immune health, and others. In 2025, the nutritional support segment is expected to dominate the market with a 35.65% market share

- On the basis of packaging type, the Europe dietary supplements market is segmented into bottles, pouches and sachets, jars and containers, blister packs, cans and tins, and others. In 2025, the bottles segment is expected to dominate the market with a 31.85% market share

- On the basis of packaging size, the Europe dietary supplements market is segmented into 100 to 250 grams, 250 to 500 grams, less than 100 grams, 500 to 750 grams, 750 to 1000 grams, and more than 1000 grams. In 2025, the 100 to 250 grams segment is expected to dominate the market with a 30.85% market share

- On the basis of consumer demography, the Europe dietary supplements market is segmented into adults (24 to 45 years), seniors (above 45 years), youngs (14 to 24 years), and kids (under 14 years). In 2025, the adults (24 to 45 years) segment is expected to dominate the market with a 41.68% market share

- On the basis of gender, the Europe dietary supplements market is segmented into female, male, and uni-sex. In 2025, the female segment is expected to dominate the market with a 50.08% market share

- On the basis of distribution channel, the Europe dietary supplements market is segmented into store based retailers and non-store retailers. In 2025, the store based retailers segment is expected to dominate the market with a 64.70% market share

Major Players

Data Bridge Market Research analyzes Nestle (Switzerland), Abbott (U.S.), Amway Corp. (U.S.), Haleon Group of Companies (United Kingdom), and Herbalife International of America, Inc. (U.S.) as the major market players of the Europe dietary supplements market.

Market Developments

- In June 2025, Nature’s Sunshine Products, Inc. announced a secondary public offering of up to 2,854,607 shares of common stock sold by Fosun Pharma USA, Inc. The company itself will not receive proceeds but may repurchase up to USD 15 million of shares. D.A. Davidson & Co. is acting as the sole book-running manager for this offering

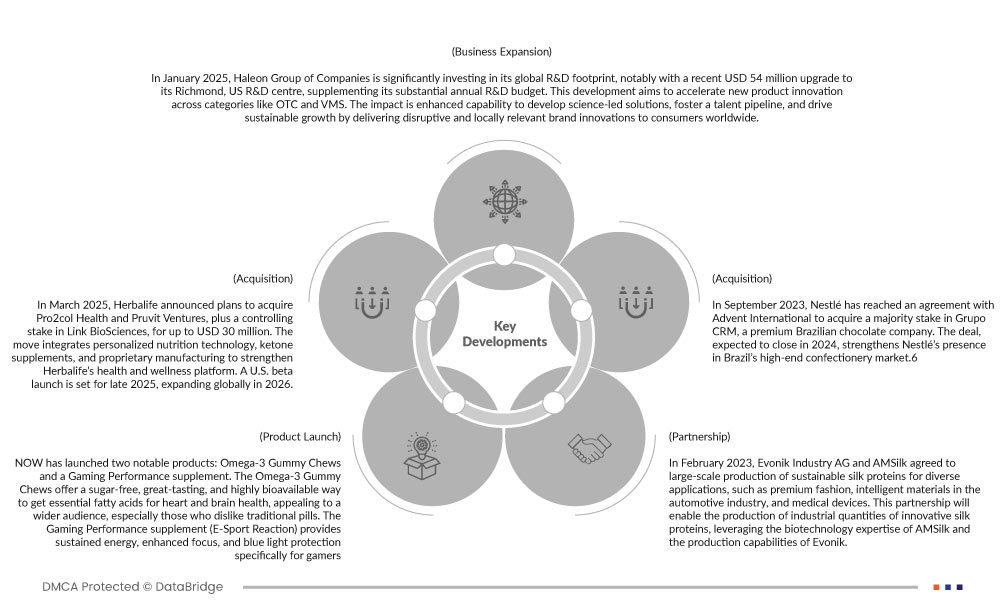

- In 2024, NOW has launched two notable products: Omega-3 Gummy Chews and a Gaming Performance supplement. The Omega-3 Gummy Chews offer a sugar-free, great-tasting, and highly bioavailable way to get essential fatty acids for heart and brain health, appealing to a wider audience, especially those who dislike traditional pills. The Gaming Performance supplement (E-Sport Reaction) provides sustained energy, enhanced focus, and blue light protection specifically for gamers

- In December 2022, Orkla Health acquired Lofoten Marine Oils to strengthen its omega-3 and marine-based health ingredient sourcing. This specialist company processes high-quality marine oils rich in essential fatty acids used in supplements. The NOK 11 million revenue addition secures local supply, improves traceability, and supports Orkla’s strategy to expand its premium health and nutrition product range sustainably

- In March 2022, Orkla Health bought Healthspan, a leading direct-to-consumer supplement company in the UK, for stronger digital health market presence. With GBP 50 million in annual revenue, Healthspan offers vitamins, minerals, and wellness products through online channels. This acquisition boosts Orkla’s e-commerce capability and enables access to millions of loyal customers seeking high-quality nutritional supplements

- In May 2025, Sanofi has recently completed the acquisition of DR-0201, a novel targeted bispecific myeloid cell engager, from Dren Bio, Inc., a clinical-stage biopharmaceutical company. This move represents a strategic R&D pipeline expansion and business development type of development for Sanofi

Regional Analysis

Geographically, the countries covered in the Europe dietary supplements market report are Italy, Germany, France, U.K., Spain, Netherlands, Russia, Switzerland, Belgium, Sweden, Denmark, Finland, Poland, Turkey, and Rest of Europe.

As per Data Bridge Market Research analysis:

Italy is expected to dominate and the fastest growing country in the Europe dietary supplements market

Italy is expected to dominate and fastest growing country in the market due to rising consumer awareness regarding preventive healthcare, increasing aging population, and the growing demand for natural and plant-based supplements. And strong government initiatives promoting healthy lifestyles and a well-established nutraceutical manufacturing sector further contribute to the country's market leadership.

For more detailed information about Europe dietary supplements market click here – https://www.databridgemarketresearch.com/reports/europe-dietary-supplements-market