Barrier films are a type of packaging film, which is widely used in the food and beverage to extend the shelf life of the food and protect the food products from the numerous types of external influences which is providing oxygen and moisture barriers. Also, barrier films hold the primary use in the product's packaging. Barrier films consist of two layers type, which is multiple layers and single layers. Multiple layers based barrier films are specially designed to achieve high-performance levels as compared to single layers based barrier films.

Global Barrier Films Market was valued at USD 22,560.89 million in 2021 and is expected to reach USD 34,362.21 million by 2029, registering a CAGR of 5.40% in 2022-2029. Barrier films are also used in agriculture to protect filling goods from oxidation, microbial infestation and vitamin loss. In agriculture, the barrier films also reduce the fumigants in crop production and emissions of volatile pesticides. Also, these films provide a moisture barrier where soil for the cultivation of vegetables and fruits undergoes fumigation or sterilization process.

Increasing applications of barrier films in food and beverages product packaging across the world will drive the market's growth rate

Barrier films are a form of impermeable packaging solutions that normally consist of single or multiple layers of flexible films, and different material types are used in barrier films that vary on the field of use. Barrier films can be used to preserve and protect a wide array of food types and products, including bakery and confectionery, dehydrated food and beverage and animal food. Barrier films are commonly used in food products to shield them from moisture depletion, while also avoiding water accumulation so that their crispness remains intact, for this reason increasing applications of barrier films in food and beverages product packaging is acting as a driver for propping the demand of the market.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2022 to 2029

|

|

Base Year

|

2021

|

|

Historic Years

|

2020 (Customizable to 2014 - 2019)

|

|

Quantitative Units

|

Revenue in USD Million, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Type (Metalized Barrier Films, Transparent Barrier Films, White Barrier Film), Material Type (Polyethylene Teraphthalate (PET), Polyethylene (PE), Polypropylene (PP), Polyamides (PA), Ethylene Vinyl Alcohol (EVOH), Linear Low-Density Polyethylene (LLDPE), Others), Layers (Multiple Layers, Single Layers), Application (Food and Beverage, Pharmaceutical, Electronics, Agriculture, Others), Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, E-Commerce, Others)

|

|

Countries Covered

|

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America

|

|

Market Players Covered

|

Amcor plc (Switzerland), Mondi (U.K.), Huhtamaki (Finland), Sealed Air (U.S.), Jindal Poly Films Limited (India), Toppan Inc., (Japan), Kureha Corporation (Japan), HPM Global, Inc. (South Korea), Flair Flexible Packaging Corporation (U.S.), Constantia Flexibles (Austria), MULTIVAC (Germany), DuPont (U.S.), Wihuri Group (Finland), BERNHARDT Packaging & Process (France), Borealis AG (Austria), and Uflex Limited (India) among others

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand

|

Segment Analysis:

Global barrier films market is categorized into five notable segments which are type, material type, layers, application and distribution channel.

- On the basis of type, the market is segmented into metalized barrier films, transparent barrier films and white barrier film. In 2021, metalized barrier films segment dominated the global barrier films market with 37.67% market share because metalized barrier films are specially designed to preserve various types of products to provide a high barrier against oxygen as well as humidity in terms of ensuring extent shelf life for sensitive products, which helps to boost its demand in the forecast year.

- On the basis of material type, the market is segmented into polyethylene teraphthalate (PET), polyethylene (PE), polypropylene (PP), polyamides (PA), ethylene vinyl alcohol (EVOH), linear low-density polyethylene (LLDPE) and others. In 2021, polyethylene teraphthalate (PET) segment dominated the global barrier films market with 19.67% market share because polyethylene teraphthalate (PET) is a strong film with good oxygen barrier and heat resistant with a good durability. Along with this polyethylene teraphthalate (PET) is an excellent laminating substrate for stand-up pouches, which helps to boost its demand in the forecast year.

- On the basis of layers, the market is segmented into multiple layers and single layers. In 2021, multiple layers segment dominated the global barrier films market with 53.22% market share because multiple layers based barrier films can achieve high-performance levels as compared to single layers based barrier films.

- On the basis of application, the market is segmented into food and beverage, pharmaceutical, electronics, agriculture and others. In 2021, food and beverage segment dominated the global barrier films market with 30.85% market share because most of the barriers films are used for food and beverage applications such as bakery and confectionery, dehydrated food and beverage, dry Fruits, and fruits and nuts, frozen food, chips and snacks, animal food and others in order to extend their shelf life, which helps to boost its demand in the forecast year.

The food and beverage segment will dominate the application segment of the barrier films market

The food and beverage segment will emerge as the dominating segment application segment. This is because of the growing number of food and beverage products in the market especially in the developing economies. Further, growth and expansion of research development services on a global scale will further bolster the growth of this segment.

- On the basis of distribution channel, the market is segmented into supermarkets/hypermarkets, specialty stores, E-commerce and others. In 2021, supermarkets/hypermarkets segment dominated the barrier films market with 30.80% market share due to most of the end users are engaged to purchase barrier films from the supermarkets/hypermarkets because in the supermarkets/hypermarkets the end users found barrier films relatively at a low price as compared to other distribution channel, which helps to boost its demand in the forecast year.

The supermarkets/hypermarkets segment will dominate the distribution channel segment of the barrier films market

The supermarkets/hypermarkets segment will emerge as the dominating segment under distribution channel with approximately 31.00% market share. This is because of the growing number of infrastructural development activities in the market especially in the developing economies. Further, growth and expansion of the chemicals and materials industry all around the globe will further bolster the growth of this segment.

Major Players

Data Bridge Market Research recognizes the following companies as the market players in market: Amcor plc (Switzerland), Mondi (U.K.), Huhtamaki (Finland), Sealed Air (U.S.), Jindal Poly Films Limited (India), Toppan Inc., (Japan), Kureha Corporation (Japan), HPM Global, Inc. (South Korea), Flair Flexible Packaging Corporation (U.S.), Constantia Flexibles (Austria), MULTIVAC (Germany), DuPont (U.S.), Wihuri Group (Finland), BERNHARDT Packaging & Process (France), Borealis AG (Austria), and Uflex Limited (India).

Market Development

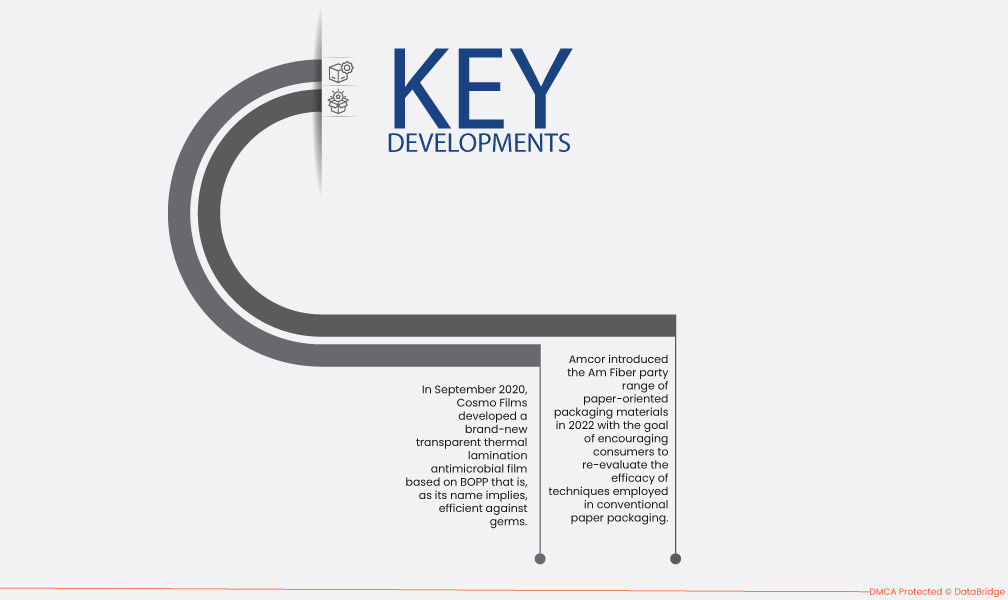

- In September 2020, Cosmo Films developed a brand-new transparent thermal lamination antimicrobial film based on BOPP that is, as its name implies, efficient against germs. The antimicrobial technology employed in this movie offers a brand-new strategy for avoiding microbial colonization on the surface, which addresses the rapidly spreading issue of bacterial infections on packaged goods worldwide. This antimicrobial film inhibits the growth of germs, is effective against a wide variety of bacteria, and promotes optimal hygiene.

- Amcor introduced the Am Fiber party range of paper-oriented packaging materials in 2022 with the goal of encouraging consumers to reevaluate the efficacy of techniques employed in conventional paper packaging.

Regional Analysis

Geographically, the countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

As per Data Bridge Market Research analysis:

Asia-Pacific is the dominant region in barrier films market during the forecast period 2022 to 2029

Asia-Pacific dominates the market in terms of revenue and market share, and this trend is expected to continue throughout the projected period of 2022–2029. The increase in demand for packaged goods and beverages within the region is responsible for the market expansion in this area.

North America is estimated to be the fastest growing region in barrier films market the forecast period 2022 to 2029

On the other hand, North America is predicted to have profitable growth from 2022 to 2029 because of the widespread use of barrier films and the advanced technology that goes into producing them.

COVID-19 Impact

The recent coronavirus outbreak significantly impacted the market for barrier films. Governments implemented preventative lockdowns to stop the spread of disease, which had additional negative effects on the market and also had financial consequences. The BIR association claims that social segregation laws and lockdown measures implemented in several nations have made collecting and sorting rubbish more difficult. As a result, landfill wastes have grown in the first and second quarters of 2020, while plastic recycling rates have significantly decreased as a result. The need for various kinds of flexible plastic packaging rose, meanwhile, during the lockdown. The demand for plastic recycling has increased as a result of the pandemic's increased usage of single-use plastics including bags, wraps, masks, face shields, and pouches.

For more detailed information about the barrier films on market report, click here – https://www.databridgemarketresearch.com/reports/global-barrier-films-market