بطانة حاوية البضائع السائبة المتوسطة (IBC) هي كيس أو بطانة مرنة مصممة لتناسب حاوية البضائع السائبة المتوسطة، وهي حاوية كبيرة قابلة لإعادة الاستخدام تُستخدم لنقل وتخزين السوائل أو المساحيق. تعمل البطانة كحاجز بين المنتج والحاوية، مما يساعد على الحفاظ على النظافة ومنع التلوث وحماية المحتويات من العوامل الخارجية. تُصنع هذه البطانات عادةً من مواد مثل البولي إيثيلين أو البولي بروبيلين ، وهي قابلة للاستخدام مرة واحدة، وتُستخدم غالبًا في صناعات مثل الأغذية والمشروبات والأدوية والمواد الكيميائية لضمان مناولة فعالة ونظيفة للمواد السائبة.

يمكنك الوصول إلى التقرير الكامل على https://www.databridgemarketresearch.com/reports/global-ibc-intermediate-bulk-container-liners-market

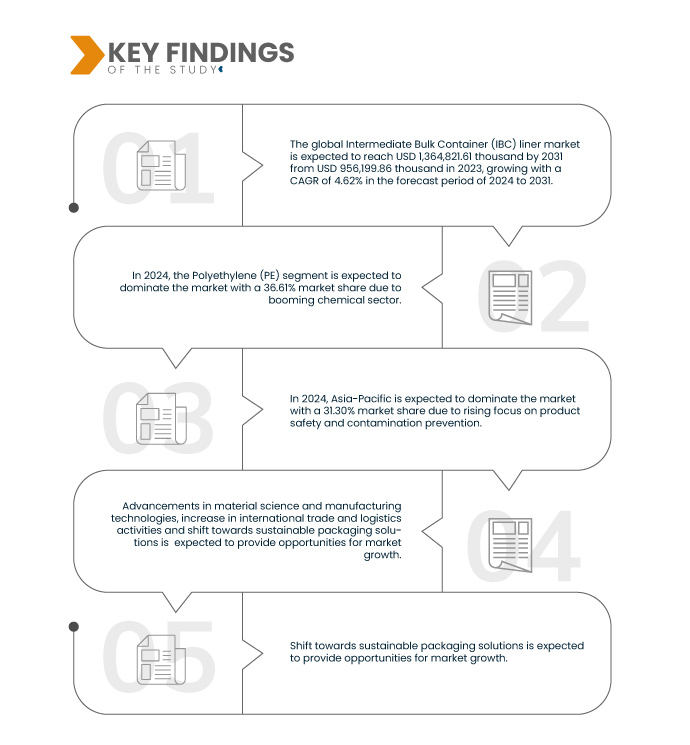

يقوم بحث سوق Data Bridge بتحليل السوق العالمي لبطانة الحاويات السائبة المتوسطة (IBC) ومن المتوقع أن يصل إلى 1،364،821.61 ألف دولار أمريكي بحلول عام 2031 من 956،199.86 ألف دولار أمريكي في عام 2023، بنمو بمعدل نمو سنوي مركب قدره 4.62٪ في الفترة المتوقعة من 2024 إلى 2031.

النتائج الرئيسية للدراسة

قطاع الكيماويات المزدهر

يؤدي التوسع في إنتاج المواد الكيميائية إلى زيادة الطلب على حلول تخزين ونقل فعّالة وآمنة وبأسعار معقولة للمواد الكيميائية. توفر بطانات حاويات الشحن المتوسطة (IBC) تغليفًا واقيًا لنقل وتخزين السوائل وشبه الصلبة والمنتجات الحبيبية، وهي مفيدة بشكل خاص في ضمان شحن المواد الكيميائية مع تقليل مخاطر التلوث والتسرب.

يسعى مصنعو المواد الكيميائية دائمًا إلى تحسين الكفاءة وخفض التكاليف، ولذلك يتزايد اعتمادهم على بطانات الحاويات المتوسطة (IBC). توفر هذه البطانات حاجزًا موثوقًا ضد الملوثات، وتُحسّن استخدام مساحة النقل، مع تقليل تكاليف التنظيف والصيانة المرتبطة بالحاويات القابلة لإعادة الاستخدام.

نطاق التقرير وتقسيم السوق

مقياس التقرير

|

تفاصيل

|

فترة التنبؤ

|

من 2024 إلى 2031

|

سنة الأساس

|

2023

|

السنوات التاريخية

|

2022 (قابلة للتخصيص حتى 2016 - 2021)

|

الوحدات الكمية

|

الإيرادات بالألف دولار أمريكي

|

القطاعات المغطاة

|

المواد (بولي إيثيلين (PE)، EVOH، رقائق الألومنيوم، بولي بروبيلين (PP)، بولي أميد (PA)، حمض البولي لاكتيك (PLA) ، وغيرها)، النوع (بطانات ملائمة للشكل، بطانات وسادة، وغيرها)، الفئة (بطانات حاويات التعبئة العلوية، بطانات حاويات مفتوحة من الأعلى، بطانات حاويات التعبئة الخلفية، بطانات حاويات حرارية، بطانات حاويات ذات وصول واسع، بطانات حاويات بدون قضبان، بطانات حاويات سائلة، وغيرها)، تقنية التعبئة (معقمة وغير معقمة)، السعة (1000-1500 لتر وأعلى من 1500 لتر)، السُمك (100 إلى 150 ميكرون، أقل من 100 ميكرون، وأعلى من 150 ميكرون)، الاستخدام النهائي (الأغذية والمشروبات، الكيماويات الصناعية، الرعاية الصحية والأدوية، مستحضرات التجميل والعناية الشخصية، الزراعة، النفط والغاز، البناء والتشييد، وغيرها)، قناة التوزيع (مباشرة وغير مباشرة)

|

الدول المغطاة

|

الولايات المتحدة الأمريكية، كندا، المكسيك، ألمانيا، فرنسا، إيطاليا، إسبانيا، هولندا، بلجيكا، بولندا، السويد، النمسا، جمهورية التشيك، الدنمارك، فنلندا، البرتغال، اليونان، أيرلندا، رومانيا، المجر، سلوفاكيا، بلغاريا، كرواتيا، ليتوانيا، لوكسمبورغ، قبرص، إستونيا، لاتفيا، مالطا، سلوفينيا، بقية دول الاتحاد الأوروبي، الصين، الهند، بقية دول آسيا والمحيط الهادئ، البرازيل، الأرجنتين، بقية دول أمريكا الجنوبية، جنوب أفريقيا، مصر، نيجيريا، كينيا، إثيوبيا، تنزانيا، زامبيا، زيمبابوي، الجزائر، تونس، موريتانيا، بقية دول أفريقيا، المملكة العربية السعودية، الإمارات العربية المتحدة، قطر، الكويت، عُمان، البحرين، تركيا، إسرائيل، الأردن، لبنان، وبقية دول المشرق العربي

|

الجهات الفاعلة في السوق المغطاة

|

ILC Dover LP (الولايات المتحدة)، Liquibox (الولايات المتحدة)، Berry Global Inc. (الولايات المتحدة)، CDF Corporation (الولايات المتحدة)، Peak Liquid Packaging (إنجلترا)، International Paper (الولايات المتحدة)، Amcor plc (أستراليا)، Bulk Lift International, LLC (الولايات المتحدة)، Arena Products, Inc. (الولايات المتحدة)، DACO CORPORATION (الولايات المتحدة)، Freedom Manufacturing LLC (الولايات المتحدة)، Paper Systems (الولايات المتحدة)، Qbig Packaging BV (هولندا)، HANGZHOU HANSIN NEW PACKING MATERIAL CO., LTD. (الصين)، Reusable Transport Packaging (الولايات المتحدة)، TIANJIN UNIPACK PACKAGING MATERIAL (الصين)، MBZ Industries Inc. (الولايات المتحدة)، TPS Rental Systems Ltd (المملكة المتحدة)، Palmetto Industries International Inc. (الولايات المتحدة)، Composite Containers, LLC (الولايات المتحدة)، Arlington Packaging Ltd (المملكة المتحدة)، وAlccorp.com (جنوب أفريقيا) وغيرها.

|

نقاط البيانات التي يغطيها التقرير

|

بالإضافة إلى الرؤى حول سيناريوهات السوق مثل القيمة السوقية ومعدل النمو والتجزئة والتغطية الجغرافية واللاعبين الرئيسيين، فإن تقارير السوق التي تم تنظيمها بواسطة Data Bridge Market Research تتضمن أيضًا تحليلًا متعمقًا من الخبراء وعلم الأوبئة للمرضى وتحليل خطوط الأنابيب وتحليل التسعير والإطار التنظيمي.

|

تحليل القطاعات:

يتم تقسيم سوق بطانة الحاويات السائبة المتوسطة (IBC) العالمية إلى ثمانية قطاعات بارزة بناءً على المادة والنوع والفئة وتكنولوجيا التعبئة والسعة والسمك والاستخدام النهائي وقناة التوزيع.

- على أساس المادة، يتم تقسيم السوق إلى البولي إيثيلين (PE)، وEVOH، ورقائق الألومنيوم، والبولي بروبيلين (PP)، والبولي أميد (PA)، وحمض البوليكتيك (PLA)، وغيرها

من المتوقع أن تهيمن شريحة البولي إيثيلين (PE) على سوق بطانة حاويات البضائع السائبة المتوسطة (IBC) العالمية في عام 2024

في عام ٢٠٢٤، من المتوقع أن يهيمن قطاع البولي إيثيلين (PE) على السوق بحصة سوقية تبلغ ٣٦.٦١٪، بفضل تنوعه وخصائصه المتميزة. وهو متوفر بأشكال متنوعة، بما في ذلك البولي إيثيلين عالي الكثافة (HDPE) والبولي إيثيلين منخفض الكثافة (LDPE).

- على أساس النوع، يتم تقسيم السوق إلى بطانات ملائمة للشكل، وبطانات الوسائد، وغيرها

في عام 2024، من المتوقع أن تهيمن شريحة بطانات الشكل المناسب على سوق بطانات الحاويات السائبة المتوسطة (IBC) العالمية

من المتوقع أن تهيمن شريحة بطانات الشكل المناسب على السوق في عام 2024 بحصة سوقية تبلغ 36.58%، وذلك بسبب التركيز المتزايد على سلامة المنتج ومنع التلوث.

- بناءً على الفئة، يُقسّم السوق إلى بطانات حاويات التعبئة العلوية، وبطانات حاويات مفتوحة من الأعلى، وبطانات حاويات التعبئة الخلفية، وبطانات حاويات حرارية، وبطانات حاويات واسعة الوصول، وبطانات حاويات بدون قضبان، وبطانات حاويات مُميّعة، وغيرها. في عام 2024، من المتوقع أن يهيمن قطاع بطانات حاويات التعبئة العلوية على السوق بحصة سوقية تبلغ 31.83%.

- بناءً على تقنية التعبئة، يُقسّم السوق إلى معقمة وغير معقمة. في عام ٢٠٢٤، من المتوقع أن يهيمن قطاع المعقمة على السوق بحصة سوقية تبلغ ٧٣.٠١٪.

- بناءً على السعة، يُقسّم السوق إلى سعات تتراوح بين 1000 و1500 لتر، وفوق 1500 لتر. في عام 2024، من المتوقع أن تهيمن فئة 1000 و1500 لتر على السوق بحصة سوقية تبلغ 57.49%.

- بناءً على السُمك، يُقسّم السوق إلى شرائح بسماكة تتراوح بين 100 و150 ميكرون، وشرائح بسماكة أقل من 100 ميكرون، وشرائح بسماكة تزيد عن 150 ميكرون. ومن المتوقع أن تهيمن شريحة الشرائح بسماكة تتراوح بين 100 و150 ميكرون على السوق بحصة سوقية تبلغ 65.18% في عام 2024.

- بناءً على الاستخدام النهائي، يُقسّم السوق إلى قطاعات الأغذية والمشروبات، والمواد الكيميائية الصناعية، والرعاية الصحية والأدوية، ومستحضرات التجميل والعناية الشخصية، والزراعة، والنفط والغاز، والبناء والتشييد، وغيرها. ومن المتوقع أن يهيمن قطاع الأغذية والمشروبات على السوق بحصة سوقية تبلغ 36.55% في عام 2024.

- بناءً على قنوات التوزيع، يُقسّم السوق إلى مباشر وغير مباشر. في عام ٢٠٢٤، من المتوقع أن يهيمن القطاع المباشر على السوق بحصة سوقية تبلغ ٦٥.٦٠٪.

اللاعبون الرئيسيون

قامت شركة Data Bridge Market Research بتحليل شركة ILC Dover LP (الولايات المتحدة)، وLiquibox (الولايات المتحدة)، وBerry Global Inc، (الولايات المتحدة)، وCDF Corporation (الولايات المتحدة)، وPeak Liquid Packaging (إنجلترا) باعتبارها اللاعبين الرئيسيين في هذا السوق.

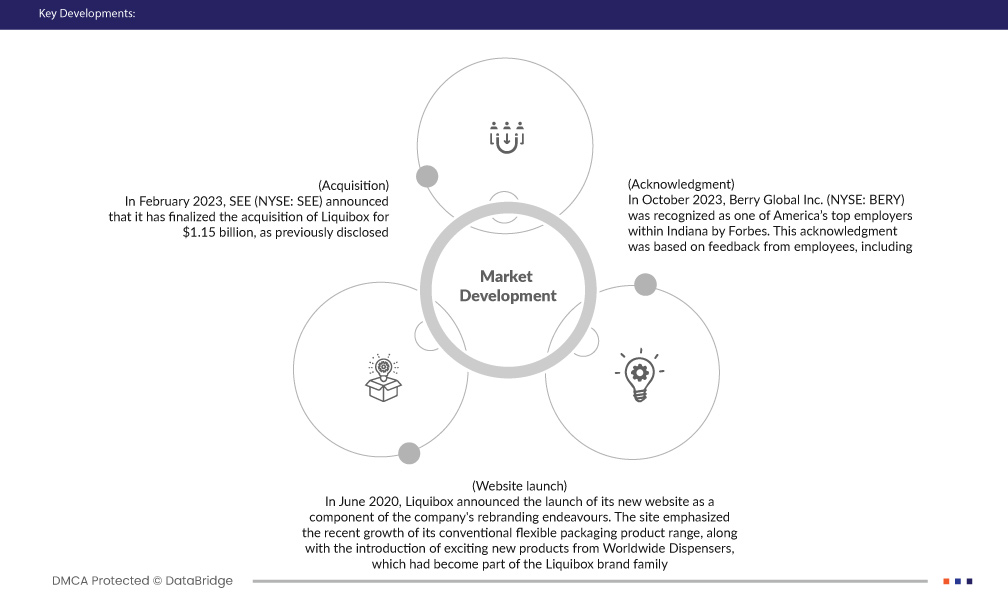

تطوير السوق

- في مارس 2024، حازت شركة أمكور بي إل سي، الرائدة عالميًا في تطوير وإنتاج حلول التغليف المسؤولة، على ثماني جوائز إنجاز في مجال التغليف المرن لمساهماتها المبتكرة والمستدامة في هذا المجال. ومن بين جميع الجوائز، حازت بطانات ماكوي دوناج فري آي بي سي للمنتجات المعقمة السائبة على ثلاث جوائز: الذهبية للاستدامة، والفضية لتوسيع نطاق استخدام التغليف المرن، والابتكار التقني. وهذا من شأنه أن يعزز سعي الشركة نحو تحقيق أهدافها في الاستدامة وتقديم حلول أكثر ابتكارًا.

- في فبراير 2023، أعلنت شركة SEE (المدرجة في بورصة نيويورك بالرمز SEE) أنها استحوذت على شركة Liquibox مقابل 1.15 مليار دولار أمريكي، كما أُعلن سابقًا. أُنجزت هذه الصفقة نقدًا وبدون ديون. سيعزز هذا قاعدة عملاء الشركة ونطاق وصولها في السوق.

- في أكتوبر 2023، حازت شركة بيري جلوبال (المدرجة في بورصة نيويورك بالرمز BERY) على لقب أفضل جهة توظيف في ولاية إنديانا الأمريكية من قِبل مجلة فوربس. وقد استند هذا التكريم إلى آراء الموظفين، بما في ذلك مساهماتهم وتوصياتهم المباشرة. وقد ساهم ذلك في بناء الثقة بين صاحب العمل والموظف، وكان له أثر إيجابي على عملائها.

- في يونيو 2020، أعلنت شركة Liquibox عن إطلاق موقعها الإلكتروني الجديد كجزء من جهودها لإعادة صياغة علامتها التجارية. سلّط الموقع الضوء على النمو الأخير في مجموعة منتجاتها من مواد التغليف المرنة التقليدية، بالإضافة إلى طرح منتجات جديدة ومميزة من Worldwide Dispensers، التي أصبحت جزءًا من عائلة Liquibox التجارية. وقد يسهّل هذا الموقع على العملاء الوصول إليه ويحسّن تجربة تصفحهم، مما يجعله تحديثًا سهل الاستخدام.

التحليل الإقليمي

على أساس الجغرافيا، يتم تقسيم السوق إلى الولايات المتحدة وكندا والمكسيك وألمانيا وفرنسا وإيطاليا وإسبانيا وهولندا وبلجيكا وبولندا والسويد والنمسا وجمهورية التشيك والدنمارك وفنلندا والبرتغال واليونان وأيرلندا ورومانيا والمجر وسلوفاكيا وبلغاريا وكرواتيا وليتوانيا ولوكسمبورغ وقبرص وإستونيا ولاتفيا ومالطا وسلوفينيا وبقية دول الاتحاد الأوروبي والصين والهند وبقية دول آسيا والمحيط الهادئ والبرازيل والأرجنتين وبقية دول أمريكا الجنوبية وجنوب إفريقيا ومصر ونيجيريا وكينيا وإثيوبيا وتنزانيا وزامبيا وزيمبابوي والجزائر وتونس وموريتانيا وبقية دول إفريقيا والمملكة العربية السعودية والإمارات العربية المتحدة وقطر والكويت وعمان والبحرين وتركيا وإسرائيل والأردن ولبنان وبقية دول بلاد الشام.

وفقًا لتحليل Data Bridge Market Research :

من المتوقع أن تهيمن منطقة آسيا والمحيط الهادئ على السوق العالمية لخطوط حاويات البضائع السائبة المتوسطة (IBC) وأن تكون أسرع المناطق نموًا

من المتوقع أن تهيمن منطقة آسيا والمحيط الهادئ على السوق باعتبارها أسرع المناطق نمواً بسبب توسع أعمال الأغذية والمشروبات، والقلق المتزايد بشأن سلامة المنتجات والتلوث، والقطاع الكيميائي المزدهر.

للحصول على معلومات أكثر تفصيلاً حول تقرير سوق حاويات البضائع السائبة المتوسطة (IBC) العالمي ، انقر هنا - https://www.databridgemarketresearch.com/reports/global-ibc-intermediate-bulk-container-liners-market