El auge de los pagos digitales, tanto simples como complejos, ha impulsado el crecimiento de la industria. La tokenización se está utilizando ampliamente en numerosas industrias debido a la creciente demanda de una mejor experiencia del cliente. Permite a las industrias mejorar sus operaciones y productividad. La tokenización ayuda a los usuarios finales a tomar mejores decisiones relacionadas con los métodos de pago, la gestión de activos, la protección de datos de los clientes, entre otros aspectos. La industria está ganando mucha popularidad en países emergentes como India y Brasil.

Acceda al informe completo en https://www.databridgemarketresearch.com/reports/global-tokenization-market

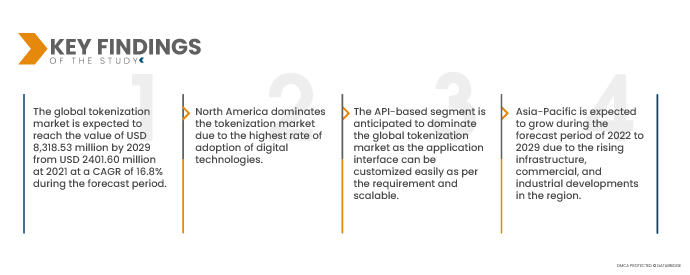

Data Bridge Market Research analiza que se espera que el mercado global de tokenización alcance los 8.318,53 millones de dólares para 2029, desde los 2.401,60 millones de dólares de 2021, con una tasa de crecimiento anual compuesta (TCAC) del 16,8 % durante el período de pronóstico. La creciente demanda de tokenización generará oportunidades potenciales de crecimiento del mercado durante el período de pronóstico.

Se prevé que la creciente demanda de experiencia del cliente impulse la tasa de crecimiento del mercado.

Varios actores del mercado que implementan con éxito una estrategia de experiencia del cliente tienen más probabilidades de lograr mayores índices de satisfacción del cliente y, por lo tanto, de mejorar el crecimiento de los ingresos. La mejora de la experiencia del cliente incluye numerosas estrategias, como capacitar a los empleados para ofrecer un mejor servicio, el mapeo del recorrido del cliente, las ideas de valor, la recopilación de comentarios de los clientes, entre otras.

Por ejemplo,

- En 2022, SuperOffice AS informó que la experiencia del cliente será una prioridad absoluta para las empresas durante los próximos cinco años, lo que contribuye a aumentar sus ganancias más que otros dos factores, a saber, el precio y el producto. Además, según un estudio de American Express, alrededor del 86 % de los clientes están dispuestos a pagar más por una mejor experiencia.

Alcance del informe y segmentación del mercado

Métrica del informe

|

Detalles

|

Período de pronóstico

|

2022 a 2029

|

Año base

|

2021

|

Años históricos

|

2020 (personalizable para 2014-2019)

|

Unidades cuantitativas

|

Ingresos en millones de USD, volúmenes en unidades, precios en USD

|

Segmentos cubiertos

|

Oferta (Soluciones y Servicios), Tamaño de la Organización (Grandes Organizaciones y PYMES), Implementación (Nube y Local), Técnica (Basada en API y en Puerta de Enlace), Tecnología (Internet de las Cosas [IoT], Aprendizaje Automático e Inteligencia Artificial, Computación en la Nube, Procesamiento del Lenguaje Natural [PLN], Cadena de Bloques y Otros), Aplicación (Seguridad en los Pagos, Autenticación de Usuarios, Gestión del Cumplimiento, Procesamiento de Datos, Cifrado y Otros), Usuario Final (Banca, Servicios Financieros y Seguros, TI y Telecomunicaciones, Gobierno y Sector Público, Medios y Entretenimiento, Comercio Minorista y Comercio Electrónico, Manufactura, Energía y Servicios Públicos, Automoción, Aeroespacial y Defensa, y Otros).

|

Países cubiertos

|

EE. UU., Canadá y México en América del Norte, Alemania, Francia, Reino Unido, Países Bajos, Suiza, Bélgica, Rusia, Italia, España, Turquía, Resto de Europa en Europa, China, Japón, India, Corea del Sur, Singapur, Malasia, Australia, Tailandia, Indonesia, Filipinas, Resto de Asia-Pacífico (APAC) en Asia-Pacífico (APAC), Arabia Saudita, Emiratos Árabes Unidos, Sudáfrica, Egipto, Israel, Resto de Medio Oriente y África (MEA) como parte de Medio Oriente y África (MEA), Brasil, Argentina y Resto de Sudamérica como parte de Sudamérica

|

Actores del mercado cubiertos

|

Fiserv, Inc. (EE. UU.), Thales Group (Francia), Hewlett Packard Enterprise Development LP (India), Broadcom (EE. UU.), Open Text Corporation (Canadá), Mastercard (EE. UU.), Micro Focus (Reino Unido), Visa (EE. UU.), American Express (EE. UU.), Entrust Corporation (EE. UU.), VeriFone, Inc. (EE. UU.), PaymentVision (EE. UU.), Quantoz NV (Países Bajos), Paya, Inc. (EE. UU.), AsiaPay Limited (Hong Kong), Bluefin Payment Systems (Irlanda).

|

Puntos de datos cubiertos en el informe

|

Además de los conocimientos del mercado, como el valor del mercado, la tasa de crecimiento, los segmentos del mercado, la cobertura geográfica, los actores del mercado y el escenario del mercado, el informe de mercado elaborado por el equipo de investigación de mercado de Data Bridge incluye un análisis experto en profundidad, análisis de importación/exportación, análisis de precios, análisis de consumo de producción y análisis pestle.

|

Análisis de segmentos:

El mercado global de tokenización está segmentado en siete segmentos notables según la oferta, la implementación, la tecnología, la técnica, el tamaño de la organización, la aplicación y el usuario final.

- Sobre la base de la oferta, el mercado global de tokenización se segmenta en soluciones y servicios.

Se prevé que el segmento de soluciones de tipo oferta domine el mercado de tokenización.

Se espera que el segmento de soluciones domine el mercado global de tokenización con una participación de mercado del 71,7%, ya que proporciona una interfaz de tokenización completa en comparación con el servicio.

- Según el tamaño de la organización, el mercado global de tokenización está segmentado en PYMES y grandes organizaciones.

Se prevé que el segmento de organizaciones de gran tamaño domine el mercado de tokenización.

Se espera que el segmento de grandes organizaciones domine el mercado global de tokenización con una participación de mercado del 63,8%, ya que tiene numerosas operaciones comerciales que pueden integrarse parcialmente a través de la tokenización.

- Según la implementación, el mercado global de tokenización se segmenta en local y en la nube. Se prevé que el segmento de la nube domine el mercado global de tokenización con una cuota de mercado del 73,4 %, ya que se puede acceder fácilmente a los datos a través de la conexión a internet.

- En términos de tecnología, el mercado global de tokenización se segmenta en computación en la nube, Internet de las Cosas (IdC), blockchain, aprendizaje automático e inteligencia artificial, procesamiento del lenguaje natural (PLN), entre otros. Se prevé que el segmento de computación en la nube domine el mercado global de tokenización con una cuota de mercado del 25,6 %, ya que ofrece soluciones de máxima seguridad y cumplimiento normativo para datos sensibles.

- Técnicamente, el mercado global de tokenización se segmenta en basado en API y basado en pasarela. Se prevé que el segmento basado en API domine el mercado global de tokenización con una cuota de mercado del 61,7 %, ya que la interfaz de la aplicación se puede personalizar fácilmente según las necesidades y es escalable.

- Según su aplicación, el mercado global de tokenización se segmenta en seguridad de pagos, autenticación de usuarios, gestión de cumplimiento, procesamiento de datos, cifrado, entre otros. Se prevé que el segmento de seguridad de pagos domine el mercado global de tokenización con una cuota de mercado del 37,0 %, ya que ofrece diversas oportunidades para proteger los datos financieros y adoptar un modelo basado en suscripción.

- En función del usuario final, el mercado global de tokenización se segmenta en banca, servicios financieros y seguros (BSFI), TI y telecomunicaciones, medios de comunicación y entretenimiento, comercio minorista y comercio electrónico, automoción, salud y ciencias de la vida, manufactura, energía y servicios públicos, aeroespacial y defensa, gobierno y sector público, entre otros. Se espera que el segmento de banca, servicios financieros y seguros (BSFI) domine el mercado global de tokenización con una participación de mercado del 25,5 %, ya que la implantación de la tecnología blockchain y la fraccionación de activos están generando nuevas oportunidades.

Actores principales

Data Bridge Market Research reconoce a las siguientes empresas como los principales actores del mercado de tokenización: Fiserv, Inc. (EE. UU.), Thales Group (Francia), Hewlett Packard Enterprise Development LP (India), Broadcom (EE. UU.), Open Text Corporation (Canadá), Mastercard. (EE. UU.), Micro Focus (Reino Unido), Visa (EE. UU.), American Express (EE. UU.), Entrust Corporation (EE. UU.), VeriFone, Inc (EE. UU.), PaymentVision (EE. UU.), Quantoz NV (Países Bajos), Paya, Inc. (EE. UU.), AsiaPay Limited (Hong Kong), Bluefin Payment Systems (Irlanda).

Desarrollo del mercado

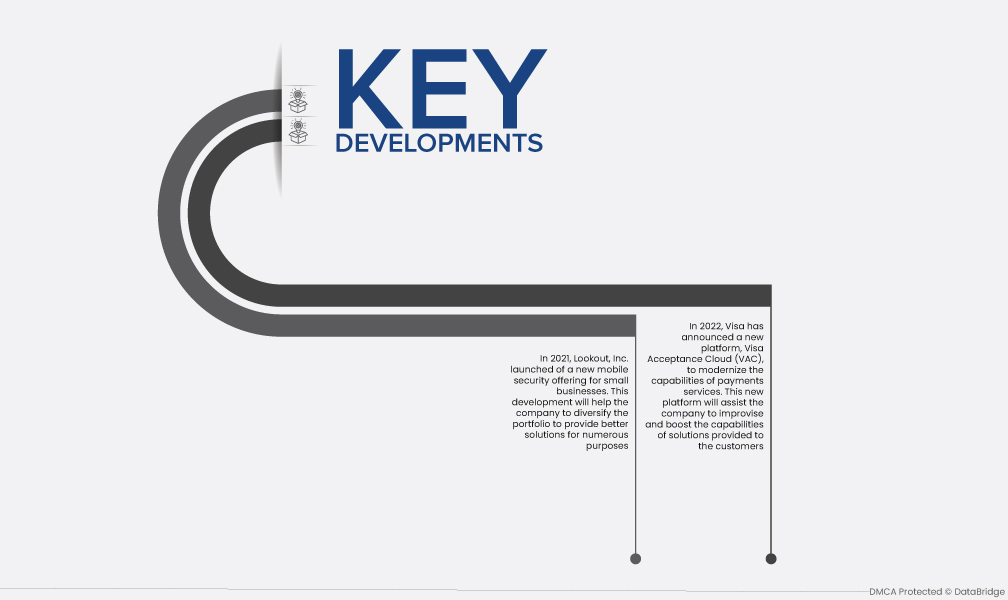

- En 2021, Lookout, Inc. lanzó una nueva oferta de seguridad móvil para pequeñas empresas. Este desarrollo permitirá a la compañía diversificar su portafolio y ofrecer mejores soluciones para diversos propósitos, lo que podría ser una solución integral para los clientes y, por lo tanto, atraer nuevos clientes.

- En 2022, Visa anunció una nueva plataforma, Visa Acceptance Cloud (VAC), para modernizar las capacidades de sus servicios de pago. Esta nueva plataforma ayudará a la compañía a optimizar y potenciar las soluciones que ofrece a sus clientes, lo que puede mejorar su relación con la empresa.

Análisis regional

Geográficamente, los países cubiertos en el informe del mercado de tokenización son EE. UU., Canadá y México en América del Norte, Alemania, Francia, Reino Unido, Países Bajos, Suiza, Bélgica, Rusia, Italia, España, Turquía, Resto de Europa en Europa, China, Japón, India, Corea del Sur, Singapur, Malasia, Australia, Tailandia, Indonesia, Filipinas, Resto de Asia-Pacífico (APAC) en Asia-Pacífico (APAC), Arabia Saudita, Emiratos Árabes Unidos, Sudáfrica, Egipto, Israel, Resto de Medio Oriente y África (MEA) como parte de Medio Oriente y África (MEA), Brasil, Argentina y Resto de América del Sur como parte de América del Sur.

Según el análisis de investigación de mercado de Data Bridge:

América del Norte es la región dominante en el mercado de tokenización durante el período de pronóstico de 2022 a 2029

Norteamérica domina el mercado de tokenización gracias a la mayor tasa de adopción de tecnologías digitales. La mayoría de los ciudadanos estadounidenses utilizan algún método de pago en línea para sus transacciones. Además, las tendencias del mercado norteamericano, como la compra inmediata y el pago posterior en criptomonedas, impulsan el mercado regional.

Se estima que Asia-Pacífico será la región de más rápido crecimiento en el mercado de tokenización durante el período de pronóstico de 2022 a 2029.

Se prevé que Asia-Pacífico crezca durante el período de pronóstico de 2022 a 2029 debido a la fuerte penetración de la innovación y la digitalización de datos en esta región, lo que ha dado lugar a la normalización de la tecnología de tokenización. La región también cuenta con inversión extranjera en las industrias de datos y tecnología, lo que impulsa el crecimiento del sector.

Para obtener información más detallada sobre el informe del mercado de tokenización, haga clic aquí: https://www.databridgemarketresearch.com/reports/global-tokenization-market