The wax emulsion is a stable mixture comprising tiny wax particles dispersed evenly in water with the aid of emulsifiers. This formulation grants wax emulsions various advantageous properties, making them versatile additives across multiple industries. Coatings and paints are effective additives, providing benefits such as improved scratch resistance, water repellency, and matting effects. The paper and packaging sector utilizes wax emulsions to enhance paper products' surface gloss, printability, and moisture resistance.

In addition, in construction, they find use as water repellents, curing agents, and additives in mortar and concrete formulations, improving durability and performance. Textile industries employ wax emulsions to impart softness and water repellency to fabrics. Moreover, wax emulsions are integral in cosmetics, facilitating the formulation of creams, lotions, and other personal care products. With their diverse applications and functional benefits, wax emulsions play a crucial role in enhancing the properties and performance of various materials across industries.

Access full Report @ https://www.databridgemarketresearch.com/reports/global-wax-emulsion-market

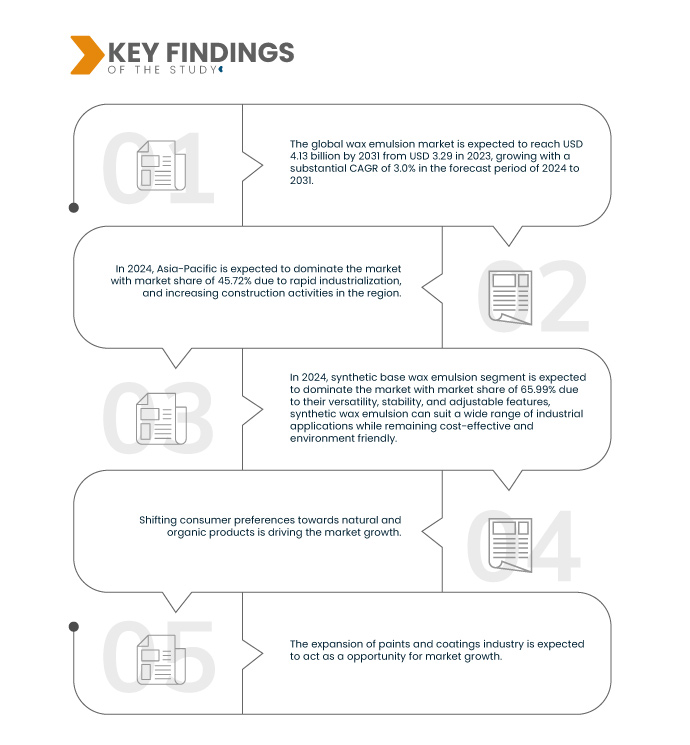

Data Bridge Market Research analyzes that the Global Wax Emulsion Market is expected to reach USD 4.13 billion by 2031 from USD 3.29 billion 2023, growing with CAGR of 3.0% in forecast period 2024 to 2031.

Key Findings of the Study

Surge in Demand for Wax Emulsion across Diverse Industries

Wax emulsions are widely used in the paint & coatings, adhesives, textile, paper, and construction sectors. Their versatility enables them to serve various applications in these industries, including water repellent, lubrication, surface protection, binding, and rheology modification. As urbanization and infrastructure development accelerate, coupled with rising consumer demand, the expanding sectors drive an increased need for wax emulsions to fulfill diverse functional requirements.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2024 to 2031

|

|

Base Year

|

2023

|

|

Historic Years

|

2022 (Customizable to 2016 - 2021)

|

|

Quantitative Units

|

Revenue in USD Billion

|

|

Segments Covered

|

Material Base (Synthetic Base Wax Emulsion and Natural Base Wax Emulsion), Emulsifier (Non-Ionic Surfactants, Anionic-Surfactants, and Cationic Surfactants), End User Industry (Paints and Coatings, Textiles, Cosmetics, Adhesives and Sealants, Construction and Woodworking, Food Industry, and Others)

|

|

Countries Covered

|

U.S., Canada, Mexico, Germany, France, Italy, U.K., Netherlands, Belgium, Spain, Switzerland, Russia, Turkey, Rest of Europe, China, Japan, South Korea, India, Australia, Singapore, Thailand, Malaysia, Indonesia, Philippines, Rest of Asia-Pacific, Brazil, Argentina, Rest of South America, Saudi Arabia, South Africa, U.A.E., Kuwait, Oman, and Rest of Middle East and Africa

|

|

Market Players Covered

|

H&R GROUP (Germany), PMC Group, Inc. (U.K.), Repsol (Spain), Michelman, Inc. (U.S.), King Honor International Ltd. (China), Govi (Belgium), Pacific Texchem Private Limited (India), Henry Company (U.S.), Micro Powders, Inc. (U.S.), CHT Germany GmbH (Germany), MEGH (Brazil), Nanjing Tianshi New Material Technologies Co., Ltd (China), Paraffinwaxco, Inc. (Subsidiary of RAHA Group) (Iran), BASF SE (Germany), NIPPON SEIRO CO.,LTD. (Japan), The Lubrizol Corporation (U.S.), Hexion (U.S.), ALTANA (Germany), Sasol Limited (South Africa), SHAMROCK (U.S.), Wacker Chemie AG (Germany), Walker Industries (Canada), and Paramelt RMC B.V. (Netherlands) among Others

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

|

Segment Analysis

The global wax emulsion market is segmented into three notable segments based on material base, emulsifier, and end user industry.

- On the basis of material base, the market is segmented into synthetic base wax emulsion and natural base wax emulsion

In 2024, the synthetic base wax emulsion segment is expected to dominate the Global Wax Emulsion Market

In 2024, the synthetic base wax emulsion segment is expected to dominate the market with a market share of 65.99% due to its versatility, stability, and adjustable features.

- On the basis of emulsifier, the market is segmented into non-ionic surfactants, Anionic-Surfactants, and Cationic Surfactants

In 2024, the non-ionic surfactants segment is expected to dominate the Global Wax Emulsion Market

In 2024, the non-ionic surfactants segment is expected to dominate the market with a 61.61% market share due to their excellent compatibility with various materials, low foam formation, and effective emulsification without affecting surface charge or pH.

- On the basis of end user industry, the market is segmented into paints and coatings, textiles, cosmetics, adhesives and sealants, construction and woodworking, food industry, and others. In 2024, the paints and coatings segment is expected to dominate the market with a 31.02% market share

Major Players

Data Bridge Market Research analyzes BASF SE (Germany), Sasol Limited (South Africa), Hexion (U.S.), Michelman, Inc. (U.S.), and Repsol (Spain) as major market players in this market.

Market Developments

- In June 2023, Michelman, Inc. achieved the prestigious distinction of being the inaugural recipient of the Innovation Research Interchange (IRI) Excellence Award for Corporate Citizenship. This recognizes Michelman's dedication to sustainability within its operations and its influential role in promoting sustainable practices across diverse sectors such as digital printing, packaging, composites, technical textiles, agriculture, and architectural coatings. The presentation of the IRI Excellence Award took place on May 24, 2023, during the IRI Awards Dinner held in Philadelphia. The award acknowledged Michelman's commitment to sustainability, contributing to a positive image and enhanced reputation. This recognition may attract environmentally conscious customers, partners, and investors

- In April 2022, WACKER introduced its "Solids & Concentrates" line to address the emerging trend in the cosmetics industry towards solid or concentrated hair and personal care products. Demonstrated formulations at their booth highlighted the significant role of silicones, particularly BELSIL DADM 3240 E, in enhancing the properties of these concentrated or solid, water-free products. In these formulations, WACKER's silicone emulsion is an active ingredient in haircare products. The oil phase of these products contains two types of silicones: amodimethicone crosspolymer and dimethicone. A loose network is formed through the emulsion, enveloping the hair fibers to nourish them and offer long-lasting protection. This formulation by the company was a step towards creating new hair care products. It will help to improve the product revenue for the company

- In April 2022, Shamrock announced the expansion of an array of sustainable bio-based wax additives. These specialty performance additives reflect the company's dedication to recycling and promoting the circular economy with sustainable, environmentally friendly products

- In November 2021, H&R Group announced it would invest MYR 200 million (USD 48 million) in a specialty manufacturing plant in Lumut, Perak. H&R is the leading global sustainable refiner and marketer of specialty plasticizers, extender oils, softeners, and waxes. The project will tentatively be carried out in three phases, with a designed capacity of 150,000 tons per annum. Phase I and Phase II will be dedicated to producing specialty plasticizers, white oils, and wax emulsions from mineral, synthetic, and renewable resources. This will strengthen the company’s presence in the country

- In February 2021, GOVI was certified as a Roundtable on Sustainable Palm Oil (RSPO) Mass Balance (MB) member. This certification marks a significant development for the company, showcasing its commitment to sustainable palm oil practices. As an RSPO MB member, GOVI ensures transparent and responsible sourcing, aligning with industry sustainability standards and enhancing its market credibility

Regional Analysis

Geographically, the regions covered in the global wax emulsion market report are U.S., Canada, Mexico, Germany, France, Italy, U.K., Netherlands, Belgium, Spain, Switzerland, Russia, Turkey, rest of Europe, China, Japan, South Korea, India, Australia, Singapore, Thailand, Malaysia, Indonesia, Philippines, rest of Asia-Pacific, Brazil, Argentina, rest of South America, Saudi Arabia, South Africa, U.A.E., Kuwait, Oman, and rest of Middle East and Africa.

As per Data Bridge Market Research analysis:

Asia-Pacific is expected to be the dominant and fastest growing region in Global Wax Emulsion Market

Asia-pacific is expected to dominate and fastest growing region in market due to rapid industrialization and increasing construction activities in the region.

For more detailed information about the Global Wax Emulsion Market report, click here – https://www.databridgemarketresearch.com/reports/global-wax-emulsion-market