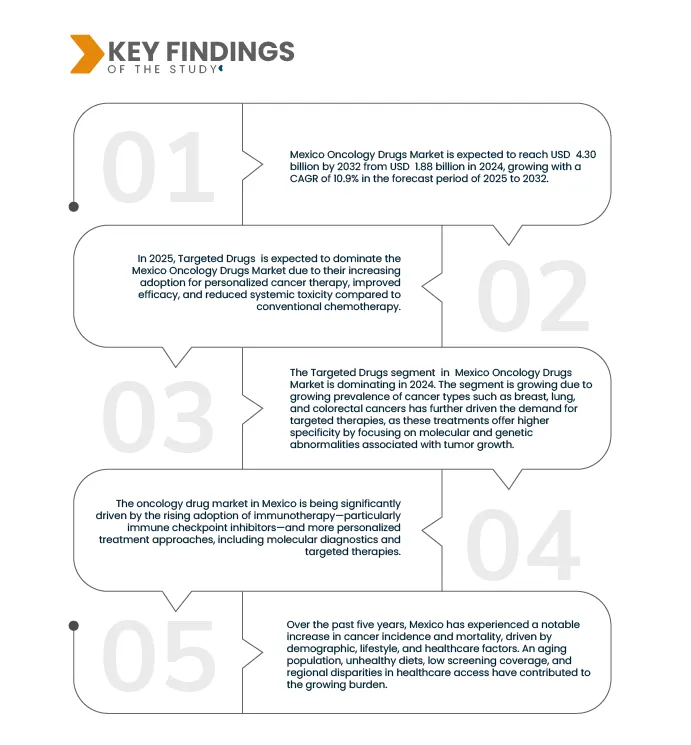

The oncology drug market in Mexico is being significantly driven by the rising adoption of immunotherapy—particularly immune checkpoint inhibitors—and more personalized treatment approaches, including molecular diagnostics and targeted therapies. However, access and implementation remain uneven across public and private healthcare sectors. For instance, In June 2022, A 2022 study of 130 adult patients receiving immunotherapy over five years reported that nivolumab was the most frequently used agent (63.1%), followed by pembrolizumab (12.3%), as well as combinations such as nivolumab plus ipilimumab and durvalumab. The median overall survival (OS) across patients was ~13 months, with pembrolizumab demonstrating superior outcomes (OS ~22 months) and improved progression-free survival (PFS), highlighting the clinical benefit of targeted immunotherapies in the Mexican population. In August 2024, A 2024 study of 188 stage IV NSCLC patients across public and private centers indicated that while chemotherapy remains the most common treatment, the uptake of immunotherapy is growing. In public hospitals, first-line immunotherapy use was ~5%, rising to ~43% in the second line, and approaching near-universal access in third-line treatment at some centers. This illustrates a clear trend of immunotherapy being increasingly integrated as patients progress through treatment lines.

The Mexican oncology landscape is experiencing a shift from traditional chemotherapy to personalized, immunotherapy-driven regimens, with clinical evidence supporting improved survival outcomes. While the private sector is leading in adoption of innovative therapies, public sector uptake remains limited, reflecting disparities in healthcare access. Expanding equitable access to immunotherapies and targeted treatments represents both a clinical opportunity and a market growth driver.

Access Full Report @ https://www.databridgemarketresearch.com/reports/mexico-oncology-drugs-market

Data Bridge market research analyzes that Mexico Oncology Drugs Market is expected to reach USD 4.30 billion by 2032 from USD 1.88 billion in 2024, growing with a substantial CAGR of 10.9% in the forecast period of 2025 to 2032.

Key Findings of the Study

Increasing Research and Development Activities

Mexico is swiftly positioning itself as one of the strategic hubs for oncology drug research, testing, and innovation in Latin America. The increasing incidence of cancer and the availability of robust clinical infrastructure have made the country a preferred site for multinational pharmaceutical companies conducting both early and late phase trials. The government’s enhanced regulatory transparency and efforts to align domestic standards with global frameworks—particularly those of the FDA and EMA—have contributed to improved investor confidence in Mexico’s research ecosystem.

The R&D landscape is currently characterized by strong collaborations between the public sector, private pharmaceutical manufacturers, and international research organizations. Mexico’s premier cancer research institutions—such as the National Institute of Cancerology (INCan), the National Autonomous University of Mexico (UNAM), and various regional biomedical centers—are now integral to multi country research networks studying novel combinations of immunotherapy, DNA repair inhibitors, and precision oncology drugs designed for specific tumor profiles.

For instance:

- In September 2024, AstraZeneca’s US $80 million investment in its Latin America Oncology Research and Innovation Center in Mexico City has enabled simultaneous early phase trial management and biomarker discovery in collaboration with local institutions.

- In May 2025, Roche Mexico’s oncology research unit is conducting multi center trials in HER2 positive and triple negative breast cancer, integrating genomic profiling to guide precision therapy protocols.

- In December 2024, Amgen, Bayer, and Novartis have expanded R&D partnerships with regional universities to explore nanocarrier based oncology drug delivery systems, improving therapeutic specificity and patient tolerance.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2025 to 2032

|

|

Base Year

|

2024

|

|

Historic Years

|

2023 (Customizable to 2018-2022)

|

|

Quantitative Units

|

Revenue in USD billion

|

|

Segments Covered

|

Drug Class (Cytotoxic drugs, Targeted Drugs, Immunotherapy, Hormonal Drugs), Drugs Type (Branded, and Generics), Type (Breast Cancer, Prostate Cancer, Colorectal Cancer, Endometrial Cancer, Kidney Cancer, Liver Cancer, Pancreatic Cancer, Thyroid Cancer, Lung cancer, Blood Cancer, Gastric Cancer, and Others), Route of Administration (Oral, Parenteral), Population Type (Children, Adults, Geriatric), Gender (Male, Female), End User (Hospitals, Specialty Clinics, Ambulatory Surgical Centers (ASCS), Home Healthcare, and Others), Distribution Channel (Direct Tender, Retail Sales and Others)

|

|

Countries Covered

|

|

|

Market Players Covered

|

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include epidemiology, industry insights, marketed drug analysis, mergers and acquisition, patent analysis, pipeline analysis, PESTLE analysis, Porter’s five force model, regulatory standards.

|

Segment Analysis

The Mexico Oncology Drugs Market is segmented into nine notable segments which are based on Drug Class, Drugs Type, Type, Route of Administration, Population Type, Gender, End User, Distribution Channel.

- On the basis of Drug Class, the market is segmented into Cytotoxic drugs, Targeted Drugs, Immunotherapy, and Hormonal Drugs.

In 2025, the Targeted Drugs segment is expected to dominate the market

In 2025, the Targeted Drugs segment is expected to dominate the market with a market share of 42.42% due to the increasing adoption of precision medicine, rising demand for therapies with higher efficacy and lower toxicity, and rapid growth in monoclonal antibodies and tyrosine kinase inhibitors. These therapies are increasingly preferred over conventional cytotoxic drugs, particularly for breast, lung, and hematologic cancers, driving strong market growth.

- On the basis of Drugs Type, the market is segmented into Branded, and Generics.

In 2025, the Branded segment is expected to dominate the market

In 2025, the Branded segment is expected to dominate the market with a market share of 76.12% due to higher adoption of innovative and patented oncology therapies, strong physician preference for clinically proven drugs, extensive marketing and promotional activities by pharmaceutical companies, and greater patient trust in established brands. Additionally, branded drugs often offer advanced formulations, better efficacy, and improved safety profiles compared to generics, which further drives their market share in Mexico’s oncology therapeutics landscape.

- On the basis of Type, the market is segmented into Breast Cancer, Prostate Cancer, Colorectal Cancer, Endometrial Cancer, Kidney Cancer, Liver Cancer, Pancreatic Cancer, Thyroid Cancer, Lung cancer, Blood Cancer, Gastric Cancer, and Others.

In 2025, the Lung Cancer segment is expected to dominate the market

In 2025, the Lung Cancer segment is expected to dominate the market with a market share of 28.34% due to high prevalence of lung cancer in the population, increasing adoption of targeted therapies and immunotherapies for advanced stages, rising awareness about early diagnosis and treatment, and significant investment in lung cancer research and drug development. The growing use of precision medicine and combination therapy approaches for lung cancer further drives the demand for effective oncology drugs in this segment.

- On the basis of Route of Administration, the market is segmented into Oral, Parenteral

In 2025, the Parenteral segment is expected to dominate the market

In 2025, the Parenteral segment is expected to dominate the market with a market share of 65.55% due to the high utilization of injectable formulations in oncology treatments, particularly for biologics, monoclonal antibodies, and cytotoxic chemotherapies that require precise dosing and rapid systemic action. Parenteral administration ensures better bioavailability and immediate therapeutic response, which is critical for advanced-stage cancers and hospital-based treatments. Moreover, the increasing availability of intravenous infusion therapies and advancements in injectable drug delivery systems further support the dominance of the parenteral segment in Mexico’s oncology drugs market.

- On the basis of Population Type, the market is segmented into Children, Adults, Geriatric

In 2025, the Geriatric segment is expected to dominate the market

In 2025, the Geriatric segment is expected to dominate the market with a market share of 62.86% due to the rising incidence of age-related cancers such as lung, prostate, colorectal, and breast cancer among older adults. The growing elderly population in Mexico, coupled with longer life expectancy and increased access to cancer diagnostics and treatments, is driving higher demand for oncology drugs within this age group.

- On the basis of Gender, the market is segmented into Male, Female

In 2025, the Male segment is expected to dominate the market

In 2025, the Male segment is expected to dominate the market with a market share of 52.51% due to the higher prevalence of certain cancers such as prostate, lung, liver, and colorectal cancers among men in Mexico. Lifestyle factors such as higher tobacco and alcohol consumption, occupational exposures, and lower participation in preventive health screenings further contribute to increased cancer incidence in males, driving greater demand for oncology drugs within this segment.

- On the basis of end user, the market is segmented into Hospitals, Specialty Clinics, Ambulatory Surgical Centers (ASCS), Home Healthcare, and Others.

In 2025, the hospitals segment is expected to dominate the market

In 2025, the hospitals cancer segment is expected to dominate the market with a market share of 57.62% due to the high volume of cancer diagnoses and treatments conducted in hospital settings, availability of advanced infrastructure for chemotherapy and biologic drug administration, and presence of multidisciplinary oncology teams. Additionally, hospitals serve as primary centers for clinical trials, specialized cancer care, and government-funded treatment programs, further reinforcing their leading position in Mexico’s oncology drugs market.

- On the basis of distribution channel, the market is segmented into Direct Tender, Retail Sales and Others.

In 2025, the Direct Tender segment is expected to dominate the market

In 2025, the Direct Tender segment is expected to dominate the market with a market share of 51.56% due to large-scale government procurement by public healthcare institutions such as IMSS and ISSSTE. Centralized purchasing ensures cost efficiency, wider access to oncology treatments, and stable drug supply across public hospitals, strengthening the segment’s market share in Mexico.

Major Players

AstraZeneca (U.K.), Pfizer Inc. (U.S.), Bristol-Myers Squibb Company (U.S.), Novartis AG (Switzerland), F. Hoffmann-La Roche Ltd. (Switzerland), Merck & Co., Inc. (U.S.) among others.

Latest Developments in Mexico Oncology Drugs Market

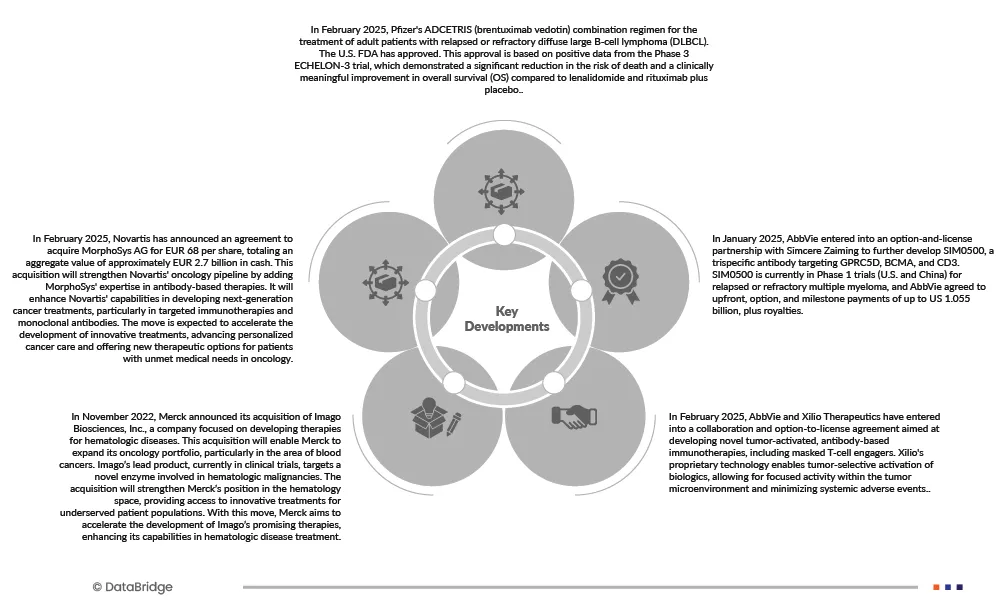

- In September 2025, Amgen announced a significant USD 650 million expansion of its US manufacturing operations. This strategic investment is focused on increasing production capacity for both existing medicines and new innovative therapies. A key outcome of this expansion is the creation of hundreds of new jobs, reinforcing the company's commitment to its domestic manufacturing footprint and the broader US economy.

- In July 2024, AbbVie submitted an sNDA to the U.S. FDA for a fixed-duration combination of VENCLEXTA® (venetoclax) and acalabrutinib to treat previously untreated chronic lymphocytic leukemia (CLL). The submission is based on positive Phase 3 AMPLIFY trial results showing significant progression-free survival benefits.

- In November 2024, Merck announced its acquisition of Imago Biosciences, Inc., a company focused on developing therapies for hematologic diseases. This acquisition will enable Merck to expand its oncology portfolio, particularly in the area of blood cancers. Imago’s lead product, currently in clinical trials, targets a novel enzyme involved in hematologic malignancies. The acquisition will strengthen Merck’s position in the hematology space, providing access to innovative treatments for underserved patient populations. With this move, Merck aims to accelerate the development of Imago’s promising therapies, enhancing its capabilities in hematologic disease treatment.

- In November 2024, Roche entered into an agreement to acquire Poseida Therapeutics for approximately USD 1 billion. This acquisition enhances Roche's capabilities in allogeneic cell therapies, particularly for oncology, immunology, and neurology. It aims to accelerate the development of off-the-shelf CAR-T therapies, benefiting patients by increasing treatment access and improving clinical outcomes. The transaction is expected to close in the first quarter of 2025.

As per Data Bridge Market Research analysis:

Geographically, the countries covered in the Mexico Oncology Drugs Market report are Mexico.

For more detailed information about the Mexico Oncology Drugs Market report, click here – https://www.databridgemarketresearch.com/reports/mexico-oncology-drugs-market