The establishment of a well-structured elderly care system addresses the crucial needs of the aging population and yields positive economic impacts. It generates employment opportunities within the healthcare sector, bolsters job creation, and fosters a skilled workforce. Furthermore, the demand for medical and assistive devices increases, stimulating market growth and innovation. This, in turn, contributes to the stability and sustainability of the healthcare industry.

Access full Report @ https://www.databridgemarketresearch.com/reports/nepal-elderly-care-market

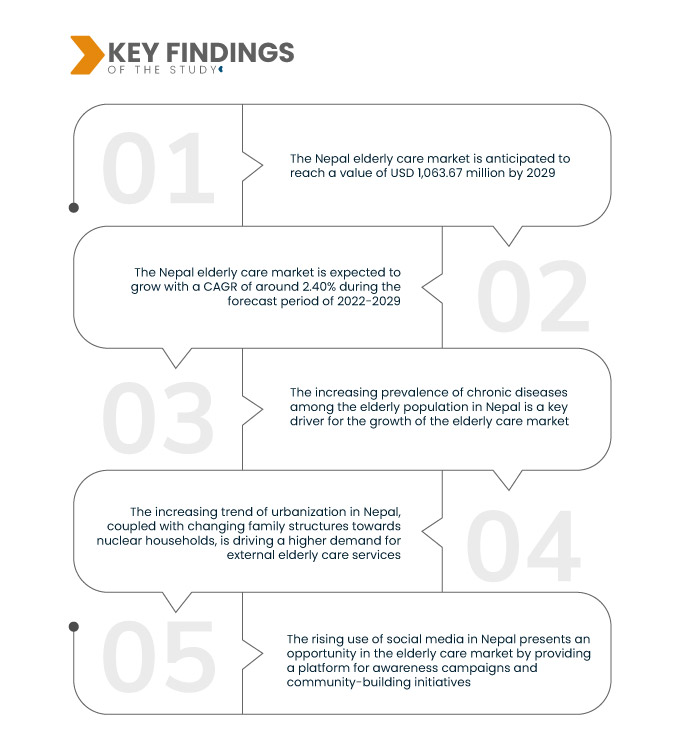

Data Bridge Market Research analyses the Nepal Elderly Care Market, which was USD 879.85 million in 2021, is expected to reach up to USD 1,063.67 million by 2029 and is expected to undergo a CAGR of 2.40% during the forecast period of 2022-2029. The Nepal elderly care market is driven by demographic shifts marked by a growing aging population. As the number of elderly individuals increases, there is a corresponding rise in demand for elderly care services, reflecting a critical driver for the expansion and development of the elderly care market in Nepal.

Key Findings of the Study

Increasing government initiatives is expected to drive the market's growth rate

In the Nepal elderly care market, government initiatives are a pivotal driving force. Policies, regulations, and financial incentives established by the government can profoundly influence the growth of the elderly care sector. Supportive measures, such as funding allocations or tax incentives, can encourage developing and expanding elderly care services. Moreover, well-crafted regulations ensure the quality and standardization of care, instilling confidence in both service providers and the elderly population. Government commitment to addressing the needs of the aging population through strategic initiatives is a key determinant in shaping the landscape and fostering a conducive environment for the growth of the Nepal elderly care market.

Report Scope and Market Segmentation

Report Metric

|

Details

|

Forecast Period

|

2022 to 2029

|

Base Year

|

2021

|

Historic Years

|

2020 (Customizable to 2014-2019)

|

Quantitative Units

|

Revenue in USD Million, Volumes in Units, Pricing in USD

|

Segments Covered

|

Product Type (Pharmaceuticals and Housing and Assistive Devices), Service (Institutional Care, Homecare, Adult Day Care), Application (Heart Diseases, Cancer, Kidney Diseases, Diabetes, Arthritis, Neurological, Osteoporosis, Respiratory, Others)

|

Market Players Covered

|

Hope Hermiatge (Nepal), Orchid Care Home (U.K.), Koninklijke Philips N.V. (India) and Medtronic (U.S.)

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

|

Segment Analysis:

The Nepal elderly care market is segmented on the basis of product, service, and applications.

- On the basis of product, the Nepal elderly care market is segmented into pharmaceuticals and housing, and assistive devices

- On the basis of service, the Nepal elderly care market is segmented into institutional care, homecare, and adult day care

- On the basis of applications, the Nepal elderly care market is segmented into heart diseases, cancer, kidney diseases, diabetes, arthritis, neurological, osteoporosis, respiratory, and others

Major Players

Data Bridge Market Research recognizes the following companies as the major Nepal elderly care market players in Nepal elderly care market are Hope Hermiatge (Nepal), Orchid Care Home (U.K.), Koninklijke Philips N.V. (India) and Medtronic (U.S.)

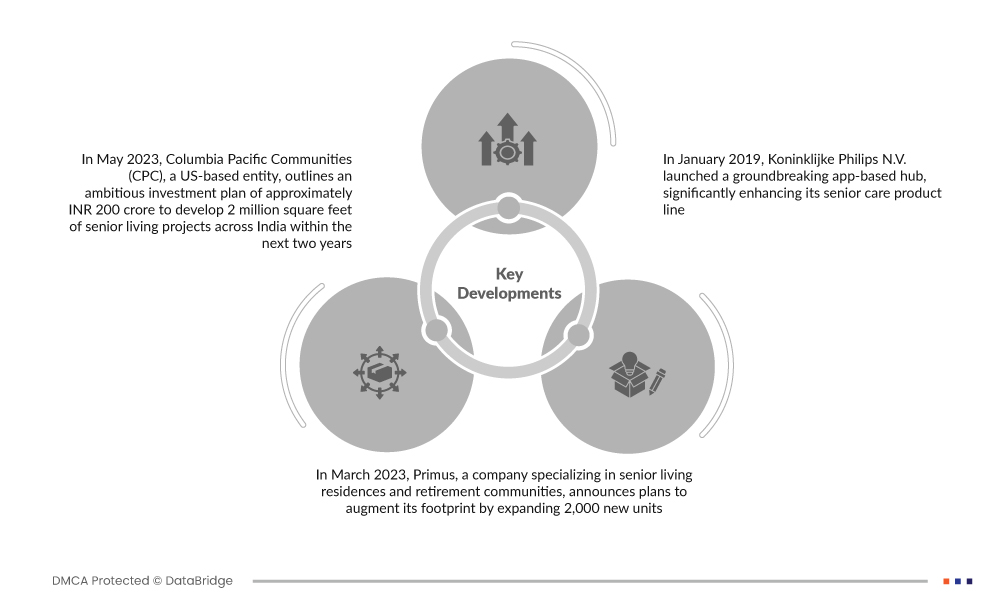

Market Developments

- In May 2023, Columbia Pacific Communities (CPC), a US-based entity, outlines an ambitious investment plan of approximately INR 200 crore to develop 2 million square feet of senior living projects across India within the next two years. With a strategic vision, the company aims to have eight communities, comprising around 2,000 homes, actively under construction and available for sale in nine cities by the end of FY 2024-25. This significant expansion reflects CPC's commitment to meeting the growing demand for high-quality senior living spaces in diverse urban centers

- In March 2023, Primus, a company specializing in senior living residences and retirement communities, announces plans to augment its footprint by expanding 2,000 new units. This expansion marks Primus's foray into the Mumbai market, a strategic move to cater to the increasing needs of seniors in the region. Primus aims to contribute to the evolving landscape of senior living by extending its offerings, emphasizing its commitment to providing enhanced lifestyle options and care services for the elderly population

- In January 2019, Koninklijke Philips N.V. launched a groundbreaking app-based hub, significantly enhancing its senior care product line. This strategic move consolidated various caretaking solutions into a unified digital ecosystem, simplifying the experience for family caretakers. The launch showcased Philips' commitment to innovation and addressed the evolving needs of the senior care market. This comprehensive platform enabled families to efficiently monitor and manage senior care, resonating with the growing demand for integrated solutions. As a result, the initiative expanded Philips' customer base and solidified its position as a leader in leveraging technology to enhance the caregiving experience

For more detailed information about the Nepal elderly care market report, click here – https://www.databridgemarketresearch.com/reports/nepal-elderly-care-market