Accounts payable automation optimizes invoice and payment processes through technology, utilizing tools such as robotic process automation, machine learning, and artificial intelligence. This market focuses on enhancing efficiency in organizations by streamlining and automating accounts payable functions. The adoption of these technological solutions aims to reduce manual intervention, and provide real-time visibility into financial transactions. The result is improved management of accounts payable tasks, enabling more strategic resource allocation.

Access Full Report @ https://www.databridgemarketresearch.com/reports/north-america-accounts-payable-automation-market

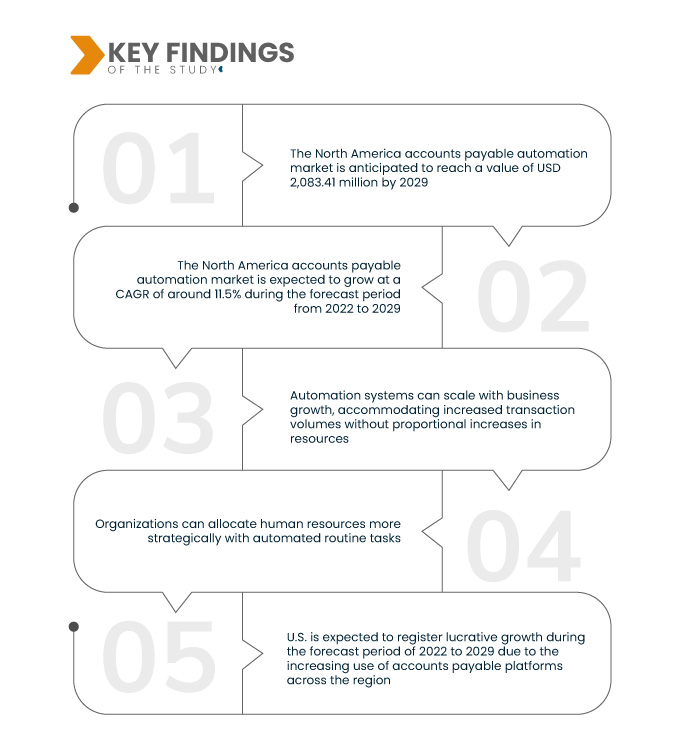

Data Bridge Market Research analyses that the North America Accounts Payable Automation Market which was USD 872.11 million in 2021, is expected to reach USD 2,083.41 million by 2029, at a CAGR of 11.5% during the forecast period of 2022 to 2029. Automated processes in accounts payable reduce errors, cut processing costs, and diminish reliance on manual labor, resulting in significant overall cost reduction for organizations.

Key Findings of the Study

Increased demand for account payable automation for bill generation is expected to drive the market's growth rate

The North America accounts payable automation market experiences heightened demand driven by the crucial role of accounts payable in timely bill payment. Ensuring timely payment enhances a company's credit rating, contributing to an uninterrupted flow of supplies and services. This surge in demand results from organizations seeking to avoid overdue payments, penalties, and late fees. The market is consequently witnessing substantial growth as businesses prioritize efficient accounts payable automation solutions to optimize their financial processes.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2022 to 2029

|

|

Base Year

|

2021

|

|

Historic Years

|

2020 (Customizable to 2014-2019)

|

|

Quantitative Units

|

Revenue in USD Million, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Components (Solution and Services), Organization Size (Large Enterprise, Small and Medium Enterprise), Process (Invoice Capture, Invoice Approval, Payment Authorization, Payment Execution and Export), Deployment Mode (Cloud and On-Premise), Vertical (Manufacturing, Consumer Goods and Retail, Energy and Utilities, Healthcare, Banking, Financial Services, and Insurance, IT and Telecom, Government, Automotive, and Others)

|

|

Countries Covered

|

U.S., Canada and Mexico in North America

|

|

Market Players Covered

|

SAP SE (Germany), Oracle Corporation (U.S.), Sage Group plc (U.K.), Tipalti Inc. (U.S.), FreshBooks (Canada), Zycus Inc. (U.S.), Airbase Inc. (U.S.), FIS (U.S.), Coupa Software Inc. (U.S.), Comarch SA (Poland), FinancialForce (U.S.), MHC Automation (U.S.), Procurify Technologies Inc. (Canada), Zoho Corporation Pvt. Ltd. (India), MineralTree (U.S.), Kofax Inc. (U.S.), AvidXchange (U.S.), Bottomline Technologies, Inc. (U.S.), FLEETCOR TECHNOLOGIES, INC. (U.S.), and Bill.com (U.S.) among others

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

|

Segment Analysis:

The North America accounts payable automation market is segmented on the basis of components, organization size, process, deployment mode and vertical.

- On the basis of components, the North America accounts payable automation market is segmented into solution and services

- On the basis of by organization size, the North America accounts payable automation market has been segmented into large enterprise and small and medium enterprise

- On the basis of process, the North America accounts payable automation market has been segmented into invoice capture, invoice approval, payment authorization, payment execution, and export

- On the basis of deployment mode, the North America accounts payable automation market has been segmented into cloud and on-premise

- On the basis of vertical, the North America accounts payable automation market has been segmented into manufacturing, consumer goods and retail, energy and utilities, healthcare, banking, financial services, and insurance, IT and telecom, government, automotive, and others

Major Players

Data Bridge Market Research recognizes the following companies as the major North America accounts payable automation market players in North America accounts payable automation market are SAP SE (Germany), Oracle Corporation (U.S.), Sage Group plc (U.K.), Tipalti Inc. (U.S.), FreshBooks (Canada), Zycus Inc. (U.S.), Airbase Inc. (U.S.), FIS (U.S.), Coupa Software Inc. (U.S.)

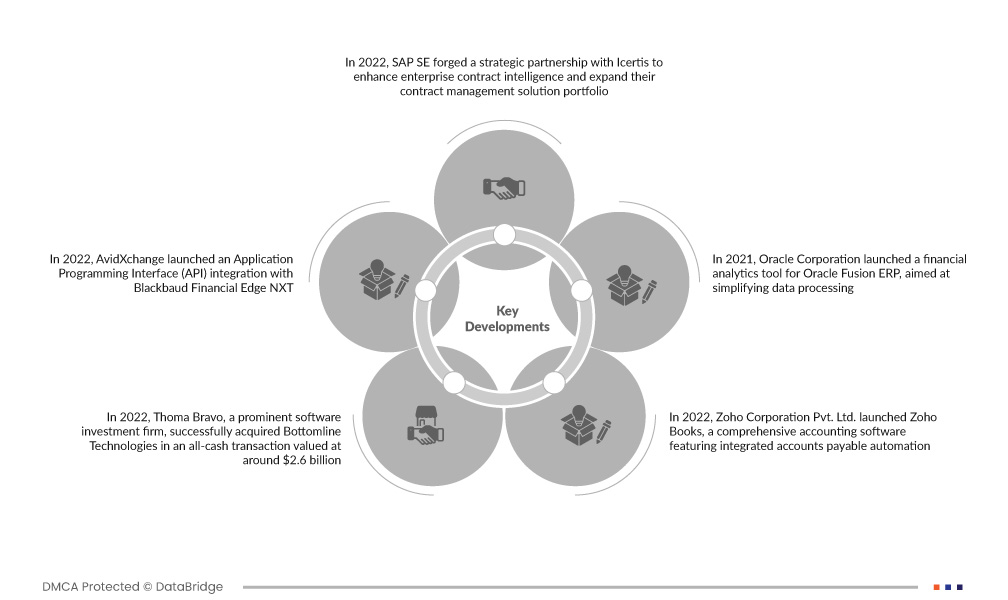

Market Developments

- In 2022, SAP SE forged a strategic partnership with Icertis to enhance enterprise contract intelligence and expand their contract management solution portfolio. Leveraging Icertis' advanced technology, this partnership aims to deliver heightened value to their customer base. By combining expertise, the partnership seeks to offer more comprehensive and innovative services, catering to the evolving needs of businesses in the realm of contract management

- In 2022, AvidXchange launched an application programming interface (API) integration with Blackbaud Financial Edge NXT. This strategic integration enhances the synergy between AvidXchange's payment automation solutions and Blackbaud's Financial Edge NXT platform, streamlining financial processes for users. The collaboration aims to provide a seamless and efficient experience in managing payments and financial workflows within the nonprofit and educational sectors

- In 2022, Thoma Bravo, a prominent software investment firm, successfully acquired Bottomline Technologies in an all-cash transaction valued at around $2.6 billion. This strategic move reflects the growing significance of financial technology in the market, positioning Thoma Bravo to leverage Bottomline Technologies' expertise and innovations in the ever-evolving landscape of financial software and services

- In 2022, Zoho Corporation Pvt. Ltd. launched Zoho Books, a comprehensive accounting software featuring integrated accounts payable automation. This platform enhances financial management by streamlining payables processes. With Zoho Books, businesses benefit from automated functionalities, facilitating efficient invoice processing, payment approvals, and overall accounts payable optimization within a unified accounting solution

- In 2021, Oracle Corporation launched a financial analytics tool for Oracle Fusion ERP, aimed at simplifying data processing. This solution enhances financial data analysis within the ERP system, providing users with a streamlined and user-friendly interface. Oracle's objective is to empower businesses with improved insights, efficiency, and ease of use in financial data management through this innovative financial analytics tool

Regional Analysis

Geographically, the countries covered in the North America accounts payable automation market report are U.S., Canada and Mexico in North America

As per Data Bridge Market Research analysis:

U.S. is estimated to be the fastest growing country in North America accounts payable automation market during the forecast period 2022-2029

The U.S. is expected to dominate the North America accounts payable automation market, driven by widespread adoption of accounts payable platforms. The region's emphasis on advanced financial technologies and the integration of automation tools in business processes contribute to this dominance. As businesses increasingly recognize the efficiency gains of automated accounts payable solutions, the U.S. market is positioned for substantial growth in the realm of financial process optimization.

For more detailed information about the North America accounts payable automation market report, click here – https://www.databridgemarketresearch.com/reports/north-america-accounts-payable-automation-market