Farmers seek more efficient and sustainable methods of cultivation, and drones offer the capability to gather high-resolution data on crop health, soil conditions, and pest infestations. This data-driven approach empowers farmers to make informed decisions, optimize resource allocation, and enhance yields while minimizing environmental impact, positioning drones as invaluable tools for modernizing agricultural practices across the region.

Access Full Report @ https://www.databridgemarketresearch.com/reports/south-america-agriculture-drones-market

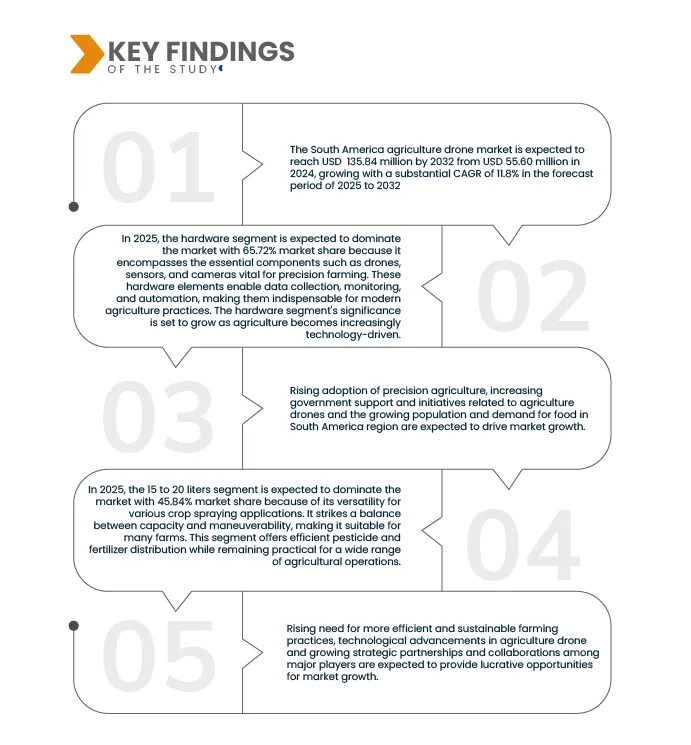

The South America Agriculture Drone Market is expected to reach USD 135.84 million by 2032 from USD 55.60 million in 2024, growing with a substantial CAGR of 11.8% in the forecast period of 2025 to 2032.

Key Findings of the Study

Increasing Government Support and Initiatives Related to Agriculture Drones

Agriculture drones can rapidly cover large areas, enabling farmers to monitor their crops and livestock more effectively. This efficiency translates into time and labor savings, making drones an attractive solution for farmers in the region. Moreover, precision agriculture provides real-time data on various aspects of farming, such as crop health, soil conditions, and pest infestations. This data allows farmers to make informed, data-driven decisions.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2025 to 2032

|

|

Base Year

|

2024

|

|

Historic Years

|

2023 (Customizable to 2018-2022)

|

|

Quantitative Units

|

Revenue in USD Million

|

|

Segments Covered

|

Offering (Hardware, Software and Services), Drone Type (Fixed-Wing Drones, Multi-Wind Drones and Others), Technology (Remote Sensing, Gps/Gnss-Based Navigation, AI and Machine Learning Algorithms, IoT Integration, Cloud-Based Data Storage and Access), Capacity (5 Liters, 5 To 10 Liters, 10 To 15 Liters, 15 To 20 Liters and Others), Flight Mode (Manual, Semi-Autonomous and Autonomous), Operation Mode (Standard Mode, Customized Mode and Remote Control Mode), Sales Channel (OEM and Aftermarket), Application (Mapping & Surveying, Precision Agriculture, Crop Dusting & Spraying, Monitoring Field Conditions, Planting & Seeding, Drone Pollination, Drone Irrigation, Livestock Management and Others)

|

|

Countries Covered

|

Brazil, Argentina, Colombia, Peru, Chile, Venezuela, Bolivia, Guyana, Uruguay, Rest of South America

|

|

Market Players Covered

|

BASF SE (Germany), DJI (China), Qingdao Zhongfei Intelligent, Technology Co., Ltd (China), XAG Co. Ltd (China), PrecisionHawk, Inc (U.S.), Qualcomm Technologies, Inc.(U.S.), Sky-Drones Technologies LTD (U.K.), Eavision Technologies Co., Ltd.(U.S.), Yamaha Motor Co., Ltd.(Japan), AgroDrone AI (Brazil), Aerodyne Group (Malaysia), and AeroVironment, Inc.(U.S.), among others.

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

|

Segment Analysis:

The South America agriculture drone market is segmented into eight notable segments which are offering, drone type, capacity, flight mode, operation mode, sales channel, application and technology

- On the basis of offering, the market is segmented into hardware, software and services

In 2025, the hardware segment is expected to dominate the South America agriculture drone market

In 2025, the hardware segment is expected to dominate with the market with 65.72% share driven by increasing farm mechanization, demand for precision farming tools, and affordability of entry-level drone platforms. Robust, easy-to-maintain hardware with modular designs is gaining traction among small to mid-sized farms seeking cost-effective and efficient aerial monitoring and spraying solutions.

- On the basis of drone type, the market is segmented into fixed wing drones, multi wing drones, others.

In 2025, the fixed wing drones segment is expected to dominate the South America agriculture drone market

In 2025, the fixed wing drones segment is expected to dominate the market with 54.89% share as fixed-wing drones are gaining preference in South American agriculture due to their extended flight times, wide coverage areas, and efficiency in mapping large farmlands, especially in Brazil and Argentina. Their ability to operate in remote or rugged terrain supports large-scale crop monitoring, making them ideal for extensive soybean, corn, and sugarcane plantations.

- On the basis of technology, the market is segmented into remote sensing, GPS/GNSS-based navigation, ai and machine learning algorithms, iot integration, cloud-based data storage and access. In 2025, the remote sensing segment is expected to dominate the market share 35.52% because remote sensing via multispectral and thermal sensors is transforming South American agriculture by enabling real-time crop health monitoring, irrigation management, and disease detection. As climate variability intensifies, farmers increasingly rely on these insights to enhance resilience, reduce losses, and comply with sustainability standards across export-oriented agricultural sectors.

- On the basis of capacity, the market is segmented into 15 to 20 liters, 10 to 15 liters, 5 to 10 liters, up to 5 liters & others. In 2025, the 15 to 20 liters segment is expected to dominate the market with 45.84% share because drones with 15 to 20 liters payload capacity are increasingly adopted across South America as they strike an optimal balance between spray volume and maneuverability. This range suits medium-to-large farms needing efficient liquid application for fertilizers and pesticides, reducing operational time while maintaining precision in diverse agricultural landscapes.

- On the basis of flight mode, the market is segmented into manual, semi-autonomous, autonomous), operation mode (standard mode, remote control mode, customized mode. In 2025, the manual segment is expected to dominate the market with 65.48% share because manual drone operation remains relevant in South America due to lower technical barriers, affordability, and suitability for smallholder farms with irregular field layouts. Farmers with limited digital literacy or in regions with poor connectivity often prefer manual control for targeted, on-demand spraying and basic field monitoring tasks.

- On the basis of operation mode, the market is segmented into standard mode, remote control mode, customized mode. In 2025, the standard mode segment is expected to dominate the market with 52.30% share because standard (semi-autonomous) mode is driving adoption among mid-scale farmers who seek a balance between automation and control. Pre-programmed flight paths with manual override enhance operational safety and consistency, making it ideal for routine tasks like crop scouting and uniform spraying across moderate-sized fields in countries like Colombia and Chile.

- On the basis of sales channel, the market is segmented into OEM, aftermarket. In 2025, the OEM segment is expected to dominate the market share 67.65% because the OEM segment is expanding as local agricultural enterprises partner with drone manufacturers to customize solutions tailored to regional crops and terrains. These collaborations reduce costs, ensure after-sales support, and accelerate technology integration, fostering trust among farmers unfamiliar with advanced drone systems across South America’s diverse agro-climatic zones.

- On the basis of application, the market is segmented into mapping & surveying, precision agriculture, crop dusting & spraying, monitoring field conditions, planting & seeding , livestock management, irrigation monitoring & others. In 2025, the mapping & surveying segment is expected to dominate the market share 23.21% because mapping and surveying applications are surging due to rising demand for data-driven farm management. Drones enable rapid, high-resolution field assessments for soil analysis, planting planning, and yield estimation, critical for optimizing inputs in large-scale commodity farming, particularly in Brazil’s agribusiness-dominated regions and Argentina’s pampas.

Major Players

Data Bridge Market Research recognizes the following companies as the major key players in the South America agriculture drone market are BASF SE (Germany), DJI (China), Qingdao Zhongfei Intelligent, Technology Co., Ltd (China), XAG Co. Ltd (China), PrecisionHawk, Inc (U.S.) among others.

Market Development

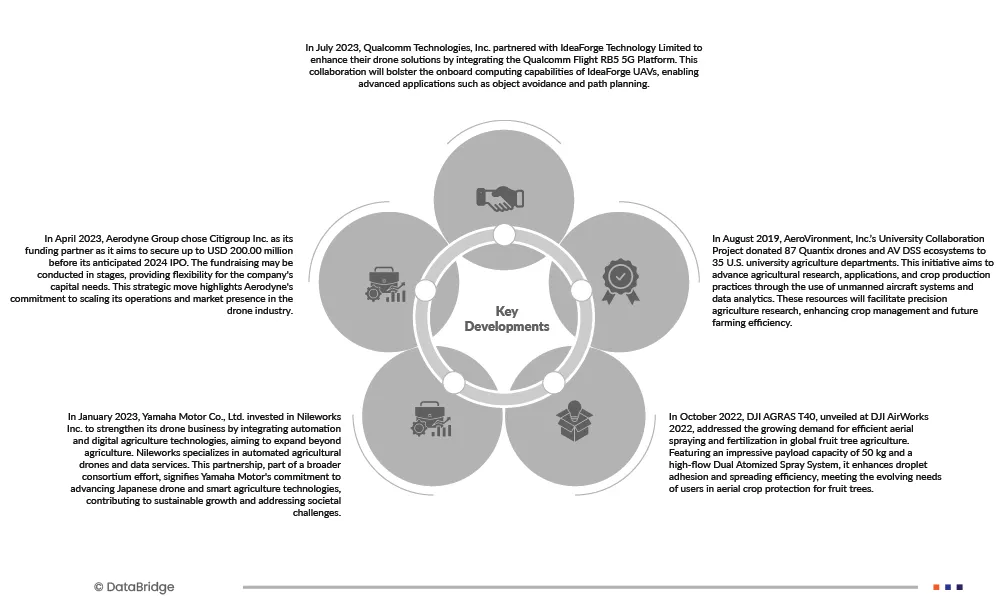

- In July 2023, Qualcomm Technologies, Inc. partnered with IdeaForge Technology Limited to enhance their drone solutions by integrating the Qualcomm Flight RB5 5G Platform. This collaboration will bolster the onboard computing capabilities of IdeaForge UAVs, enabling advanced applications such as object avoidance and path planning. IdeaForge aims to offer improved UAV performance across various applications, showcasing the potential of Indian companies in addressing real-world challenges through advanced technology solutions by combining their technology with Qualcomm's compute capabilities

- In April 2023, Aerodyne Group chose Citigroup Inc. as its funding partner as it aims to secure up to USD 200.00 million before its anticipated 2024 IPO. The fundraising may be conducted in stages, providing flexibility for the company's capital needs. This strategic move highlights Aerodyne's commitment to scaling its operations and market presence in the drone industry

- In January 2023, Yamaha Motor Co., Ltd. invested in Nileworks Inc. to strengthen its drone business by integrating automation and digital agriculture technologies, aiming to expand beyond agriculture. Nileworks specializes in automated agricultural drones and data services. This partnership, part of a broader consortium effort, signifies Yamaha Motor's commitment to advancing Japanese drone and smart agriculture technologies, contributing to sustainable growth and addressing societal challenges

- In October 2022, DJI AGRAS T40, unveiled at DJI AirWorks 2022, addressed the growing demand for efficient aerial spraying and fertilization in global fruit tree agriculture. Featuring an impressive payload capacity of 50 kg and a high-flow Dual Atomized Spray System, it enhances droplet adhesion and spreading efficiency, meeting the evolving needs of users in aerial crop protection for fruit trees

- In August 2019, AeroVironment, Inc.’s University Collaboration Project donated 87 Quantix drones and AV DSS ecosystems to 35 U.S. university agriculture departments. This initiative aims to advance agricultural research, applications, and crop production practices through the use of unmanned aircraft systems and data analytics. These resources will facilitate precision agriculture research, enhancing crop management and future farming efficiency

Regional Analysis

Geographically, the countries covered in the South America agriculture drone market report are Brazil, Argentina, Colombia, Peru, Chile, Venezuela, Bolivia, Guyana, Uruguay.

As per Data Bridge Market Research analysis:

Brazil is the dominant region in the agriculture drone market during the forecast period 2025 -2032

In 2025, the Brazil is expected to dominate the market because of its vast agricultural landscape and diverse crops. The country's significant adoption of modern farming practices and technology fuels the demand for agricultural drones. Brazil's position as a major global agricultural producer and exporter further enhances its leadership in this market.

For more detailed information about the South America Agriculture Drone Market report, click here – https://www.databridgemarketresearch.com/reports/south-america-agriculture-drones-market