The accounts receivable automation refers to the industry segment focused on providing technological solutions and services to streamline and optimize the accounts receivable processes of businesses and organizations operating in Spain. This includes automating tasks such as invoice generation, payment processing, data reconciliation, and customer communication, ultimately improving efficiency, reducing manual labor, enhancing cash flow, and strengthening customer relationships through the use of advanced software and technology solutions.

Access Full Report @ https://www.databridgemarketresearch.com/reports/spain-accounts-receivable-automation-market

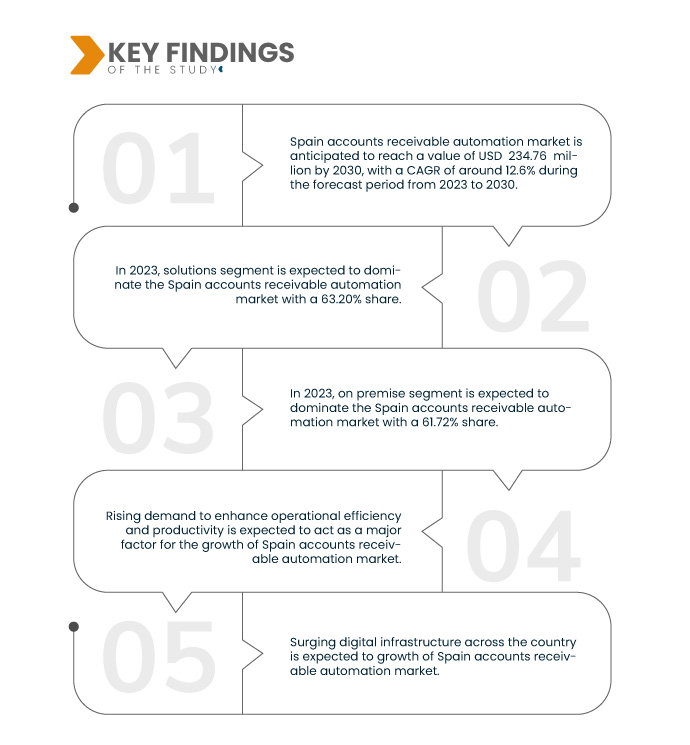

Data Bridge Market Research analyzes that the Spain Accounts Receivable Automation Market is expected to grow at a CAGR of 12.6% in the forecast period of 2023 to 2030 and is expected to reach USD 234.76 million by 2030. Businesses in Spain are recognizing the advantages of cloud-based AR automation which offers flexibility, scalability, and accessibility. Companies can efficiently manage their AR processes from anywhere with an internet connection, facilitating remote work and enabling real-time access to financial data by leveraging cloud solutions. This enhances operational efficiency and contributes to better cash flow management and quicker decision-making, which are critical in today's dynamic business environment.

Key Findings of the Study

Increasing Adoption of Cloud-Based AR Automation Solutions is expected to drive the market's growth rate

Cloud-based AR automation solutions typically reduce the need for extensive on-premises infrastructure and ongoing maintenance costs. This can particularly appeal to businesses looking to control expenses and allocate resources more strategically. The scalability of cloud solutions also allows companies to adapt to changing workloads and business needs without the constraints of traditional on-premises systems. Spanish businesses recognize the advantages of cloud-based AR automation is expected to drive market growth.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2023 to 2030

|

|

Base Year

|

2022

|

|

Historic Years

|

2021 (Customizable to 2015 - 2020)

|

|

Quantitative Units

|

Revenue in USD Million

|

|

Segments Covered

|

Offering (Solutions and Services), Deployment Type (On Premise, Cloud), Enterprise Size (Large Enterprise and Small Enterprise), Operating System (Window, Mobile, Mac, and Linux), Automation Level (Basic Automation and Advanced Automation), Pricing Category (Subscription Based and Free), End User (Manufacturing, Food and Beverages, Energy and Utilities, Healthcare, Banking, Financial Services and Insurance, IT and Telecommunication, Government and Public Sector, Construction, Transportation and Logistics, Retail and Consumer Goods, Hospitality, and Others)

|

|

Countries Covered

|

Spain

|

|

Market Players Covered

|

SAP (Germany), Sage Group plc (U.K.), Esker (France), Quadient (France), Celonis (Germany), EDICOM (Spain), BlackLine Inc. (U.S.), Certinia Inc. (U.S.), QUALCO Group of companies (Greece), Pagero (Sweden), Iron Mountain, Inc. (U.S.), Zoho Corporation Pvt. Ltd. (India), Serrala (Germany), and Dynatos (Netherlands) and among others

|

|

Data Points Covered in the Report

|

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and consumer behavior.

|

Segment Analysis

Spain accounts receivable automation market is segmented on the basis of offering, deployment type, enterprise size, operating system, automation level, pricing category, end user.

- On the basis of offering, the market is segmented into solutions and services. In 2023, solutions segment is expected to dominate the market with a 63.20% share.

- On the basis of enterprise size, the market is segmented into large enterprises and small and medium enterprises. In 2023, large enterprises segment is expected to dominate the market with a 65.89% share.

- On the basis of deployment type, the market is segmented into on premise and cloud.

On premise segment is expected to dominate the Spain accounts receivable automation market.

In 2023, on premise segment is expected to dominate the market with a 61.72% share because some businesses in Spain and in other countries, may have specific data privacy and security concerns. On-premises solutions can offer greater control over sensitive financial data, making them more appealing to companies with strict data protection regulations.

- On the basis of operating system, the market is segmented into mac, windows, linux, and mobile.

Windows segment is expected to dominate the Spain accounts receivable automation market

In 2023, windows segment is expected to dominate the Spain accounts receivable automation market with a 55.32% share, due to its historical prevalence and widespread use in the business environment. Windows-based automation software offers a familiar and user-friendly interface, making it easier for businesses in Spain to adopt and integrate these solutions.

- On the basis of automation level, the market is segmented into basic automation and advanced automation. In 2023, basic automation segment is expected to dominate the market with a 72.34% share.

- On the basis of pricing category, the market is segmented into free and subscription based. In 2023, subscription based segment is expected to dominate the market with 82.28% share.

- On the basis of end user, the market is segmented into banking, financial services, and insurance (BFSI), government and public sector, IT and telecommunication, manufacturing, healthcare, retail and consumer goods, construction, transportation and logistics, food and beverages, energy and utilities, hospitality, and others. In 2023, manufacturing segment is expected to dominate the market with a 17.87% share.

Major Players

Data Bridge Market Research analyzes SAP (Germany), Sage Group plc (U.K.), Esker (France), Quadient (France), and Celonis (Germany) as the major market players in market.

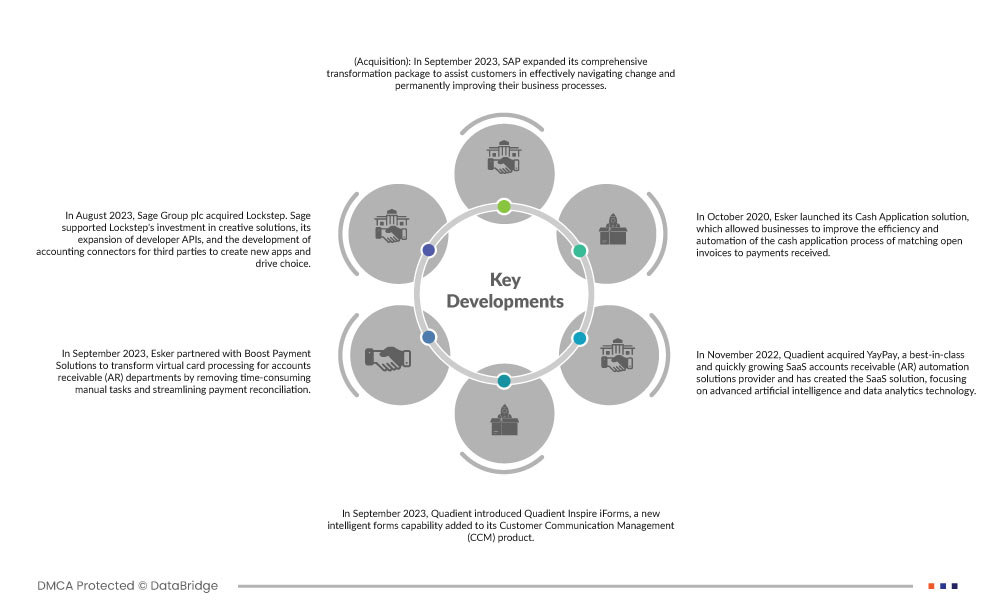

Market Development

- In September 2023, SAP and LeanIX GmbH acquired LeanIX, an enterprise architecture management (EAM) software pioneer. SAP expanded its comprehensive transformation package to assist customers in effectively navigating change and permanently improving their business processes. LeanIX extended the transformation capabilities providing SAP customers with unique visibility on IT landscapes. That helped SAP expand its business transformation portfolio, giving customers access to the tools required for continuous business transformation and facilitating AI-enabled process optimization.

- In August 2023, Sage Group plc acquired Lockstep. Sage supported Lockstep's investment in creative solutions, its expansion of developer APIs, and the development of accounting connectors for third parties to create new apps and drive choice. That acquisition brought Sage's resources to Lockstep, which accelerated its target of automating accounting operations across companies. It provided Sage with supporting tools and capabilities to deliver on its ambition of becoming the trusted network for SMBs. The company enhanced its portfolio of offerings, advancing its digital capabilities and facilitating automation and customization.In August 2021, Pain Plaisir opened a new outlet in Bucharest's J8 Office Park. Pain Plaisir focused on opening stores "near home," for most of the time being only in Bucharest because artisan bread must be eaten fresh and purchased virtually daily in the lack of preservation and rising chemicals. The store's location was ideal for expansion goals, which included reaching out to residential neighborhoods closer to the clients.

- In September 2023, Esker partnered with Boost Payment Solutions to transform virtual card processing for accounts receivable (AR) departments by removing time-consuming manual tasks and streamlining payment reconciliation. That collaboration resulted in unparalleled efficiency and simplicity in the virtual card acceptance procedure. Businesses may easily integrate virtual card payments into their AR operations, reducing manual intervention and human errors while improving processing time and costs. That collaboration enabled the company to improve its payment capabilities, allowing customers to process virtual card payments more efficiently and automatically

- In September 2023, Quadient introduced Quadient Inspire iForms, a new intelligent forms capability added to its Customer Communication Management (CCM) product. The Quadient Inspire iForms functionality would be accessible through Quadient's standard sales channels, benefiting enterprises of all sizes daily with its full cloud-based Intelligent Communication Automation platform. That solution would provide them a competitive advantage and help customers develop exceptional customer experience.

- In November 2022, Quadient acquired YayPay, a best-in-class and quickly growing SaaS accounts receivable (AR) automation solutions provider and has created the SaaS solution, focusing on advanced artificial intelligence and data analytics technology. That acquisition of YayPay broadened Quadient's Business Process Automation offering, particularly complimenting its cloud-based platform Quadient Impress, a multichannel document automation platform for small and medium businesses.

- In October 2020, Esker launched its Cash Application solution, which allowed businesses to improve the efficiency and automation of the cash application process of matching open invoices to payments received. The launch of that solution strengthened the company’s accounts receivables financial suite, making it a more comprehensive and effective offering for its customers. Esker brought valuable benefits to the customers' businesses by expanding its role in financial technology (fintech).

For more detailed information about the Spain accounts receivable automation market report, click here – https://www.databridgemarketresearch.com/reports/spain-accounts-receivable-automation-market