The crypto asset management market boasts features such as diversification, security, and accessibility. Investors can diversify portfolios with various cryptocurrencies, hedge against market volatility, and enjoy 24/7 accessibility. Among segments, cryptocurrency funds are the dominating category. These funds pool investments to optimize returns while managing risks. Institutional investors are increasingly favoring these funds due to professional management and regulatory compliance. With the rising interest in cryptocurrencies, this segment continues to gain prominence, serving as a trusted avenue for crypto asset management.

Access Full Report @ https://www.databridgemarketresearch.com/reports/us-and-europe-crypto-asset-management-market

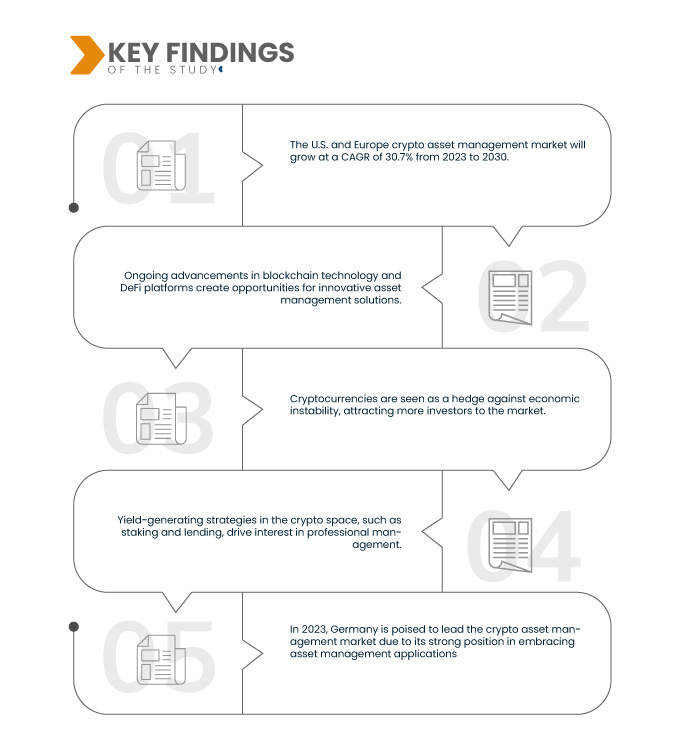

Data Bridge Market Research analyses that the U.S. and Europe Crypto Asset Management Market will grow at a CAGR of 30.7% from 2023 to 2030. Enhanced regulatory frameworks create a sense of security for investors, assuring them of a well-defined legal environment. This assurance encourages greater investor participation in the market, as it mitigates risks and fosters trust in the asset class.

Key Findings of the Study

Institutional investment is expected to drive the market's growth rate

The influx of institutional investments in cryptocurrencies has triggered a corresponding surge in demand for professional asset management and custody solutions. Institutions require expert guidance to navigate the complexities of the crypto market, ensuring compliance with regulations and best practices. Robust custody solutions are crucial to safeguard their digital assets. This trend reflects a maturing market where institutional participation is a key driver of growth, emphasizing the necessity for specialized crypto asset management services.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2023 to 2030

|

|

Base Year

|

2022

|

|

Historic Years

|

2021 (Customizable to 2015-2020)

|

|

Segments Covered

|

Solution (Wallet Management, Custodian Solutions), Deployment Mode (Cloud, On-Premise), Application Type (Mobile, Web-Based), Operating System (Android, IOS, and Others), End User (Individual, Enterprise), Vertical (BFSI, Healthcare, Government, Retail and E-Commerce, Travel and Hospitality, Media and Entertainment, and Others)

|

|

Countries Covered

|

U.S., U.K., Germany, France, Spain, Italy, Netherlands, Switzerland, Russia, Belgium, Turkey, and the rest of Europe

|

|

Market Players Covered

|

Coinbase Global, Inc. (U.S.), Gemini Trust Company, LLC. (U.S.), Crypto Finance Group (Switzerland), Genesis Global Trading, Inc. (U.S.), Bakkt Holdings, Inc. (U.S.), BitGo Inc. (U.S.), Ledger SAS. (France), Xapo Holdings Limited (U.K.), Paxos Trust Company, LLC (U.S.), Blockdaemon (U.S.), Binance (Services Holdings) Limited (Cayman Islands), CoinStats Inc (U.S.), Fireblocks (U.S.), Bankex (U.S.), copper.co (U.K.), CYBAVO Pte. Ltd (Singapore)

|

|

Data Points Covered in the Report

|

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

|

Segment Analysis:

The U.S. and Europe crypto asset management market is segmented on solution, deployment, application type, operating system, end user, and vertical.

- On the basis of solution, the U.S. and Europe crypto asset management market is segmented into wallet management, and custodian solutions.

- On the basis of deployment mode, the U.S. and Europe crypto asset management market is segmented into cloud and on-premise.

- On the basis of application type, the U.S. and Europe crypto asset management market is segmented into mobile and web-based.

- On the basis of operating system, the U.S. and Europe crypto asset management market is segmented into android, IOS, and others.

- On the basis of end user, the U.S. and Europe crypto asset management market is segmented into individual and enterprise.

- On the basis of vertical, the U.S. and Europe crypto asset management market is segmented into BFSI, healthcare, government, retail and e-commerce, travel and hospitality, media and entertainment, and others.

Major Players

Data Bridge Market Research recognizes the following companies as the U.S. and Europe crypto asset management market players in U.S. and Europe crypto asset management market Coinbase Global, Inc. (U.S.), Gemini Trust Company, LLC. (U.S.), Crypto Finance Group (Switzerland), Genesis Global Trading, Inc. (U.S.), Bakkt Holdings, Inc. (U.S.), BitGo Inc. (U.S.), Ledger SAS. (France), Xapo Holdings Limited (U.K.), Paxos Trust Company, LLC (U.S.).

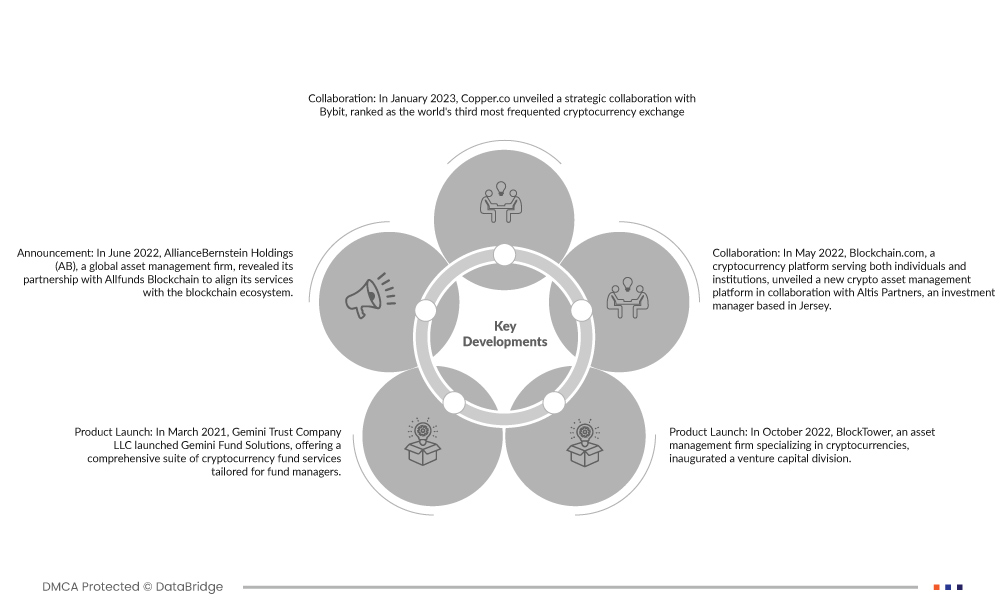

Market Developments

- In January 2023, Copper.co unveiled a strategic collaboration with Bybit, ranked as the world's third most frequented cryptocurrency exchange. The partnership aims to enhance Copper's institutional digital asset custody and trading solutions, making them available to Bybit's institutional clients through Copper's renowned ClearLoop service. This move significantly bolstered the company's market presence and positioned it as a formidable player in the industry.

- In June 2022, AllianceBernstein Holdings (AB), a global asset management firm, revealed its partnership with Allfunds Blockchain to align its services with the blockchain ecosystem. Allfunds Blockchain, a division of the fund distribution platform Allfunds (ALLFG), specializes in integrating blockchain technology with investment funds, aiming to enhance efficiency and introduce an extra layer of security.

- In March 2021, Gemini Trust Company LLC launched Gemini Fund Solutions, offering a comprehensive suite of cryptocurrency fund services tailored for fund managers. This all-in-one platform facilitates clearing, custody, trade execution, and various other services within the capital markets.

- In October 2022, BlockTower, an asset management firm specializing in cryptocurrencies, inaugurated a venture capital division. They initiated this division with a $150 million fund dedicated to supporting projects within the decentralized finance (DeFi) and blockchain infrastructure sectors.

- In May 2022, Blockchain.com, a cryptocurrency platform serving both individuals and institutions, unveiled a new crypto asset management platform in collaboration with Altis Partners, an investment manager based in Jersey. This new platform, known as Blockchain.com Asset Management (BCAM), specializes in offering regulated investment products designed for family offices, institutional investors, and high-net-worth individuals. Altis Partners will oversee investment management, while Blockchain.com will provide the crypto trading infrastructure, security, research, and software services.

Regional Analysis

Geographically, the countries covered in the U.S. and Europe crypto asset management market report are U.S., U.K., Germany, France, Spain, Italy, Netherlands, Switzerland, Russia, Belgium, Turkey, and the rest of Europe.

As per Data Bridge Market Research analysis:

Germany is expected to dominate the U.S. and Europe crypto asset management market in the forecast period 2023 - 2030

Germany is poised to lead the crypto asset management market due to its strong position in embracing asset management applications. With a well-established financial sector and a reputation for adopting innovative financial technologies, Germany attracts both local and global players. This leadership in traditional asset management seamlessly translates into the crypto sector, where secure and regulated management solutions are in high demand, positioning Germany as a dominant force in this emerging market.

For more detailed information about the U.S. and Europe crypto asset management market report, click here – https://www.databridgemarketresearch.com/reports/us-and-europe-crypto-asset-management-market