The rising population and rapid urbanization in Argentina are driving a measurable increase in water-heater demand by creating more households and changing daily hot-water consumption patterns. Growing urbanization is leading to construction shifts toward multi-unit apartment blocks and mixed-use buildings where each new dwelling either needs its own hot-water appliance or contributes to demand for centralized systems. Developers and building managers are therefore specifying compact storage and instantaneous (tankless) units that fit constrained utility spaces and meet tenant expectations for on-demand hot water.

Urban migration also concentrates peak usage. Mornings and evenings see higher simultaneous showering, laundry, and dishwashing events, which pushes both residential buyers and small commercial operators to select higher-capacity or faster-recovery models, expanding sales at the upper end of the market. Growing numbers of single-person and small-family households in cities favor compact, energy-efficient models designed for limited bathrooms and kitchenettes, encouraging manufacturers to introduce smaller, lower-cost SKUs and spurring aftermarket parts and service revenues.

Access Full Report @ https://www.databridgemarketresearch.com/reports/argentina-water-heater-market

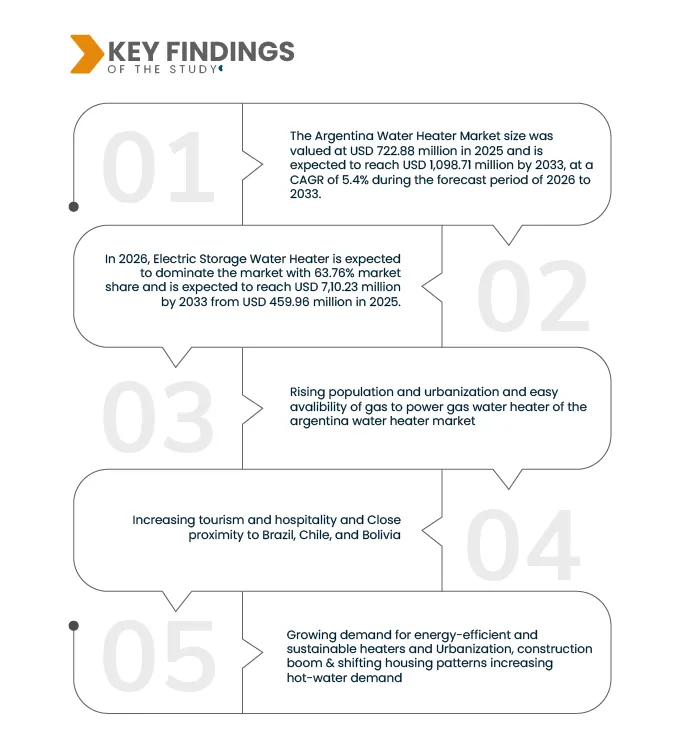

Data Bridge market research analyzes that the Argentina Water Heater Market size was valued at USD 722.88 million in 2025 and is expected to reach USD 1,098.71 million by 2033, at a CAGR of 5.4% during the forecast period of 2026 to 2033.

Key Findings of the Study

EASY AVALIBILITY OF GAS TO POWER GAS WATER HEATER

Easy availability of natural gas in Argentina strengthens demand for gas water heaters as it gives households and small businesses a reliable, low-cost, and familiar energy source that supports consistent hot-water use throughout the year. Dense gas distribution networks in major cities and expanding connections in secondary urban zones make it simple for consumers to install or replace gas-based units without major infrastructure upgrades, reducing both installation time and overall ownership cost. This widespread access encourages builders to pre-configure residential projects with gas pipelines, which naturally steers new homeowners and tenants toward gas heaters as the default choice. Established gas supply also reassures consumers about stable performance that homes can run multiple hot-water points, such as showers, sinks, and kitchens, without worrying about electrical load limits, which is especially important in older buildings where wiring may not support high-wattage electric heaters. In regions where electricity prices fluctuate or power interruptions occur, consumers perceive gas heaters as more dependable and economical over the appliance’s lifetime, leading to faster adoption and more frequent upgrades from outdated electric or immersion systems. Easy gas availability also supports light-commercial segments such as restaurants, cafés, laundromats, and hostels, where operators depend on continuous hot-water flow for daily operations and favor gas units for their faster heating and lower operating costs. Overall, straightforward access to affordable and dependable gas infrastructure directly strengthens the market by lowering operating costs, simplifying installation, increasing reliability, and aligning with user preferences.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2026 to 2033

|

|

Base Year

|

2025

|

|

Historic Years

|

2024 (Customizable to 2018-2023)

|

|

Quantitative Units

|

Revenue in USD Million

|

|

Segments Covered

|

By Product (Residential Boiler, Electric Storage Water Heater, Gas Water Heater)

|

|

Countries Covered

|

Argentina

|

|

Market Players Covered

|

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

|

Segment Analysis

The Argentina water heater market is segmented into one notable segment which is product type.

- On the basis of product type, the market is segmented into residential boiler, electric storage water heater, gas water heater.

In 2026, the electric storage water heater segment is expected to dominate the market

In 2026, electric storage water heater segment is expected to dominate with the market share of 63.76%, due to a combination of rising urban household demand, improved energy efficiency standards, and increasing consumer preference for cost-effective and easy-to-install heating solutions. Argentina’s growing residential construction activities, particularly in urban centre, are driving the adoption of electric storage heaters because they are more suitable for apartments and smaller living spaces compared to gas systems, which often require more complex ventilation and installation requirements.

Major Players

ESKABE (Argentina), LONGVIE SA (Argentina), Ecotermo (Argentina), Orbis SE (Argentina), RHEEM MANUFACTURING COMPANY (United States)

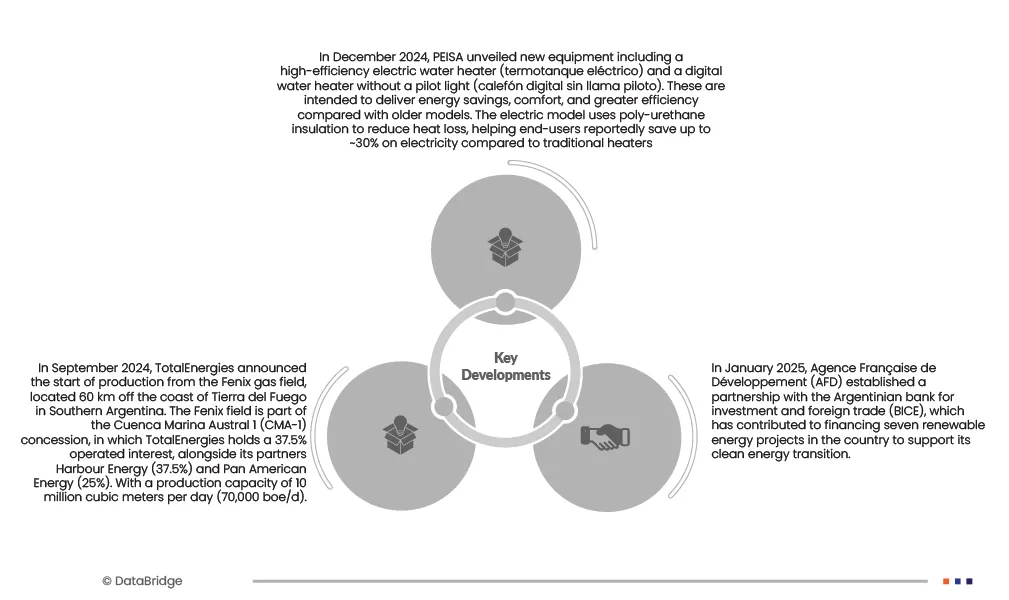

Market Developments

- On February 11, 2025, Rheem officially unveiled its brand refresh titled “Engineered for Life” as part of its 100th‑anniversary celebration. The new branding emphasizes Rheem’s century-long legacy of innovation, durability, and reliability, positioning its products as built to support “everyday life.” At booth 2343, Rheem showcased a broad lineup of advanced and sustainable water-heating and HVAC solutions, including the ProTerra hybrid electric heat-pump water heater, the 50‑gallon Maximus condensing tank, and its IKONIC condensing tankless gas water heater, signaling a strong commitment to energy efficiency and environmental responsibility.

- In August 2025, Rheem celebrated its 100th anniversary with a series of global events, reflecting its century-long commitment to innovation, collaboration, and sustainability. Rheem used the milestone to highlight its progress toward a bold environmental pledge: launching a line of heating, cooling, and water‑heating products by 2025 that reduce greenhouse gas emissions by 50% (relative to its 2019 baseline).

As per Data Bridge Market Research analysis:

For more detailed information about the Argentina water heater market report, click here – https://www.databridgemarketresearch.com/reports/argentina-water-heater-market