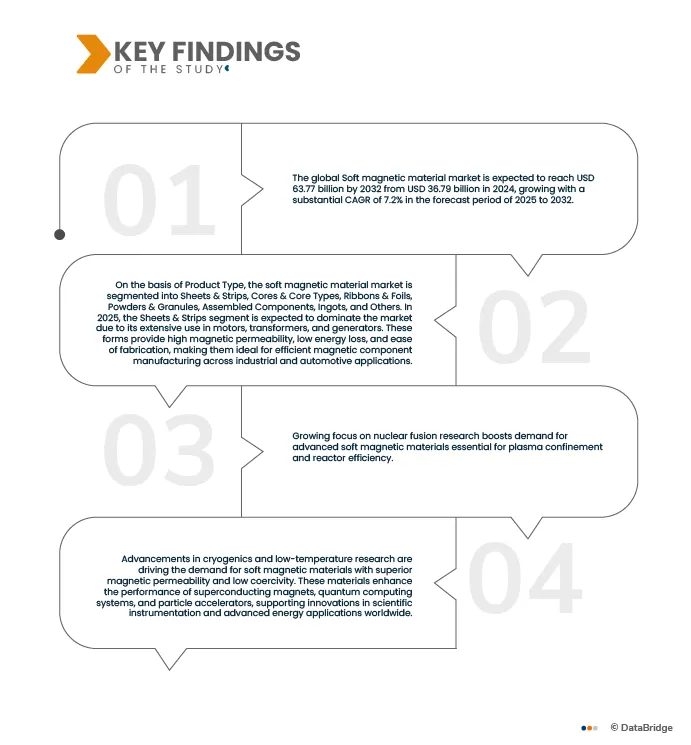

The growing global focus on nuclear fusion research is significantly driving demand for soft magnetic materials. Fusion reactors require extremely precise motion control systems to manage components such as magnetic coils, cryogenic systems, and plasma containment structures. Soft magnetic materials enable high torque, zero backlash, and stable performance under extreme temperatures and radiation environments. As research institutions and private firms like ITER, General Fusion, and Commonwealth Fusion Systems accelerate large-scale fusion projects, the need for highly reliable and efficient mechanical transmission systems is increasing. These gearboxes play a crucial role in positioning, assembly, and maintenance operations within fusion reactors, ensuring accuracy and safety. Furthermore, the rise in investments by governments and energy companies toward clean, limitless fusion energy continues to create lucrative opportunities for gearbox manufacturers specializing in high-precision, durable, and radiation-resistant solutions.

Access Full Report @ https://www.databridgemarketresearch.com/reports/global-soft-magnetic-materials-market

Data Bridge market research analyzes that The Global Soft Magnetic Material Market is expected to reach USD 63.77 billion by 2032 from USD 36.78 billion in 2024, growing with a substantial CAGR of 7.2% in the forecast period of 2025 to 2032..

Key Findings of the Study

Increased Use in Neutron Detection Systems

The increased use of boron trifluoride (BF₃) in neutron detection systems is primarily driven by its exceptional sensitivity to thermal neutrons. BF₃ gas acts as a neutron absorber through the boron-10 isotope, which captures neutrons and produces detectable charged particles. This property makes it vital for radiation monitoring, nuclear research, reactor control systems, and homeland security applications. With the growing emphasis on nuclear safety, non-proliferation, and advanced reactor technologies, the demand for accurate neutron detection has surged. Additionally, BF₃-based proportional counters are being increasingly adopted due to their reliability, compact design, and ability to operate under varying environmental conditions. The replacement of helium-3 detectors, owing to helium scarcity, has further boosted the use of BF₃ as an efficient alternative. Technological innovations in detector design and gas purity enhancement are expected to expand BF₃’s integration into next-generation neutron detection and monitoring solutions globally.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2025 to 2032

|

|

Base Year

|

2024

|

|

Historic Years

|

2023 (Customizable to 2018-2022)

|

|

Quantitative Units

|

Revenue in USD Million

|

|

Segments Covered

|

By Product Type (sheets & strips, cores & core types, ribbons & foils, powders & granules, assembled components, ingots, others), Material Type (electrical steels (fe-si), amorphous & nanocrystalline alloys, soft ferrites, powdered iron & metal powders, soft magnetic alloys, thin films & magnetic coatings, others), Manufacturing Process (Cold Rolling & Annealing, Melt Spinning, Powder Metallurgy, Others), Application (electromagnetic induction, electromagnetic energy conversion, magnetic shielding, electromagnetic sensing and detection, power conditioning and conversion, signal processing and noise suppression, energy storage and transfer, magnetic recording and data storage, magnetization & demagnetization systems, others), End User (automotive industry, electrical & power utilities, consumer electronics, it & telecommunications, industrial manufacturing, aerospace & defence, healthcare & medical, renewable energy, construction industry, others), Distribution Channel (direct sales, indirect sales),

|

|

Countries Covered

|

U.S., Canada and Mexico in North America, Germany, U.K., France, Spain, Belgium, Russia, Netherlands, Italy, Turkey, Switzerland, Sweden, Denmark, Norway, Finland, and Rest of Europe in Europe, India, China, Japan, Australia, South Korea, Singapore, Thailand, Indonesia, Taiwan, Hong Kong, Malaysia, New Zealand, Philippines, and Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), U.A.E, Saudi Arabia, South Africa, Egypt, Qatar, Kuwait, Bahrain, Oman, Israel, and Rest of Middle East and Africa as a part of Middle East and Africa (MEA), Brazil, Argentina and rest of South America as part of South America.

|

|

Market Players Covered

|

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

|

Segment Analysis

The global Soft magnetic material market is segmented into three segments based on type, plastic, and end-use..

- On the basis of Product Type, the soft magnetic material market is segmented into Sheets & Strips, Cores & Core Types, Ribbons & Foils, Powders & Granules, Assembled Components, Ingots, and Others..

In 2025, the Sheets & Strips segment is expected to dominate the market

n 2025, the Sheets & Strips segment is expected to dominate the market due to its extensive use in automotive, electrical, and industrial applications. These materials offer superior magnetic permeability, flexibility, and machinability, making them ideal for motors, transformers, and energy-efficient devices. Growing demand for advanced electronic components and sustainable manufacturing further strengthens the segment’s leadership in the soft magnetic materials market..

- On the basis of Material Type, the soft magnetic material market is segmented into Soft Ferrites, Electrical Steels (Fe-Si), Powdered Iron & Metal Powders, Amorphous & Nanocrystalline Alloys, Soft Magnetic Alloys, Permalloy, Permendur, Carbonyl Iron Powder (CIP), High-purity Iron Powder, Solenoid-quality Stainless Steel Powder, Sendust Powder (Fe-Si-Al), Iron-Silicon Powder, Thin Films & Magnetic Coatings, Others..

In 2025, the In Soft Ferrites segment is expected to dominate the market

In 2025, the In Soft Ferrites segment is expected to dominate the market due to Line gearboxes, designed for linear motion applications, are increasingly adopted in automated assembly systems, material handling, and CNC machinery. Their high precision, rigidity, and low noise operation make them suitable for modern manufacturing environments emphasizing speed and accuracy. With the ongoing expansion of smart factories and automated production lines, line gearboxes enable synchronized motion control and improved process efficiency, driving their integration into industries prioritizing precision alignment and consistent mechanical performance.

- On the basis of Manufacturing Process, the soft magnetic material market is segmented into Cold Rolling & Annealing, Melt Spinning, Powder Metallurgy, and Others..

In 2025, the Cold Rolling & Annealing segment is expected to dominate the market

In 2025, the Cold Rolling & Annealing segment is expected to dominate the market due to its crucial role in enhancing the mechanical strength, surface finish, and magnetic properties of materials. This process improves dimensional accuracy and reduces impurities, making it highly suitable for applications in automotive, electrical, and industrial manufacturing where precision and performance are key requirements..

- On the basis of Application, the soft magnetic material market is segmented into Electromagnetic Induction, Electromagnetic Energy Conversion, Magnetic Shielding, Electromagnetic Sensing and Detection, Power Conditioning and Conversion, Signal Processing and Noise Suppression, Energy Storage and Transfer, Magnetic Recording and Data Storage, Magnetization & Demagnetization Systems, and Others..

In 2025, the Electromagnetic Induction segment is expected to dominate the market

In 2025, the Electromagnetic Induction segment is expected to dominate the market due to its wide applicability in power generation, transformers, sensors, and electric vehicle systems. The growing shift toward renewable energy, electrification, and smart grid infrastructure is increasing the demand for efficient magnetic materials and components that rely on electromagnetic induction for improved energy conversion and transmission efficiency..

- On the basis of End User, the soft magnetic material market is segmented into Automotive Industry, Electrical & Power Utilities, Consumer Electronics, IT & Telecommunications, Industrial Manufacturing, Aerospace & Defence, Healthcare & Medical, Renewable Energy, and Construction Industry..

In 2025, the Automotive Industry segment is expected to dominate the market

In 2025, the Automotive Industry segment is expected to dominate the market due to the increasing adoption of electric and hybrid vehicles, which require advanced magnetic materials for motors, sensors, and energy conversion systems. Rising demand for fuel efficiency, lightweight components, and improved performance in vehicle powertrains and electronics further drives the use of magnetic materials across the automotive manufacturing value chain..

- On the basis of Distribution Channel, the market is segmented into Direct To Businesses, Dealers, International Traders, Private Label Manufacturers, and Government / Cooperatives..

In 2025, the Direct To Businesses segment is expected to dominate the market

In 2025, the Direct to Businesses segment is expected to dominate the market due to growing partnerships between manufacturers and industrial end users for customized magnetic material solutions. Direct supply enables better pricing control, faster delivery, and enhanced product quality assurance. Additionally, businesses prefer direct procurement to streamline logistics, reduce intermediaries, and ensure consistent material performance for high-precision industrial applications.

Major Players

arcelormittal s.a., jfe steel corporation, tata steel ltd., tdk corporation, thyssenkrupp ag, kede magnetics, daido steel co., ltd., dmegc magnetics co., ltd., vacuumschmelze gmbh & co. kg, proterial, ltd., posco holdings, nippon steel corporation, gkn powder metallurgy, advanced technology & materials co., ltd., miba ag, ferroxcube international holding b.v., voestalpine ag, arnold magnetic technologies, mate co., ltd, ames group Sintering, SA, MMG India Pvt Ltd and among others.

Market Developments

- In September 2022, Gabriel-Chemie introduced a new series of halogen-free flame retardant masterbatches for the electrical conduits and tubes market, emphasizing the company's commitment to sustainability. These masterbatches comply with flame retardant standard EN 61386, halogen-free standard EN 50642, and low smoke standard IEC 61304-2. Benefits include reduced toxic gas emissions during fires, enhanced recyclability, and minimized corrosion of electronic equipment and machinery.

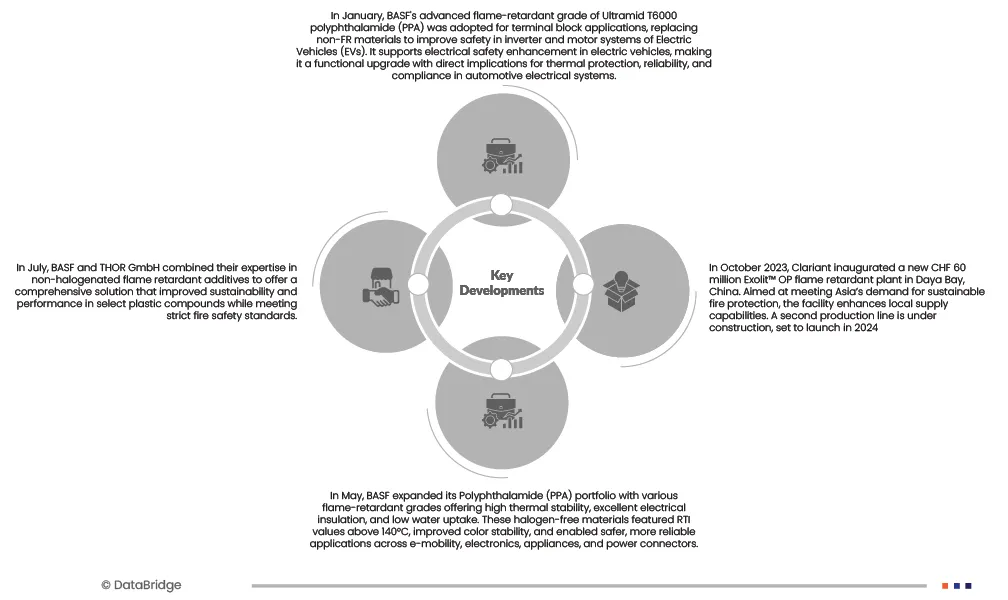

- In October 2023, Clariant inaugurated a new CHF 60 million Exolit™ OP flame retardant plant in Daya Bay, China. Aimed at meeting Asia’s demand for sustainable fire protection, the facility enhances local supply capabilities. A second production line is under construction, set to launch in 2024

- In May, BASF expanded its Polyphthalamide (PPA) portfolio with various flame-retardant grades offering high thermal stability, excellent electrical insulation, and low water uptake. These halogen-free materials featured RTI values above 140°C, improved color stability, and enabled safer, more reliable applications across e-mobility, electronics, appliances, and power connectors.

- In July, BASF and THOR GmbH combined their expertise in non-halogenated flame retardant additives to offer a comprehensive solution that improved sustainability and performance in select plastic compounds while meeting strict fire safety standards.

- In January, BASF's advanced flame-retardant grade of Ultramid T6000 polyphthalamide (PPA) was adopted for terminal block applications, replacing non-FR materials to improve safety in inverter and motor systems of Electric Vehicles (EVs). It supports electrical safety enhancement in electric vehicles, making it a functional upgrade with direct implications for thermal protection, reliability, and compliance in automotive electrical systems.

As per Data Bridge Market Research analysis:

For more detailed information about the Global Soft magnetic material Market report, click here – https://www.databridgemarketresearch.com/reports/global-soft-magnetic-materials-market