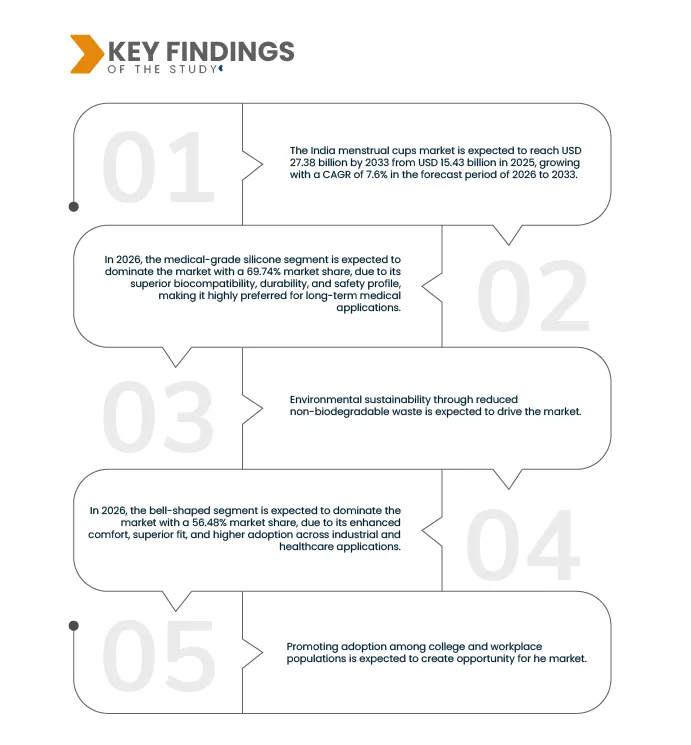

The reduction of non-biodegradable menstrual waste is a key driver for the India menstrual cup market, as menstrual cups offer a highly sustainable alternative to disposable sanitary products that end up in landfills and water bodies. Reports such as the 2023 ARTH study by the Population Foundation of India show that menstrual cups generate 99% less non-biodegradable waste compared to disposable pads, while research published in 2024 highlights their long life span of 5–10 years, significantly reducing solid menstrual waste. Further evidence from the Journal of South Asian Federation of Obstetrics and Gynecology notes that India produces over 12 Million sanitary pads annually, creating long-lasting waste that menstrual cups can substantially offset due to their decade-long usability. With rising environmental consciousness, increased promotion in public programs, supportive policies on waste management, and growing consumer acceptance of eco-friendly solutions, the strong sustainability advantage of menstrual cups continues to propel market demand and drive the growth of the India menstrual cups market.

Access Full Report @ https://www.databridgemarketresearch.com/reports/india-menstrual-cups-market

Data Bridge Market Research analyses that the India Menstrual Cups Market is USD 27.38 million in 2033 from USD 15.43 million in 2025, growing with the CAGR of 7.6% in the forecast period of 2026 to 2033.

Key Findings of the Study

Long-Term Cost-Effectiveness of Menstrual Cups

Menstrual cups offer significant long-term cost savings in India due to their 5–10 years of reusability, eliminating the recurring expense of disposable sanitary pads and tampons and making them an economical choice for women across both urban and rural regions. Reports highlight substantial financial benefits—for example, a 2023 Economic Times article noted that if 5,000 women used menstrual cups for five years, they would collectively save up to Rs 10 lakh while preventing around 100 tons of sanitary waste; similarly, studies published in the Journal of South Asian Federation of Obstetrics and Gynecology in 2025 emphasized that a one-time investment of USD 20–USD 40 can replace the thousands spent on disposable products, offering critical relief from period poverty. Additionally, a 2025 study in the Korean Journal of Family Medicine found menstrual cups to be cost-effective, easily accessible, and reusable for up to a decade, significantly reducing ongoing menstrual hygiene expenses. This strong economic advantage—particularly beneficial for low-income and marginalized women—acts as a major driver of adoption and contributes substantially to the growth of the India menstrual cup market.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2026 to 2033

|

|

Base Year

|

2025

|

|

Historic Years

|

2018-2024 (Customizable from 2013-2017)

|

|

Quantitative Units

|

Revenue in USD Million

|

|

Segments Covered

|

By Usability (Reusable Menstrual Cups and Disposable Menstrual Cups), Material (Medical Grade Silicone, Natural Gum Rubber (Latex), Thermoplastic Elastomer (TPE), and Others), Shape (Bell-Shaped, Cylindrical, V-Shaped, Disc-Style, Asymmetrical), By Type (Round Solid Stem, Round Hollow Stem, Flat Tab Stem, Pointed/Conical Stem, and Stemless / No-Stem Design), Size (Small, Medium, and Large), Packaging/Kit Variants (Cup Only, Cup + Carry Case, Cup + Sterilizer/Cleaning Accessory, Multi-Pack/Family Pack, and Educational Kit), Age Group (Adolescents (12–17), Young Adults (18–24), Adults (25–39), Mature Adults/Perimenopausal (40–50)), Lifestyle (Students, Working Professionals, Sports & Fitness Users (Athletes), Frequent Travelers/Outdoor Users), Geography (Urban, Semi-Urban, and Rural), End-User (Homecare / Individual Users, Specialty Clinics / Gynecology Centers, Hospitals, NGO & Institutional Programs, and Others), Distribution Channel (Hospital Pharmacies, Retail Pharmacies/Chemists, Online Pharmacies, and Others)

|

|

Market Players Covered

|

Leevacare (India), SAFECUP (India), Avni Wellness (India), Redcliffe Hygine Private Limited (Pee Safe) (India), RG Biocosmetic Private Limited (India), Ami Polymer (India), Asan India (U.K.), HLL LIFECARE LIMITED (India), Reva Eco-nauts (India), Shecup (India), Silky Cup (India), Sirona (India)

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

|

Segment Analysis

The India menstrual cups market is categorized into fifteen notable segments based on usability, material, shape, type, size, packaging / kit variants, age group, lifestyle, geography, end-user, distribution channel

- On the basis of usability, the India menstrual cup market is segmented into reusable menstrual cups and disposable menstrual cups

In 2026, the reusable menstrual cups segment is expected to dominate the India menstrual cups market

In 2026, the reusable menstrual cups segment is expected to dominate the India menstrual cup market with a market share of 83.09% due to their long lifespan, cost-effectiveness, and increasing preference for sustainable menstrual hygiene products.

- On the basis of material, the India menstrual cup market is segmented into medical grade silicone, natural gum rubber (latex), Thermoplastic Elastomer (TPE), and others

In 2026, the medical grade silicone segment dominates the India menstrual cups market

In 2026, the medical grade silicone segment is expected to dominate the India menstrual cup market with a market share of 69.74% due to its high biocompatibility, durability, and safety profile, which make it suitable for long hours of internal use without causing irritation or allergic reactions.

- On the basis of shape, the India menstrual cup market is segmented into bell-shaped, V-shaped, cylindrical, disc-style, asymmetrical. In 2026, the bell-shaped segment is expected to dominate the India menstrual cups market with a market share of 56.48%

- On the basis of type, the India menstrual cup market is segmented into round solid stem, round hollow stem, flat tab stem, and pointed/conical stem. In 2026, the round solid stem segment is expected to dominate the India menstrual cup market with a market share of 39.82%

- On the basis of size, the India menstrual cup market is segmented into medium, small, and large. In 2026, the medium size segment is expected to dominate the India menstrual cup market with a market share of 48.37%

- On the basis of packaging/kit variants, the India menstrual cup market is segmented into cup only, cup + carry case, cup + sterilizer/cleaning accessory, multi-pack/family pack, and educational kit. In 2026, the cup-only segment is expected to dominate the India menstrual cup market with a market share of 53.28%

- On the basis of age group, the India menstrual cup market is segmented into adults (25–39), young adults (18–24), mature adults (40–50) and adolescents (12–17). In 2026, the adults (25–39) segment is expected to dominate the India menstrual cup market with a market share of 46.94%

- On the basis of lifestyle, the India menstrual cup market is segmented into students, working professionals, sports & fitness users, and frequent travelers/outdoor users. In 2026, the working professionals segment is expected to dominate the India menstrual cup market with a market share of 48.11%

- On the basis of geography, the India menstrual cup market is segmented into urban, semi-urban, and rural. In 2026, the urban segment is expected to dominate the India menstrual cup market with a market share of 70.39%

- On the basis of end user, the India menstrual cup market is segmented into homecare / individual users, specialty clinics / genecology centers, hospitals, NGO & institutional programs, and others. In 2026, the homecare/individual users segment is expected to dominate the India menstrual cup market with a market share of 76.28%

- On the basis of distribution channel, the India menstrual cup market is segmented into online pharmacies, retail pharmacies / chemists, hospital pharmacies, others. In 2026, the online pharmacies segment is expected to dominate the India menstrual cup market with a market share of 55.62%

Major Players

Data Bridge Market Research analyzes Sirona Hygiene (India), Redcliffe Hygiene Private Limited (Pee Safe) (India), HLL Lifecare Limited (India), Avni Wellness (Pee Safe) (India), Asan India (India) as the major players operating in the market.

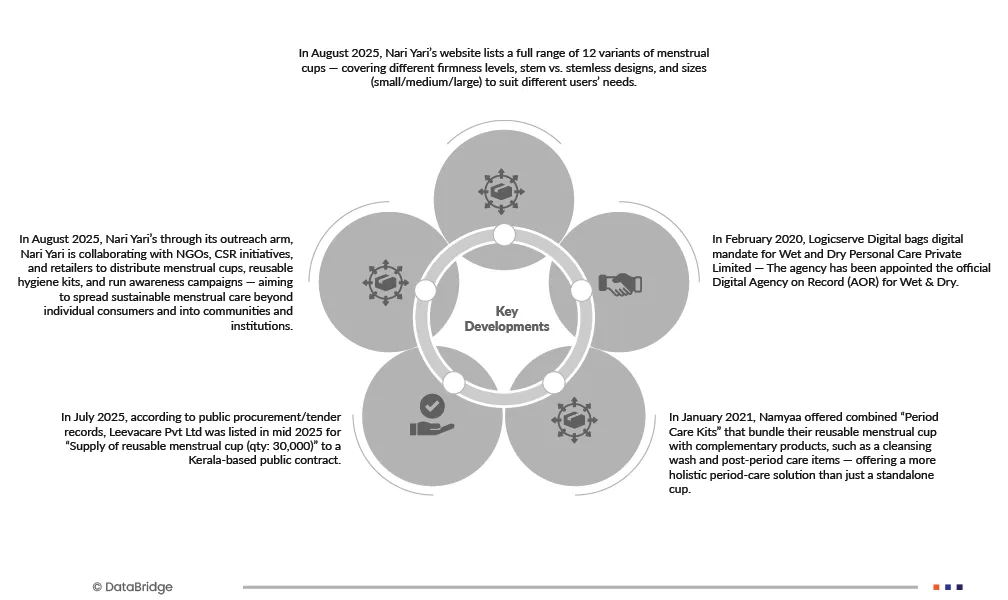

Market Developments

- In July 2025, according to public procurement/tender records, Leevacare Pvt Ltd was listed in mid-2025 for “Supply of reusable menstrual cup (qty: 30,000)” to a Kerala-based public contract.

- In January 2021, Namyaa now offers combined “Period Care Kits” that bundle their reusable menstrual cup with complementary products such as a cleansing wash and post-period care items — offering a more holistic period-care solution than just a standalone cup.

- In August 2025, Nari Yari’s website lists a full range of 12 variants of menstrual cups — covering different firmness levels, stem vs. stemless designs, and sizes (small/medium/large) to suit different users’ needs.

- In August 2025, Nari Yari’s through its outreach arm, Nari Yari is collaborating with NGOs, CSR initiatives, and retailers to distribute menstrual cups, reusable hygiene kits, and run awareness campaigns — aiming to spread sustainable menstrual care beyond individual consumers and into communities and institutions.

- In February 2020, Logicserve Digital bags digital mandate for Wet and Dry Personal Care Private Limited — The agency has been appointed the official Digital Agency on Record (AOR) for Wet & Dry. They will handle paid-media services, social-media management and creative duties for the brand. Wet & Dry — part of PAN Health with brands such as Everteen, NEUD, Nature Sure and ManSure — partnered with Logicserve Digital after a multi-agency pitch. The partnership aims to strengthen their digital presence and expand outreach to their target consumers.

As per Data Bridge Market Research analysis:

For more detailed information about Menstrual Cups Market click here – https://www.databridgemarketresearch.com/reports/india-menstrual-cups-market