Europe Transplant Diagnostics Market

Market Size in USD Billion

CAGR :

%

USD

2.30 Billion

USD

3.72 Billion

2025

2033

USD

2.30 Billion

USD

3.72 Billion

2025

2033

| 2026 –2033 | |

| USD 2.30 Billion | |

| USD 3.72 Billion | |

|

|

|

|

Europe Transplant Diagnostics Market Size

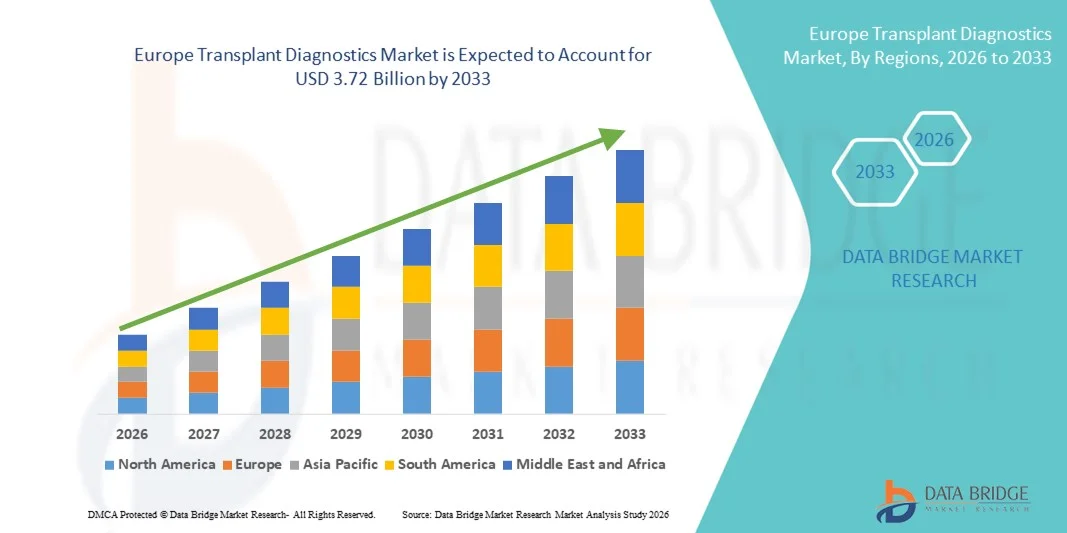

- The Europe transplant diagnostics market size was valued at USD 2.30 billion in 2025 and is expected to reach USD 3.72 billion by 2033, at a CAGR of 6.2% during the forecast period

- The market growth is largely fueled by growing healthcare infrastructure and expenditures, heightened awareness of organ donation and transplant diagnostics, and ongoing technological innovations in testing platforms, which enhance pre‑ and post‑transplant compatibility assessments across major healthcare systems in Europe

- Furthermore, rising patient demand for precise, reliable, and efficient diagnostic solutions to ensure better transplant outcomes as well as supportive government initiatives and increasing R&D investments are positioning transplant diagnostics as an essential component of modern transplant care, thereby significantly boosting industry growth

Europe Transplant Diagnostics Market Analysis

- Transplant diagnostics, including instruments, software, and reagents, are increasingly vital in improving the success rates of organ and tissue transplants across Europe. These solutions support clinicians in accurate donor‑recipient matching, monitoring post‑transplant outcomes, and enabling precision medicine approaches in both solid organ and stem cell transplantation

- The rising adoption of transplant diagnostics is primarily driven by growing organ transplant procedures, increasing awareness of compatibility testing, and technological advancements in PCR‑based and sequencing‑based molecular assays, which allow faster and more accurate detection of HLA types and genetic markers

- Germany dominated the Europe transplant diagnostics market in 2025 with a 28.5% market share, supported by advanced healthcare infrastructure, high transplant procedure volumes, and strong presence of diagnostic companies providing instruments, reagents, and software solutions

- Italy is expected to be the fastest-growing country during the forecast period, driven by improving healthcare infrastructure, rising organ donation rates, and increasing adoption of advanced diagnostic reagents and instruments in hospitals and research laboratories

- Transplant diagnostic reagents segment dominated the market in 2025 with a market share of 45.6%, driven by their critical role in both diagnostic and research applications

Report Scope and Europe Transplant Diagnostics Market Segmentation

|

Attributes |

Europe Transplant Diagnostics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Europe Transplant Diagnostics Market Trends

Advancements in AI and High-Throughput Molecular Testing

- A significant and accelerating trend in the Europe transplant diagnostics market is the integration of artificial intelligence (AI) and high-throughput molecular platforms, enabling faster, more precise donor-recipient matching and improved post-transplant monitoring

- For instance, AI-powered HLA typing systems can analyze complex genetic datasets to predict compatibility more accurately and reduce the risk of graft rejection in solid organ and stem cell transplantation

- High-throughput molecular assays and sequencing-based platforms are being adopted to streamline workflows and reduce turnaround times, supporting both diagnostic and research applications in hospitals and transplant centers

- The integration of AI with molecular diagnostics allows automated anomaly detection and predictive outcome modeling, providing clinicians with actionable insights to optimize immunosuppressive therapy and transplant success rates

- The trend towards intelligent, faster, and integrated diagnostic systems is transforming transplant care, driving adoption across hospitals, research laboratories, and commercial service providers as stakeholders prioritize accuracy, efficiency, and improved patient outcomes

- In addition, miniaturized and portable diagnostic instruments are gaining traction, allowing point-of-care testing and rapid compatibility assessments directly within transplant centers

- For instance, portable PCR-based platforms enable clinicians in Italy and Spain to conduct on-site pre-transplant testing, reducing delays and improving patient management

Europe Transplant Diagnostics Market Dynamics

Driver

Rising Organ Transplant Procedures and Demand for Precision Testing

- The increasing volume of organ and stem cell transplants across Europe, coupled with growing awareness of compatibility testing, is a major driver for transplant diagnostics market growth

- For instance, in 2024, major hospitals in Germany and France adopted high-throughput HLA typing systems to support growing solid organ transplant programs, accelerating diagnostics adoption

- Clinicians and hospitals are demanding precise, rapid, and reliable testing to reduce graft rejection and improve post-transplant outcomes, positioning advanced diagnostics as essential tools in modern transplant care

- Furthermore, the expansion of hospital-based transplant centers and commercial service providers is fueling the adoption of molecular assays, sequencing technologies, and diagnostic reagents across multiple transplant types

- For instance, increasing investment in hospital laboratories in Italy and Spain has enabled the deployment of integrated diagnostic solutions, allowing faster pre-transplant compatibility assessments and personalized therapy planning

- Growing government initiatives and reimbursement support for transplant diagnostics are further encouraging adoption across European countries

- For instance, national healthcare programs in the U.K. and Germany are providing coverage for advanced HLA and molecular testing, making it more accessible to patients and hospitals

Restraint/Challenge

High Costs and Regulatory Compliance Hurdles

- The high cost of advanced transplant diagnostics instruments, reagents, and sequencing-based platforms poses a significant barrier to widespread adoption in certain European countries

- For instance, small hospitals and research labs in Eastern Europe may delay adoption due to limited budgets, particularly for AI-enabled or high-throughput molecular diagnostic platforms

- Strict regulatory requirements and compliance standards for transplant diagnostics, including ISO certifications and CE marking, add complexity and time to product approvals, slowing market penetration

- Furthermore, concerns around data privacy and the secure handling of sensitive genetic and patient information can impact clinician and patient confidence in new diagnostic technologies

- For instance, companies such as Thermo Fisher Scientific and Illumina must ensure compliance with GDPR and other national regulations while implementing AI-based predictive analytics, adding operational and cost challenges

- Limited skilled personnel and specialized training requirements in molecular and sequencing-based diagnostics restrict adoption in smaller centers

- For instance, some hospitals in Italy and Spain need to hire or train specialized staff to operate high-throughput HLA and sequencing platforms, delaying implementation and increasing operational costs

Europe Transplant Diagnostics Market Scope

The market is segmented on the basis of product type, technology, transplant type, application, end user, and distribution channel.

- By Product Type

On the basis of product type, the Europe transplant diagnostics market is segmented into transplant diagnostic instruments, transplant diagnostic software, and transplant diagnostic reagents. The transplant diagnostic reagents segment dominated the market with the largest revenue share of 45.6% in 2025, driven by their essential role in both diagnostic and research applications. Reagents are critical for PCR-based and sequencing-based molecular assays, enabling precise donor-recipient compatibility testing. Hospitals and transplant centers rely heavily on high-quality reagents for accurate HLA typing and graft matching. In addition, reagents are consumables with recurring demand, supporting consistent market revenue growth. The increasing adoption of advanced molecular techniques further strengthens the dominance of the reagent segment.

The transplant diagnostic software segment is expected to witness the fastest CAGR from 2026 to 2033, fueled by the integration of AI and predictive analytics. Software solutions allow automated data interpretation, risk prediction, and reporting, improving clinical decision-making. Hospitals and research labs are increasingly adopting software to streamline workflows, reduce human error, and ensure compliance with regulatory standards. AI-enabled software also facilitates remote monitoring and data sharing, enhancing operational efficiency. Growing investments in digital health platforms and the demand for personalized transplant care are major factors driving rapid software adoption.

- By Technology

On the basis of technology, the market is segmented into PCR-based molecular assays and sequencing-based molecular assays. The PCR-based molecular assays segment dominated the market with 60% share in 2025, due to its widespread use in routine HLA typing and compatibility testing. PCR assays offer fast turnaround times, high accuracy, and cost-effectiveness, making them the preferred choice for many hospitals and transplant centers. They are compatible with multiple sample types and can be easily integrated into existing laboratory workflows. Their proven reliability and regulatory approvals further consolidate market dominance. Hospitals with high transplant volumes particularly rely on PCR-based assays for rapid pre-transplant testing.

The sequencing-based molecular assays segment is anticipated to witness the fastest growth rate from 2026 to 2033, driven by advancements in next-generation sequencing (NGS) technologies. Sequencing-based assays provide deeper insights into genetic compatibility, rare allele detection, and personalized immunogenetic profiling. Increasing adoption in research applications and specialty hospitals is enhancing growth. These assays also support the development of AI-driven predictive models, improving patient outcomes. Rising demand for precision medicine in transplant care is accelerating the shift toward sequencing-based platforms.

- By Transplant Type

On the basis of transplant type, the market is segmented into solid organ transplantation, stem cell transplantation, soft tissue transplantation, bone marrow transplantation, and other transplants. The solid organ transplantation segment dominated with 55% market share in 2025, owing to the high volume of kidney, liver, and heart transplants across Europe. Hospitals rely on transplant diagnostics for accurate donor-recipient matching and post-transplant monitoring. Regulatory requirements for organ compatibility and risk mitigation further drive the adoption of diagnostics in solid organ transplantation. The segment benefits from continuous technological advancements and recurring diagnostic demand for multiple organ types. Established transplant programs in Germany, France, and the U.K. reinforce its market dominance.

The stem cell transplantation segment is expected to witness the fastest CAGR from 2026 to 2033, driven by increasing hematopoietic stem cell transplant procedures for treating cancer and genetic disorders. Stem cell transplants require precise molecular and HLA matching to reduce graft-versus-host disease and improve survival rates. The adoption of AI-enabled diagnostics and advanced sequencing assays is accelerating growth in this segment. Rising R&D activities in personalized cell therapies and supportive reimbursement frameworks are additional growth factors. Emerging markets in Italy and Spain are particularly contributing to the rapid expansion of stem cell diagnostics.

- By Application

On the basis of application, the market is segmented into diagnostic applications and research applications. The diagnostic applications segment dominated the market with 70% share in 2025, due to its critical role in clinical transplant decision-making and post-transplant monitoring. Hospitals and transplant centers rely on diagnostics to ensure graft compatibility and patient safety. Increasing organ transplant volumes and stringent regulatory oversight further strengthen the segment. Diagnostic applications provide actionable insights for clinicians, improving patient outcomes. The recurring nature of testing in both pre- and post-transplant stages reinforces consistent demand. Established healthcare infrastructure in Germany, France, and the U.K. further supports the segment’s dominance.

The research applications segment is expected to witness the fastest growth from 2026 to 2033, driven by the rising need for understanding genetic compatibility, novel biomarkers, and precision medicine approaches. Academic institutions and pharmaceutical companies are increasingly leveraging sequencing-based assays and AI-enabled software to develop new therapies. Expansion of clinical trials and translational research initiatives is accelerating adoption. Rising funding for genomics and transplant research, particularly in Italy and Spain, is a key growth factor.

- By End User

On the basis of end user, the market is segmented into research laboratories and academic institutes, hospital and transplant centers, commercial service providers, and others. The hospital and transplant centers segment dominated with 65% share in 2025, driven by high transplant volumes and direct reliance on diagnostics for patient care. Hospitals conduct pre- and post-transplant testing on a recurring basis, ensuring continuous demand for instruments, reagents, and software. The adoption of AI-enabled diagnostics and integrated platforms is concentrated in large hospital networks. Regulatory compliance and accuracy requirements further reinforce the dominance of hospitals. Major transplant centers in Germany and France act as primary revenue drivers for the segment.

The research laboratories and academic institutes segment is expected to witness the fastest CAGR from 2026 to 2033, fueled by increasing investment in genomic research and novel transplant therapies. These end users leverage high-throughput molecular assays and sequencing technologies for translational research. Expansion of personalized medicine initiatives and collaborations with commercial service providers is accelerating growth. Rising funding for research infrastructure in Italy, Spain, and the U.K. supports the segment’s rapid adoption.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tender and retail sales and others. The direct tender segment dominated with 50% market share in 2025, as hospitals and transplant centers prefer procurement via tenders for bulk purchasing of instruments, reagents, and software. Tender-based procurement ensures regulatory compliance, consistent supply, and cost efficiency. Large-scale hospital chains in Germany and France favor direct tender agreements for recurring diagnostic requirements. Strategic partnerships with diagnostic manufacturers also support dominance. The segment benefits from long-term contracts that secure recurring revenue for suppliers.

The retail sales and others segment is expected to witness the fastest CAGR from 2026 to 2033, driven by the growth of smaller laboratories, private clinics, and point-of-care diagnostic setups. These end users increasingly require flexible purchasing options for instruments and consumables. Rising adoption of portable PCR and sequencing platforms supports retail growth. Expansion of commercial service providers offering outsourced diagnostics further accelerates this segment. Emerging markets in Italy and Spain are key contributors to the segment’s rapid adoption.

Europe Transplant Diagnostics Market Regional Analysis

- Germany dominated the Europe transplant diagnostics market in 2025 with a 28.5% market share, supported by advanced healthcare infrastructure, high transplant procedure volumes, and strong presence of diagnostic companies providing instruments, reagents, and software solutions

- Hospitals and transplant centers in the country prioritize accurate donor-recipient matching, post-transplant monitoring, and precision medicine approaches, making transplant diagnostics an essential component of patient care

- This widespread adoption is further supported by substantial R&D investment, regulatory support, and the presence of key diagnostic companies, establishing Germany as the leading market for both diagnostic instruments and reagents

The Germany Transplant Diagnostics Market Insight

The Germany transplant diagnostics market dominated Europe in 2025 with the largest revenue share of 28.5%, fueled by advanced healthcare infrastructure, high transplant volumes, and strong R&D presence. Hospitals and transplant centers are adopting PCR-based assays, sequencing platforms, and AI-enabled software for precise donor-recipient matching. Government initiatives and reimbursement support further drive adoption across clinical and research applications. Germany’s emphasis on technological innovation and regulatory compliance ensures the integration of advanced diagnostic solutions in both solid organ and stem cell transplantation programs. The country also serves as a hub for diagnostic reagent and instrument development, boosting market growth.

France Transplant Diagnostics Market Insight

The France transplant diagnostics market held 21.5% share in 2025 and is expected to grow steadily during the forecast period, driven by well-established organ transplant programs and rising awareness of compatibility testing. Hospitals and research centers are increasingly implementing high-throughput PCR and sequencing assays to reduce graft rejection rates. Government funding and healthcare policies supporting advanced diagnostic adoption contribute to market expansion. France is witnessing growth across both diagnostic and research applications, with AI-enabled software platforms being adopted for workflow efficiency. The presence of key diagnostic companies and collaborations with academic institutes further stimulate market growth.

U.K. Transplant Diagnostics Market Insight

The U.K. transplant diagnostics market accounted for 19.0% share in 2025 and is anticipated to grow at a notable CAGR during the forecast period, driven by increasing organ transplant procedures and emphasis on personalized patient care. Hospitals and transplant centers are adopting sequencing-based assays, molecular diagnostics, and predictive analytics software to improve post-transplant outcomes. The U.K.’s strong healthcare system, robust regulatory framework, and focus on innovation support adoption across clinical and research applications. Rising awareness among clinicians and patients about compatibility testing is further fueling market growth. Commercial service providers are also contributing to increased accessibility of advanced diagnostics.

Italy Transplant Diagnostics Market Insight

The Italy transplant diagnostics market is expected to be the fastest-growing country in Europe during the forecast period, supported by rising organ donation rates, expansion of hospital transplant centers, and increasing adoption of AI-enabled and high-throughput molecular platforms. Hospitals and research laboratories are rapidly implementing PCR-based and sequencing-based diagnostics for both pre- and post-transplant applications. Government initiatives and growing investment in healthcare infrastructure are facilitating wider adoption. The market is also benefiting from collaborations between hospitals, academic institutes, and diagnostic companies. The shift toward personalized medicine and precision diagnostics further accelerates growth.

Europe Transplant Diagnostics Market Share

The Europe Transplant Diagnostics industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific Inc. (U.S.)

- Illumina, Inc. (U.S.)

- Eurobio Scientific SE (France)

- Abbott (U.S.)

- BIOMÉRIEUX (France)

- Bio Rad Laboratories, Inc. (U.S.)

- BD (U.S.)

- GenDx (Netherlands)

- CareDx, Inc. (U.S.)

- Immucor (Spain)

- Eurofins Scientific SE (Luxembourg)

- Hologic, Inc. (U.S.)

- Omixon Inc. (U.S.)

- Ortho Clinical Diagnostics (U.S.)

- Natera, Inc. (U.S.)

- Danaher (U.S.)

- F. Hoffmann La Roche Ltd (Switzerland)

- Biofortuna Limited (U.K.)

- Beckman Coulter, Inc. (U.S.)

- QIAGEN (Netherlands)

What are the Recent Developments in Europe Transplant Diagnostics Market?

- In April 2025, the 38th European Immunogenetics & Histocompatibility Conference (EFI 2025) featured a focus on AlloSeq HCT high‑sensitivity chimerism testing by NGS for transplant surveillance, reflecting broad adoption of next‑generation approaches for monitoring graft health in Europe

- In March 2025, Thermo Fisher Scientific unveiled the One Lambda HybriType HLA Plus Typing Flex kit, an advanced next‑generation sequencing HLA typing solution that enhances depth of immunogenetic testing and improves confidence in donor‑recipient matching

- In October 2023, GenDx, a Eurobio Scientific company, launched NGS‑Turbo® a high‑resolution HLA typing solution designed for Oxford Nanopore sequencing devices that can deliver results from blood sample to final high‑resolution HLA typing in as little as three hours, representing a major advancement in transplant diagnostics workflows

- In May 2022, CareDx showcased its NGS‑based AlloSeq portfolio including AlloSeq Tx17, Tx9, AlloSeq cfDNA, and AlloSeq HCT at the European Federation for Immunogenetics (EFI) conference in Amsterdam, highlighting expanded pre‑ and post‑transplant testing solutions for European labs and clinicians

- In April 2021, CareDx presented innovative pre‑ and post‑transplant diagnostic solutions including advanced HLA typing assays and post‑transplant surveillance tools during the EFI 2021 Conference, reinforcing its commitment to advancing transplant diagnostics across European research and clinical communities

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.