Global Anastrozole Tablets Market

Market Size in USD Million

CAGR :

%

USD

410.71 Million

USD

512.25 Million

2025

2033

USD

410.71 Million

USD

512.25 Million

2025

2033

| 2026 –2033 | |

| USD 410.71 Million | |

| USD 512.25 Million | |

|

|

|

|

Anastrozole Tablets Market Size

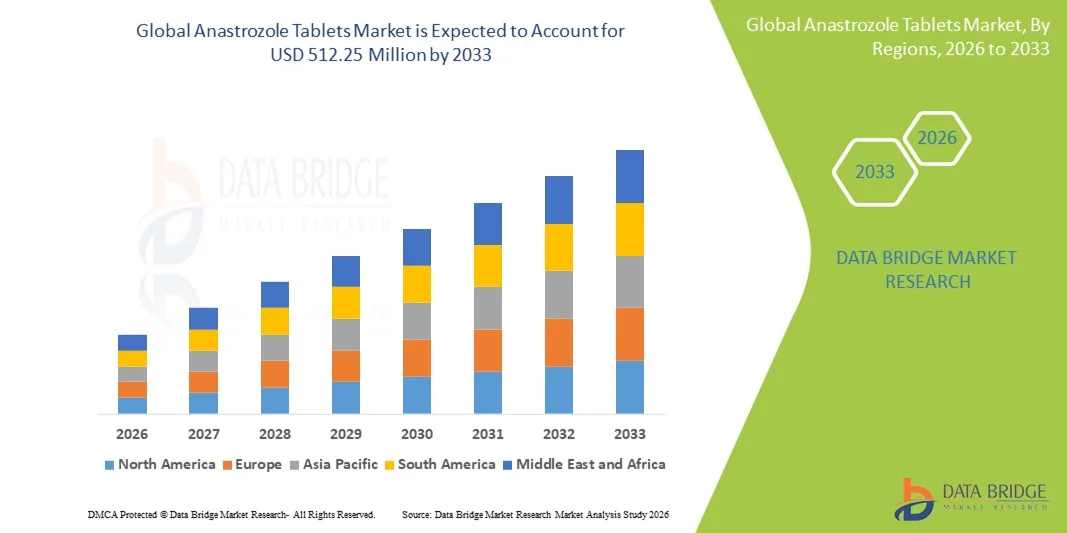

- The global anastrozole tablets market size was valued at USD 410.71 million in 2025 and is expected to reach USD 512.25 million by 2033, at a CAGR of 2.80% during the forecast period

- This growth is largely driven by increasing incidence of hormone receptor‑positive breast cancer, particularly in postmenopausal women, coupled with rising awareness and early diagnosis of breast cancer

- Furthermore, the market is benefiting from patent expiries and the proliferation of generic anastrozole, making treatment more accessible and cost‑effective, while demand for well-tolerated, long-term hormonal therapy continues to rise

Anastrozole Tablets Market Analysis

- Anastrozole tablets, used as aromatase inhibitors in the treatment of hormone receptor–positive breast cancer, are increasingly vital components of breast cancer therapy in both adjuvant and metastatic settings due to their proven efficacy, tolerability, and integration into standard treatment protocols

- The escalating demand for anastrozole tablets is primarily fueled by the rising incidence of breast cancer among postmenopausal women, increasing awareness of early diagnosis, and growing preference for well-tolerated, long-term hormonal therapies over alternative treatment options

- North America dominated the anastrozole tablets market with the largest revenue share of 38.2% in 2025, characterized by advanced healthcare infrastructure, high cancer prevalence, and strong presence of key pharmaceutical companies, with the U.S. experiencing substantial adoption of anastrozole, particularly in postmenopausal patients, driven by innovations in generic formulations and supportive reimbursement policies

- Asia-Pacific is expected to be the fastest growing region in the anastrozole tablets market during the forecast period, due to improving healthcare access, rising awareness of breast cancer treatments, and increasing government initiatives to support oncology care

- Generic Anastrozole Tablets segment dominated the market with a market share of 55.7% in 2025, driven by increased affordability, wide availability, and established efficacy in standard hormonal therapy regimens

Report Scope and Anastrozole Tablets Market Segmentation

|

Attributes |

Anastrozole Tablets Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Anastrozole Tablets Market Trends

Increasing Adoption of Personalized Hormonal Therapy

- A significant and accelerating trend in the global anastrozole tablets market is the growing integration of personalized hormonal therapy programs, combining anastrozole treatment with genetic and biomarker profiling to optimize efficacy and minimize side effects

- For instance, hospitals in the U.S. and Europe are utilizing gene expression tests to guide anastrozole dosing and treatment duration, improving patient outcomes in hormone receptor–positive breast cancer

- Personalized therapy enables oncologists to tailor treatment plans according to individual patient profiles, potentially reducing adverse events and enhancing long-term adherence to therapy

- Integration with electronic health records (EHR) allows clinicians to track patient response and adjust anastrozole treatment schedules more precisely, supporting data-driven decision-making

- This trend towards precision medicine and patient-specific hormonal therapy is reshaping clinical expectations and treatment protocols, leading pharmaceutical companies to focus on developing companion diagnostics alongside anastrozole formulations

- The demand for anastrozole therapies customized to patient biomarkers is growing rapidly across both developed and emerging markets, as clinicians increasingly prioritize treatment efficacy and safety

- Advances in digital health solutions, such as mobile apps and telemedicine platforms, are facilitating remote patient monitoring, adherence tracking, and real-time management of side effects associated with anastrozole therapy

- Partnerships between pharmaceutical companies and diagnostic firms are emerging to develop co-branded testing kits that support targeted anastrozole therapy, further driving adoption of personalized treatment approaches

Anastrozole Tablets Market Dynamics

Driver

Rising Breast Cancer Incidence and Awareness

- The increasing prevalence of hormone receptor–positive breast cancer among postmenopausal women, coupled with rising awareness of early diagnosis and treatment options, is a major driver for the growing demand for anastrozole tablets

- For instance, in March 2025, Pfizer expanded its anastrozole access program in North America to support early-stage breast cancer patients through hospital and outpatient channels

- As awareness of the benefits of hormonal therapy grows, anastrozole is increasingly prescribed as a first-line adjuvant treatment, providing long-term disease control

- The expansion of government screening programs and breast cancer awareness campaigns is supporting greater adoption of anastrozole therapy in both urban and rural regions

- Improved patient education, physician training, and guideline-based prescribing practices are driving consistent uptake of anastrozole across developed and emerging markets, ensuring better clinical outcomes

- Increasing insurance coverage and reimbursement for hormonal therapies in key markets is facilitating wider access to anastrozole, particularly among older women who are at higher risk of breast cancer

- Growing investments in oncology research and clinical trials focusing on combination therapies with anastrozole are encouraging adoption and expanding indications for its use

Restraint/Challenge

Side Effects and Access Barriers

- Concerns surrounding adverse effects such as bone density loss, joint pain, and cardiovascular issues pose a significant challenge to broader adoption of anastrozole tablets, impacting patient compliance

- For instance, clinical reports highlighting musculoskeletal side effects have caused some patients to discontinue therapy prematurely or switch to alternative aromatase inhibitors

- Addressing these concerns through patient monitoring, dose adjustments, and supplementation is crucial for maintaining adherence and treatment effectiveness

- High cost and limited access to branded formulations in certain regions can hinder adoption, particularly in emerging markets with constrained healthcare infrastructure

- While generic versions improve affordability, awareness about proper administration and long-term management is still needed to encourage consistent usage among patients

- Overcoming these challenges through patient education, improved access to generics, and supportive care programs will be vital for sustained market growth in the global anastrozole tablets industry

- Regulatory hurdles and lengthy approval processes for new formulations or combination therapies can delay market entry, limiting timely availability of innovative anastrozole products

- Cultural and social barriers in certain regions, including misconceptions about hormonal therapy, may negatively impact patient acceptance and adherence, necessitating targeted awareness campaigns

Anastrozole Tablets Market Scope

The market is segmented on the basis of type, strength, drug class, end-users, and distribution channel.

- By Type

On the basis of type, the anastrozole tablets market is segmented into generic anastrozole tablets and branded anastrozole tablets. The generic anastrozole tablets segment dominated the market with the largest revenue share of 55.7% in 2025, driven by their affordability, widespread availability, and equivalent efficacy compared to branded formulations. Patients and healthcare providers increasingly prefer generics as a cost-effective option, especially in emerging markets where healthcare budgets are constrained. The segment benefits from the patent expiry of branded anastrozole products, enabling multiple manufacturers to supply high-quality generic alternatives. In addition, generics are widely covered under insurance plans, increasing patient accessibility. Generic anastrozole tablets are also supported by government programs and hospital formularies that prioritize cost savings without compromising clinical outcomes. The established supply chains of generic manufacturers ensure continuous availability across retail and hospital pharmacies.

The branded anastrozole tablets segment is anticipated to witness the fastest growth rate of 7.1% CAGR from 2026 to 2033, fueled by ongoing innovation in formulation, patient support programs, and marketing initiatives by pharmaceutical companies. Branded formulations are often perceived as higher quality by some physicians and patients, particularly in developed markets. Companies continue to invest in awareness campaigns emphasizing adherence, side-effect management, and combination therapies. Branded products also benefit from loyalty programs and patient assistance schemes that improve compliance. Furthermore, combination therapies and newer dosage forms in branded anastrozole tablets are creating niche growth opportunities. Premium pricing and targeted marketing in North America and Europe are accelerating adoption in oncology specialty clinics and hospitals.

- By Strength

On the basis of strength, the market is segmented into 1 mg and Others. The 1 mg strength segment dominated the market in 2025 with a revenue share of 61.8%, as it represents the standard dose recommended for adjuvant and metastatic breast cancer therapy in postmenopausal women. Physicians and oncologists widely prescribe 1 mg tablets due to established clinical guidelines, efficacy, and safety profiles. This strength is supported by extensive clinical research, making it the preferred option in hospitals, clinics, and outpatient oncology centers. Its consistent dosing simplifies patient compliance and monitoring of side effects over long-term therapy. Generic and branded versions of 1 mg tablets are readily available, ensuring broad patient access. In addition, bulk procurement by hospitals and government programs further strengthens the segment’s dominance.

The Others segment, including strengths such as 0.5 mg or 2 mg tablets, is expected to witness the fastest growth during the forecast period due to increasing adoption in personalized therapy approaches and dosage adjustments based on patient-specific requirements. Oncologists may prescribe lower or higher doses for patients with comorbidities or varying tolerance levels. Growth is also driven by emerging clinical studies exploring combination therapies that require alternative strengths. Hospitals and specialty oncology centers are gradually incorporating these variations to optimize therapeutic outcomes. The expansion of clinical trials in Asia-Pacific and Latin America further supports demand for non-standard strengths.

- By Drug Class

On the basis of drug class, the market is segmented into aromatase inhibitors and antineoplastics. The aromatase inhibitor segment dominated the market with a revenue share of 73.5% in 2025, as anastrozole is widely recognized as a standard aromatase inhibitor for postmenopausal breast cancer patients. This class is preferred over other therapies due to its high efficacy in reducing estrogen production and controlling tumor progression. The segment’s dominance is supported by clinical guidelines from organizations such as NCCN and ESMO. Its extensive adoption across hospitals, clinics, and specialty oncology centers contributes to steady revenue growth. Patients benefit from well-documented safety profiles and long-term tolerability, further reinforcing preference for aromatase inhibitors. Pharmaceutical companies continue to invest in R&D to optimize formulations within this class.

The antineoplastic segment is anticipated to witness the fastest growth rate of 6.8% CAGR from 2026 to 2033, driven by increasing exploration of combination therapies where anastrozole is used alongside other chemotherapeutic agents. Ongoing clinical trials targeting multiple cancer pathways create opportunities for integration with antineoplastic regimens. The growth is supported by hospitals and oncology specialty clinics adopting combination therapy protocols. Pharmaceutical firms are focusing on co-branded therapies and supportive care packages to increase adoption. Expansion in emerging markets with improving oncology infrastructure also fuels segment growth.

- By End-Users

On the basis of end-users, the market is segmented into clinics, hospitals, and others. The hospital segment dominated the market with a revenue share of 58.9% in 2025, as hospitals serve as the primary point of care for breast cancer diagnosis, treatment, and follow-up. Hospitals provide structured treatment plans, monitor patient adherence, and manage side effects, making them the preferred setting for anastrozole therapy. Strong purchasing power and formulary inclusion allow hospitals to procure both branded and generic tablets in bulk. Oncology departments ensure continuous supply and professional administration. The dominance is further supported by the availability of patient education programs and clinical monitoring facilities. Hospitals in North America and Europe account for the majority of consumption due to advanced oncology care infrastructure.

The clinics segment is expected to witness the fastest growth rate of 7.3% CAGR from 2026 to 2033, driven by the rising number of outpatient oncology clinics and specialized cancer care centers offering personalized therapy programs. Clinics provide convenient access for follow-up consultations and long-term therapy management. Adoption is higher in urban regions where patients prefer localized treatment options. Growth is also fueled by telemedicine integration, allowing clinicians to monitor adherence and side effects remotely. The rise of private oncology clinics in Asia-Pacific and Latin America contributes to increasing market share for clinic-based administration.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into hospital pharmacy, retail pharmacy, and online pharmacy. The hospital pharmacy segment dominated the market in 2025 with a revenue share of 54.6%, as hospitals are the primary distribution point for oncology medications including anastrozole. Hospital pharmacies ensure regulated dispensing, patient counseling, and adherence monitoring. The integration with electronic medical records facilitates prescription accuracy and inventory management. Strong purchasing contracts with pharmaceutical companies ensure continuous supply. Patients receiving therapy at hospitals prefer in-house pharmacy access for convenience and reliability. In addition, hospitals often provide patient assistance programs and subsidized pricing for long-term therapy.

The online pharmacy segment is expected to witness the fastest growth rate of 8.2% CAGR from 2026 to 2033, driven by increasing e-commerce adoption, patient preference for home delivery, and the growing trend of telemedicine consultations. Online pharmacies offer subscription models, price comparisons, and doorstep delivery, enhancing convenience for long-term therapy patients. Growth is particularly strong in developed regions with high digital literacy. Mobile apps and automated reminders for refill and adherence further support segment expansion. Emerging markets are gradually adopting online platforms as access to retail and hospital pharmacies remains limited in rural areas.

Anastrozole Tablets Market Regional Analysis

- North America dominated the anastrozole tablets market with the largest revenue share of 38.2% in 2025, characterized by advanced healthcare infrastructure, high cancer prevalence, and strong presence of key pharmaceutical companies

- Patients and healthcare providers in the region highly value the established efficacy, well-documented safety profile, and availability of both branded and generic anastrozole formulations, along with supportive patient assistance programs offered by pharmaceutical companies

- This widespread adoption is further supported by strong insurance coverage, government-led cancer awareness campaigns, and the presence of leading pharmaceutical manufacturers, establishing anastrozole as a preferred adjuvant and metastatic breast cancer therapy across hospitals, clinics, and outpatient oncology centers

U.S. Anastrozole Tablets Market Insight

The U.S. anastrozole tablets market captured the largest revenue share of 41% in 2025 within North America, fueled by the high prevalence of hormone receptor–positive breast cancer and widespread adoption of guideline-based hormonal therapies. Patients are increasingly prioritizing effective, well-tolerated, and long-term adjuvant treatment options. The growing preference for both branded and generic anastrozole formulations, combined with robust insurance coverage and patient assistance programs, further propels the market. Moreover, ongoing awareness campaigns and clinical programs supporting early diagnosis and treatment adherence are significantly contributing to market expansion.

Europe Anastrozole Tablets Market Insight

The Europe anastrozole tablets market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by rising breast cancer incidence and increasing awareness of hormonal therapies. The region’s focus on advanced healthcare infrastructure, combined with government initiatives promoting cancer screening, is fostering the adoption of anastrozole tablets. European patients are also drawn to the convenience of oral therapy and long-term disease management benefits. The market is experiencing significant growth across hospitals, oncology clinics, and outpatient centers, with anastrozole therapy being incorporated into both new treatment protocols and guideline updates.

U.K. Anastrozole Tablets Market Insight

The U.K. anastrozole tablets market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising awareness of hormone receptor–positive breast cancer and increasing adoption of personalized therapy approaches. In addition, concerns regarding recurrence and long-term disease management are encouraging physicians and patients to choose anastrozole as a preferred adjuvant therapy. The U.K.’s strong healthcare infrastructure, well-established oncology guidelines, and robust e-prescription and pharmacy networks are expected to continue stimulating market growth.

Germany Anastrozole Tablets Market Insight

The Germany anastrozole tablets market is expected to expand at a considerable CAGR during the forecast period, fueled by growing awareness of hormonal therapy options and increasing demand for innovative oncology treatments. Germany’s well-developed healthcare system, emphasis on evidence-based treatment protocols, and widespread adoption of clinical guidelines promote the use of anastrozole, particularly in hospital and specialty clinic settings. Integration of patient monitoring systems and supportive care programs is also becoming increasingly prevalent, aligning with local expectations for high-quality cancer care.

Asia-Pacific Anastrozole Tablets Market Insight

The Asia-Pacific anastrozole tablets market is poised to grow at the fastest CAGR of 9.5% during 2026–2033, driven by increasing breast cancer incidence, improving healthcare infrastructure, and rising awareness of hormonal therapy benefits in countries such as China, Japan, and India. The region's growing inclination towards early cancer detection and adoption of guideline-based treatments is driving the uptake of anastrozole tablets. Furthermore, expanding insurance coverage and availability of affordable generic formulations are enabling broader patient access, particularly in emerging markets.

Japan Anastrozole Tablets Market Insight

The Japan anastrozole tablets market is gaining momentum due to the country’s high awareness of breast cancer and strong preference for oral, long-term therapy options. Adoption is driven by increasing focus on postmenopausal breast cancer management and integration of anastrozole therapy with routine clinical monitoring. Japan’s advanced healthcare infrastructure, coupled with patient support programs and government-led awareness initiatives, is fueling growth. Moreover, the aging population is such asly to increase demand for effective, tolerable, and convenient treatment options in both hospital and outpatient settings.

India Anastrozole Tablets Market Insight

The India anastrozole tablets market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rising breast cancer awareness, improving healthcare access, and expanding availability of generic formulations. India represents a rapidly growing market for oral hormonal therapies, with hospitals, oncology clinics, and retail pharmacies increasingly stocking anastrozole tablets. The push towards early diagnosis, patient education initiatives, and affordability through generics and local manufacturers are key factors propelling market growth in India.

Anastrozole Tablets Market Share

The Anastrozole Tablets industry is primarily led by well-established companies, including:

- AstraZeneca (U.K.)

- Teva Pharmaceutical Industries Ltd (Israel)

- Dr. Reddy’s Laboratories Ltd (India)

- Sun Pharmaceutical Industries Ltd (India)

- Cipla (India)

- Novartis AG (Switzerland)

- Hikma Pharmaceuticals PLC (U.K.)

- Natco Pharma Limited (India)

- Apotex Inc (Canada)

- Aurobindo Pharma Limited (India)

- Lupin (India)

- Torrent Pharmaceuticals Ltd (India)

- Glenmark Pharmaceuticals Ltd (India)

- Alkem Laboratories Ltd (India)

- Intas Pharmaceuticals Ltd (India)

- Hetero Drugs Ltd (India)

- Taj Pharmaceuticals Ltd (India)

- Zydus Cadila (India)

- Strides Pharma Science Ltd (India)

- Cerata Pharmaceuticals LLP (India)

What are the Recent Developments in Global Anastrozole Tablets Market?

- In April 2024, a sub‑study of the IBIS-II prevention trial reported that anastrozole treatment did not cause significant long-term changes in body composition (fat or fat-free mass) in high-risk postmenopausal women, helping address concerns about weight gain with preventive therapy

- In March 2024, researchers at Manchester University NHS Foundation Trust published research (in Lancet Oncology) on a highly sensitive blood test that measures oestradiol levels, which could help predict which post menopausal women at high risk will or will not benefit from preventive anastrozole therapy. The study found that up to 25% of high-risk women have very low baseline oestradiol, and these women may derive little benefit from anastrozole

- In November 2023, the UK’s Medicines and Healthcare products Regulatory Agency (MHRA) granted a licence variation for anastrozole to be used for primary prevention of breast cancer in post menopausal women at moderate or high risk. This new indication aligns with previous trial evidence (IBIS-II) showing that anastrozole can reduce breast cancer incidence in this high-risk group

- In November 2023, NHS England announced that around 289,000 post-menopausal women in England could now be eligible to take anastrozole as a preventive therapy, estimating that up to 2,000 breast cancer cases might be prevented if ~25 % of eligible women opt in. This rollout is based on a modelling of uptake and such asly benefits, tied to the newly granted MHRA licence

- In May 2023, data from the Phase III AERAS trial showed that extending adjuvant anastrozole therapy to 10 years in postmenopausal women with hormone-receptor positive breast cancer improved disease-free survival (DFS) significantly compared to stopping at 5 years

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.