Global Botanical Drug Based Oncology Market

Market Size in USD Million

CAGR :

%

USD

28.12 Million

USD

55.25 Million

2024

2032

USD

28.12 Million

USD

55.25 Million

2024

2032

| 2025 –2032 | |

| USD 28.12 Million | |

| USD 55.25 Million | |

|

|

|

|

Botanical Drug-Based Oncology Market Size

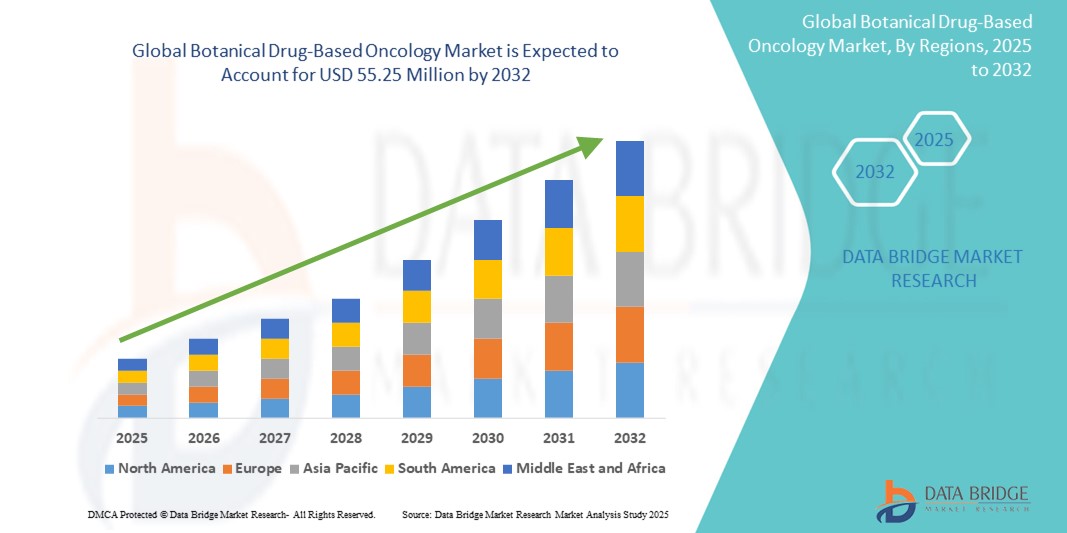

- The global botanical drug-based oncology market size was valued at USD 28.12 million in 2024 and is expected to reach USD 55.25 million by 2032, at a CAGR of 8.81% during the forecast period

- The market growth is primarily driven by increasing interest in plant-derived therapies as complementary and alternative treatments in oncology, alongside rising cancer prevalence and patient preference for less toxic therapeutic options

- Furthermore, ongoing research into bioactive compounds, combined with regulatory support for botanical drug approvals and integration into mainstream cancer care, is enhancing market potential. These synergistic factors are driving the adoption of botanical oncology drugs, thereby significantly contributing to the market’s expansion

Botanical Drug-Based Oncology Market Analysis

- Botanical drug-based oncology therapies, derived from plant and natural sources, are becoming essential components of integrative cancer care due to their ability to offer complementary benefits such as reduced toxicity, immune system support, and potential tumor suppression, enhancing treatment outcomes in both clinical and supportive care settings

- The rising demand for botanical oncology drugs is primarily driven by the increasing global cancer incidence, growing interest in plant-derived treatments among patients and healthcare providers, and expanding clinical research validating the efficacy of phytochemicals such as curcumin, paclitaxel, and vinblastine in oncology

- North America dominated the botanical drug-based oncology market with the largest revenue share of 39.1% in 2024, attributed to strong regulatory frameworks, advanced R&D capabilities, and a growing consumer shift toward evidence-based natural therapies, particularly in the U.S. where integrative oncology practices are on the rise

- Asia-Pacific is expected to be the fastest growing region in the botanical oncology market during the forecast period due to the presence of well-established traditional medicine systems, increasing cancer prevalence, and rising government investments in herbal and botanical drug development

- The plant-based segment dominated the botanical drug-based oncology market with a market share of 72.8% in 2024, driven by the extensive availability of medicinal plants, proven anti-cancer activity of many phytochemicals, and widespread acceptance in both modern and traditional cancer treatment frameworks

Report Scope and Botanical Drug-Based Oncology Market Segmentation

|

Attributes |

Botanical Drug-Based Oncology Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Botanical Drug-Based Oncology Market Trends

“Integration of Botanical Compounds into Mainstream Oncology Protocols”

- A significant and accelerating trend in the global botanical drug-based oncology market is the integration of clinically validated plant-derived compounds into conventional cancer treatment regimens. This convergence of traditional botanical knowledge with modern oncology is significantly enhancing patient outcomes by reducing toxicity and improving therapeutic efficacy

- For instance, paclitaxel, a chemotherapy drug derived from the Pacific yew tree, is now a widely used standard in treating ovarian, breast, and non-small cell lung cancers. Similarly, curcumin from turmeric is being studied extensively for its potential to reduce inflammation and inhibit tumor progression when used alongside chemotherapy

- Advancements in extraction technologies and formulation science are enabling the creation of highly bioavailable botanical compounds, allowing for more consistent therapeutic outcomes. Some formulations are being designed to enhance absorption and target specific cancer types with improved precision

- The growing interest in plant-based interventions is supported by regulatory agencies such as the U.S. FDA, which has introduced dedicated pathways for botanical drug approval, encouraging investment in clinical trials and commercialization

- The seamless integration of botanical therapies into comprehensive cancer care models facilitates personalized and supportive treatment experiences for patients. Through combined use with chemotherapy or radiation, botanical oncology drugs help manage side effects, boost immunity, and improve overall quality of life

- This trend toward holistic and integrative cancer care is fundamentally reshaping patient and provider expectations, prompting pharmaceutical companies to develop botanical oncology pipelines. Consequently, firms such as Himalaya Wellness and PhytoHealth are advancing clinical-grade botanical products with targeted anti-cancer applications

- The demand for botanical oncology drugs that align with natural health trends and clinical efficacy is growing rapidly across both developed and emerging markets, as healthcare systems increasingly prioritize integrative and patient-centered approaches to cancer care

Botanical Drug-Based Oncology Market Dynamics

Driver

“Rising Cancer Burden and Patient Preference for Natural Therapies”

- The increasing global cancer burden, combined with heightened demand for non-toxic, patient-friendly therapies, is a major driver behind the adoption of botanical drug-based oncology treatments. Patients are seeking alternatives that offer fewer side effects while supporting conventional treatment outcomes

- For instance, multiple studies have documented the supportive role of herbal formulations such as astragalus, mistletoe, and ginseng in managing cancer-related fatigue, nausea, and immune suppression. Such findings are encouraging oncologists to explore complementary approaches using standardized botanical products

- As awareness grows around the benefits of integrative oncology, hospitals and cancer centers are incorporating botanical agents into patient care plans. Government initiatives and research funding aimed at validating traditional medicine are also contributing to market expansion

- The convenience of capsule-based or oral botanical formulations, combined with the rise of natural health trends and improved product accessibility through pharmacies and e-commerce, further supports market growth in both high-income and emerging economies

Restraint/Challenge

“Standardization and Regulatory Compliance Hurdles”

- Challenges in standardizing botanical drug compositions and navigating diverse regulatory frameworks pose significant barriers to market growth. Variability in raw materials, manufacturing processes, and bioactive compound concentrations can lead to inconsistent therapeutic outcomes

- For instance, while the U.S. FDA provides a specific regulatory pathway for botanical drugs, the high cost and complexity of meeting clinical trial requirements discourage smaller firms from entering the market. Limited large-scale randomized trials on many botanicals hinder their inclusion in mainstream oncology protocols

- Furthermore, inconsistent global regulations and quality assurance practices can erode trust among healthcare providers and consumers

- Some regions lack harmonized standards for labeling, testing, and approval of botanical oncology drugs, complicating international distribution

- High development costs, consumer skepticism about the efficacy of natural cancer treatments, and the presence of non-standardized or unregulated herbal products in the market contribute to adoption challenges

- Overcoming these issues through investment in quality control, scientific validation, and regulatory collaboration is essential for sustaining long-term growth in the botanical oncology market

Botanical Drug-Based Oncology Market Scope

The market is segmented on the basis of source, drug type, dosage form, and end user.

- By Source

On the basis of source, the botanical drug-based oncology market is segmented into plant-based, algae-based, macroscopic fungi, and others. The plant-based segment dominated the market with the largest revenue share of 72.8% in 2024, attributed to the extensive availability of medicinal plants with proven anti-cancer properties such as paclitaxel (from yew tree), vincristine (from periwinkle), and curcumin (from turmeric). These plant-derived compounds are widely accepted in both traditional and conventional cancer therapies due to their effectiveness and lower toxicity.

The macroscopic fungi segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing research on mushroom-derived polysaccharides such as lentinan and PSK, which exhibit immunomodulatory and anti-tumor properties. The rising interest in functional fungi for oncology applications, especially in integrative cancer care across Asia and North America, is contributing to the segment's rapid expansion.

- By Drug Type

On the basis of drug type, the botanical drug-based oncology market is segmented into prescription and over-the-counter (OTC). The prescription segment held the largest market revenue share in 2024, driven by the clinical use of standardized botanical formulations in cancer treatment protocols. Regulatory bodies are increasingly approving prescription-grade botanical drugs after rigorous clinical trials, especially in North America and Europe.

The over-the-counter segment botanical drug-based oncology market, owing to the rising popularity of herbal oncology supplements and supportive care products that are readily accessible to patients seeking adjunctive or preventive cancer therapies. Consumer preference for natural, self-directed treatments is fueling demand in this segment.

- By Dosage Form

On the basis of dosage form, the botanical drug-based oncology market is segmented into tablets, capsules, pills, injectables, and others. The tablet segment led the market in 2024, benefiting from patient convenience, precise dosage, and long shelf life. Tablets are widely adopted across global markets due to their standardized formulation and ease of administration, particularly in outpatient oncology settings.

The injectables segment is expected to experience the fastest growth rate from 2025 to 2032, as advanced formulations of botanical compounds are developed for intravenous use, ensuring higher bioavailability and rapid therapeutic action. This growth is supported by increasing R&D investments in injectable botanical drug delivery technologies and clinical oncology applications.

- By End User

On the basis of end user, the botanical drug-based oncology market is segmented into hospitals & clinics, research & academic institutions, retail pharmacies, and online pharmacies. The hospitals & clinics segment dominated the market with the largest revenue share in 2024, reflecting the growing integration of botanical drugs into formal oncology treatment pathways and supportive care services. The expansion of cancer treatment facilities and oncology-focused hospitals is further driving this segment.

The online pharmacies segment is projected to grow at the fastest CAGR from 2025 to 2032, driven by the increasing consumer shift toward e-commerce, rising digital health awareness, and greater availability of botanical oncology supplements via online platforms. This trend is particularly strong in urban and tech-savvy populations looking for convenient access to complementary cancer care solutions.

Botanical Drug-Based Oncology Market Regional Analysis

- North America dominated the botanical drug-based oncology market with the largest revenue share of 39.1% in 2024, attributed to strong regulatory frameworks, advanced R&D capabilities, and a growing consumer shift toward evidence-based natural therapies

- Patients and healthcare providers in the region increasingly value the lower toxicity, immune-supportive properties, and complementary nature of botanical oncology drugs, especially when integrated with conventional treatments such as chemotherapy and radiation

- This widespread adoption is further supported by advanced healthcare infrastructure, favorable regulatory frameworks (such as the U.S. FDA’s botanical drug pathway), and a rising preference for holistic, evidence-based approaches to cancer care, positioning botanical oncology drugs as a key component of personalized cancer treatment strategies

U.S. Botanical Drug-Based Oncology Market Insight

The U.S. botanical drug-based oncology market captured the largest revenue share of 76.3% in 2024 within North America, driven by the rapid adoption of integrative oncology practices and increased patient interest in natural, supportive cancer therapies. The demand for botanical drugs is supported by a growing clinical research base and the FDA’s regulatory framework that enables the approval of standardized botanical formulations. Consumer preferences for holistic treatment options, combined with strong academic and research collaborations, continue to advance the market significantly.

Europe Botanical Drug-Based Oncology Market Insight

The Europe botanical drug-based oncology market is projected to grow at a substantial CAGR throughout the forecast period, propelled by increasing clinical trials, regulatory support for botanical product development, and public acceptance of plant-based cancer therapies. The region’s commitment to complementary medicine and personalized care is fueling demand across outpatient clinics, hospitals, and integrative health centers. Botanical drugs are being increasingly incorporated into supportive care for cancer patients, particularly in Germany, France, and the Nordic countries.

U.K. Botanical Drug-Based Oncology Market Insight

The U.K. botanical drug-based oncology market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by a rising focus on patient-centered care and demand for alternative treatment pathways. The NHS and private cancer care providers are increasingly exploring the integration of botanical-based interventions for palliative and supportive oncology care. Public interest in natural remedies, combined with expanding research in phytopharmacology, is expected to foster further market growth.

Germany Botanical Drug-Based Oncology Market Insight

The Germany botanical drug-based oncology market is expected to expand at a considerable CAGR during the forecast period, driven by the country’s strong tradition in phytomedicine, regulatory backing for botanical therapeutics, and a mature healthcare infrastructure. Germany remains a leader in botanical drug research and manufacturing, with growing clinical application in oncology settings. The country's emphasis on quality, sustainability, and clinical efficacy is aligning well with the adoption of botanical oncology treatments.

Asia-Pacific Botanical Drug-Based Oncology Market Insight

The Asia-Pacific botanical drug-based oncology market is poised to grow at the fastest CAGR of 25.2% during the forecast period of 2025 to 2032, driven by increasing cancer incidence, supportive government policies, and the widespread use of traditional medicine systems in countries such as China and India. The region benefits from abundant botanical resources, low manufacturing costs, and growing investments in oncology research focused on natural products. Expanding awareness of integrative therapies and improved healthcare infrastructure are further accelerating market penetration.

Japan Botanical Drug-Based Oncology Market Insight

The Japan botanical drug-based oncology market is gaining momentum due to the country's deep-rooted use of Kampo medicine and strong regulatory support for natural therapies. Growing cancer prevalence and a rapidly aging population are increasing demand for safer, supportive care solutions. Japan’s focus on precision medicine and digital health integration is also enabling innovative delivery of botanical oncology drugs through personalized care models.

India Botanical Drug-Based Oncology Market Insight

The India botanical drug-based oncology market accounted for the largest market revenue share in Asia Pacific in 2024, driven by the growing integration of Ayurveda and traditional medicine into mainstream oncology care. Government initiatives such as AYUSH, coupled with expanding research on herbal anti-cancer compounds, are catalyzing industry growth. India’s rising cancer burden, expanding middle class, and increased access to herbal therapeutics are fostering strong demand across both rural and urban healthcare systems.

Botanical Drug-Based Oncology Market Share

The botanical drug-based oncology industry is primarily led by well-established companies, including:

- PhytoHealth Corporation (Taiwan)

- Indena S.p.A. (Italy)

- Himalaya Wellness Company (India)

- Avesthagen Limited (India)

- Kampo Research Inc. (Japan)

- Zhejiang Conba Pharmaceutical Co., Ltd. (China)

- Tsumura & Co. (Japan)

- Napo Pharmaceuticals, Inc. (U.S.)

- Boehringer Ingelheim International GmbH (Germany)

- Hutchmed (China) Limited (China)

- Artemis Bio-solutions Inc. (U.S.)

- ZandCell AB (Sweden)

- Nature's Sunshine Products, Inc. (U.S.)

- Dr. Willmar Schwabe GmbH & Co. KG (Germany)

- Tongrentang Technologies Co., Ltd. (China)

- Herbalife International of America, Inc. (U.S.)

- Gaia Herbs, Inc. (U.S.)

- Yiling Pharmaceutical Co., Ltd. (China)

- Bioforce AG (A.Vogel) (Switzerland)

- Sabinsa Corporation (U.S.)

What are the Recent Developments in Global Botanical Drug-Based Oncology Market?

- In April 2024, PhytoHealth Corporation, a Taiwan-based biopharmaceutical company, initiated a Phase II clinical trial for its botanical drug PHY906, derived from a traditional Chinese herbal formulation. The trial targets advanced pancreatic cancer and aims to evaluate the drug’s efficacy in reducing chemotherapy-induced toxicity. This development highlights PhytoHealth’s commitment to advancing evidence-based botanical oncology therapies and integrating traditional knowledge with modern clinical research to address unmet needs in cancer treatment

- In March 2024, Indena S.p.A., an Italian leader in botanical active ingredient development, announced a strategic partnership with a U.S.-based oncology research center to co-develop a new botanical extract targeting triple-negative breast cancer. The collaboration focuses on leveraging Indena’s expertise in phytochemistry and sustainable sourcing to develop clinically validated botanical formulations for aggressive cancer types. This marks a significant step in bridging scientific innovation and natural compound-based oncology research

- In February 2024, Himalaya Wellness Company, a global player in herbal healthcare, launched CystCare Botanica, an adjunct botanical therapy designed to support ovarian cancer treatment. Developed in collaboration with Indian oncology institutions, the formulation is based on Ayurvedic principles and supported by preclinical data. This reflects a growing trend of blending traditional medicine with modern oncological applications and promoting regional innovation in botanical therapeutics

- In January 2024, Avesthagen Limited, a genomics and botanical drug development company in India, received regulatory clearance to begin clinical trials of its botanical drug AV-D8 for colorectal cancer. The drug, derived from a proprietary blend of Indian medicinal plants, aims to provide anti-inflammatory and tumor-inhibiting benefits. This milestone showcases the increasing regulatory support for botanical oncology drug development in emerging markets

- In December 2023, Kampo Research Inc., based in Japan, expanded its research initiative with leading universities to study the efficacy of traditional Kampo herbal medicines in post-chemotherapy recovery. The project aims to standardize formulations and validate their use in managing side effects such as fatigue, nausea, and immunosuppression. This underscores the continued integration of culturally significant botanical remedies into modern oncology protocols and Japan’s proactive approach to personalized, patient-centric cancer care

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.