Global Dental Hygiene Devices Market

Market Size in USD Billion

CAGR :

%

USD

10.24 Billion

USD

14.26 Billion

2025

2033

USD

10.24 Billion

USD

14.26 Billion

2025

2033

| 2026 –2033 | |

| USD 10.24 Billion | |

| USD 14.26 Billion | |

|

|

|

|

Dental Hygiene Devices Market Size

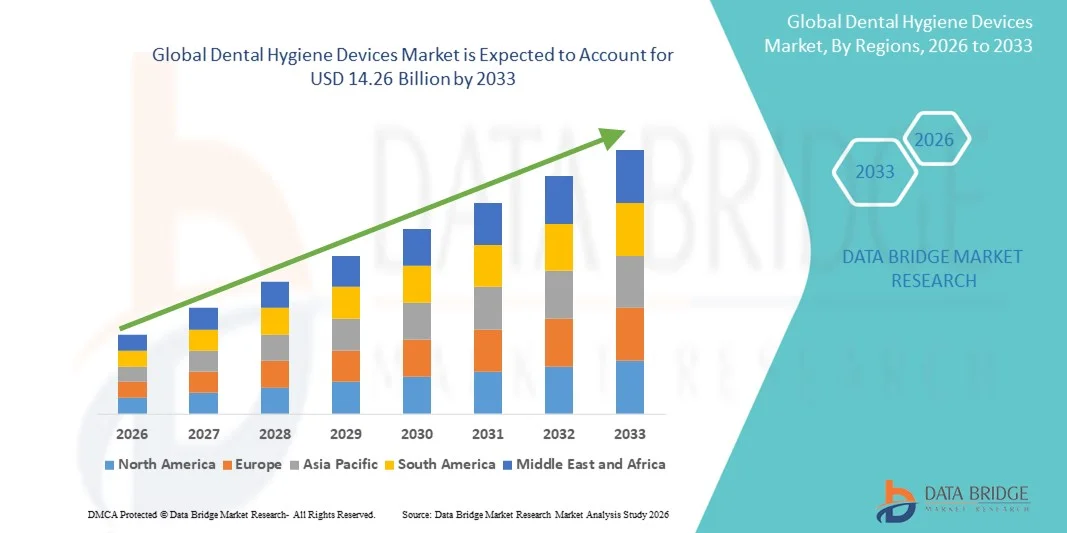

- The global dental hygiene devices market size was valued at USD 10.24 billion in 2025 and is expected to reach USD 14.26 billion by 2033, at a CAGR of 4.23% during the forecast period

- The market growth is largely driven by increasing awareness of oral health, rising prevalence of dental diseases, and growing adoption of advanced dental care solutions across both developed and emerging regions

- Furthermore, escalating consumer preference for innovative, convenient, and effective oral care devices, coupled with technological advancements in electric toothbrushes, water flossers, and interdental cleaning devices, is propelling market expansion. These factors collectively are accelerating the adoption of dental hygiene devices, thereby significantly boosting the industry's growth

Dental Hygiene Devices Market Analysis

- Dental hygiene devices, including dental burs, handpieces, lasers, and scalers, are increasingly essential in both preventive and therapeutic oral care, offering precision, efficiency, and improved patient outcomes in dental treatments

- The growing demand for dental hygiene devices is primarily driven by rising awareness of oral health, increasing prevalence of dental disorders, and the adoption of advanced technologies in dental practices to enhance treatment quality and patient comfort

- North America dominated the dental hygiene devices market with the largest revenue share of 40.2% in 2025, supported by high dental care awareness, strong healthcare infrastructure, and the presence of leading dental device manufacturers, with the U.S. witnessing substantial adoption of advanced dental handpieces and laser systems

- Asia-Pacific is expected to be the fastest growing region in the dental hygiene devices market during the forecast period due to increasing dental service penetration, rising disposable incomes, and growing awareness of modern oral care practices in countries such as China and India

- Dental handpieces segment dominated the dental hygiene devices market with a market share of 41.8% in 2025, driven by their extensive use in routine dental procedures, reliability, and continuous technological advancements improving performance and ergonomics

Report Scope and Dental Hygiene Devices Market Segmentation

|

Attributes |

Dental Hygiene Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Dental Hygiene Devices Market Trends

Advanced Digital and Smart Oral Care Devices

- A significant and accelerating trend in the global dental hygiene devices market is the integration of smart technologies, including AI-enabled brushing feedback and connectivity with mobile apps, enhancing oral care personalization and monitoring

- For instance, Oral-B iO series toothbrushes provide real-time brushing guidance and track oral hygiene habits through connected smartphone applications. Similarly, Philips Sonicare 9900 Prestige offers AI-based pressure sensors and adaptive brushing modes to optimize cleaning performance

- AI integration in dental devices allows features such as personalized brushing suggestions, detection of missed areas, and habit tracking to improve oral hygiene outcomes. For instance, some devices can alert users to improper brushing techniques or insufficient coverage for specific dental zones

- The seamless integration of dental hygiene devices with mobile applications and cloud-based platforms enables users to track progress, set oral care goals, and share data with dental professionals for better preventive care

- This trend towards intelligent, connected, and interactive dental devices is reshaping consumer expectations for oral hygiene. Consequently, companies such as Colgate are developing app-enabled toothbrushes with AI coaching and real-time feedback for enhanced user engagement

- The demand for smart and digitally connected dental hygiene devices is growing rapidly across both home and professional segments, as consumers increasingly seek convenience, personalization, and improved oral care outcomes

- The adoption of smart, connected, and app-enabled dental hygiene devices is increasing rapidly in both developed and emerging markets, as consumers prioritize convenience, real-time feedback, and improved oral health management

Dental Hygiene Devices Market Dynamics

Driver

Increasing Awareness of Oral Health and Preventive Care

- The rising prevalence of dental disorders, coupled with increasing consumer awareness of oral hygiene and preventive dental care, is a significant driver for the growing demand for dental hygiene devices

- For instance, in March 2025, Philips Sonicare launched a global awareness campaign promoting the benefits of preventive oral care using electric toothbrushes and interdental cleaning devices. Such initiatives by key companies are expected to drive market expansion in the forecast period

- As consumers become more conscious of oral health issues, dental hygiene devices offer advanced features such as effective plaque removal, gum care, and guided cleaning, providing a superior alternative to traditional manual oral care methods

- Furthermore, the increasing adoption of connected and smart oral care devices enables monitoring of oral hygiene habits, making these tools integral to personal preventive healthcare routines

- The convenience of app connectivity, personalized brushing feedback, and easy availability through retail and online channels are key factors propelling the adoption of dental hygiene devices in both home and clinical settings

- The rising prevalence of dental diseases and increasing frequency of dental visits are further pushing consumers and dental professionals to adopt advanced, user-friendly, and data-driven dental hygiene devices

- The trend towards proactive dental care and increased endorsement by dental professionals further contributes to market growth

Restraint/Challenge

High Cost and Limited Awareness in Emerging Regions

- Concerns regarding the high cost of advanced dental hygiene devices, including electric toothbrushes, dental lasers, and handpieces, pose a significant challenge to broader market adoption. These premium-priced devices are often less accessible in price-sensitive regions

- For instance, reports indicate that many consumers in developing countries still rely on manual toothbrushes due to budget constraints, limiting the penetration of advanced dental hygiene technologies

- Addressing affordability issues through cost-effective models, promotions, and educational campaigns is crucial for expanding market reach. Companies such as Oral-B and Colgate emphasize both quality and value offerings to attract a wider consumer base

- In addition, limited awareness about the benefits of modern dental devices and preventive oral care practices in some regions hinders adoption, requiring focused marketing and professional advocacy

- While urban markets show strong uptake, the combination of price sensitivity and lack of oral health education in rural and emerging regions remains a key barrier

- The perceived complexity of smart or AI-enabled devices may discourage certain consumer groups, particularly older adults or those unfamiliar with technology, from adoption despite potential health benefits

- Overcoming these challenges through targeted education, product diversification, and affordable options will be vital for sustained market growth

Dental Hygiene Devices Market Scope

The market is segmented on the basis of product type, age group, and end user

- By Product Type

On the basis of product type, the dental hygiene devices market is segmented into dental burs, dental handpieces, dental lasers, and dental scalers. The dental handpieces segment dominated the market with the largest revenue share of 41.8% in 2025, driven by their extensive use in routine dental procedures such as cavity preparation, polishing, and cleaning. Dental handpieces are highly valued by dental professionals for precision, efficiency, and ergonomic design, making them a staple in dental clinics worldwide. Their compatibility with multiple dental attachments and continual technological advancements, such as high-speed motors and noise reduction, further contribute to their dominance. Increasing demand from dental hospitals and private clinics, along with rising dental treatment rates in urban areas, is supporting the segment's growth. In addition, manufacturers are investing in advanced, durable, and sterilizable handpieces, enhancing adoption among professionals. The segment’s dominance is also reinforced by its integration into preventive, restorative, and cosmetic dental procedures.

The dental lasers segment is anticipated to witness the fastest growth rate during the forecast period due to rising adoption of minimally invasive and pain-free dental treatments. Dental lasers offer advantages such as precision, reduced bleeding, faster healing, and patient comfort, which make them highly sought-after in modern dentistry. Growing awareness among dental practitioners about laser-assisted procedures, coupled with the introduction of cost-effective and portable laser devices, is fueling adoption. The segment is further supported by increasing investments in dental technology by hospitals and private practices. Expanding applications in soft tissue surgeries, periodontal treatments, and cosmetic procedures are also driving growth. As patient preference for advanced and less invasive treatments increases, dental lasers are expected to gain significant traction globally.

- By Age Group

On the basis of age group, the dental hygiene devices market is segmented into 0-8 years old, 9-21 years old, 22-34 years old, 35-44 years old, 45-64 years old, 65-74 years old, and >74 years old. The 22-34 years old segment dominated the market in 2025 due to higher awareness about preventive oral care and willingness to invest in advanced dental hygiene devices. Young adults are increasingly adopting electric toothbrushes, water flossers, and other smart dental devices to maintain oral health and aesthetics. They also actively follow recommendations from dental professionals and online health resources, increasing demand for modern oral care solutions. The growing influence of lifestyle trends, social media, and health consciousness among this demographic further drives adoption. In addition, disposable income and inclination toward digital health tracking encourage the use of app-enabled oral care devices. Dental practices also target this age group with specialized preventive programs, supporting the segment’s revenue dominance.

The 65-74 years old segment is expected to witness the fastest growth rate during forecast period, due to an increasing aging population and rising dental care needs associated with tooth loss, gum diseases, and other oral health issues. Older adults are adopting devices that simplify oral hygiene routines and improve accessibility, such as electric toothbrushes with pressure sensors and ergonomic designs. Growing awareness of the link between oral health and systemic health is encouraging preventive care among seniors. The segment also benefits from increased focus by manufacturers on age-specific device designs and features. Rising healthcare initiatives targeting elderly oral care and easy availability through retail and online pharmacies further accelerate adoption.

- By End User

On the basis of end user, the dental hygiene devices market is segmented into hospital pharmacies, retail pharmacies, and online pharmacies. The retail pharmacies segment dominated the market with the largest revenue share in 2025, supported by widespread availability, consumer trust, and convenience in purchasing dental hygiene devices. Retail pharmacies allow immediate access to a wide range of products including dental scalers, handpieces, and electric toothbrushes, making them a preferred choice for both routine and advanced oral care needs. The segment also benefits from promotional campaigns, in-store guidance, and professional endorsements that boost consumer confidence. In addition, partnerships between dental device manufacturers and pharmacy chains enhance visibility and product penetration. The retail pharmacy channel remains critical for reaching both urban and semi-urban populations.

The online pharmacies segment is expected to witness the fastest CAGR during the forecast period due to increasing e-commerce penetration and consumer preference for home delivery. Online channels provide access to a broader product portfolio, price comparisons, and detailed product information, appealing to tech-savvy and convenience-oriented consumers. The segment is further supported by growth in digital marketing, app-based ordering, and subscription models for oral care products. Expanding internet penetration in emerging regions and trust in online payment systems are also key growth enablers. Online pharmacies facilitate easy repeat purchases, ensuring continuity in oral care routines, which drives the rapid adoption of dental hygiene devices.

Dental Hygiene Devices Market Regional Analysis

- North America dominated the dental hygiene devices market with the largest revenue share of 40.2% in 2025, supported by high dental care awareness, strong healthcare infrastructure, and the presence of leading dental device manufacturers, with the U.S. witnessing substantial adoption of advanced dental handpieces and laser systems

- Consumers in the region increasingly prioritize preventive oral care, opting for electric toothbrushes, dental handpieces, and smart oral hygiene devices that offer enhanced cleaning efficiency and convenience

- This widespread adoption is further supported by high disposable incomes, a health-conscious population, and the growing availability of professional dental services and retail channels, establishing dental hygiene devices as a preferred choice for maintaining oral health across all age groups

U.S. Dental Hygiene Devices Market Insight

The U.S. dental hygiene devices market captured the largest revenue share of 82% in 2025 within North America, fueled by high awareness of oral health and the widespread adoption of advanced dental care technologies. Consumers increasingly prioritize preventive oral care, opting for electric toothbrushes, dental handpieces, and dental scalers for improved hygiene and convenience. The growing preference for connected and app-enabled devices, combined with the availability of professional dental services and retail accessibility, further propels market growth. Moreover, the rising prevalence of dental disorders and strong dental insurance coverage is significantly contributing to the market’s expansion.

Europe Dental Hygiene Devices Market Insight

The Europe dental hygiene devices market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing awareness of preventive oral care and the rising prevalence of dental diseases. The increase in urbanization, coupled with demand for technologically advanced dental devices, is fostering adoption among consumers and dental professionals. European consumers are also attracted to the convenience, efficiency, and ergonomic design of modern dental devices. The region is witnessing significant growth across hospitals, clinics, and retail pharmacies, with dental hygiene devices being integrated into both routine dental care and advanced treatment practices.

U.K. Dental Hygiene Devices Market Insight

The U.K. dental hygiene devices market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising oral health awareness and the increasing trend of preventive dental care. Concerns regarding gum diseases, cavities, and tooth decay are encouraging both consumers and dental practitioners to adopt modern oral hygiene solutions. The U.K.’s strong retail and e-commerce infrastructure, alongside government initiatives promoting oral health, is expected to continue stimulating market growth. In addition, easy availability of advanced devices such as dental lasers, handpieces, and scalers supports the adoption across both residential and professional segments.

Germany Dental Hygiene Devices Market Insight

The Germany dental hygiene devices market is expected to expand at a considerable CAGR during the forecast period, fueled by growing awareness of oral hygiene and preventive dental care practices. Germany’s well-developed healthcare infrastructure, combined with high consumer spending on health and wellness, promotes the adoption of advanced dental devices. The integration of modern dental hygiene tools such as electric handpieces and dental lasers into routine treatments is becoming increasingly prevalent. Consumers also prefer devices offering precision, reliability, and ergonomic design, aligning with local expectations for quality and efficiency in oral care.

Asia-Pacific Dental Hygiene Devices Market Insight

The Asia-Pacific dental hygiene devices market is poised to grow at the fastest CAGR of 23% during the forecast period of 2026 to 2033, driven by increasing urbanization, rising disposable incomes, and awareness of oral health in countries such as China, Japan, and India. The region’s growing inclination toward preventive care and the modernization of dental clinics are driving the adoption of dental hygiene devices. Furthermore, as APAC emerges as a manufacturing hub for dental equipment, affordability and accessibility of devices are expanding to a wider consumer base. Government health initiatives and increasing penetration of retail and online pharmacies further accelerate market growth.

Japan Dental Hygiene Devices Market Insight

The Japan dental hygiene devices market is gaining momentum due to high oral health awareness, a health-conscious population, and advanced dental care infrastructure. The market emphasizes preventive care, and adoption of devices such as dental handpieces, lasers, and scalers is driven by technological innovation and ergonomic designs. Integration of smart features in dental devices, including app connectivity and AI-based guidance, is fueling growth. Moreover, Japan’s aging population is likely to spur demand for user-friendly and efficient oral care solutions across both home and clinical settings.

India Dental Hygiene Devices Market Insight

The India dental hygiene devices market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rising awareness of oral health, rapid urbanization, and increasing disposable incomes. India represents a significant growth opportunity for dental hygiene devices, with rising demand in hospitals, retail pharmacies, and online channels. The push toward preventive dental care, coupled with affordable and locally manufactured devices, is propelling market expansion. Moreover, government initiatives promoting oral health awareness and dental check-ups are supporting the adoption of modern dental hygiene solutions across urban and semi-urban populations.

Dental Hygiene Devices Market Share

The Dental Hygiene Devices industry is primarily led by well-established companies, including:

- Colgate‑Palmolive Company (U.S.)

- Procter & Gamble (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- Unilever PLC (U.K.)

- GSK plc (U.K.)

- 3M (U.S.)

- Church & Dwight Co., Inc. (U.S.)

- Peter Brasseler Holdings, LLC (U.S.)

- Ultradent Products, Inc. (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- Carestream Health (U.S.)

- Ivoclar Vivadent AG (Liechtenstein)

- Lion Corporation (Japan)

- Nakanishi Inc. (Japan)

- BIOLASE, Inc. (U.S.)

- Dentsply Sirona Inc. (U.S.)

- Straumann Group (Switzerland)

- GC Corporation (Japan)

- Young Innovations, Inc. (U.S.)

- Den‑Mat Holdings, LLC (U.S.)

What are the Recent Developments in Global Dental Hygiene Devices Market?

- In June 2025, Waterpik expanded its oral care lineup with the Cordless 1100 Water Flosser, an ADA‑accepted device featuring PRECISIONPULSE™ technology that delivers targeted water pressure and pulsations to remove up to 99.9% of plaque bacteria from treated areas, combining convenience with high‑performance cleaning previously typical only in larger devices. This launch reflects Waterpik’s commitment to making advanced dental hygiene technology more accessible and convenient for everyday use

- In January 2025, Philips launched an advanced Sonicare electric toothbrush with adaptive brushing technology that uses high‑speed sonic movements and automatic adjustment of brushing dynamics to improve biofilm and plaque removal compared with standard power brushes, reflecting ongoing innovation in ergonomic and intelligent consumer dental hygiene tools designed to optimize cleanliness regardless of user technique

- In October 2024, Soocas unveiled the NEOS II — the first 2‑in‑1 electric toothbrush with an integrated built‑in water flosser, combining brushing and flossing functions into a single compact device that streamlines daily oral care routines and improves overall hygiene efficiency for home users. This innovation represents a significant advancement in multifunctional dental hygiene technology, appealing to consumers who seek convenience and comprehensive care in one tool

- In September 2024, Waterpik introduced the Sensonic Complete Care, an ADA‑accepted combo unit that merges a high‑pressure water flosser with an advanced sonic toothbrush, offering ten water pressure settings, five specialized flossing tips, and three brushing modes a notable innovation in integrated, customizable home oral care devices. This combined system aims to significantly improve overall oral health and hygiene outcomes in a single unit

- In August 2023, Waterpik launched the Sensonic Electric Toothbrush, featuring advanced sonic cleaning technology with three brushing modes and ergonomic design, which clinical evidence suggests can remove up to four times more plaque in hard‑to‑reach areas versus manual brushing reinforcing the shift toward clinically backed electric toothbrush adoption for enhanced preventive care at home

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.