Global Health Insurance Market

Market Size in USD Billion

CAGR :

%

USD

219.58 Billion

USD

403.44 Billion

2024

2032

USD

219.58 Billion

USD

403.44 Billion

2024

2032

| 2025 –2032 | |

| USD 219.58 Billion | |

| USD 403.44 Billion | |

|

|

|

|

Health Insurance Market Size

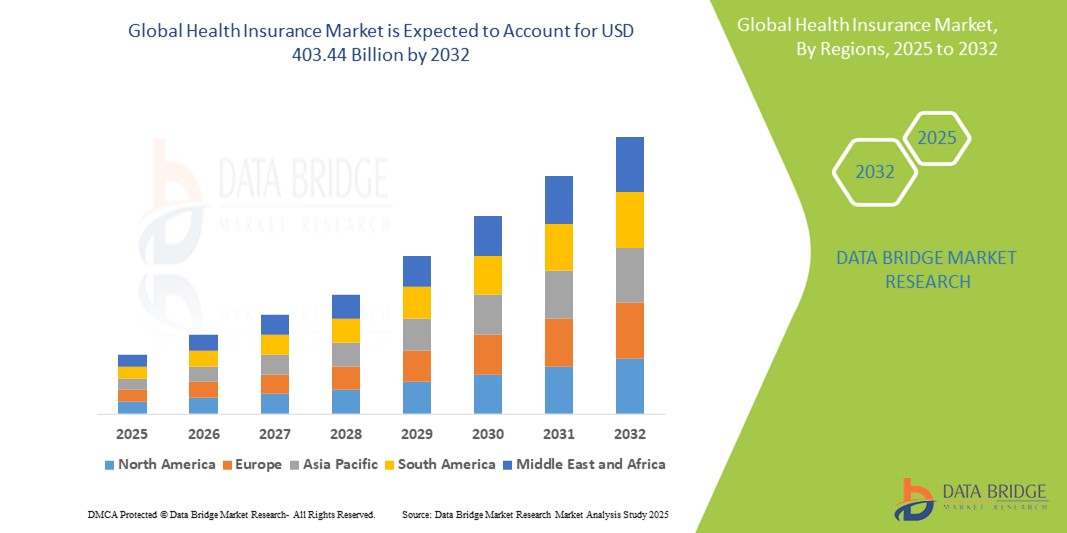

- The global health insurance market size was valued at USD 219.58 billion in 2024 and is expected to reach USD 403.44 billion by 2032, at a CAGR of 7.90% during the forecast period

- The market growth is largely fueled by increasing adoption of smart home technologies and the rising demand for enhanced security solutions among residential and commercial users. This trend is supported by advancements in IoT and mobile connectivity

- Growing urbanization, coupled with the proliferation of connected devices and integration with voice assistants such as Alexa and Google Assistant, is driving demand for Health Insurances as part of integrated home automation systems

Health Insurance Market Analysis

- The current health insurance market is witnessing a strong shift in consumer preference toward lifetime coverage plans that ensure uninterrupted access to medical benefits throughout different life stages

- Insurers are increasingly tailoring long-term policies with added wellness features and continuous renewal benefits to meet the rising demand for comprehensive and enduring health protection

- North America dominates the Health Insurance Market with the largest revenue share of 40.06% in 2024, driven by a well-established healthcare infrastructure and high consumer awareness about health insurance benefits

- Asia-Pacific is expected to be the fastest growing region in the health insurance market during the forecast period share of 9.14% in 2025, fueled by rising healthcare expenditures, increased awareness about health insurance, and government-driven reforms in countries such as China, India, and Japan

- The preferred provider organization (PPO) plans are widely preferred with market share of 28.05% due to their flexibility in choosing healthcare providers and specialists without requiring referrals, making them popular among consumers who value freedom of choice and convenience

Report Scope and Health Insurance Market Segmentation

|

Attributes |

Health Insurance Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Health Insurance Market Trends

“Growing Preference for Lifetime Health Insurance Coverage”

- Lifetime health insurance offers continuous coverage, eliminating the need for frequent policy renewals

- Insurers are tailoring plans to provide comprehensive benefits that adapt to policyholders' evolving health needs

- Consumers are increasingly valuing the stability and predictability that lifetime coverage provides

- The shift towards lifetime plans is influencing insurers to innovate and enhance their offerings

- This trend underscores a market focus on sustained health security and customer-centric solutions

- For instance, individuals are now more inclined to choose lifelong policies that eliminate the stress of frequent renewals and offer consistent coverage even during retirement years

- In conclusion, this emphasis on lifetime health coverage reflects a market trend centered on long-term value and personal well-being, making it a key factor in shaping the future of health insurance offerings

Health Insurance Market Dynamics

Driver

“Increasing Awareness About Long-Term Health Security”

- Increasing awareness of long-term health security is driving people to prioritize insurance as a necessary part of life planning especially after global events such as the COVID-19 pandemic highlighted the financial burden of medical care

- Healthcare inflation is prompting individuals to protect themselves from unpredictable costs by choosing comprehensive plans that cover major illnesses and hospitalizations

- Public and private sector campaigns such as India's Ayushman Bharat Digital Mission and employer-led insurance education programs have improved understanding of insurance benefits among wider populations

- For instance, after the second wave of COVID-19 many families opted for higher sum insured policies and lifetime renewals to avoid being financially unprepared in similar future situations

- Consumers are no longer viewing health insurance as a tax-saving product but as a core financial tool for lifelong security and access to better treatment facilities

- In conclusion, this changing mindset is expanding the insured base and encouraging providers to launch flexible and inclusive long-term plans for lasting market growth

Restraint/Challenge

“Complexity in Policy Structures and Coverage Terms”

- The complexity and lack of transparency in health insurance policies make it hard for consumers to understand coverage and exclusions leading to confusion and unexpected expenses during claims

- Many plans contain technical jargon, fine print, and varied definitions which first-time buyers often misinterpret affecting their trust in insurers

- For instance, a customer might assume full hospitalization coverage but later face limits on room rent or specific treatments not clearly communicated

- Even tech-savvy users struggle to compare plans due to inconsistent benefit formats, co-payment clauses, and renewal terms which reduces market confidence

- The problem extends beyond purchase to claims and renewals where unclear communication can frustrate policyholders and damage insurer reputation

- Simplifying policy language and improving advisory services are essential to build customer trust and support healthier market growth

Health Insurance Market Scope

The market is segmented on the basis of type, communication protocol, unlocking mechanism, and application.

- By Type

On the basis of type, the health insurance market is segmented into product and solutions. The deadbolt segment dominates the largest market in 2025, the products segment is expected to dominate the market due to its widespread adoption and the growing demand for comprehensive insurance policies that cover a variety of health risks. Customers increasingly prefer customizable and flexible product offerings that address their specific needs, fueling this segment’s growth. Moreover, advancements in digital platforms have made purchasing and managing health insurance products more accessible and efficient.

Meanwhile, the solutions segment is also gaining traction as healthcare providers and insurers adopt integrated technologies to improve service delivery. Solutions such as telemedicine platforms, claims management software, and wellness monitoring tools are becoming essential components of the health insurance ecosystem. These solutions enhance operational efficiency and customer experience, driving investment and innovation within the market. As a result, the solutions segment is expected to show steady growth alongside the products segment.

- By Services

On the basis of services, the health insurance market is segmented into inpatient treatment, outpatient treatment, medical assurance, and others. The inpatient treatment segment holds a significant share of the market, driven by the rising number of hospitalizations and surgeries. As healthcare costs increase globally, insured individuals seek robust inpatient coverage to mitigate the financial burden of prolonged hospital stays and complex medical procedures.

The outpatient treatment segment is also experiencing substantial growth, fueled by the increasing preference for cost-effective and convenient healthcare services that do not require overnight hospitalization. Medical assurance services, including preventive care and health monitoring, are gaining importance as insurers focus on improving long-term health outcomes and reducing claims. Meanwhile, the ‘others’ category, which includes services such as emergency care and wellness programs, continues to diversify the service offerings in the market.

- By Level of Coverage

On the basis of level of coverage, the health insurance market is segmented into bronze, silver, gold, and platinum. The bronze segment typically offers basic coverage with lower premiums, making it an attractive option for cost-conscious consumers. This segment holds a significant share due to its affordability, especially among younger and healthier individuals who prefer minimal coverage for unexpected health events.

The silver and gold segments, which provide more comprehensive coverage and higher benefits, are witnessing steady growth as consumers increasingly prioritize better protection against medical expenses. The gold segment, in particular, appeals to middle-income groups seeking a balance between cost and coverage. Meanwhile, the platinum segment offers the highest level of coverage with premium benefits and lower out-of-pocket costs, catering to customers who demand extensive protection and are willing to pay higher premiums for peace of mind.

- By Services Providers

On the basis of services, the health insurance market is segmented into public health insurance providers and private health insurance providers. Public health insurance providers continue to play a crucial role, especially in regions where government-backed schemes offer broad coverage to large populations at subsidized rates. These providers are instrumental in promoting healthcare accessibility and reducing financial strain on vulnerable groups through national or regional health programs.

Private health insurance providers, on the other hand, dominate the market in terms of innovation and customized offerings. They cater to customers seeking enhanced benefits, faster claim processing, and a wider range of policy options. The increasing demand for personalized plans, coupled with advancements in technology and customer service, drives the growth of private providers. As healthcare needs become more complex, the competition between public and private providers intensifies, fostering improved services across the market.

- By Health Insurance Plans

On the basis of level of coverage, the health insurance market is segmented into point of service (pos), exclusive provider organization (epos), preferred provider organization (PPO), indemnity health insurance, health maintenance organization (HMO), health savings account (HSA), qualified small employer health reimbursement arrangements (Qsehras), and others. Among these, preferred provider organization (PPO) plans are widely preferred with market share of 28.05% due to their flexibility in choosing healthcare providers and specialists without requiring referrals, making them popular among consumers who value freedom of choice and convenience.

HMOS, known for their cost-effective coverage and coordinated care through a primary care physician, also hold a substantial share in the market, particularly among budget-conscious individuals and families. Meanwhile, newer plans such as HSAS and Qsehras are gaining traction as they offer tax advantages and increased control over healthcare spending. Indemnity health insurance, although less common, remains relevant for those seeking the widest range of provider options without network restrictions. Overall, the diversity of plan options reflects the evolving needs of consumers for customizable and efficient health coverage.

- By Demographics

On the basis of demographics, the health insurance market is segmented into adults, minors, and senior citizens. The adult segment represents the largest share, driven by the working population's growing awareness of health risks and the need for comprehensive insurance coverage. Adult segment dominates the healthcare insurance market with share of 60.13% due to employers often provide health insurance benefits, further boosting the adoption rates within this demographic. Additionally, adults typically seek plans that cover a wide range of medical needs, including preventive care and chronic disease management.

The senior citizens segment is rapidly expanding due to increasing life expectancy and a higher prevalence of age-related health conditions. This group demands specialized insurance plans that offer extensive coverage for hospitalizations, medications, and long-term care. Meanwhile, the minors segment, though smaller, remains important as parents prioritize securing health insurance for their children to cover pediatric care, vaccinations, and emergency treatments. Overall, demographic trends strongly influence product development and marketing strategies in the health insurance market.

- By Coverage Type

On the basis of coverage type, the health insurance market is segmented into lifetime coverage and term coverage. Lifetime coverage is dominant with market share of 76.14%, and is plans provide insured individuals with protection throughout their entire life, ensuring continuous access to healthcare benefits without the need for renewal. This type of coverage is particularly favored by consumers seeking long-term security and stability, especially in markets where chronic illnesses and aging populations are on the rise.

Term coverage, on the other hand, offers protection for a specified period, typically ranging from one to several years. It is often chosen by individuals who require health insurance for a defined timeframe, such as during employment contracts or while transitioning between life stages. Term plans generally come with lower premiums compared to lifetime coverage, making them attractive for budget-conscious consumers or those with temporary healthcare needs. Both coverage types play a vital role in addressing diverse consumer preferences within the health insurance landscape.

- By End User

On the basis of end user, the health insurance market is segmented into corporates, individuals, and others. The corporate segment holds a significant share of the market, as many companies offer group health insurance plans as part of employee benefits packages. These plans help attract and retain talent while providing employees with access to comprehensive healthcare coverage. The rising focus on employee wellness and preventive care further drives the adoption of health insurance in this segment.

The individual segment is also growing steadily, fueled by increasing health awareness and the availability of customizable insurance plans tailored to personal needs. This segment includes self-employed professionals, freelancers, and those not covered under corporate plans. The ‘others’ category includes government schemes, non-profit organizations, and other institutions that provide health insurance coverage to specific groups such as low-income populations or community members. Together, these end users shape the demand and innovation trends in the health insurance market.

- By Distribution Channel

On the basis of end user, the health insurance market is segmented into direct sales, financial institutions, e-commerce, hospitals, clinics, and others. Direct sales remain a crucial channel, allowing insurers to engage customers personally through agents and brokers, providing tailored advice and building trust. This traditional approach continues to be effective, especially in regions where face-to-face interaction is preferred.

Meanwhile, digital channels such as e-commerce are rapidly gaining ground due to their convenience and wide reach, enabling customers to compare and purchase policies online with ease. Financial institutions such as banks also play a significant role by bundling insurance products with their offerings, making health insurance more accessible. Hospitals and clinics are emerging as important touchpoints for insurance distribution, often partnering with insurers to offer coverage at the point of care. The ‘others’ segment includes emerging channels such as mobile apps and corporate partnerships, which are reshaping how health insurance is marketed and sold.

Health Insurance Market Regional Analysis

- North America dominates the health insurance market with the largest revenue share of 40.06% in 2024, driven by a well-established healthcare infrastructure and high consumer awareness about health insurance benefits

- The region benefits from advanced healthcare systems and extensive government and private insurance programs that promote widespread coverage. Strong regulatory frameworks and ongoing reforms also contribute to improving access and affordability of health insurance products

- High prevalence of chronic diseases and an aging population increase the demand for comprehensive health insurance plans, especially those offering coverage for long-term treatments and specialized care. This demographic trend fuels market growth significantly

U.S. Health Insurance Market Insight

The U.S. health insurance market captured the largest revenue share of 41.05% within North America in 2025, driven by the growing prevalence of chronic diseases, favorable government policies, and a well-established healthcare infrastructure. The market is further fueled by increasing consumer awareness regarding the benefits of health coverage and the surge in digital health technologies. The widespread adoption of telemedicine, electronic health records (EHR), and AI-driven diagnostic tools is enhancing operational efficiency and accessibility, boosting demand for comprehensive insurance plans. In addition, employer-sponsored health benefits and the expansion of Medicaid and Medicare continue to support market growth.

Europe Health Insurance Market Insight

The European health insurance market is projected to expand at a substantial CAGR throughout the forecast period, propelled by universal healthcare mandates and a growing elderly population. The implementation of regulatory frameworks such as the GDPR and cross-border healthcare directives is improving transparency and service quality across the region. Increasing demand for supplemental insurance to cover gaps in public healthcare services, particularly in Germany, France, and the U.K., is fostering market expansion. The rise of digital health platforms and partnerships between insurers and health-tech startups are also transforming the regional health insurance landscape.

U.K. Health Insurance Market Insight

The U.K. health insurance market is anticipated to grow at a noteworthy CAGR during the forecast period, largely influenced by rising pressures on the National Health Service (NHS) and growing consumer interest in private health coverage. A shift towards personalized insurance products, supported by advanced data analytics and wearable health devices, is enhancing risk assessment and customer engagement. Moreover, the trend toward health-conscious lifestyles and preventive care is encouraging insurers to offer wellness incentives and integrated digital health services, further stimulating market demand.

Germany Health Insurance Market Insight

The German health insurance market is expected to expand at a considerable CAGR during the forecast period, supported by the dual public-private insurance system and rising demand for private supplementary coverage. High standards in healthcare quality, alongside increasing healthcare costs, are prompting consumers to invest in more comprehensive plans. Technological advancements such as e-prescriptions and digital health records are being integrated into insurance offerings to streamline services. Additionally, Germany’s focus on data protection and privacy compliance aligns with consumer expectations, fostering trust in digital insurance platforms.

Asia-Pacific Health Insurance Market Insight

The Asia-Pacific health insurance market is poised to grow at the fastest CAGR and market share of 9.14% in 2025, fueled by rising healthcare expenditures, increased awareness about health insurance, and government-driven reforms in countries such as China, India, and Japan. The expansion of middle-class populations, coupled with rapid urbanization and the penetration of digital technologies, is broadening the insurance customer base. The emergence of insurtech startups, telehealth services, and app-based insurance policies is making coverage more accessible and affordable across the region, especially in underserved rural areas.

Japan Health Insurance Market Insight

The Japan health insurance market is gaining momentum due to the country’s high-tech culture, rapid urbanization, and demand for convenience. the country’s robust public health insurance system is being complemented by private insurance products aimed at covering co-payments, advanced treatments, and long-term care. demand is also rising for customized health plans tailored to senior citizens and chronic disease management. technological integration, such as ai-based underwriting and remote health monitoring, is enhancing customer service and enabling insurers to develop more targeted, efficient offerings.

China Health Insurance Market Insight

The China health insurance market accounted for the largest market revenue share in Asia pacific in 2025, driven by government healthcare reforms, a burgeoning middle class, and the growing digitization of health services. the healthy China 2030 initiative and expansion of the basic medical insurance system are key growth drivers. additionally, the rise of online insurance platforms, wearable health monitoring devices, and mobile payment integration is streamlining enrollment and claims processes. strong investments from both domestic and international insurers, along with growing partnerships in health tech, are accelerating market development.

Health Insurance Market Share

The health insurance industry is primarily led by well-established companies, including:

- Cigna Healthcare(U.S.)

- Centene Corporation(U.S.)

- Allianz Care (A Subsidiary of Allianz) (Germany)

- Aetna Inc. (A Subsidiary of CVS Health) (U.S.)

- Anthem Insurance Companies, Inc. (A subsidiary of Elevance Health) (U.S.)

- AXA (France)

- Broadstone Corporate Benefits Limited (U.K.)

- Bupa (U.K.)

- HealthCare International Global Network Ltd. (U.K.)

- HBF Health Limited (Australia)

- Now Health International (U.K.)

- Oracle (U.S.)

- UnitedHealth Group (U.S.)

- Vhi Group (Ireland)

- Vitality (A Subsidiary of Discovery Ltd) (U.K.)

- International Medical Group (A Subsidiary of Sirius Point) (U.S.)

Latest Developments in Global Health Insurance Market

- In March 2022, Broadstone Corporate Benefits Limited acquired the clients of Charterhouse Consultancy, which is an independent pensions administration company specializing in smaller trust-based occupational pension schemes. This has strengthened Broadstone’s position in the marketplace and its commitment and offering to the smaller schemes market

- In January 2021, Allianz Care officially began its eight-year worldwide partnership with the Olympic & Paralympic Movements, building on a collaboration with the Paralympic Movement since 2006. This development acted as a strategic branding and helped the company build its brand image

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.