Global In Vitro Diagnostic Ivd Regulatory Affairs Outsourcing Market

Market Size in USD Thousand

CAGR :

%

USD

674,277.97 Thousand

USD

1,830,957.45 Thousand

2021

2029

USD

674,277.97 Thousand

USD

1,830,957.45 Thousand

2021

2029

| 2022 –2029 | |

| USD 674,277.97 Thousand | |

| USD 1,830,957.45 Thousand | |

|

|

|

|

Market Analysis and Size

The healthcare companies faced challenges in keeping up with regulatory standards especially due to the COVID-19 (coronavirus) pandemic. To avail a quality-driven culture for med-tech companies, consulting firms use quality management system (QMS) software. Companies involved in the in vitro diagnostic (IVD) regulatory affairs outsourcing provides project-based support to healthcare organizations.

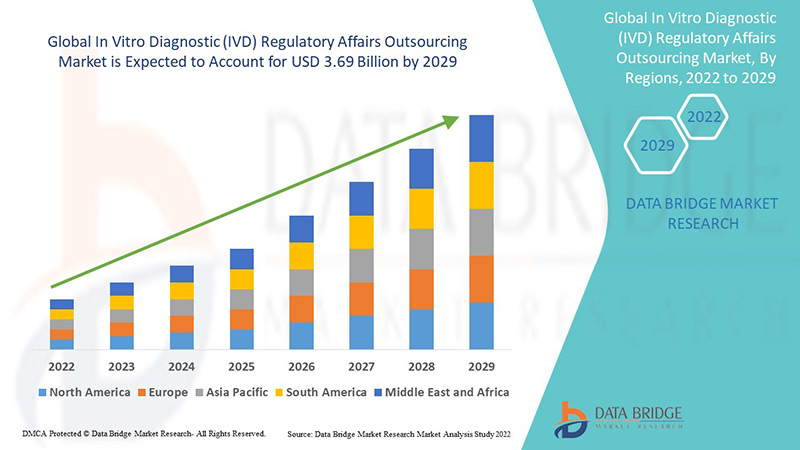

The deployment of the outsourcing is resulting in the initiation of long-term outsourcing agreements. Global In Vitro Diagnostic (IVD) Regulatory Affairs Outsourcing Market was valued at USD 1.6 billion in 2021 and is expected to reach USD 3.69 billion by 2029, registering a CAGR of 11% during the forecast period of 2022-2029. Pharmaceutical Companies is expected to witness high growth owing to increase in the number of clinical approvals.

Market Definition

Regulatory affairs play a highly crucial role in the vitro diagnostic device (IVD) industry. These affairs are concerned with the lifecycle of various healthcare products, and offers strategic, tactical, and operational support and direction for manufacturing companies to work within the regulatory framework.

Report Scope and Market Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Service (Regulatory Writing and Submissions, Regulatory Registration and Clinical Trial Applications, Regulatory Consulting, Legal Representation, Data Management Services, Chemistry Manufacturing and Controls (CMC) Services, and Others), Indication (Oncology, Neurology, Cardiology, Clinical Chemistry and Immunoassays, Precision Medicine, Infectious Diseases, Diabetes, Genetic Testing, HIV/AIDS, Haematology, Drug Testing/Pharmacogenomics, Blood Transfusion, Point of Care, and Others), Deployment Mode (Cloud and On-Premises), Organization Size (Small and Medium Enterprises (SMES) and Large Enterprises), Stage (Clinical, Preclinical, and PMA (Post-Market Authorization)), Class (Class I, Class II, and Class III), End User (Pharmaceutical Companies, Medical Device Companies, Biotechnology Companies, and Others) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America. |

|

Market Players Covered |

Freyr Solutions (India), PPD Inc. (US), EMERGO (US), ICON (Healthcare), Parexel International Corporation (US), CRITERIUM, INC. (US), Groupe ProductLife S.A. (France), Labcorp Drug Development (US), WuXi AppTec (China), Genpact (US), Medpace (US), Dor Pharmaceutical Services (Israel), Qserve (Netherlands), among others |

|

Market Opportunities |

|

In Vitro Diagnostic (IVD) Regulatory Affairs Outsourcing Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

- High Use in the Healthcare Industry

The increase in the deployment of the outsourcing services across the healthcare sector acts as one of the major factors driving the growth of in vitro diagnostic (IVD) regulatory affairs outsourcing market. The surge in geographical expansion activities aiming for speedy approvals in local markets further assists in the growth.

- Research and Development

The rise in the research and development activities increasing the volume of clinical trial applications and product registration accelerate the market growth.

- Clinical Approvals

An increase in demand for in vitro diagnostic (IVD) regulatory affairs outsourcing is being witnessed as companies are under constant pressure to procure timely clinical approvals from regulators. The demand for regulatory affairs services is increasing due to such actions.

Opportunities

Furthermore, development of disease-specific biomarkers and tests, and significance of companion diagnostics extend profitable opportunities to the market players in the forecast period of 2022 to 2029. Also, surge in investments will further expand the market.

Restraints/Challenges

On the other hand, changing regulations regarding medical devices and in vitro diagnostic (IVD) regulatory affairs outsourcing are expected to obstruct market growth. Also, lack of infrastructure in healthcare service is projected to challenge the in vitro diagnostic (IVD) regulatory affairs outsourcing market in the forecast period of 2022-2029.

This in vitro diagnostic (IVD) regulatory affairs outsourcing market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on in vitro diagnostic (IVD) regulatory affairs outsourcing market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Covid-19 Impact on Diagnostic Tests Market

COVID-19 had a negative impact on the healthcare sector. Major Key players adapted innovative strategies to the rapidly changing situation during the outbreak of the COVID-19. Countries took critical healthcare changes until the crisis took a back seat. Healthcare reforms are expected to witness cost containment, increased access and technological progress in the coming years. An increase in demand for in vitro diagnostic (IVD) regulatory affairs outsourcing was witnessed owing to the emphasis on the importance of remote diagnosis, care, and consultation. These services decline the burden on hospitals in the post-pandemic scenario.

Recent Developments

- USA-9 Technology Magazine Listed Freyr in the “10 Best Technology Solution Providers of 2021 in November’2021. USA-9.com is a Technology Magazine that has listed Freyr Solutions, a leading global regulatory solution, and services provider, as the “10 Best Technology Solution Providers of 2021 as Fryer continues to design innovative software solutions and support clients in their respective compliance objectives. This has helped company to increase its popularity.

Global In Vitro Diagnostic (IVD) Regulatory Affairs Outsourcing Market Scope and Market Size

The in vitro diagnostic (IVD) regulatory affairs outsourcing market is segmented on the basis of services, indication, deployment mode, organization size, stage, class and end user. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Services

- Regulatory Writing and Submissions

- Regulatory Registration and Clinical Trial Applications

- Regulatory Consulting

- Legal Representation

- Data Management Services

- Chemistry Manufacturing and Controls (CMC) Services

- Others

On the basis of services, the global in vitro diagnostic (IVD) regulatory affairs outsourcing market is segmented into regulatory writing and submissions, regulatory registration and clinical trial applications, regulatory consulting, legal representation, data management services, chemistry manufacturing and controls (CMC) services, and others.

Indication

- Oncology

- Neurology

- Cardiology

- Clinical Chemistry and Immunoassays

- Precision Medicine

- Infectious Diseases

- Diabetes

- Genetic Testing

- HIV/AIDS

- Haematology

- Drug Testing/Pharmacogenomics

- Blood Transfusion

- Point Of Care

- Others

On the basis of indication, the global in vitro diagnostic (IVD) regulatory affairs outsourcing market is segmented into oncology, neurology, cardiology, clinical chemistry and immunoassays, precision medicine, infectious diseases, diabetes, genetic testing, HIV/AIDS, haematology, drug testing/pharmacogenomics, blood transfusion, point of care, and others.

Deployment Mode

- Cloud

- On-Premises

On the basis of deployment mode, the global in vitro diagnostic (IVD) regulatory affairs outsourcing market is segmented into cloud and on-premises.

Organization Size

- Small and Medium Enterprises (Smes)

- Large Enterprises

On the basis of organization size, the global in vitro diagnostic (IVD) regulatory affairs outsourcing market is segmented into small and medium enterprises (SMES) and large enterprises.

Stage

- Clinical

- Preclinical

- PMA (Post-Market Authorization)

On the basis of stage, the global in vitro diagnostic (IVD) regulatory affairs outsourcing market is segmented into clinical, preclinical, and PMA (post-market authorization).

Class

- Class I

- Class II

- Class III

On the basis of class, the global in vitro diagnostic (IVD) regulatory affairs outsourcing market is segmented into class I, class II, and class III.

End User

- Pharmaceutical Companies

- Medical Device Companies

- Biotechnology Companies

- Others

On the basis of end user, the global in vitro diagnostic (IVD) regulatory affairs outsourcing market is segmented into pharmaceutical companies, medical device companies, biotechnology companies, and others.

In Vitro Diagnostic (IVD) Regulatory Affairs Outsourcing Market Regional Analysis/Insights

The in vitro diagnostic (IVD) regulatory affairs outsourcing market is analysed and market size insights and trends are provided by country, services, indication, deployment mode, organization size, stage, class and end user as referenced above.

The countries covered in the in vitro diagnostic (IVD) regulatory affairs outsourcing market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

Asia-Pacific (APAC) dominates the in vitro diagnostic (IVD) regulatory affairs outsourcing market because of the rise in number of clinical trials and the rising number of companies within the region.

North America is expected to witness significant growth during the forecast period of 2022 to 2029 due to the presence of key pharmaceutical and medical devices companies and the rise in the research and development spending in the region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Healthcare Infrastructure growth Installed base and New Technology Penetration

The in vitro diagnostic (IVD) regulatory affairs outsourcing market also provides you with detailed market analysis for every country growth in healthcare expenditure for capital equipment, installed base of different kind of products for in vitro diagnostic (IVD) regulatory affairs outsourcing market, impact of technology using life line curves and changes in healthcare regulatory scenarios and their impact on the in vitro diagnostic (IVD) regulatory affairs outsourcing market. The data is available for historic period 2010-2020.

Competitive Landscape and In Vitro Diagnostic (IVD) Regulatory Affairs Outsourcing Market Share Analysis

The in vitro diagnostic (IVD) regulatory affairs outsourcing market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to in vitro diagnostic (IVD) regulatory affairs outsourcing market.

Some of the major players operating in the in vitro diagnostic (IVD) regulatory affairs outsourcing market are:

- Freyr Solutions (India)

- PPD Inc. (US)

- EMERGO (US)

- ICON (Healthcare)

- Parexel International Corporation (US)

- CRITERIUM, INC. (US)

- Groupe ProductLife S.A. (France)

- Labcorp Drug Development (US)

- WuXi AppTec (China)

- Genpact (US)

- Medpace (US)

- Dor Pharmaceutical Services (Israel)

- Qserve (Netherlands)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1. INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL IN VITRO DIAGNOSTIC (IVD) REGULATORY AFFAIRS OUTSOURCING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2. MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL IN VITRO DIAGNOSTIC (IVD) REGULATORY AFFAIRS OUTSOURCING MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MULTIVARIATE MODELLING

2.2.4 TOP TO BOTTOM ANALYSIS

2.2.5 STANDARDS OF MEASUREMENT

2.2.6 VENDOR SHARE ANALYSIS

2.2.7 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.8 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL IN VITRO DIAGNOSTIC (IVD) REGULATORY AFFAIRS OUTSOURCING MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3. MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4. PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES MODEL

5. INDUSTRY INSIGHTS

5.1 MICRO AND MACRO ECONOMIC FACTORS

5.2 PENETRATION AND GROWTH PROSPECT MAPPING

5.3 KEY PRICING STRATEGIES

5.4 INTERVIEWS WITH SPECIALIST

5.5 ANALYIS AND RECOMMENDATION

6. INTELLECTUAL PROPERTY (IP) PORTFOLIO

6.1 PATENT QUALITY AND STRENGTH

6.2 PATENT FAMILIES

6.3 LICENSING AND COLLABORATIONS

6.4 COMPETITIVE LANDSCAPE

6.5 IP STRATEGY AND MANAGEMENT

6.6 OTHER

7. COST ANALYSIS BREAKDOWN

8. TECHNONLOGY ROADMAP

9. INNOVATION TRACKER AND STRATEGIC ANALYSIS

9.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

9.1.1 JOINT VENTURES

9.1.2 MERGERS AND ACQUISITIONS

9.1.3 LICENSING AND PARTNERSHIP

9.1.4 TECHNOLOGY COLLABORATIONS

9.1.5 STRATEGIC DIVESTMENTS

9.2 NUMBER OF PRODUCTS IN DEVELOPMENT

9.3 STAGE OF DEVELOPMENT

9.4 TIMELINES AND MILESTONES

9.5 INNOVATION STRATEGIES AND METHODOLOGIES

9.6 RISK ASSESSMENT AND MITIGATION

9.7 FUTURE OUTLOOK

10. REGULATORY COMPLIANCE

10.1 REGULATORY AUTHORITIES

10.2 REGULATORY CLASSIFICATIONS

10.2.1 CLASS I

10.2.2 CLASS II

10.2.3 CLASS III

10.3 REGULATORY SUBMISSIONS

10.4 INTERNATIONAL HARMONIZATION

10.5 COMPLIANCE AND QUALITY MANAGEMENT SYSTEMS

10.6 REGULATORY CHALLENGES AND STRATEGIES

11. REIMBURSEMENT FRAMEWORK

12. OPPUTUNITY MAP ANALYSIS

13. INSTALLED BASE DATA

14. VALUE CHAIN ANALYSIS

15. HEALTHCARE ECONOMY

15.1 HEALTHCARE EXPENDITURE

15.2 CAPITAL EXPENDITURE

15.3 CAPEX TRENDS

15.4 CAPEX ALLOCATION

15.5 FUNDING SOURCES

15.6 INDUSTRY BENCHMARKS

15.7 GDP RATION IN OVERALL GDP

15.8 HEALTHCARE SYSTEM STRUCTURE

15.9 GOVERNMENT POLICIES

15.10 ECONOMIC DEVELOPMENT

16. GLOBAL IN VITRO DIAGNOSTIC (IVD) REGULATORY AFFAIRS OUTSOURCING MARKET, BY SERVICE

16.1 OVERVIEW

16.2 REGULATORY WRITING & SUBMISSIONS

16.3 REGULATORY REGISTRATION & CLINICAL TRIAL APPLICATIONS

16.4 REGULATORY CONSULTING

16.5 LEGAL REPRESENTATION

16.6 DATA MANAGEMENT SERVICES

16.7 CHEMISTRY MANUFACTURING AND CONTROLS (CMC) SERVICES

16.8 OTHERS

17. GLOBAL IN VITRO DIAGNOSTIC (IVD) REGULATORY AFFAIRS OUTSOURCING MARKET, BY INDICATION

17.1 OVERVIEW

17.2 ONCOLOGY

17.3 NEUROLOGY

17.4 CARDIOLOGY

17.5 CLINICAL CHEMISTRY AND IMMUNOASSAYS

17.6 PRECISION MEDICINE

17.7 INFECTIOUS DISEASES

17.7.1 SEPSIS

17.7.2 VIROLOGY

17.7.3 BACTERIOLOGY

17.7.4 MICROBIOLOGY AND MYCOLOGY

17.7.5 HEPATITIS B

17.7.6 HEPATITIS C

17.7.7 SYPHILIS

17.7.8 TUBERCULOSIS

17.7.9 MALARIA

17.7.10 HUMAN PAPILLOMAVIRUS (HPV) INFECTION

17.7.11 OTHERS

17.8 DIABETES

17.9 GENETIC TESTING

17.10 HIV/AIDS

17.11 HAEMATOLOGY

17.12 DRUG TESTING/PHARMACOGENOMICS

17.13 BLOOD TRANSFUSION

17.14 OTHERS

18. GLOBAL IN VITRO DIAGNOSTIC (IVD) REGULATORY AFFAIRS OUTSOURCING MARKET, BY STAGE

18.1 OVERVIEW

18.2 PRECLINICAL

18.3 CLINICAL

18.4 PMA (POST MARKET AUTHORIZATION)

19. GLOBAL IN VITRO DIAGNOSTIC (IVD) REGULATORY AFFAIRS OUTSOURCING MARKET, BY CLASS

19.1 OVERVIEW

19.2 CLASS I

19.3 CLASS II

19.4 CLASS III

20. GLOBAL IN VITRO DIAGNOSTIC (IVD) REGULATORY AFFAIRS OUTSOURCING MARKET, BY TYPE

20.1 OVERVIEW

20.2 POINT-OF-CARE (POC) IVD PRODUCT

20.3 LABORATORY-DEVELOPED TESTS (LDTS) IVD PRODUCT

20.4 COMPANION DIAGNOSTICS IVD PRODUCT

20.5 DIRECT-TO-CONSUMER (DTC) TESTING IVD PRODUCT

20.6 OTHERS IVD PRODUCT

21. GLOBAL IN VITRO DIAGNOSTIC (IVD) REGULATORY AFFAIRS OUTSOURCING MARKET, BY DEPLOYMENT MODE

21.1 OVERVIEW

21.2 CLOUD

21.3 ON-PREMISES

22. GLOBAL IN VITRO DIAGNOSTIC (IVD) REGULATORY AFFAIRS OUTSOURCING MARKET, BY ORGANIZARION SIZE

22.1 OVERVIEW

22.2 SMALL & MEDIUM ENTERPRISES (SMES)

22.3 LARGE ENTERPRISES

23. GLOBAL IN VITRO DIAGNOSTIC (IVD) REGULATORY AFFAIRS OUTSOURCING MARKET, BY END USER

23.1 OVERVIEW

23.2 PHARMACEUTICAL COMPANIES

23.2.1 BY ORGANIZATION SIZE

23.2.1.1. SMALL & MEDIUM ENTERPRISES (SMES)

23.2.1.2. LARGE ENTERPRISES

23.2.2 BY SERVICE

23.2.2.1. REGULATORY WRITING & SUBMISSIONS

23.2.2.2. REGULATORY REGISTRATION & CLINICAL TRIAL APPLICATIONS

23.2.2.3. REGULATORY CONSULTING

23.2.2.4. LEGAL REPRESENTATION

23.2.2.5. DATA MANAGEMENT SERVICES

23.2.2.6. CHEMISTRY MANUFACTURING AND CONTROLS (CMC) SERVICES

23.2.2.7. OTHERS

23.3 MEDICAL DEVICE COMPANIES

23.3.1 BY ORGANIZATION SIZE

23.3.1.1. SMALL & MEDIUM ENTERPRISES (SMES)

23.3.1.2. LARGE ENTERPRISES

23.3.2 BY SERVICE

23.3.2.1. REGULATORY WRITING & SUBMISSIONS

23.3.2.2. REGULATORY REGISTRATION & CLINICAL TRIAL APPLICATIONS

23.3.2.3. REGULATORY CONSULTING

23.3.2.4. LEGAL REPRESENTATION

23.3.2.5. DATA MANAGEMENT SERVICES

23.3.2.6. CHEMISTRY MANUFACTURING AND CONTROLS (CMC) SERVICES

23.3.2.7. OTHERS

23.4 BIOTECHNOLOGY COMPANIES

23.4.1 BY ORGANIZATION SIZE

23.4.1.1. SMALL & MEDIUM ENTERPRISES (SMES)

23.4.1.2. LARGE ENTERPRISES

23.4.2 BY SERVICE

23.4.2.1. REGULATORY WRITING & SUBMISSIONS

23.4.2.2. REGULATORY REGISTRATION & CLINICAL TRIAL APPLICATIONS

23.4.2.3. REGULATORY CONSULTING

23.4.2.4. LEGAL REPRESENTATION

23.4.2.5. DATA MANAGEMENT SERVICES

23.4.2.6. CHEMISTRY MANUFACTURING AND CONTROLS (CMC) SERVICES

23.4.2.7. OTHERS

23.5 OTHERS

24. GLOBAL IN VITRO DIAGNOSTIC (IVD) REGULATORY AFFAIRS OUTSOURCING MARKET, BY REGION

24.1 GLOBAL IN VITRO DIAGNOSTIC (IVD) REGULATORY AFFAIRS OUTSOURCING MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

24.1.1 NORTH AMERICA

24.1.1.1. U.S.

24.1.1.2. CANADA

24.1.1.3. MEXICO

24.1.2 EUROPE

24.1.2.1. GERMANY

24.1.2.2. FRANCE

24.1.2.3. U.K.

24.1.2.4. ITALY

24.1.2.5. SPAIN

24.1.2.6. RUSSIA

24.1.2.7. TURKEY

24.1.2.8. BELGIUM

24.1.2.9. NETHERLANDS

24.1.2.10. SWITZERLAND

24.1.2.11. REST OF EUROPE

24.1.3 ASIA-PACIFIC

24.1.3.1. JAPAN

24.1.3.2. CHINA

24.1.3.3. SOUTH KOREA

24.1.3.4. INDIA

24.1.3.5. AUSTRALIA

24.1.3.6. SINGAPORE

24.1.3.7. THAILAND

24.1.3.8. MALAYSIA

24.1.3.9. INDONESIA

24.1.3.10. PHILIPPINES

24.1.3.11. REST OF ASIA-PACIFIC

24.1.4 SOUTH AMERICA

24.1.4.1. BRAZIL

24.1.4.2. ARGENTINA

24.1.4.3. REST OF SOUTH AMERICA

24.1.5 MIDDLE EAST AND AFRICA

24.1.5.1. SOUTH AFRICA

24.1.5.2. EGYPT

24.1.5.3. ISRAEL

24.1.5.4. UAE

24.1.5.5. SAUDI ARABIA

24.1.5.6. REST OF MIDDLE EAST AND AFRICA

24.1.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

25. GLOBAL IN VITRO DIAGNOSTIC (IVD) REGULATORY AFFAIRS OUTSOURCING MARKET, COMPANY LANDSCAPE

25.1 COMPANY SHARE ANALYSIS: GLOBAL

25.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

25.3 COMPANY SHARE ANALYSIS: EUROPE

25.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

25.5 MERGERS & ACQUISITIONS

25.6 NEW PRODUCT DEVELOPMENT & APPROVALS

25.7 EXPANSIONS

25.8 REGULATORY CHANGES

25.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

26. GLOBAL IN VITRO DIAGNOSTIC (IVD) REGULATORY AFFAIRS OUTSOURCING MARKET, COMPANY PROFILE

26.1 FREYR SOLUTIONS

26.1.1 COMPANY OVERVIEW

26.1.2 COMPANY SNAPSHOT

26.1.3 REVENUE ANALYSIS

26.1.4 PRODUCT PORTFOLIO

26.1.5 RECENT DEVELOPMENTS

26.2 AXSOURCE CONSULTING INC.

26.2.1 COMPANY OVERVIEW

26.2.2 COMPANY SNAPSHOT

26.2.3 REVENUE ANALYSIS

26.2.4 PRODUCT PORTFOLIO

26.2.5 RECENT DEVELOPMENTS

26.3 LORENZ LIFE SCIENCES GROUP

26.3.1 COMPANY OVERVIEW

26.3.2 COMPANY SNAPSHOT

26.3.3 REVENUE ANALYSIS

26.3.4 PRODUCT PORTFOLIO

26.3.5 RECENT DEVELOPMENTS

26.4 LABORATORY CORPORATION OF AMERICA HOLDINGS

26.4.1 COMPANY OVERVIEW

26.4.2 COMPANY SNAPSHOT

26.4.3 REVENUE ANALYSIS

26.4.4 PRODUCT PORTFOLIO

26.4.5 RECENT DEVELOPMENTS

26.5 REG IQ PTY LTD.

26.5.1 COMPANY OVERVIEW

26.5.2 COMPANY SNAPSHOT

26.5.3 REVENUE ANALYSIS

26.5.4 PRODUCT PORTFOLIO

26.5.5 RECENT DEVELOPMENTS

26.6 PROMEDICA INTERNATIONAL, A CALIFORNIA CORPORATION (IUVO BIOSCIENCES)

26.6.1 COMPANY OVERVIEW

26.6.2 COMPANY SNAPSHOT

26.6.3 REVENUE ANALYSIS

26.6.4 PRODUCT PORTFOLIO

26.6.5 RECENT DEVELOPMENTS

26.7 MAKROCARE

26.7.1 COMPANY OVERVIEW

26.7.2 COMPANY SNAPSHOT

26.7.3 REVENUE ANALYSIS

26.7.4 PRODUCT PORTFOLIO

26.7.5 RECENT DEVELOPMENTS

26.8 EMERGO BY UL

26.8.1 COMPANY OVERVIEW

26.8.2 COMPANY SNAPSHOT

26.8.3 REVENUE ANALYSIS

26.8.4 PRODUCT PORTFOLIO

26.8.5 RECENT DEVELOPMENTS

26.9 ICON PLC

26.9.1 COMPANY OVERVIEW

26.9.2 COMPANY SNAPSHOT

26.9.3 REVENUE ANALYSIS

26.9.4 PRODUCT PORTFOLIO

26.9.5 RECENT DEVELOPMENTS

26.10 WUXI APPTEC

26.10.1 COMPANY OVERVIEW

26.10.2 COMPANY SNAPSHOT

26.10.3 REVENUE ANALYSIS

26.10.4 PRODUCT PORTFOLIO

26.10.5 RECENT DEVELOPMENTS

26.11 THERMO FISHER SCIENTIFIC INC.

26.11.1 COMPANY OVERVIEW

26.11.2 COMPANY SNAPSHOT

26.11.3 REVENUE ANALYSIS

26.11.4 PRODUCT PORTFOLIO

26.11.5 RECENT DEVELOPMENTS

26.12 CHARLES RIVER LABORATORIES.

26.12.1 COMPANY OVERVIEW

26.12.2 COMPANY SNAPSHOT

26.12.3 REVENUE ANALYSIS

26.12.4 PRODUCT PORTFOLIO

26.12.5 RECENT DEVELOPMENTS

26.13 ACCELL CLINICAL RESEARCH, LLC

26.13.1 COMPANY OVERVIEW

26.13.2 COMPANY SNAPSHOT

26.13.3 REVENUE ANALYSIS

26.13.4 PRODUCT PORTFOLIO

26.13.5 RECENT DEVELOPMENTS

26.14 PAREXEL INTERNATIONAL (MA) CORPORATION

26.14.1 COMPANY OVERVIEW

26.14.2 COMPANY SNAPSHOT

26.14.3 REVENUE ANALYSIS

26.14.4 PRODUCT PORTFOLIO

26.14.5 RECENT DEVELOPMENTS

26.15 METECON GMBH

26.15.1 COMPANY OVERVIEW

26.15.2 COMPANY SNAPSHOT

26.15.3 REVENUE ANALYSIS

26.15.4 PRODUCT PORTFOLIO

26.15.5 RECENT DEVELOPMENTS

26.16 GENPACT

26.16.1 COMPANY OVERVIEW

26.16.2 COMPANY SNAPSHOT

26.16.3 REVENUE ANALYSIS

26.16.4 PRODUCT PORTFOLIO

26.16.5 RECENT DEVELOPMENTS

26.17 CRITERIUM, INC

26.17.1 COMPANY OVERVIEW

26.17.2 COMPANY SNAPSHOT

26.17.3 REVENUE ANALYSIS

26.17.4 PRODUCT PORTFOLIO

26.17.5 RECENT DEVELOPMENTS

26.18 MEDPACE

26.18.1 COMPANY OVERVIEW

26.18.2 COMPANY SNAPSHOT

26.18.3 REVENUE ANALYSIS

26.18.4 PRODUCT PORTFOLIO

26.18.5 RECENT DEVELOPMENTS

26.19 GROUPE PRODUCTLIFE S.A.

26.19.1 COMPANY OVERVIEW

26.19.2 COMPANY SNAPSHOT

26.19.3 REVENUE ANALYSIS

26.19.4 PRODUCT PORTFOLIO

26.19.5 RECENT DEVELOPMENTS

26.20 DOR PHARMACEUTICAL SERVICES

26.20.1 COMPANY OVERVIEW

26.20.2 COMPANY SNAPSHOT

26.20.3 REVENUE ANALYSIS

26.20.4 PRODUCT PORTFOLIO

26.20.5 RECENT DEVELOPMENTS

26.21 QSERVE

26.21.1 COMPANY OVERVIEW

26.21.2 COMPANY SNAPSHOT

26.21.3 REVENUE ANALYSIS

26.21.4 PRODUCT PORTFOLIO

26.21.5 RECENT DEVELOPMENTS

26.22 ORTHO CLINICAL DIAGNOSTICS.

26.22.1 COMPANY OVERVIEW

26.22.2 COMPANY SNAPSHOT

26.22.3 REVENUE ANALYSIS

26.22.4 PRODUCT PORTFOLIO

26.22.5 RECENT DEVELOPMENTS

26.23 ANGSTROM BIOTECH PVT. LTD.

26.23.1 COMPANY OVERVIEW

26.23.2 COMPANY SNAPSHOT

26.23.3 REVENUE ANALYSIS

26.23.4 PRODUCT PORTFOLIO

26.23.5 RECENT DEVELOPMENTS

26.24 RQM+

26.24.1 COMPANY OVERVIEW

26.24.2 COMPANY SNAPSHOT

26.24.3 REVENUE ANALYSIS

26.24.4 PRODUCT PORTFOLIO

26.24.5 RECENT DEVELOPMENTS

26.25 REGULATORY COMPLIANCES ASSOCIATES (SOTERA HEALTH)

26.25.1 COMPANY OVERVIEW

26.25.2 COMPANY SNAPSHOT

26.25.3 REVENUE ANALYSIS

26.25.4 PRODUCT PORTFOLIO

26.25.5 RECENT DEVELOPMENTS

26.26 RESEARCHDX

26.26.1 COMPANY OVERVIEW

26.26.2 COMPANY SNAPSHOT

26.26.3 REVENUE ANALYSIS

26.26.4 PRODUCT PORTFOLIO

26.26.5 RECENT DEVELOPMENTS

26.27 CMIC HOLDINGS CO., LTD.

26.27.1 COMPANY OVERVIEW

26.27.2 COMPANY SNAPSHOT

26.27.3 REVENUE ANALYSIS

26.27.4 PRODUCT PORTFOLIO

26.27.5 RECENT DEVELOPMENTS

26.28 NORTH AMERICAN SCIENCE ASSOCIATES, LLC

26.28.1 COMPANY OVERVIEW

26.28.2 COMPANY SNAPSHOT

26.28.3 REVENUE ANALYSIS

26.28.4 PRODUCT PORTFOLIO

26.28.5 RECENT DEVELOPMENTS

26.29 QARAD BV

26.29.1 COMPANY OVERVIEW

26.29.2 COMPANY SNAPSHOT

26.29.3 REVENUE ANALYSIS

26.29.4 PRODUCT PORTFOLIO

26.29.5 RECENT DEVELOPMENTS

26.30 TRANSCRIP

26.30.1 COMPANY OVERVIEW

26.30.2 COMPANY SNAPSHOT

26.30.3 REVENUE ANALYSIS

26.30.4 PRODUCT PORTFOLIO

26.30.5 RECENT DEVELOPMENTS

26.31 CLIN-R+

26.31.1 COMPANY OVERVIEW

26.31.2 COMPANY SNAPSHOT

26.31.3 REVENUE ANALYSIS

26.31.4 PRODUCT PORTFOLIO

26.31.5 RECENT DEVELOPMENTS

26.32 VCLS

26.32.1 COMPANY OVERVIEW

26.32.2 COMPANY SNAPSHOT

26.32.3 REVENUE ANALYSIS

26.32.4 PRODUCT PORTFOLIO

26.32.5 RECENT DEVELOPMENTS

26.33 PROPHARMA GROUP

26.33.1 COMPANY OVERVIEW

26.33.2 COMPANY SNAPSHOT

26.33.3 REVENUE ANALYSIS

26.33.4 PRODUCT PORTFOLIO

26.33.5 RECENT DEVELOPMENTS

26.34 ARRIELLO IRELAND LIMITED

26.34.1 COMPANY OVERVIEW

26.34.2 COMPANY SNAPSHOT

26.34.3 REVENUE ANALYSIS

26.34.4 PRODUCT PORTFOLIO

26.34.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

27. RELATED REPORTS

28. QUESTIONNAIRE

29. ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.