Global Marine Insurance Market

Market Size in USD Billion

CAGR :

%

USD

28.04 Billion

USD

39.87 Billion

2021

2029

USD

28.04 Billion

USD

39.87 Billion

2021

2029

| 2022 –2029 | |

| USD 28.04 Billion | |

| USD 39.87 Billion | |

|

|

|

|

Market Analysis and Size

Marine insurance has become a crucial aspect among cargo owners, and ship owners due to incidences of losses such as damage caused to ships, and cargo vessels, among others. This facility has decline the rate of financial loss incurred by a policyholder. The fundamental principles of this insurance are known to be drawn from Marine Insurance Act, 1963. The maritime insurance is based on the fundamental principles of Insurable Interest, Proximate Cause, Contribution, Insurable Interest, Proximate Cause, Subrogation and Utmost Good Faith.

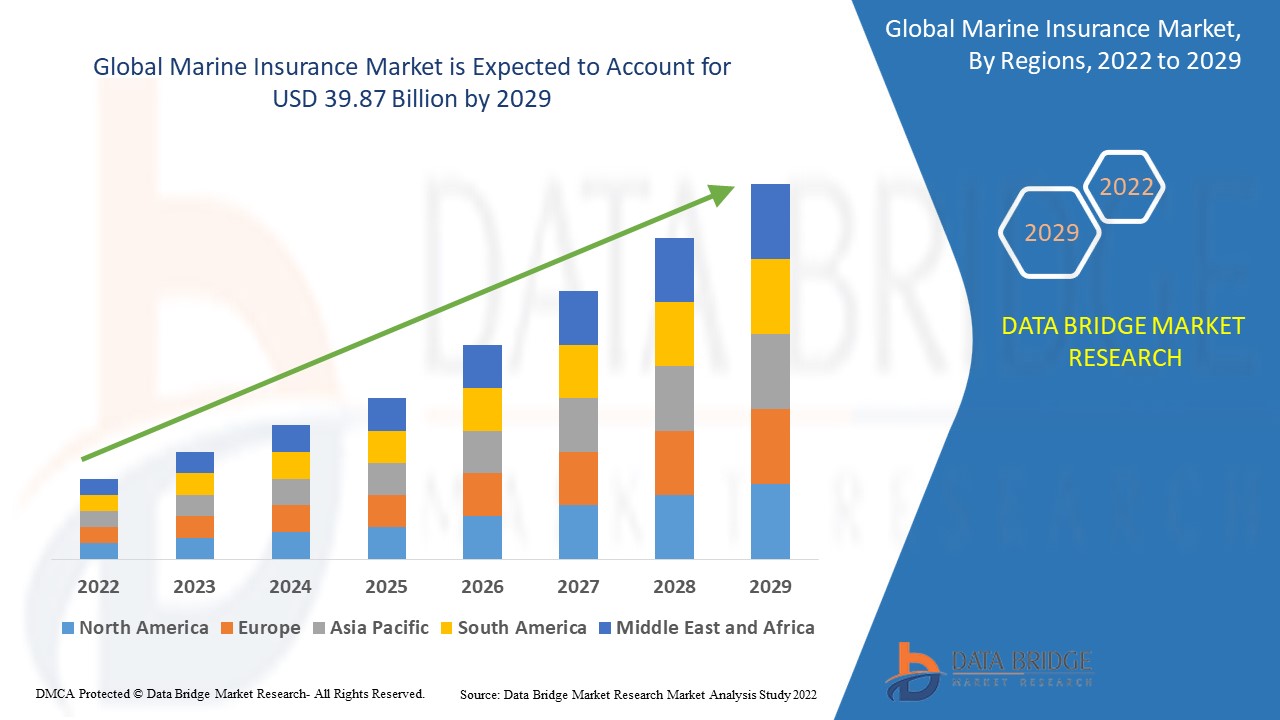

Global Marine Insurance Market was valued at USD 28.04 billion in 2021 and is expected to reach USD 39.87 billion by 2029, registering a CAGR of 4.50% during the forecast period of 2022-2029. “Transport/Cargo” accounts for the largest type segment in the respective market owing to the rise in the free trade agreements. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team also includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Market Definition

Marine insurance covers the loss or damage of cargo, ships, terminals, and any transport by which the property is transferred, acquired, or held between the points of origin and the final destination.

Report Scope and Market Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Type (Transport/Cargo, Hull, Offshore/Energy, Marine Liability), Insurance (Loss/Damage, Fire/Explosion, Natural Calamity, Others), End-User (Cargo Owners, Ship Owners, Government, Others), Policy Type (Time Policy, Voyage Policy, Floating Policy, Valued Policy, Others) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, Israel, Egypt, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America. |

|

Market Players Covered |

Lloyd's (UK), Concirrus (UK), Marsh & McLennan Companies, INC. (US), Swiss Re (Switzerland), American International Group, Inc. (US), Beazley Group (UK), QBE Insurance Group Limited. (Australia), RSA (UK), Allianz (Germany), American International Group, Inc. (US), Aon plc (UK), Gallagher (US), Brown & Brown, Inc. (US), Lockton Companies. (US), Chubb (Switzerland), Willis Towers Watson (UK), United India Insurance Co. Ltd. (India), Tokio Marine Holdings, Inc. (Japan), among others |

|

Market Opportunities |

|

Marine Insurance Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers

- Coverage against a Wide Range of Risks

The increase in the adoption of marine insurance as it provides coverage against a wide range of risk measures acts as one of the major factors driving the marine insurance market. These type of insurance also assist in the smooth functioning of trade activities.

- Rise in Global Trade

The rise in the global trade along with the expansion of e-commerce sector accelerate the market growth. Approximately 85% of the global trade is carried by sea and tons cargo ships that largely contributes toward the global economy.

- Incidences of Losses

The increase in the incidences of losses such as damage caused to cargo vessels, ships and terminals due to massive marine business operations further influence the market. Maritime insurance possesses an important role in the management of these risks and losses in the marine business.

Additionally, rapid urbanization, change in lifestyle, surge in investments and increased consumer spending positively impact the marine insurance market.

Opportunities

Furthermore, incorporation of Internet of things (IoT) system in the existing marine insurance product lines for risk monitoring, and simplifies claims processing, among others extend profitable opportunities to the market players in the forecast period of 2022 to 2029. Also, increase in demand for marine insurance due to higher concentrations of cargo in ports and in transit, and warehouses will further expand the market.

Restraints/Challenges

On the other hand, sudden increments in marine insurance premiums are expected to obstruct market growth. Also, imposition of lockdown across several countries during the COVID outbreak is projected to challenge the marine insurance market in the forecast period of 2022-2029.

This marine insurance market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on marine insurance market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Marine Insurance Market

The COVID-19 had a negative impact on the growth of the marine insurance market. The business travel insurance witnessed decline during the COVID-19 pandemic. The outbreak of COVID caused lockdown across various countries and ban on national and international travel. The movement of people across borders came to a standstill due to countries closing their borders for visitors. The rise in number of flights cancellations enhanced number of insurance claims that negatively impacted the growth of the market after COVID-19 outbreak.

Recent Developments

- In April’2022, Tokio Marine launched corporate venture capital (CVC) fund to invest in early-stage startups globally. The Palo Alto-based CVC fund is expected to write checks worth between $500,000 and $3 million into seed and Series across sectors including fintech, healthcare, automation, climate tech, insurtech, mobility, cybersecurity, and artificial intelligence.

Global Marine Insurance Market Scope and Market Size

The marine insurance market is segmented on the basis of type, insurance, end-user and policy type. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Transport/Cargo

- Hull

- Offshore/Energy

- Marine Liability

Insurance

- Loss/Damage

- Fire/Explosion

- Natural Calamity

- Others

End-User

- Cargo Owners

- Ship Owners

- Government

- Others

Policy Type

- Time Policy

- Voyage Policy

- Floating Policy

- Valued Policy

- Others

Marine Insurance Market Regional Analysis/Insights

The marine insurance market is analysed and market size insights and trends are provided by country, type, insurance, end-user and policy type as referred above.

The countries covered in the marine insurance market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, Israel, Egypt, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

Europe dominates the marine insurance market as the region is surrounded by waterbodies and promotes marine trades.

Asia-Pacific (APAC) is expected to witness significant growth during the forecast period of 2022 to 2029 because of the surge in investments and rise in the e-commerce sector in the region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Marine Insurance Market

The marine insurance market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to marine insurance market.

Some of the major players operating in marine insurance market are

- Lloyd's (UK)

- Concirrus (UK)

- Marsh & McLennan Companies, INC. (US)

- Swiss Re (Switzerland)

- American International Group, Inc. (US)

- Beazley Group (UK)

- QBE Insurance Group Limited. (Australia)

- RSA (UK)

- Allianz (Germany)

- American International Group, Inc. (US)

- Aon plc (UK)

- Gallagher (US)

- Brown & Brown, Inc. (US)

- Lockton Companies. (US)

- Chubb (Switzerland)

- Willis Towers Watson (UK)

- United India Insurance Co. Ltd. (India)

- Tokio Marine Holdings, Inc. (Japan)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL MARINE INSURANCE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL MARINE INSURANCE MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 TOP TO BOTTOM ANALYSIS

2.2.8 STANDARDS OF MEASUREMENT

2.2.9 VENDOR SHARE ANALYSIS

2.2.10 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.11 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL MARINE INSURANCE MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW AND INDUSTRY TRENDS

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 TECHNOLOG ANALYSIS

5.2 REGULATORY STANDARDS

5.3 CASE STUDY ANALYSIS

5.4 VALUE CHAIN ANALYSIS

5.5 PORTER’S FIVE FORCE MODEL

5.6 MARINE INSURANCE ECOSYSTEM

5.6.1 MARINE CARGO INSURANCE CLAIMS

5.6.2 INSURANCE AGAINST FIRE RISKS AND EXPLOSIONS

5.6.3 INSURANCE AGAINST THEFT AND BURGLARY

5.6.4 INSURANCE AGAINST NATURAL CALAMITIES

5.6.5 INSURANCE AGAINST VESSEL COLLISIONS AND DAMAGES

6 GLOBAL MARINE INSURANCE MARKET, BY PRODUCT TYPE

6.1 OVERVIEW

6.2 HULL

6.3 CARGO/TRANSPORT

6.4 OFFSHORE/ENERGY

6.5 MARINE LIABILITY

6.6 OTHERS

7 GLOBAL MARINE INSURANCE MARKET, BY POLICY TYPE

7.1 OVERVIEW

7.2 VOYAGE POLICY

7.3 TIME POLICY

7.4 VALUED POLICY

7.5 FLOATING POLICY

7.6 OTHERS

8 GLOBAL MARINE INSURANCE MARKET, BY PREMIUM TYPE

8.1 OVERVIEW

8.2 LARGE

8.3 MEDIUM

8.4 SMALL

9 GLOBAL MARINE INSURANCE MARKET, BY INSURANCE

9.1 OVERVIEW

9.2 LOSS/DAMAGE

9.3 FIRE/EXPLOSION

9.4 NATURAL CALAMITY

9.5 OTHERS

10 GLOBAL MARINE INSURANCE MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 ON-WATER COMMERCIAL

10.3 SMALL RECREATIONAL BOATS

10.4 UNDERWATER LEISURE

10.5 UNDERWATER AUV

10.6 OTHERS

11 GLOBAL MARINE INSURANCE MARKET, BY END-USER

11.1 OVERVIEW

11.2 SHIP OWNERS

11.2.1 VOYAGE POLICY

11.2.2 TIME POLICY

11.2.3 VALUED POLICY

11.2.4 FLOATING POLICY

11.2.5 OTHERS

11.3 CARGO OWNERS

11.3.1 VOYAGE POLICY

11.3.2 TIME POLICY

11.3.3 VALUED POLICY

11.3.4 FLOATING POLICY

11.3.5 OTHERS

11.4 GOVERNMENT

11.4.1 VOYAGE POLICY

11.4.2 TIME POLICY

11.4.3 VALUED POLICY

11.4.4 FLOATING POLICY

11.4.5 OTHERS

11.5 OTHERS

12 GLOBAL MARINE INSURANCE MARKET, BY GEOGRAPHY

GLOBAL MARINE INSURANCE MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

12.2 EUROPE

12.2.1 GERMANY

12.2.2 FRANCE

12.2.3 U.K.

12.2.4 ITALY

12.2.5 SPAIN

12.2.6 RUSSIA

12.2.7 TURKEY

12.2.8 BELGIUM

12.2.9 NETHERLANDS

12.2.10 SWITZERLAND

12.2.11 REST OF EUROPE

12.3 ASIA PACIFIC

12.3.1 JAPAN

12.3.2 CHINA

12.3.3 SOUTH KOREA

12.3.4 INDIA

12.3.5 AUSTRALIA

12.3.6 SINGAPORE

12.3.7 THAILAND

12.3.8 MALAYSIA

12.3.9 INDONESIA

12.3.10 PHILIPPINES

12.3.11 REST OF ASIA PACIFIC

12.4 SOUTH AMERICA

12.4.1 BRAZIL

12.4.2 ARGENTINA

12.4.3 REST OF SOUTH AMERICA

12.5 MIDDLE EAST AND AFRICA

12.5.1 SOUTH AFRICA

12.5.2 EGYPT

12.5.3 SAUDI ARABIA

12.5.4 U.A.E

12.5.5 ISRAEL

12.5.6 REST OF MIDDLE EAST AND AFRICA

12.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

13 GLOBAL MARINE INSURANCE MARKET,COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: GLOBAL

13.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

13.3 COMPANY SHARE ANALYSIS: EUROPE

13.4 COMPANY SHARE ANALYSIS: ASIA PACIFIC

13.5 MERGERS & ACQUISITIONS

13.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

13.7 EXPANSIONS

13.8 REGULATORY CHANGES

13.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

14 GLOBAL MARINE INSURANCE MARKET , SWOT & DBMR ANALYSIS

15 GLOBAL MARINE INSURANCE MARKET, COMPANY PROFILE

15.1 ALLIANZ GROUP

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 GEOGRAPHIC PRESENCE

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 LOCKTON COMPANIES

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 GEOGRAPHIC PRESENCE

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 BROWN & BROWN INC

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 GEOGRAPHIC PRESENCE

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 BEAZLEY PLC

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 GEOGRAPHIC PRESENCE

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 SWISS RE LTD

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 GEOGRAPHIC PRESENCE

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 MARSH

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 GEOGRAPHIC PRESENCE

15.6.4 PRODUCT PORTFOLIO

15.6.5 RECENT DEVELOPMENTS

15.7 AXA GROUP

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 GEOGRAPHIC PRESENCE

15.7.4 PRODUCT PORTFOLIO

15.7.5 RECENT DEVELOPMENTS

15.8 AON PLC

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 GEOGRAPHIC PRESENCE

15.8.4 PRODUCT PORTFOLIO

15.8.5 RECENT DEVELOPMENTS

15.9 AMERICAN INTERNATIONAL GROUP (AIG)

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 GEOGRAPHIC PRESENCE

15.9.4 PRODUCT PORTFOLIO

15.9.5 RECENT DEVELOPMENTS

15.1 ARTHUR J. GALLAGHER & CO.

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 GEOGRAPHIC PRESENCE

15.10.4 PRODUCT PORTFOLIO

15.10.5 RECENT DEVELOPMENTS

15.11 ANDERSON INSURANCE AGENCY

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 GEOGRAPHIC PRESENCE

15.11.4 PRODUCT PORTFOLIO

15.11.5 RECENT DEVELOPMENTS

15.12 ARIES MARINE INSURANCE BROKERS

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 GEOGRAPHIC PRESENCE

15.12.4 PRODUCT PORTFOLIO

15.12.5 RECENT DEVELOPMENTS

15.13 ATRIUM

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 GEOGRAPHIC PRESENCE

15.13.4 PRODUCT PORTFOLIO

15.13.5 RECENT DEVELOPMENTS

15.14 ASCOT GROUP

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 GEOGRAPHIC PRESENCE

15.14.4 PRODUCT PORTFOLIO

15.14.5 RECENT DEVELOPMENTS

15.15 BERKSHIRE HATHWAY SPECIALTY INSURANCE

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 GEOGRAPHIC PRESENCE

15.15.4 PRODUCT PORTFOLIO

15.15.5 RECENT DEVELOPMENTS

15.16 GARD

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 GEOGRAPHIC PRESENCE

15.16.4 PRODUCT PORTFOLIO

15.16.5 RECENT DEVELOPMENTS

15.17 HANNOVER RE

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 GEOGRAPHIC PRESENCE

15.17.4 PRODUCT PORTFOLIO

15.17.5 RECENT DEVELOPMENTS

15.18 HDFC ERGO GENERAL INSURANCE

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 GEOGRAPHIC PRESENCE

15.18.4 PRODUCT PORTFOLIO

15.18.5 RECENT DEVELOPMENTS

15.19 LAMPE & SCHWARTZE

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 GEOGRAPHIC PRESENCE

15.19.4 PRODUCT PORTFOLIO

15.19.5 RECENT DEVELOPMENTS

15.2 MUNICH RE

15.20.1 COMPANY SNAPSHOT

15.20.2 REVENUE ANALYSIS

15.20.3 GEOGRAPHIC PRESENCE

15.20.4 PRODUCT PORTFOLIO

15.20.5 RECENT DEVELOPMENTS

15.21 THE HARTFORD

15.21.1 COMPANY SNAPSHOT

15.21.2 REVENUE ANALYSIS

15.21.3 GEOGRAPHIC PRESENCE

15.21.4 PRODUCT PORTFOLIO

15.21.5 RECENT DEVELOPMENTS

15.22 GREAT AMERICAN INSURANCE GROUP

15.22.1 COMPANY SNAPSHOT

15.22.2 REVENUE ANALYSIS

15.22.3 GEOGRAPHIC PRESENCE

15.22.4 PRODUCT PORTFOLIO

15.22.5 RECENT DEVELOPMENTS

15.23 CHUBB

15.23.1 COMPANY SNAPSHOT

15.23.2 REVENUE ANALYSIS

15.23.3 GEOGRAPHIC PRESENCE

15.23.4 PRODUCT PORTFOLIO

15.23.5 RECENT DEVELOPMENTS

15.24 TATA AIG GENERAL INSURANCE COMPANY LIMITED

15.24.1 COMPANY SNAPSHOT

15.24.2 REVENUE ANALYSIS

15.24.3 GEOGRAPHIC PRESENCE

15.24.4 PRODUCT PORTFOLIO

15.24.5 RECENT DEVELOPMENTS

15.25 NATIONWIDE

15.25.1 COMPANY SNAPSHOT

15.25.2 REVENUE ANALYSIS

15.25.3 GEOGRAPHIC PRESENCE

15.25.4 PRODUCT PORTFOLIO

15.25.5 RECENT DEVELOPMENTS

15.26 NATIONAL INSURANCE COMPANY LIMITED

15.26.1 COMPANY SNAPSHOT

15.26.2 REVENUE ANALYSIS

15.26.3 GEOGRAPHIC PRESENCE

15.26.4 PRODUCT PORTFOLIO

15.26.5 RECENT DEVELOPMENTS

*NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

16 CONCLUSION

17 RELATED REPORTS

18 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.