Global Nicotine Replacement Therapy Market

Market Size in USD Billion

CAGR :

%

USD

2.92 Billion

USD

7.93 Billion

2021

2029

USD

2.92 Billion

USD

7.93 Billion

2021

2029

| 2022 –2029 | |

| USD 2.92 Billion | |

| USD 7.93 Billion | |

|

|

|

|

Market Analysis and Size

According to the US Agency for Healthcare Research and Quality, except for pregnant women and teenagers, nicotine replacement therapy (NRT) is safe for all adults who want to quit smoking. Nicotine replacement therapy (NRT) is a method of assisting people in quitting smoking. Nicotine is delivered in small doses in the form of inhalers, lozenges, patches, sprays, or gum, while other toxins contained in tobacco cigarettes are avoided. The fundamental goal of nicotine replacement therapy is to diminish nicotine cravings by easing nicotine withdrawal symptoms.

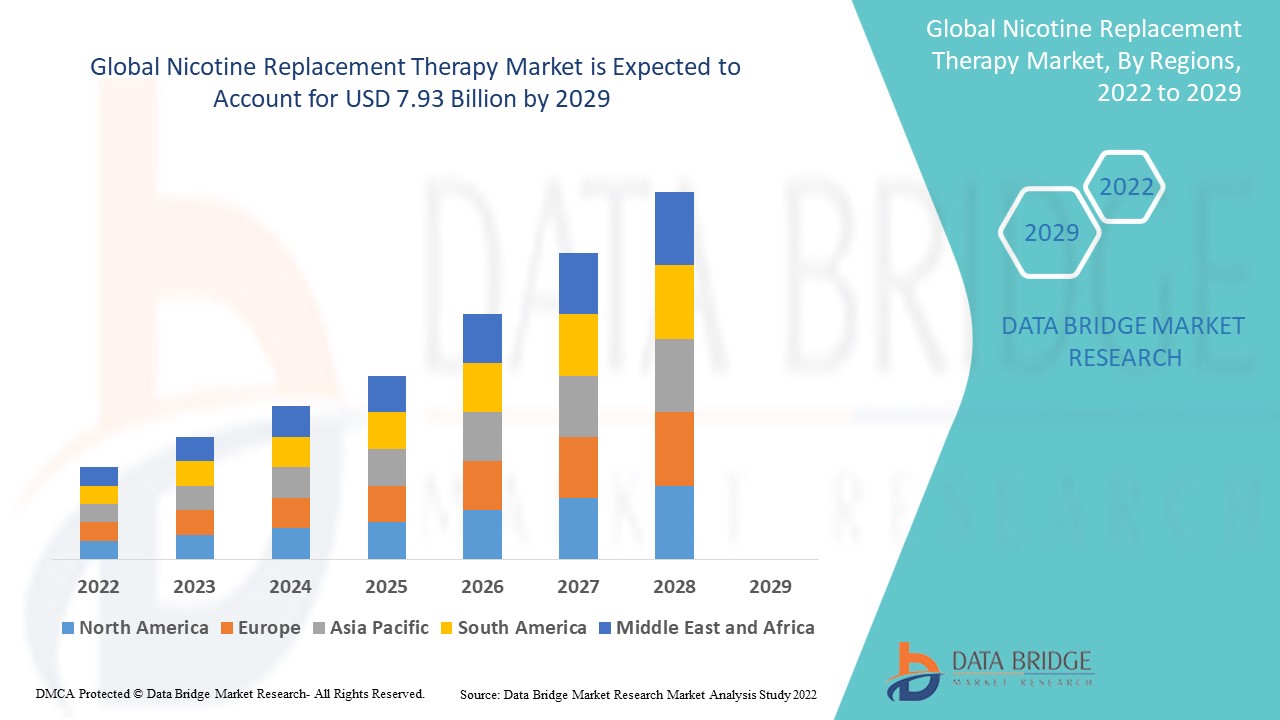

Data Bridge Market Research analyses that the nicotine replacement therapy market was valued at USD 2.92 billion in 2021 and is expected to reach USD 7.93 billion by 2029, registering a CAGR of 13.31% during the forecast period of 2022 to 2029. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team also includes in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Report Scope and Market Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Product Type (Patches, Gums, Logenzes, Inhalers, Nasal Spray, Sublingual Tablets), End-Users (Hospitals, Specialty Clinics, Homecare, Others), Distribution Channel (Hospital Pharmacy, Retail Pharmacy, Online Pharmacy, Others) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Market Players Covered |

Pfizer Inc. (US), GlaxoSmithKline plc (UK), Novartis AG (Switzerland), Mylan N.V. (US), Teva Pharmaceutical Industries Ltd.(Israel), Sanofi (France), AstraZeneca (UK), Johnson & Johnson Private Limited (US), Merck & Co., Inc. (US), Cipla Inc. (US), Takeda Pharmaceutical Company Limited (Japan), Perrigo Company plc (Ireland), McNeil AB (Sweden), Imperial Brands (UK), Philip Morris Products S.A. (US), BAT (UK), NJOY (US), Fertin Pharma (Denmark), Glenmark Pharmaceuticals Limited (India), Pierre Fabre Group (France) |

|

Market Opportunities |

|

Market Definition

Nicotine replacement therapy is a treatment that entails the administration of nicotine by smokers in the form of patches, inhalers, gums, sprays, and lozenges that are free of the toxic compounds found in tobacco. In contrast to cigarettes, which contain a large amount of nicotine and so cause lung cancer, asthma, and other chronic problems, nicotine replacement treatment uses medications that provide nicotine at a low dose. Nicotine replacement therapy reduces or eliminates tobacco intake, reducing the frequency and intensity of cravings.

Nicotine Replacement Therapy Market Dynamics

Drivers

- Rise in the prevalence of chronic diseases

The surging prevalence of chronic diseases is a major factor driving the nicotine replacement therapy market's growth rate during the forecast period of 2022-2029. The Centers for Disease Control and Prevention (CDC) estimates that smoking cigarettes cause approximately 80% to 90% of lung cancer deaths in the United States each year. Tobacco smoke contains more than 7000 compounds, with more than 70 of them known to cause cancer in humans. Furthermore, the rising prevalence of chronic illnesses is driving large corporations to develop breakthrough NRT solutions that help people resist the need to smoke. The rising prevalence of tobacco addiction among teenagers is fueling demand for NTR products, which will boost the worldwide nicotine replacement therapy market over the forecast period.

- Increasing investment for healthcare infrastructure

Another significant factor influencing the growth rate of nicotine replacement therapy market is the rising healthcare expenditure which helps in improving its infrastructure. Also, various government organizations aims to improve the healthcare infrastructure by increasing funding and this will further influence the market dynamics.

- Rising awareness about the ill-effects of smoking

Growing public awareness of the harmful effects of smoking is projected to be a major driver of the market. Globally, the number of smokers has topped 1.1 billion. People are turning to smoking cessation therapies as a result of government initiatives such as the "affordable care act," insurance regulations, and programs to raise awareness about the harmful effects of smoking on health through counseling. In 2018, 55 percent of the 34.2 million smokers in the United States attempted to quit.

Furthermore, sedentary lifestyle of people and surging geriatric population will result in the expansion of nicotine replacement therapy market. Along with this, favourable reimbursement policies will enhance the market's growth rate.

Opportunities

- Technological advancement

Technological developments in the nicotine replacement therapy market are continuing, resulting in an increase in the number of people moving to advanced products. The acceptance of NRT is anticipated to be aided by innovations such as heat-not-burn products, flavoured chewing gums, and lozenges. Tobacco giants such as British American Tobacco have developed smokeless and less hazardous alternatives. When opposed to traditional cigarettes, these improvements have a variable range of effectiveness and are accepted in society, promoting their adoption and enhancing market growth. This will create new market opportunities in the coming years.

- Rising number of product launches

Major companies such as GlaxoSmithKline plc and Johnson & Johnson Inc hold over 80% of the total market share and are constantly consolidating their positions by introducing novel nicotine replacement therapy products in the global marketplace. Moreover, over the projected period, other market players are attempting to strengthen their positions by implementing strategies such as collaboration, merger and acquisition, and introducing new products. This will create new market opportunities.

Moreover, the market's growth is fueled by an increase in the number of research and development activities. Nicotine replacement therapy has been shown to be effective in clinical trials, increasing the likelihood of quitting smoking by 50% to 70%. This will provide beneficial opportunities for the nicotine replacement therapy market growth.

Restraints/Challenges

- The ban on e-cigarettes

One of the most important reasons impeding the market's growth is the ban on e-cigarettes. For instance, the Indian government banned the import, manufacture, and sale of e-cigarettes in September 2019. With over 100 million smokers in India, this may have been a huge opportunity for market expansion. Other countries, including Mexico, Brazil, Malaysia, and Thailand, have prohibited the use, import, and manufacture of e-cigarettes. By 2020, over 20 countries will have outlawed the use of e-cigarettes. This is projected to stifle market expansion.

On the other hand, high cost factors and lack of awareness will obstruct the market's growth rate. The lack of healthcare infrastructure in developing economies and dearth of skilled professionals will challenge the nicotine replacement therapy market. Additionally, side effects associated with nicotine replacement therapy such as headache, nausea and other digestive problem will act as restrain and further impede the growth rate of market during the forecast period of 2022-2029.

This nicotine replacement therapy market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the nicotine replacement therapy market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Patient Epidemiology Analysis

Nicotine replacement therapy market also provides you with detailed market analysis for patient analysis, prognosis and cures. Prevalence, incidence, mortality, adherence rates are some of the data variables that are available in the report. Direct or indirect impact analyses of epidemiology to market growth are analysed to create a more robust and cohort multivariate statistical model for forecasting the market in the growth period.

COVID-19 Impact on Nicotine Replacement Therapy Market

The COVID-19 outbreak and subsequent lockdown in numerous countries around the world had a huge impact on the financial status of enterprises in all sectors. The private healthcare sector is one of the areas where the pandemic had a significant impact. The deadly impacts of the new coronavirus was seen all across the world. Millions of people have already died as a result of the outbreak, and many more were battling the symptoms all around the world. The disease affecting the respiratory organs is considered highly lethal for those who heavily consume tobacco products. To lessen the impact on smokers, various government bodies promote anti-smoking initiatives and prescribe nicotine replacement therapy to those addicted to cigarettes.

Recent Development

- In June 2020, Taat Herb Co. announced the launch of its new hemp cigarettes from the Taat stable. According to the firm, the new product closely resembles the sensation of smoking a typical cigarette and contains 50mg of cannabidiol (CBD), which is effective in reducing tobacco dependence.

Global Nicotine Replacement Therapy Market Scope

The nicotine replacement therapy market is segmented on the basis of product type, end-users and distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product Type

- Patches

- Gums

- Logenzes

- Inhalers

- Nasal Spray

- Sublingual Tablets

End-Users

- Hospitals

- Specialty Clinics

- Homecare

- Others

Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

- Others

Nicotine Replacement Therapy Market Regional Analysis/Insights

The nicotine replacement therapy market is analysed and market size insights and trends are provided by country, product type, end-users and distribution channel as referenced above.

The countries covered in the nicotine replacement therapy market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America

North America dominates the nicotine replacement therapy market in terms of market share and market revenue and will continue to flourish its dominance during the forecast period. This is due to the growing adoption rate of e-cigarette and heated tobacco and rising healthcare expenditure will further propel the market's growth rate in this region. Additionally, the increase in the prevalence of diseases associated with smoking and the number of favourable government initiatives will further propel themarket's growth rate in this region.

Asia-Pacific is expected to be the fastest-growing region during the forecast period of 2022-2029 due to surging rising competition between the big tobacco companies in this region. Also, the development of healthcare infrastructure and rising demand for NRT products will further propel themarket's growth rate in this region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Nicotine Replacement Therapy Market Share Analysis

The nicotine replacement therapy market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to nicotine replacement therapy market.

Some of the major players operating in the nicotine replacement therapy market are:

- Pfizer Inc. (US)

- GlaxoSmithKline plc (UK)

- Novartis AG (Switzerland)

- Mylan N.V. (US)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Sanofi (France)

- AstraZeneca (UK)

- Johnson & Johnson Private Limited (US)

- Merck & Co., Inc. (US)

- Cipla Inc. (US)

- Takeda Pharmaceutical Company Limited (Japan)

- Perrigo Company plc (Ireland)

- McNeil AB (Sweden)

- Imperial Brands (UK)

- Philip Morris Products S.A. (US)

- BAT (UK)

- NJOY (US)

- Fertin Pharma (Denmark)

- Glenmark Pharmaceuticals Limited (India)

- Pierre Fabre Group (France)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL NICOTINE REPLACEMENT THERAPY MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL NICOTINE REPLACEMENT THERAPY MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 EPIDEMIOLOGY MODELING

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL NICOTINE REPLACEMENT THERAPY MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER'S 5 FORCES

4.2 PESTEL ANALYSIS

4.3 PATEINT TREATMENT SUCCESS RATES

5 INDUSTRY INSIGHTS

5.1 PATENT ANALYSIS

5.2 DRUG TREATMENT RATE BY MATURED MARKETS

5.3 DEMOGRAPHIC TRENDS: IMPACTS ON ALL INCIDENCE RATES

5.4 PATIENT FLOW DIAGRAM

5.5 KEY PRICING STRATEGIES

5.6 KEY PATIENT ENROLLMENT STRATEGIES

5.7 INTERVIEWS WITH PHYSICIANS

5.8 OTHER KOL SNAPSHOTS

6 REGULATORY SCENARIO

6.1 FDA APPROVALS

6.2 EMA APPROVALS

7 MERGERS AND ACQUISITION

7.1 LICENSING

7.2 COMMERCIALIZATION AGREEMENTS

8 PIPELINE ANALYSIS

8.1 CLINICAL TRIALS AND PHASE ANALYSIS

8.2 DRUG THERAPY PIPELINE

8.3 PHASE III CANDIDATES

8.3.1 NICVAX VACCINE

8.4 PHASE II CANDIDATE

8.4.1 VACCINE

8.4.1.1. NIC002

8.4.1.2. TANIC

8.5 PHASE I CANDIDATE

8.5.1 SEL-069 VACCINE

8.6 OTHERS (PRE-CLINICAL AND RESEARCH)

9 MARKET OVERVIEW

9.1 DRIVERS

9.2 RESTRAINS

9.3 OPPURTUNITY

9.4 CHALLENGES

10 GLOBAL NICOTINE REPLACEMENT THERAPY MARKET, BY TYPE

10.1 OVERVIEW

10.2 OVER THE COUNTER

10.2.1 TRANSDERMAL PATCHES

10.2.1.1. FULL STRENGHT PATCH (15-22 MG OF NICOTINE)

10.2.1.1.1. MARKET VALUE (USD MN)

10.2.1.1.2. MARKET VOLUME (UNITS)

10.2.1.1.3. AVERAGE SELLING PRICE (USD)

10.2.1.2. WEAKER PATCH (5-14 MG OF NICOTINE)

10.2.1.2.1. MARKET VALUE (USD MN)

10.2.1.2.2. MARKET VOLUME (UNITS)

10.2.1.2.3. AVERAGE SELLING PRICE (USD)

10.2.2 NICOTINE GUM

10.2.2.1. MARKET VALUE (USD MN)

10.2.2.2. MARKET VOLUME (UNITS)

10.2.2.3. AVERAGE SELLING PRICE (USD)

10.2.3 SUBLINGUAL TABLET

10.2.3.1. MARKET VALUE (USD MN)

10.2.3.2. MARKET VOLUME (UNITS)

10.2.3.3. AVERAGE SELLING PRICE (USD)

10.2.4 LOZENGE

10.2.4.1. MARKET VALUE (USD MN)

10.2.4.2. MARKET VOLUME (UNITS)

10.2.4.3. AVERAGE SELLING PRICE (USD)

10.3 PRESCRIPTION

10.3.1 NICOTINE INHALERS

10.3.1.1. MARKET VALUE (USD MN)

10.3.1.2. MARKET VOLUME (UNITS)

10.3.1.3. AVERAGE SELLING PRICE (USD)

10.3.2 NICOTINE METERED NASAL SPRAY

10.3.2.1. MARKET VALUE (USD MN)

10.3.2.2. MARKET VOLUME (UNITS)

10.3.2.3. AVERAGE SELLING PRICE (USD)

10.3.3 ELECTRONIC CIGARETTE

10.3.3.1. MARKET VALUE (USD MN)

10.3.3.2. MARKET VOLUME (UNITS)

10.3.3.3. AVERAGE SELLING PRICE (USD)

10.3.4 OTHERS

11 GLOBAL NICOTINE REPLACEMENT THERAPY MARKET, BY ROUTE OF ADMINISTRATION

11.1 OVERVIEW

11.2 ORAL

11.3 NASAL

11.4 TRANSDERMAL

12 GLOBAL NICOTINE REPLACEMENT THERAPY MARKET, BY POPULATION TYPE

12.1 OVERVIEW

12.2 ADOLESCENTS

12.3 ADULTS

12.4 GERIATRIC

13 GLOBAL NICOTINE REPLACEMENT THERAPY MARKET, BY END USER

13.1 OVERVIEW

13.2 HOSPITALS

13.3 CLINICS

13.4 HOME HEALTHCARE

13.5 OTHERS

14 GLOBAL NICOTINE REPLACEMENT THERAPY MARKET, BY DISTRIBUTION CHANNEL

14.1 OVERVIEW

14.2 HOSPITAL PHARMACY

14.3 RETAIL PHARMACY

14.4 OTHERS

15 GLOBAL NICOTINE REPLACEMENT THERAPY MARKET, BY GEOGRAPHY

GLOBAL NICOTINE REPLACEMENT THERAPY MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

15.1 NORTH AMERICA

15.1.1 U.S.

15.1.1.1. U.S. NICOTINE REPLACEMENT THERAPY MARKET, BY TYPE

15.1.1.2. U.S. NICOTINE REPLACEMENT THERAPY MARKET, BY ROUTE OF ADMINISTRATION

15.1.1.3. U.S. NICOTINE REPLACEMENT THERAPY MARKET, BY END USER

15.1.1.4. U.S. NICOTINE REPLACEMENT THERAPY MARKET, BY DISTRIBUTION CHANNEL

15.1.2 CANADA

15.1.3 MEXICO

15.1.4 DOMINICAN REPUBLIC

15.1.5 JAMAICA

15.1.6 PANAMA

15.2 EUROPE

15.2.1 GERMANY

15.2.2 FRANCE

15.2.3 U.K.

15.2.4 HUNGARY

15.2.5 LITHUANIA

15.2.6 AUSTRIA

15.2.7 IRELAND

15.2.8 NORWAY

15.2.9 POLAND

15.2.10 ITALY

15.2.11 SPAIN

15.2.12 RUSSIA

15.2.13 TURKEY

15.2.14 NETHERLANDS

15.2.15 SWITZERLAND

15.2.16 REST OF EUROPE

15.3 ASIA-PACIFIC

15.3.1 JAPAN

15.3.2 CHINA

15.3.3 TAIWAN

15.3.4 SOUTH KOREA

15.3.5 INDIA

15.3.6 AUSTRALIA

15.3.7 SINGAPORE

15.3.8 THAILAND

15.3.9 MALAYSIA

15.3.10 INDONESIA

15.3.11 PHILIPPINES

15.3.12 VIETNAM

15.3.13 REST OF ASIA-PACIFIC

15.4 SOUTH AMERICA

15.4.1 BRAZIL

15.4.2 ECUADOR

15.4.3 CHILE

15.4.4 COLOMBIA

15.4.5 VENEZUELA

15.4.6 ARGENTINA

15.4.7 PERU

15.4.8 CURAÇAO

15.4.9 PARAGUAY

15.4.10 URUGUAY

15.4.11 TRINIDAD AND TOBAGO

15.4.12 REST OF SOUTH AMERICA

15.5 MIDDLE EAST AND AFRICA

15.5.1 SOUTH AFRICA

15.5.2 SAUDI ARABIA

15.5.3 UAE

15.5.4 EGYPT

15.5.5 KUWAIT

15.5.6 ISRAEL

15.5.7 BOLIVIA

15.5.8 REST OF MIDDLE EAST AND AFRICA

15.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

16 GLOBAL NICOTINE REPLACEMENT THERAPY MARKET, SWOT AND DBMR ANALYSIS

17 GLOBAL NICOTINE REPLACEMENT THERAPY MARKET, COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: GLOBAL

17.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

17.3 COMPANY SHARE ANALYSIS: EUROPE

17.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

17.5 MERGERS & ACQUISITIONS

17.6 NEW PRODUCT DEVELOPMENT & APPROVALS

17.7 EXPANSIONS

17.8 REGULATORY CHANGES

17.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

18 GLOBAL NICOTINE REPLACEMENT THERAPY MARKET, COMPANY PROFILE

18.1 JOHNSON & JOHNSON

18.1.1 COMPANY OVERVIEW

18.1.2 REVENUE ANALYSIS

18.1.3 GEOGRAPHIC PRESENCE

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENTS

18.2 GSK

18.2.1 COMPANY OVERVIEW

18.2.2 REVENUE ANALYSIS

18.2.3 GEOGRAPHIC PRESENCE

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT DEVELOPMENTS

18.3 PERRIGO COMPANY PLC

18.3.1 COMPANY OVERVIEW

18.3.2 REVENUE ANALYSIS

18.3.3 GEOGRAPHIC PRESENCE

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT DEVELOPMENTS

18.4 PIERRE FABRE SA

18.4.1 COMPANY OVERVIEW

18.4.2 REVENUE ANALYSIS

18.4.3 GEOGRAPHIC PRESENCE

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT DEVELOPMENTS

18.5 PFIZER

18.5.1 COMPANY OVERVIEW

18.5.2 REVENUE ANALYSIS

18.5.3 GEOGRAPHIC PRESENCE

18.5.4 PRODUCT PORTFOLIO

18.5.5 RECENT DEVELOPMENTS

18.6 CIPLA

18.6.1 COMPANY OVERVIEW

18.6.2 REVENUE ANALYSIS

18.6.3 GEOGRAPHIC PRESENCE

18.6.4 PRODUCT PORTFOLIO

18.6.5 RECENT DEVELOPMENTS

18.7 BRITISH AMERICAN TOBACCO PLC

18.7.1 COMPANY OVERVIEW

18.7.2 REVENUE ANALYSIS

18.7.3 GEOGRAPHIC PRESENCE

18.7.4 PRODUCT PORTFOLIO

18.7.5 RECENT DEVELOPMENTS

18.8 SPARSHA PHARMA

18.8.1 COMPANY OVERVIEW

18.8.2 REVENUE ANALYSIS

18.8.3 GEOGRAPHIC PRESENCE

18.8.4 PRODUCT PORTFOLIO

18.8.5 RECENT DEVELOPMENTS

18.9 DR REDDY LABORATORIES

18.9.1 COMPANY OVERVIEW

18.9.2 REVENUE ANALYSIS

18.9.3 GEOGRAPHIC PRESENCE

18.9.4 PRODUCT PORTFOLIO

18.9.5 RECENT DEVELOPMENTS

18.1 NOVARTIS

18.10.1 COMPANY OVERVIEW

18.10.2 REVENUE ANALYSIS

18.10.3 GEOGRAPHIC PRESENCE

18.10.4 PRODUCT PORTFOLIO

18.10.5 RECENT DEVELOPMENTS

18.11 TEVA PHARMAMCEUTICALS

18.11.1 COMPANY OVERVIEW

18.11.2 REVENUE ANALYSIS

18.11.3 GEOGRAPHIC PRESENCE

18.11.4 PRODUCT PORTFOLIO

18.11.5 RECENT DEVELOPMENTS

18.12 TAKEDA PHARMACEUTICALS

18.12.1 COMPANY OVERVIEW

18.12.2 REVENUE ANALYSIS

18.12.3 GEOGRAPHIC PRESENCE

18.12.4 PRODUCT PORTFOLIO

18.12.5 RECENT DEVELOPMENTS

18.13 BRISTOL MEYERS SQUIBB

18.13.1 COMPANY OVERVIEW

18.13.2 REVENUE ANALYSIS

18.13.3 GEOGRAPHIC PRESENCE

18.13.4 PRODUCT PORTFOLIO

18.13.5 RECENT DEVELOPMENTS

18.14 MERCK & CO., INC

18.14.1 COMPANY OVERVIEW

18.14.2 REVENUE ANALYSIS

18.14.3 GEOGRAPHIC PRESENCE

18.14.4 PRODUCT PORTFOLIO

18.14.5 RECENT DEVELOPMENTS

18.15 SANOFI

18.15.1 COMPANY OVERVIEW

18.15.2 REVENUE ANALYSIS

18.15.3 GEOGRAPHIC PRESENCE

18.15.4 PRODUCT PORTFOLIO

18.15.5 RECENT DEVELOPMENTS

18.16 ELI LILLY

18.16.1 COMPANY OVERVIEW

18.16.2 REVENUE ANALYSIS

18.16.3 GEOGRAPHIC PRESENCE

18.16.4 PRODUCT PORTFOLIO

18.16.5 RECENT DEVELOPMENTS

18.17 SHIRE PHARMACEUTICALS

18.17.1 COMPANY OVERVIEW

18.17.2 REVENUE ANALYSIS

18.17.3 GEOGRAPHIC PRESENCE

18.17.4 PRODUCT PORTFOLIO

18.17.5 RECENT DEVELOPMENTS

18.18 BOEHRINGER INGELHEIM

18.18.1 COMPANY OVERVIEW

18.18.2 REVENUE ANALYSIS

18.18.3 GEOGRAPHIC PRESENCE

18.18.4 PRODUCT PORTFOLIO

18.18.5 RECENT DEVELOPMENTS

18.19 ASTRAZENCA

18.19.1 COMPANY OVERVIEW

18.19.2 REVENUE ANALYSIS

18.19.3 GEOGRAPHIC PRESENCE

18.19.4 PRODUCT PORTFOLIO

18.19.5 RECENT DEVELOPMENTS

18.2 SUN PHARMA

18.20.1 COMPANY OVERVIEW

18.20.2 REVENUE ANALYSIS

18.20.3 GEOGRAPHIC PRESENCE

18.20.4 PRODUCT PORTFOLIO

18.20.5 RECENT DEVELOPMENTS

18.21 F-HOFFMANN LA ROCHE

18.21.1 COMPANY OVERVIEW

18.21.2 REVENUE ANALYSIS

18.21.3 GEOGRAPHIC PRESENCE

18.21.4 PRODUCT PORTFOLIO

18.21.5 RECENT DEVELOPMENTS

18.22 ABBVIE

18.22.1 COMPANY OVERVIEW

18.22.2 REVENUE ANALYSIS

18.22.3 GEOGRAPHIC PRESENCE

18.22.4 PRODUCT PORTFOLIO

18.22.5 RECENT DEVELOPMENTS

18.23 AMGEN

18.23.1 COMPANY OVERVIEW

18.23.2 REVENUE ANALYSIS

18.23.3 GEOGRAPHIC PRESENCE

18.23.4 PRODUCT PORTFOLIO

18.23.5 RECENT DEVELOPMENTS

18.24 BAUSCH HEALTH

18.24.1 COMPANY OVERVIEW

18.24.2 REVENUE ANALYSIS

18.24.3 GEOGRAPHIC PRESENCE

18.24.4 PRODUCT PORTFOLIO

18.24.5 RECENT DEVELOPMENTS

18.25 EISAI CO.,

18.25.1 COMPANY OVERVIEW

18.25.2 REVENUE ANALYSIS

18.25.3 GEOGRAPHIC PRESENCE

18.25.4 PRODUCT PORTFOLIO

18.25.5 RECENT DEVELOPMENTS

18.26 GRIFOLS

18.26.1 COMPANY OVERVIEW

18.26.2 REVENUE ANALYSIS

18.26.3 GEOGRAPHIC PRESENCE

18.26.4 PRODUCT PORTFOLIO

18.26.5 RECENT DEVELOPMENTS

18.27 ALEXION PHARMACEUTICALS

18.27.1 COMPANY OVERVIEW

18.27.2 REVENUE ANALYSIS

18.27.3 GEOGRAPHIC PRESENCE

18.27.4 PRODUCT PORTFOLIO

18.27.5 RECENT DEVELOPMENTS

18.28 CETLIC PHARMA

18.28.1 COMPANY OVERVIEW

18.28.2 REVENUE ANALYSIS

18.28.3 GEOGRAPHIC PRESENCE

18.28.4 PRODUCT PORTFOLIO

18.28.5 RECENT DEVELOPMENTS

18.29 SELECTA BIOSCIENCE

18.29.1 COMPANY OVERVIEW

18.29.2 REVENUE ANALYSIS

18.29.3 GEOGRAPHIC PRESENCE

18.29.4 PRODUCT PORTFOLIO

18.29.5 RECENT DEVELOPMENTS

18.3 NABI BIOPHARMACEUTICALS

18.30.1 COMPANY OVERVIEW

18.30.2 REVENUE ANALYSIS

18.30.3 GEOGRAPHIC PRESENCE

18.30.4 PRODUCT PORTFOLIO

18.30.5 RECENT DEVELOPMENTS

*NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

19 RELATED REPORTS

20 CONCLUSION

21 QUESTIONNAIRE

22 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.