Global Patient Temperature Monitoring Market

Market Size in USD Billion

CAGR :

%

USD

3.96 Billion

USD

5.78 Billion

2024

2032

USD

3.96 Billion

USD

5.78 Billion

2024

2032

| 2025 –2032 | |

| USD 3.96 Billion | |

| USD 5.78 Billion | |

|

|

|

|

Patient Temperature Monitoring Market Analysis

The patient temperature monitoring market is a rapidly growing sector within healthcare, driven by the increasing prevalence of chronic diseases, surgical procedures, and the need for effective patient care. Temperature monitoring plays a crucial role in diagnosing and managing conditions such as fever, hypothermia, and infections, ensuring optimal treatment outcomes. Recent developments in wearable and non-invasive temperature monitoring devices are improving accuracy and patient comfort. Innovations such as smart temperature monitoring patches, wearable sensors, and table-top devices are replacing traditional methods, offering continuous and real-time monitoring for both hospitalized patients and home care settings. The market is further fueled by advancements in telemedicine and healthcare technologies, providing remote monitoring solutions. Key players, including companies such as Medtronic, Philips, and BD, are continually introducing new products with enhanced features. As healthcare systems increasingly adopt digital health solutions, the patient temperature monitoring market is poised for continued expansion, particularly in emerging markets where access to advanced medical technologies is rising.

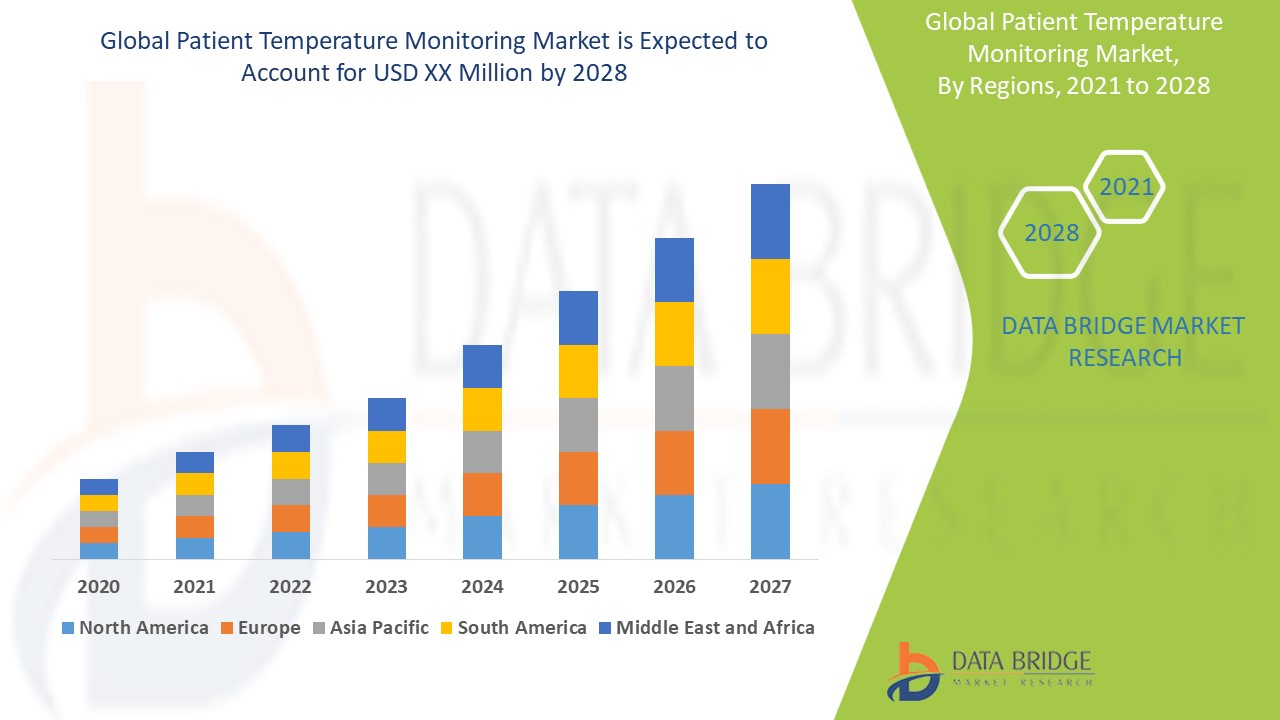

Patient Temperature Monitoring Market Size

The global patient temperature monitoring market size was valued at USD 3.96 billion in 2024 and is projected to reach USD 5.78 billion by 2032, with a CAGR of 4.85% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Patient Temperature Monitoring Market Trends

“Adoption of Wireless and Remote Temperature Monitoring Devices”

The patient temperature monitoring market is evolving with advancements in technology, driven by the increasing demand for real-time, non-invasive monitoring device. Innovations in wearable sensors, smart temperature patches, and portable devices are transforming traditional temperature monitoring methods, offering continuous, accurate readings in both hospital and home care settings. One key trend is the growing adoption of wireless and remote temperature monitoring devices, enabling healthcare providers to track patients' temperature in real time, even from a distance. This trend is particularly valuable for managing chronic conditions and improving patient comfort. As healthcare systems move toward digitization and remote care, the patient temperature monitoring market is expected to see significant growth, with enhanced accessibility and improved patient outcomes.

Report Scope and Patient Temperature Monitoring Market Segmentation

|

Attributes |

Patient Temperature Monitoring Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America. |

|

Key Market Players |

Cardinal Health (U.S.), Koninklijke Philips N.V. (Netherlands), Baxter (U.S.), Drägerwerk AG & Co. KGaA (Germany), Terumo Medical Corporation (Japan), Masimo (U.S.), Microlife Corporation (Switzerland), Procter & Gamble (U.S.), DONGGUAN ACTHERM MEDICAL CORP (China), NPX Medical (U.S.), Briggs Healthcare (U.S.), Hicks India (India), Medtronic (U.S.), Welch Allyn Warehouse (U.S.), Medium Healthcare (U.K.), Cosinuss GmbH (Germany), Helen of Troy (U.S.), Omron Healthcare, Inc. (Japan), and BD (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Patient Temperature Monitoring Market Definition

Patient temperature monitoring refers to the process of regularly measuring and tracking a patient's body temperature to assess their health condition and detect any abnormalities, such as fever or hypothermia. It is an essential aspect of patient care, used in various medical settings, including hospitals, clinics, home care, and surgical environments. Temperature monitoring can be performed using various devices, such as smart thermometers, wearable sensors, smart patches, and invasive or non-invasive devices.

Patient Temperature Monitoring Market Dynamics

Drivers

- Rising Prevalence of Chronic Diseases

The rising prevalence of chronic conditions, such as fever, infections, and hypothermia, is a significant driver of the patient temperature monitoring market. These conditions require frequent and precise monitoring of body temperature to ensure timely diagnosis and effective treatment. As chronic diseases continue to rise globally, healthcare systems are increasingly adopting continuous and accurate temperature monitoring solutions in hospitals and home care settings. This demand is further amplified by the growing emphasis on personalized healthcare, where real-time monitoring is critical for managing patients' conditions, enhancing recovery, and preventing complications. Consequently, the need for advanced temperature monitoring technologies continues to grow.

- Increase in Surgical Procedures

The global increase in surgical procedures is a key driver for the growth of the patient temperature monitoring market. Temperature monitoring plays a critical role in detecting fever, preventing hypothermia, and ensuring optimal body temperature during surgery, which is essential for patient safety and recovery. As the number of surgical operations rises, particularly in critical care and elective surgeries, the need for reliable, real-time temperature monitoring solutions becomes more important. These devices help reduce complications, improve surgical outcomes, and provide healthcare providers with accurate data to make timely decisions. This growing demand for temperature monitoring in surgery is significantly contributing to market expansion.

Opportunities

- Wearable and Non-Invasive Devices

The increasing demand for wearable devices, non-invasive temperature monitoring devices represents a major growth opportunity in the patient temperature monitoring market. These devices offer continuous, real-time monitoring, making them highly effective for both hospital and home care settings. They are particularly beneficial for patients with chronic conditions, such as infections or fever, as well as those recovering from surgery. Wearable temperature sensors enhance patient comfort and convenience, while enabling healthcare providers to track patients’ conditions remotely. This continuous monitoring helps detect early signs of complications, improving patient outcomes and reducing hospital visits, ultimately driving market growth and adoption.

- Integration with Telemedicine

The rise of telemedicine and remote healthcare solutions presents a significant opportunity for integrating temperature monitoring systems into digital health platforms. With remote monitoring, healthcare providers can track patients' vitals, including temperature, from a distance, enabling continuous care without the need for frequent in-person visits. This improves patient convenience and accessibility and helps reduce healthcare costs by minimizing hospital admissions and follow-up appointments. In addition, it enables early detection of potential health issues, allowing for timely interventions. As telemedicine continues to expand globally, the demand for integrated temperature monitoring solutions is expected to grow, driving further market opportunities.

Restraints/Challenges

- Limited Awareness in Emerging Markets

While patient temperature monitoring devices are well-established in developed countries, their adoption is slower in emerging markets due to limited awareness and healthcare infrastructure. In many of these regions, there is a lack of education about the importance of continuous temperature monitoring, especially for patients with chronic conditions or those recovering from surgery. In addition, the healthcare systems in emerging markets often lack the resources and infrastructure to implement advanced monitoring solutions. These barriers restrict the widespread use of patient temperature monitoring devices, hindering market growth and creating challenges for manufacturers aiming to expand their reach in these regions.

- High Cost of Advanced Devices

The high cost of advanced temperature monitoring devices, particularly wearable and continuous monitoring systems, poses a significant restraint in the patient temperature monitoring market. These devices, often equipped with cutting-edge technologies, can be expensive to manufacture and purchase, making them less accessible, especially in low-resource settings or emerging markets. The upfront costs, combined with the ongoing expenses for maintenance and calibration, can deter healthcare providers and patients from adopting these solutions. As a result, the market for temperature monitoring devices may face slower growth in regions with limited healthcare budgets, creating challenges for widespread adoption and expansion.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Patient Temperature Monitoring Market Scope

The market is segmented on the basis of product, end-user, site, and application. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Wearable Continuous Monitoring Sensors

- Smart Temperature Monitoring Patches

- Table-Top Temperature Monitoring Devices

- Handheld Temperature Monitoring Devices

- Invasive Temperature Monitoring Devices

End-User

- Hospital and Surgical Centers

- Nursing Facilities

- Home Care

- Ambulatory Care Centers

- Other End Users

Site

- Non-Invasive Temperature Monitoring

- Invasive Temperature Monitoring

Application

- Pyrexia/Fever

- Hypothermia

- Blood Transfusion

- Anesthesia

- Other Applications

Patient Temperature Monitoring Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, product, end-user, site, and application as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the patient temperature monitoring market, fueled by its advanced healthcare infrastructure and substantial healthcare expenditure. The region's leadership is reinforced by a growing demand for temperature monitoring solutions, driven by an aging population and the widespread prevalence of chronic conditions. Furthermore, cutting-edge advancements in monitoring technologies and the rapid adoption of telemedicine and remote patient monitoring solidify North America's dominant position in this market.

Asia-Pacific leads the patient temperature monitoring market due to several factors, including the growing demand for cosmetic surgeries and an expanding pediatric population. In addition, the increasing incidence of infectious diseases, higher rates of blood donations and transfusions, and government initiatives to improve access to elective surgeries contribute to the market's growth. The region's improving healthcare infrastructure further drives the adoption of advanced temperature monitoring solutions.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Patient Temperature Monitoring Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Patient Temperature Monitoring Market Leaders Operating in the Market Are:

- Cardinal Health (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- Baxter (U.S.)

- Drägerwerk AG & Co. KGaA (Germany)

- Terumo Medical Corporation (Japan)

- Masimo (U.S.)

- Microlife Corporation (Switzerland)

- Procter & Gamble (U.S.)

- DONGGUAN ACTHERM MEDICAL CORP (China)

- NPX Medical. (U.S.)

- Briggs Healthcare (U.S.)

- Hicks India (India)

- Medtronic (U.S.)

- Welch Allyn Warehouse (U.S.)

- Medium Healthcare (U.K.)

- Cosinuss GmbH (Germany)

- Helen of Troy (U.S.)

- Omron Healthcare, Inc. (Japan)

- BD (U.S.)

Latest Developments in Patient Temperature Monitoring Market

- In October 2023, Philips introduced a new wearable temperature monitoring device intended for continuous use in hospital environments. This innovative device is designed to improve patient care by providing real-time temperature tracking, allowing for quicker responses to changes in patient conditions. With its continuous monitoring capabilities, Philips aims to enhance patient outcomes and streamline healthcare processes in clinical settings

- In September 2023, a leading healthcare technology company gained FDA approval for its advanced smart thermometer, designed to integrate seamlessly with telehealth platforms. This innovative device enables real-time remote monitoring of patients, allowing healthcare providers to track temperature data and share it efficiently. By facilitating remote care, the smart thermometer enhances patient management and supports more effective telemedicine services

- In August 2023, Attune Medical signed a non-exclusive distribution agreement with Gentherm Medical AG to provide Blanketrol III Heat Exchangers to ensoETM users. This partnership aims to enhance patient care by offering advanced heat exchange solutions for temperature management. By integrating Blanketrol III into its offerings, Attune Medical seeks to expand its product range and improve the quality of thermal regulation in clinical settings

- In September 2022, Signant Health introduced its cloud-based Temperature Excursion Management (TEM) solution as part of its clinical supply chain management offerings. This innovative solution aims to improve temperature monitoring and management across the supply chain, ensuring the integrity of temperature-sensitive products. By integrating TEM, Signant Health enhances its suite of solutions to support more efficient and secure handling of clinical supplies

- In October 2020, Gentherm Medical received FDA 510(k) clearance for its ASTOPAD Patient Warming System, marking its debut in the U.S. market. The system is designed for use across a wide range of surgical procedures, effectively preventing and managing patient hypothermia during the perioperative period. By introducing ASTOPAD, Gentherm Medical aims to enhance patient safety and comfort during surgeries with its advanced temperature management technology

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.