Global Protein Crisps Market

Market Size in USD Million

CAGR :

%

USD

766.50 Million

USD

1,203.36 Million

2024

2032

USD

766.50 Million

USD

1,203.36 Million

2024

2032

| 2025 –2032 | |

| USD 766.50 Million | |

| USD 1,203.36 Million | |

|

|

|

|

Protein Crisps Market Size

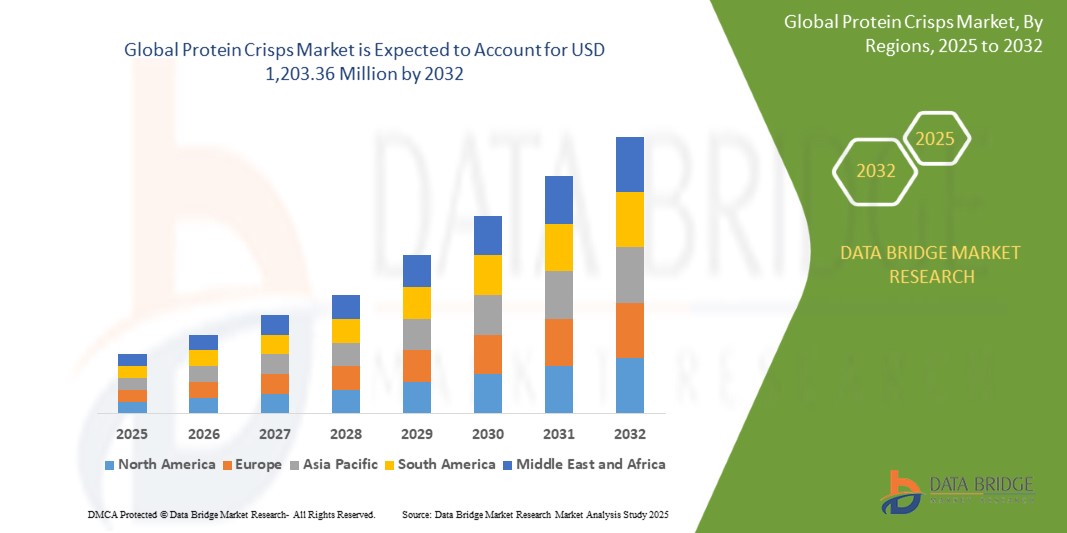

- The global protein crisps market was valued at USD 766.50 million in 2024 and is expected to reach USD 1,203.36 million by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 5.80%, primarily driven by rising demand for high-protein and low-carb snacks

- This growth is driven by growing health consciousness and fitness trends among consumers

Protein Crisps Market Analysis

- The protein crisps market has witnessed substantial growth due to increasing consumer preference for high-protein, low-carb, and minimally processed snacks. The rising awareness of health, fitness, and clean-label nutrition has driven demand for protein-rich foods made from natural and organic food ingredients. In addition, growing concerns over artificial additives, preservatives, and unhealthy snack options are prompting consumers to shift towards functional and nutritious alternatives. Advancements in baking technology, innovative protein sources, and sustainable packaging are further enhancing product quality and shelf life, making protein crisps more accessible to a wider audience

- The market is primarily driven by the rising demand for ready-to-eat protein snacks, plant-based alternatives, and sustainable sourcing practices. Increasing investments in alternative protein development, food-tech innovations, and eco-friendly production methods are improving the availability and affordability of high-protein snack options. In addition, the expansion of direct-to-consumer sales models, personalized nutrition solutions, and AI-driven supply chain management is optimizing distribution networks, reducing food waste, and ensuring a steady supply of protein crisps throughout the year

- For instance, in the U.S., major snack brands and online grocery platforms are expanding their protein crisps offerings, introducing high-protein, gluten-free, and plant-based options to meet the growing consumer demand for healthy, on-the-go snacks

- Globally, protein crisps are becoming a staple in modern dietary trends, with a significant shift towards functional snacking, high-protein meal replacements, and sports nutrition. Innovations such as plant-based protein crisps, AI-driven food formulation, and biodegradable snack packaging are reshaping industry trends, enhancing food security, and driving long-term market expansion

Report Scope and Protein Crisps Market Segmentation

|

Attributes |

Protein Crisps Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework |

Protein Crisps Market Trends

“Innovation in Plant-Based and Alternative Protein Crisps”

- The increasing demand for plant-based and alternative protein snacks is driving innovation in the protein crisps market, with manufacturers developing pea, lentil, chickpea, and soy-based crisps to cater to vegan, vegetarian, and flexitarian consumers

- Major food brands, startups, and nutrition-focused companies are introducing high-protein, gluten-free, and allergen-friendly crisps, responding to the growing consumer shift toward clean-label and functional snacking options

- Advancements in protein extraction technology, extrusion techniques, and ingredient formulation are enhancing the texture, taste, and nutritional profile of plant-based protein crisps, making them a viable alternative to traditional protein snacks

For instance,

- In March 2024, Beyond Snacks introduced a new range of pea protein crisps designed for health-conscious and vegan consumers, offering 12g of plant-based protein per serving

- Companies such as Kind and Simply Good Foods are expanding their plant-based product lines, focusing on high-protein, minimally processed snacks to meet evolving consumer preferences

- Startups such as Plantein are leveraging AI-driven ingredient optimization to create customized plant-based protein crisps, enhancing product innovation and catering to specific dietary needs

- As demand for sustainable and plant-based protein sources grows, alternative protein crisps will continue to reshape the market, providing consumers with healthier, environmentally friendly, and high-protein snacking solutions while driving market expansion and product innovation

Protein Crisps Market Dynamics

Driver

“Rising Demand for Plant-Based and Alternative Protein Crisps”

- The growing shift towards plant-based diets and sustainable protein sources is driving the demand for protein crisps made from pea protein, lentils, chickpeas, and other plant-based ingredients, appealing to vegan, vegetarian, and flexitarian consumers

- Major food brands and startups are expanding their plant-based snack portfolios, introducing high-protein, dairy-free, and gluten-free crisps to cater to health-conscious consumers seeking clean-label and allergen-friendly options

- Advancements in protein extraction, food processing technologies, and ingredient innovation are enhancing the taste, texture, and nutritional profile of plant-based Protein Crisps, making them more appealing to mainstream consumers

For instance,

- In January 2024, PepsiCo expanded its Off the Eaten Path brand, introducing new lentil and chickpea-based protein crisps, formulated to provide a high-protein, plant-based snacking experience

- Beyond Meat and PepsiCo's joint venture, The PLANeT Partnership, continues to innovate in the plant-based snack segment, with plans to launch new high-protein, sustainable crisps targeting health-conscious consumers

- Startup companies such as BRAMI and Outstanding Foods are pioneering plant-based protein snack alternatives, utilizing fava beans and mushrooms to create crispy, high-protein snack options

- As consumer interest in sustainable and plant-based protein options continues to grow, the protein crisps market is expected to expand rapidly, with brands leveraging innovative ingredients, clean-label formulations, and eco-friendly packaging to enhance product appeal and drive long-term market growth

Opportunity

“Expansion of High-Protein Snacks in Fitness and Sports Nutrition”

- The rising focus on fitness, muscle recovery, and active lifestyles is creating new opportunities for protein crisps brands to expand their presence in the sports nutrition and health-conscious consumer segments

- Sports nutrition brands, gyms, and fitness retailers are increasingly partnering with high-protein snack manufacturers to offer on-the-go, protein-packed snack options tailored to athletes, bodybuilders, and fitness enthusiasts

- Advancements in functional ingredients, protein fortification, and personalized nutrition solutions are driving the development of customized protein crisps designed for specific fitness goals, including endurance, muscle growth, and weight management

For instance,

- In January 2024, Quest Nutrition launched a new line of high-protein crisps containing 25g of protein per serving, specifically formulated for post-workout recovery and muscle building

- Brands such as Optimum Nutrition and RXBAR are expanding their high-protein snack categories, introducing convenient, nutrient-dense crisps to cater to the growing demand for functional sports nutrition

- Startups such as MyProteinX are leveraging AI-driven health data analysis to create personalized protein snack solutions, offering consumers tailored nutritional recommendations based on their fitness routines

- As sports nutrition and fitness-driven eating habits continue to gain traction, protein crisps brands tapping into this market will benefit from higher consumer engagement, increased brand loyalty, and long-term market expansion in the health and wellness industry

Restraint/Challenge

“Rising Costs of Protein Ingredients Impacting Product Pricing”

- The increasing costs of protein ingredients such as whey, pea protein, and soy isolates are posing a major challenge in the protein crisps market, leading to higher production expenses and rising retail prices

- Fluctuations in raw material costs, supply chain disruptions, and climate-related agricultural challenges are affecting the availability and affordability of key protein sources, impacting manufacturers' ability to offer competitively priced products

- Small and mid-sized protein snack brands face difficulties in securing bulk ingredient supplies at stable costs, limiting their capacity to scale operations, innovate with new formulations, and maintain profitability in a competitive market

For instance,

- In December 2024, European food manufacturers reported a 15% surge in pea protein prices due to poor crop yields and increased demand from plant-based food sectors, impacting the affordability of protein-based snacks

- To mitigate this challenge, protein crisps brands must explore alternative protein sources, optimize ingredient sourcing strategies, and invest in cost-efficient production methods to ensure long-term market sustainability and competitive pricing

Protein Crisps Market Scope

The market is segmented on the basis of source, type, packaging, distribution channel, end-use, and flavor.

|

Segmentation |

Sub-Segmentation |

|

By Source |

|

|

By Type |

|

|

By Packaging |

|

|

By Distribution Channel |

|

|

By End-Use |

|

|

By Flavor |

|

Protein Crisps Market Regional Analysis

“North America is the Dominant Region in the Protein Crisps Market”

- North America is projected to dominate the Protein Crisps market in terms of revenue and market share, driven by the growing demand for high-protein, low-carb snacks among health-conscious consumers

- Rising adoption of protein-enriched snacks among fitness enthusiasts, athletes, and busy professionals is fueling market expansion across the region

- The presence of key market players, continuous product innovations, and increasing retail availability of protein crisps contribute to strong market growth

- With these trends, North America is expected to maintain its leadership position in the global protein crisps market, driving innovation and consumer engagement

“Asia-Pacific is projected to register the Highest Growth Rate”

- Asia-Pacific is expected to be the fastest-growing region in the protein crisps market, driven by increasing health consciousness and rising demand for nutritious, high-protein snacks, particularly in India and China

- The expanding middle-class population and growing preference for on-the-go healthy snacks are fueling higher consumer spending, boosting market demand

- Rapid urbanization, increasing gym culture, and evolving dietary preferences are creating a favorable environment for the growth of protein-based snack products in the region

- With these factors in play, Asia-Pacific is set to become a key driver of global protein crisps market expansion, fostering innovation and wider product availability

Protein Crisps Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Abbott (U.S.)

- Snack Food & Wholesale Bakery (U.S.)

- BFY BRANDS (U.S.)

- Gluck (Germany)

- ProtiDiet (Canada)

- TORQ Ltd. (U.K.)

- Tyson Foods, Inc. (U.S.)

- Glanbia PLC (Ireland)

- The Hut.com Ltd (U.K.)

- Erie Foods International, Inc. (U.S.)

- Grande Cheese Company (U.S.)

- PGP International (U.S.)

- Mondelez International (U.S.)

- Quest Nutrition & WorldPantry.com LLC (U.S.)

- Kellanova (U.S.)

- General Mills Inc. (U.S.)

- GNC Holdings, LLC (U.S.)

- Hormel Foods Corporation (U.S.)

- LINK SNACKS, INC. (U.S.)

- Meat Snacks USA (U.S.)

- Mars, Incorporated (U.S.)

- Kerry Group plc (Ireland)

Latest Developments in Global Protein Crisps Market

- In August 2022, PepsiCo collaborated with Beyond Meat to create and distribute innovative plant-based protein snacks and beverages, aligning with the growing vegan trend. Beyond Meat, a Los Angeles-based company specializing in plant-based meat alternatives, was founded in 2009 and launched its products in the U.S. in 2012. The company went public in 2019, becoming the first in its category to do so. This partnership reinforces PepsiCo's commitment to expanding its plant-based product offerings

- In September 2022, Kellogg’s introduced Kashi GO Protein Wafer Crisps, a crispy wafer snack made with pea protein. These on-the-go protein snacks provide 5g of plant-based protein per serving. Kellogg’s, an American multinational food company headquartered in Chicago, U.S., is known for producing cereals and convenience foods under brands such as Pringles, Eggo, and Cheez-It. This launch reflects Kellogg’s strategy to cater to the demand for plant-based protein snacks

- In January 2022, Quest Nutrition unveiled its new Quest Chips, a range of crunchy baked protein chips in flavors such as loaded taco, cheddar sour cream, and barbecue. Each serving contains 21g of protein, making them a high-protein snacking option. Quest Nutrition, founded in 1999, has grown into a leading brand in the protein snack industry. This launch strengthens Quest Nutrition’s position in the functional snack segment

- In October 2021, Simply Good Foods acquired Quest Nutrition, a well-known brand for protein bars, chips, and cookies, for USD 1 billion to expand its product portfolio. Simply Good Foods focuses on offering nutritious and convenient snack options while promoting consumer education on smart snacking. This acquisition enhances Simply Good Foods' footprint in the high-protein snack market

- In April 2021, PepsiCo launched Off the Eaten Path Lentil & Pea Protein Crisps, a high-protein vegan snack containing 5g of protein per serving. PepsiCo, headquartered in Purchase, New York, is a global leader in food, snacks, and beverages, managing a vast portfolio of brands. This launch highlights PepsiCo's focus on plant-based and health-conscious snacking solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Protein Crisps Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Protein Crisps Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Protein Crisps Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.