1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL SPIRITS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL SPIRITS MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 DEMAND AND SUPPLY-SIDE VARIABLES

2.2.8 TOP TO BOTTOM ANALYSIS

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.12 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL SPIRITS MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 SUPPLY CHAIN ANALYSIS

5.2 FACTORS INFLUENCING PURCHASING DECISION OF CUSTOMERS

5.3 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

5.4 INDUTRY TRENDS AND FUTURE PERSPECTIVES

5.5 SHOPPING BEHAVIOUR AND DYNAMICS

5.5.1 RECOMMENDATION FROM FAMILY & FRIENDS

5.5.2 RESEARCH

5.5.3 IMPULSIVE

5.5.4 ADVERTISEMENT

5.6 PRIVATE LABEL VS BRAND ANALYSIS

5.7 CONSUMER LEVEL TRENDS

5.8 NEW PRODUCT LAUNCHES

6 BRAND OUTLOOK GRID

6.1 BRAND COMAPARATIVE ANALYSIS

6.2 PRODUCT VS BRAND ANALYSIS

7 PRODUCTION CAPACITY OUTLOOK

8 REGULATORY FRAMEWORK AND GUIDELINES

9 GLOBAL SPIRITS MARKET, BY TYPE, (2022-2031) (USD MILLION) (MILLION LITRES)

9.1 OVERVIEW

9.2 WHISKEY

9.2.1 WHISKEY, BY TYPE

9.2.1.1. RYE WHISKEY

9.2.1.2. RYE MALT WHISKEY

9.2.1.3. MALT WHISKEY

9.2.1.4. BOURBON WHISKEY

9.2.1.5. IRISH WHISKEY

9.2.1.6. WHEAT WHISKEY

9.2.1.7. CORN WHISEY

9.2.1.8. OTHERS

9.3 RUM

9.3.1 RUM, BY TYPE

9.3.1.1. WHITE RUM

9.3.1.2. DARK RUM

9.4 VODKA

9.5 TEQUILA

9.5.1 TEQUILA, BY TYPE

9.5.1.1. TEQUILA BLANCO

9.5.1.2. TEQUILA JOVEN

9.5.1.3. TEQUILA REPOSADO

9.5.1.4. OTHERS

9.6 GIN

9.7 LIQUEUR

9.8 OTHERS

10 GLOBAL SPIRITS MARKET, BY SOURCE, (2022-2031) (USD MILLION)

10.1 OVERVIEW

10.2 GRAPES

10.3 MOLASSES

10.4 SUGAR

10.5 GRAIN

10.5.1 CORN

10.5.2 RYE

10.5.3 BARLEY

10.5.4 WHEAT

10.5.5 OTHERS

10.6 POTATO

10.7 OTHERS

11 GLOBAL SPIRITS MARKET, BY FLAVOR, (2022-2031) (USD MILLION)

11.1 OVERVIEW

11.2 PLAIN

11.3 HONEY

11.4 MAPLE

11.5 CARAMEL

11.6 CHOCOLATE

11.7 VANILLA

11.8 FRUIT

11.9 SPICES

11.9.1 CINNAMON

11.9.2 GINGER

11.9.3 PEPPER

11.9.4 CLOVE

11.9.5 NUTMEG

11.9.6 OTHERS

11.1 NUTS

11.10.1 ALMOND

11.10.2 WALNUT

11.10.3 HHAZELNUT

11.10.4 MACADAMIA NUTS

11.10.5 OTHERS

12 GLOBAL SPIRITS MARKET, BY AGEING, (2022-2031) (USD MILLION)

12.1 OVERVIEW

12.2 AGED

12.3 UNAGED

13 GLOBAL SPIRITS MARKET, BY AGING BARREL TYPE, (2022-2031) (USD MILLION)

13.1 OVERVIEW

13.2 OAK

13.3 MAPLE

13.4 CEDAR

13.5 HICKORY

13.6 OTHERS

14 GLOBAL SPIRITS MARKET, BY DISTILLATION TYPE , (2022-2031) (USD MILLION)

14.1 OVERVIEW

14.2 DISTILLED

14.2.1 SINGLE

14.2.2 DOUBLE

14.2.3 TRIPLE

14.2.4 OTHERS

14.3 UNDISTILLED

15 GLOBAL SPIRITS MARKET, BY DISTRIBUTION CHANNEL, (2022-2031) (USD MILLION)

15.1 OVERVIEW

15.2 ONLINE

15.2.1 COMPANY WEBSITES

15.2.2 THIRD PARTY WEBSITES/E-COMMERCE

15.3 OFFLINE

15.3.1 OFF-TRADE

15.3.1.1. SUPERMARKETS AND HYPERMARKETS

15.3.1.2. CONVENIENCE STORES

15.3.1.3. AIRPORT DUTY-FREE SHOPS

15.3.1.4. SPECIALTY WINE AND LIQUOR STORES

15.3.1.5. OTHERS

15.3.2 ON-TRADE

15.3.2.1. RESTAURANTS AND BARS

15.3.2.2. CAFES AND BISTROS

15.3.2.3. VENDING MACHINES

15.3.2.4. OTHERS

16 GLOBAL SPIRITS MARKET, COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: GLOBAL

16.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

16.3 COMPANY SHARE ANALYSIS: EUROPE

16.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

16.5 MERGERS & ACQUISITIONS

16.6 NEW PRODUCT DEVELOPMENT & APPROVALS

16.7 EXPANSIONS & PARTNERSHIP

16.8 REGULATORY CHANGES

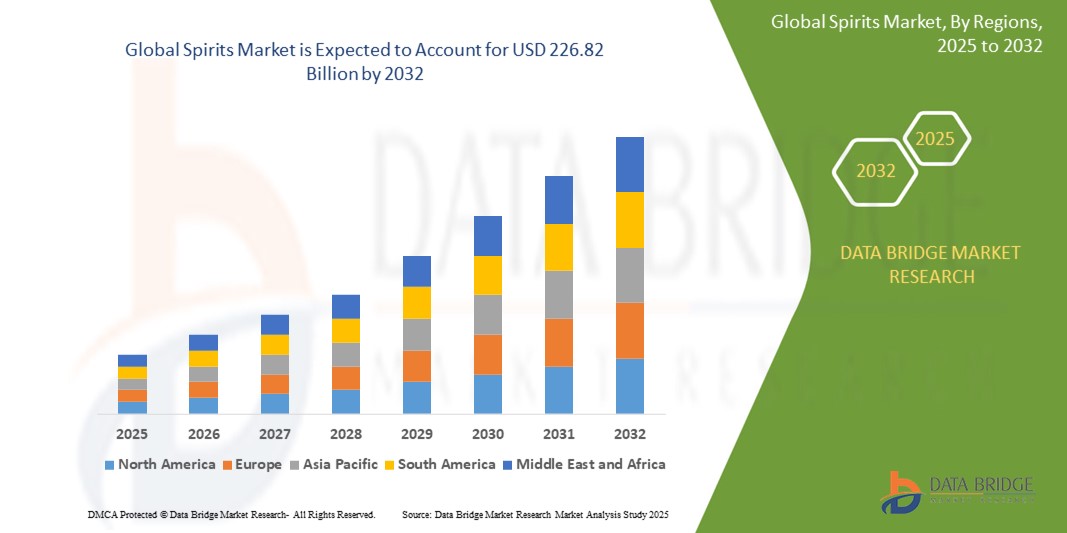

17 GLOBAL SPIRITS MARKET, BY GEOGRAPHY, (2022-2031) (USD MILLION) (MILLION LITRES)

OVERVIEW (ALL SEGMENTATION PROVIDED ABOVE IS REPRESNTED IN THIS CHAPTER BY COUNTRY)

17.1 NORTH AMERICA

17.1.1 U.S.

17.1.2 CANADA

17.1.3 MEXICO

17.2 EUROPE

17.2.1 GERMANY

17.2.2 U.K.

17.2.3 ITALY

17.2.4 FRANCE

17.2.5 SPAIN

17.2.6 SWITZERLAND

17.2.7 NETHERLANDS

17.2.8 BELGIUM

17.2.9 RUSSIA

17.2.10 TURKEY

17.2.11 REST OF EUROPE

17.3 ASIA-PACIFIC

17.3.1 JAPAN

17.3.2 CHINA

17.3.3 SOUTH KOREA

17.3.4 INDIA

17.3.5 AUSTRALIA

17.3.6 SINGAPORE

17.3.7 THAILAND

17.3.8 INDONESIA

17.3.9 MALAYSIA

17.3.10 PHILIPPINES

17.3.11 REST OF ASIA-PACIFIC

17.4 SOUTH AMERICA

17.4.1 BRAZIL

17.4.2 ARGENTINA

17.4.3 REST OF SOUTH AMERICA

17.5 MIDDLE EAST AND AFRICA

17.5.1 SOUTH AFRICA

17.5.2 U.A.E.

17.5.3 SAUDI ARABIA

17.5.4 KUWAIT

17.5.5 REST OF MIDDLE EAST AND AFRICA

18 GLOBAL SPIRITS MARKET, SWOT & DBMR ANALYSIS

19 GLOBAL SPIRITS MARKET, COMPANY PROFILES

19.1 BACARDI LIMITED

19.1.1 COMPANY OVERVIEW

19.1.2 REVENUE ANALYSIS

19.1.3 PRODUCT PORTFOLIO

19.1.4 RECENT UPDATES

19.2 CONSTELLATION BRANDS, INC.

19.2.1 COMPANY OVERVIEW

19.2.2 REVENUE ANALYSIS

19.2.3 PRODUCT PORTFOLIO

19.2.4 RECENT UPDATES

19.3 NOVABEV GROUP

19.3.1 COMPANY OVERVIEW

19.3.2 REVENUE ANALYSIS

19.3.3 GEOGRAPHICAL PRESENCE

19.3.4 PRODUCT PORTFOLIO

19.3.5 RECENT UPDATES

19.4 PROXIMO SPIRITS

19.4.1 COMPANY OVERVIEW

19.4.2 REVENUE ANALYSIS

19.4.3 PRODUCT PORTFOLIO

19.4.4 RECENT UPDATES

19.5 DIAGEO

19.5.1 COMPANY OVERVIEW

19.5.2 REVENUE ANALYSIS

19.5.3 PRODUCT PORTFOLIO

19.5.4 RECENT UPDATES

19.6 BELVEDERE VODKA

19.6.1 COMPANY OVERVIEW

19.6.2 REVENUE ANALYSIS

19.6.3 PRODUCT PORTFOLIO

19.6.4 RECENT UPDATES

19.7 PINNACLE VODKA

19.7.1 COMPANY OVERVIEW

19.7.2 REVENUE ANALYSIS

19.7.3 PRODUCT PORTFOLIO

19.7.4 RECENT UPDATES

19.8 CRYSTAL HEAD

19.8.1 COMPANY OVERVIEW

19.8.2 REVENUE ANALYSIS

19.8.3 PRODUCT PORTFOLIO

19.8.4 RECENT UPDATES

19.9 CHIVAS BROTHERS LIMITED & CHIVAS BROTHERS INTERNATIONAL LIMITED

19.9.1 COMPANY OVERVIEW

19.9.2 REVENUE ANALYSIS

19.9.3 PRODUCT PORTFOLIO

19.9.4 RECENT UPDATES

19.1 WILLIAM GRANT & SONS

19.10.1 COMPANY OVERVIEW

19.10.2 REVENUE ANALYSIS

19.10.3 PRODUCT PORTFOLIO

19.10.4 RECENT UPDATES

19.11 EDRINGTON

19.11.1 COMPANY OVERVIEW

19.11.2 REVENUE ANALYSIS

19.11.3 PRODUCT PORTFOLIO

19.11.4 RECENT UPDATES

19.12 SUNTORY GLOBAL SPIRITS, INC.

19.12.1 COMPANY OVERVIEW

19.12.2 REVENUE ANALYSIS

19.12.3 PRODUCT PORTFOLIO

19.12.4 RECENT UPDATES

19.13 WHYTE & MACKAY

19.13.1 COMPANY OVERVIEW

19.13.2 REVENUE ANALYSIS

19.13.3 PRODUCT PORTFOLIO

19.13.4 RECENT UPDATES

19.14 INTERNATIONAL BEVERAGE HOLDINGS LTD.

19.14.1 COMPANY OVERVIEW

19.14.2 REVENUE ANALYSIS

19.14.3 PRODUCT PORTFOLIO

19.14.4 RECENT UPDATES

19.15 LOCH LOMOND GROUP

19.15.1 COMPANY OVERVIEW

19.15.2 REVENUE ANALYSIS

19.15.3 PRODUCT PORTFOLIO

19.15.4 RECENT UPDATES

19.16 DAVIDE CAMPARI-MILANO N.V.

19.16.1 COMPANY OVERVIEW

19.16.2 REVENUE ANALYSIS

19.16.3 PRODUCT PORTFOLIO

19.16.4 RECENT UPDATES

19.17 IAN MACLEOD DISTILLERS LIMITED

19.17.1 COMPANY OVERVIEW

19.17.2 REVENUE ANALYSIS

19.17.3 PRODUCT PORTFOLIO

19.17.4 RECENT UPDATES

19.18 JAMES EADIE LTD

19.18.1 COMPANY OVERVIEW

19.18.2 REVENUE ANALYSIS

19.18.3 PRODUCT PORTFOLIO

19.18.4 RECENT UPDATES

19.19 BROWN-FORMAN

19.19.1 COMPANY OVERVIEW

19.19.2 REVENUE ANALYSIS

19.19.3 PRODUCT PORTFOLIO

19.19.4 RECENT UPDATES

19.2 JOHN DISTILLERIES

19.20.1 COMPANY OVERVIEW

19.20.2 REVENUE ANALYSIS

19.20.3 PRODUCT PORTFOLIO

19.20.4 RECENT UPDATES

19.21 PERNOD RICARD

19.21.1 COMPANY OVERVIEW

19.21.2 REVENUE ANALYSIS

19.21.3 PRODUCT PORTFOLIO

19.21.4 RECENT UPDATES

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

20 RELATED REPORTS

21 CONCLUSION

22 QUESTIONNAIRE

23 ABOUT DATA BRIDGE MARKET RESEARCH