Global Spirulina Dietary Supplements Market

Market Size in USD Million

CAGR :

%

USD

375.89 Million

USD

590.13 Million

2024

2032

USD

375.89 Million

USD

590.13 Million

2024

2032

| 2025 –2032 | |

| USD 375.89 Million | |

| USD 590.13 Million | |

|

|

|

|

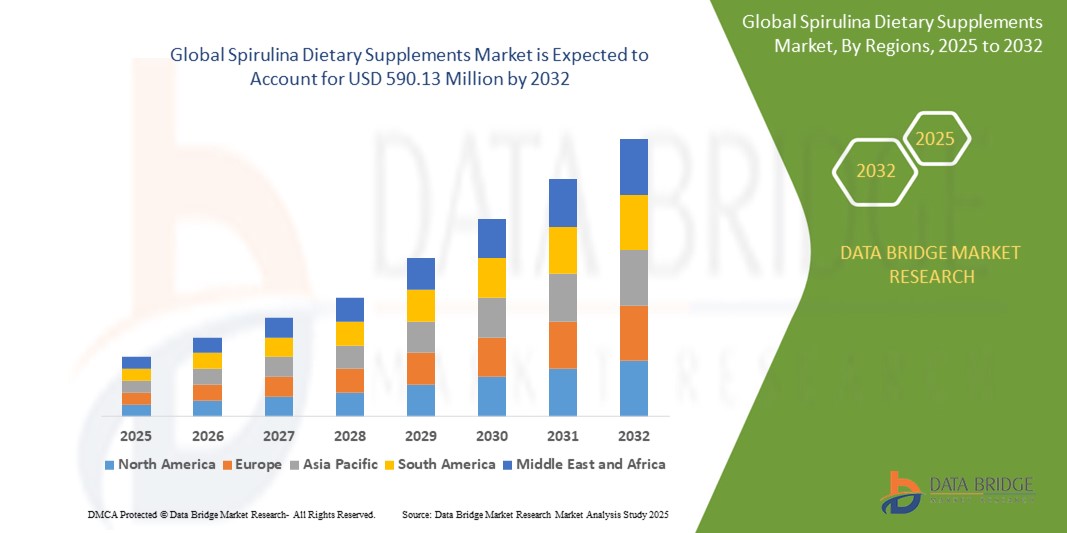

What is the Global Spirulina Dietary Supplements Market Size and Growth Rate?

- The global spirulina dietary supplements market size was valued at USD 375.89 million in 2024 and is expected to reach USD 590.13 million by 2032, at a CAGR of 5.80% during the forecast period

- The spirulina dietary supplements market is experiencing significant growth, driven by increasing consumer awareness of health and wellness and a growing preference for natural and organic products. Spirulina, a nutrient-dense blue-green algae, is prized for its high protein content, vitamins, minerals, and antioxidants, which contribute to its popularity in dietary supplements

- The market's expansion is supported by rising health consciousness among consumers and the growing trend towards preventive healthcare, which emphasizes natural and holistic approaches to wellness

What are the Major Takeaways of Spirulina Dietary Supplements Market?

- Consumers are increasingly prioritizing natural and organic alternatives to synthetic supplements as part of a broader shift towards healthier, more sustainable living. Spirulina, with its natural origins as a blue-green algae and its availability in organic-certified forms, perfectly aligns with this trend. Its appeal is heightened by growing consumer awareness of the benefits of natural ingredients, which are perceived as safer and more effective compared to their synthetic counterparts

- This preference for organic and natural products drives demand for spirulina dietary supplements, positioning them favorably in the competitive market. The natural and organic certification meets consumer expectations and helps build trust and credibility, making spirulina a popular choice among health-conscious individuals

- North America dominated the spirulina dietary supplements market with the largest revenue share of 41.58% in 2024, driven by increasing health awareness, growing adoption of plant-based supplements, and favorable regulatory support

- Asia-Pacific spirulina dietary supplements market is poised to grow at the fastest CAGR of 9.24% during the forecast period of 2025 to 2032, driven by increasing consumer awareness, rising income levels, and government promotion of plant-based diets

- The powder segment dominated the spirulina dietary supplements market with the largest market revenue share of 46.8% in 2024, owing to its high solubility, ease of blending into smoothies or health drinks, and longer shelf life

Report Scope and Spirulina Dietary Supplements Market Segmentation

|

Attributes |

Spirulina Dietary Supplements Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Spirulina Dietary Supplements Market?

“Enhanced Convenience through New Formats and Functional Innovation”

- A significant and accelerating trend in the global spirulina dietary supplements market is the innovation in product formats and delivery systems aimed at improving user convenience and daily intake adherence

- Companies are introducing chewable tablets, flavored powders, gummies, capsules, and ready-to-drink spirulina shots that cater to various age groups and dietary preferences

- These innovations enhance the palatability and accessibility of spirulina, addressing a long-standing challenge of its earthy taste and strong odor, while also supporting higher absorption and bioavailability

- In addition, brands are launching combination supplements by blending spirulina with other superfoods such as chlorella, turmeric, or probiotics, offering multifunctional health benefits in one product

- This consumer-centric approach is driving product differentiation and boosting spirulina’s appeal in both the nutraceutical and functional food segments

- In March 2024, NOW Foods (U.S.) introduced flavored spirulina gummies targeted at children and seniors, enhancing ease of consumption and expanding its demographic reach

- The trend of convenient, taste-friendly, and multifunctional spirulina formats is reshaping how consumers perceive and adopt this superfood in their daily health routines

What are the Key Drivers of Spirulina Dietary Supplements Market?

- Increasing consumer awareness around preventive healthcare and immunity boosting, especially post-COVID-19, is driving the demand for natural supplements such as spirulina

- Spirulina’s dense nutritional profile, including high protein, antioxidants, and essential vitamins, makes it an ideal supplement for vegetarians, vegans, athletes, and those with specific dietary needs

- The surge in plant-based lifestyles and the clean-label movement is further fueling its adoption, particularly in Western markets that emphasize organic and sustainable wellness products

- Government initiatives promoting algae cultivation for nutrition and sustainability also support market growth by enhancing spirulina’s availability and reducing production costs

- In February 2024, DIC Corporation (Japan) scaled its algae-based spirulina production facilities to meet growing global demand, highlighting spirulina’s role in plant-based nutrition and food security

- Spirulina is gaining momentum as a clean, sustainable, and nutrient-rich supplement, with global demand driven by health-conscious consumers and supportive policy frameworks

Which Factor is challenging the Growth of the Spirulina Dietary Supplements Market?

- A primary challenge in the spirulina supplements market is the risk of contamination and product inconsistency, often due to poor quality control during cultivation or processing

- Spirulina grown in unregulated environments may contain microcystins, heavy metals, or other toxins, posing serious health risks and dampening consumer confidence

- In addition, the lack of standardized regulations across countries leads to varying product quality, making it difficult for consumers to identify trustworthy brands

- The distinct smell and taste of spirulina also limit its mass appeal, despite flavor-masking efforts. Furthermore, high production costs—especially for organic-certified spirulina—can drive up retail prices and limit accessibility in price-sensitive markets

- In 2023, a study by ConsumerLab found that several spirulina brands failed purity standards, raising red flags about contamination and transparency in sourcing

- To sustain long-term growth, the market must prioritize quality assurance, regulatory alignment, consumer education, and affordable product innovation to overcome trust and taste-related barriers

How is the Spirulina Dietary Supplements Market Segmented?

The market is segmented on the basis of form, end user, and distribution channel.

- By Form

On the basis of form, the spirulina dietary supplements market is segmented into powder, tablets/capsules, liquid, and granules. The powder segment dominated the spirulina dietary supplements market with the largest market revenue share of 46.8% in 2024, owing to its high solubility, ease of blending into smoothies or health drinks, and longer shelf life. Consumers and manufacturers asuch as favor powdered spirulina for its versatility in food and beverage applications and customizable dosage.

The tablets/capsules segment is anticipated to witness the fastest growth rate of 20.3% from 2025 to 2032, driven by the increasing consumer demand for convenient and travel-friendly supplement formats. Tablets and capsules mask the earthy taste of spirulina and offer accurate dosage, making them especially popular in developed markets with busy lifestyles.

- By End User

On the basis of end user, the spirulina dietary supplements market is segmented into food and beverages, nutraceuticals, feed, and pharmaceutical. The nutraceuticals segment held the largest market revenue share in 2024, accounting for 38.6%, supported by the growing preference for natural health boosters and the rising trend of plant-based supplements. Spirulina’s rich nutrient content, including proteins, iron, and antioxidants, makes it a highly favored ingredient in immunity-boosting and anti-fatigue formulations.

The pharmaceutical segment is projected to witness the fastest CAGR from 2025 to 2032, driven by ongoing research into spirulina’s anti-inflammatory and antiviral properties and its increasing integration into therapeutic formulations. Clinical validations and the expansion of spirulina’s functional claims in drug formulations are expected to further accelerate this trend.

- By Distribution Channel

On the basis of distribution channel, the spirulina dietary supplements market is segmented into super stores, department stores, other offline mediums, and online retailers. The online retailers segment dominated the market in 2024 with the highest revenue share of 40.5%, attributed to the growing preference for e-commerce platforms, rising internet penetration, and consumer inclination toward comparing product reviews and certifications before purchase.

The super stores segment is expected to witness the fastest growth rate from 2025 to 2032, as these outlets enhance their health supplement offerings and provide consumers with in-person advice, promotional bundling, and sampling opportunities. The trust in branded retail chains also plays a role in supporting the steady growth of offline purchases.

Which Region Holds the Largest Share of the Spirulina Dietary Supplements Market?

- North America dominated the spirulina dietary supplements market with the largest revenue share of 41.58% in 2024, driven by increasing health awareness, growing adoption of plant-based supplements, and favorable regulatory support

- Consumers in the region are increasingly turning to Spirulina-based products for their rich nutritional profile, including high protein, vitamins, and antioxidant content. The market is further propelled by the clean-label trend and demand for natural dietary supplements

- The strong presence of major nutraceutical companies, high disposable income, and established distribution networks contribute to North America's leadership in the global spirulina dietary supplements market

U.S. Spirulina Dietary Supplements Market Insight

The U.S. spirulina dietary supplements market captured the largest revenue share in 2024 within North America, fueled by growing demand for vegan and natural health supplements. Rising awareness about chronic disease prevention, fitness-focused lifestyles, and the popularity of protein-rich superfoods are key drivers. In addition, the growing trend of dietary supplementation among millennials and the elderly population, along with robust e-commerce growth, supports the market's expansion.

Europe Spirulina Dietary Supplements Market Insight

The Europe spirulina dietary supplements market is projected to expand at a substantial CAGR throughout the forecast period, driven by rising health consciousness and regulatory approvals for Spirulina in food and pharma applications. The region is witnessing an uptick in demand for sustainable, algae-based supplements due to environmental concerns. Spirulina’s inclusion in food, beverages, and sports nutrition products is also gaining momentum, particularly in countries such as Germany, France, and Italy.

U.K. Spirulina Dietary Supplements Market Insight

The U.K. spirulina dietary supplements market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by increasing demand for immunity-boosting supplements and clean-label products. A well-informed consumer base and a rising trend of veganism and flexitarian diets are driving adoption. Spirulina’s application in smoothies, juices, and health bars is witnessing significant growth in the retail and wellness segments.

Germany Spirulina Dietary Supplements Market Insight

The Germany spirulina dietary supplements market is expected to expand at a considerable CAGR during the forecast period, fueled by the country’s focus on preventive healthcare and strong demand for organic supplements. German consumers value science-backed nutritional products, and Spirulina is being adopted for its anti-inflammatory, antioxidant, and detoxifying benefits. The product’s penetration is rising in pharmacies, organic stores, and online health platforms.

Which Region is the Fastest Growing Region in the Spirulina Dietary Supplements Market?

Asia-Pacific spirulina dietary supplements market is poised to grow at the fastest CAGR of 9.24% during the forecast period of 2025 to 2032, driven by increasing consumer awareness, rising income levels, and government promotion of plant-based diets. Countries such as India, China, and Japan are experiencing growing interest in Spirulina due to its nutritional benefits and alignment with traditional health beliefs.

Japan Spirulina Dietary Supplements Market Insight

The Japan spirulina dietary supplements market is gaining momentum, supported by the population's focus on longevity, preventive healthcare, and dietary balance. Spirulina is popular in functional beverages and wellness supplements, driven by its role in improving immunity and energy levels. The aging demographic is also a key factor, prompting interest in nutrient-rich supplements for daily health maintenance.

China Spirulina Dietary Supplements Market Insight

The China spirulina dietary supplements market accounted for the largest revenue share in Asia Pacific in 2024, attributed to a growing middle class, urbanization, and consumer shift toward natural health products. Spirulina is widely used in health drinks, powders, and tablets, with strong support from both local manufacturers and e-commerce platforms. Government initiatives to boost domestic nutraceuticals production are also fueling growth in the country.

Which are the Top Companies in Spirulina Dietary Supplements Market?

The spirulina dietary supplements industry is primarily led by well-established companies, including:

- Sensient Technologies Corporation (U.S.)

- NOW Foods (U.S.)

- Parry Nutraceuticals Limited (India)

- NATUREX (France)

- Naturalin Bio-Resources Co., Ltd. (China)

- GNT Group B.V. (Netherlands)

- GNC Holdings, LLC (U.S.)

- Fuqing King Dnarmsa Spirulina Co., Ltd. (China)

- Fraken Biochem Co., Ltd. (China)

- Far East Bio-Tec Co., Ltd. (China)

- ALGAPHARMA BIOTECH CORP. (Brazil)

- Döhler GmbH (Germany)

- DIC CORPORATION (Japan)

What are the Recent Developments in Global Spirulina Dietary Supplements Market?

- In September 2024, SimpliiGood, a key player in the spirulina market, unveiled its plans to introduce a spirulina-based smoked salmon in Europe by early 2025. The initiative aligns with the clean label trend and broadens the company's innovative spirulina product portfolio. This move reflects the brand’s ambition to expand its plant-based offerings in the European market

- In June 2024, MD Logic Health, a U.S.-based producer of professional-grade nutraceuticals, in collaboration with AvalonX—founded by Melanie Avalon—launched a co-branded vegan spirulina dietary supplement. The product reinforces both brands’ commitment to clean, plant-based wellness solutions. This collaboration highlights the growing demand for high-quality vegan supplements

- In August 2021, Prolgae Spirulina Supplies Pvt. Ltd., an India-based supplier of sun-dried organic spirulina, launched its sweet spirulina powder and spirulina protein bar in Chennai. Designed as all-in-one vegan superfoods, these products aim to support daily nutrition and immunity. This launch strengthened Prolgae’s position in the Indian plant-based nutrition segment

- In August 2021, Prolgae introduced its 100% vegan sweet spirulina powder and protein bar in India as part of its superfood product line. These offerings were designed to enhance daily health and immunity naturally. The launch marked a strategic step in making spirulina more accessible to the Indian health-conscious population

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Spirulina Dietary Supplements Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Spirulina Dietary Supplements Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Spirulina Dietary Supplements Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.