Global Utility Locator Market

Market Size in USD Million

CAGR :

%

USD

932.78 Million

USD

1,466.63 Million

2024

2032

USD

932.78 Million

USD

1,466.63 Million

2024

2032

| 2025 –2032 | |

| USD 932.78 Million | |

| USD 1,466.63 Million | |

|

|

|

Utility Locator Market Analysis

The utility locator market is witnessing significant growth due to increased infrastructure development and the need for accurate underground utility detection. Advancements in technology, such as the integration of ground penetrating radar (GPR) and electromagnetic field techniques, are driving this expansion by providing more efficient, precise, and faster utility locating solutions. These innovations enable professionals to detect various utilities such as water pipes, gas lines, and electrical cables without excavation, reducing the risk of accidental damage and ensuring public safety. The rise in smart utility locators equipped with GPS and real-time data interpretation features further enhances their accuracy and usability. The increasing adoption of 5G networks and the growing focus on sustainability in urban planning also drive the demand for reliable utility locating systems. Moreover, with governments prioritizing infrastructure development and public safety, there is heightened demand for advanced utility locators in industries such as telecommunication, oil and gas, and transportation. These market dynamics, along with the increasing use of utility locator solutions in both developed and emerging economies, suggest a strong growth trajectory for the utility locator market.

Utility Locator Market Size

The global utility locator market size was valued at USD 932.78 million in 2024 and is projected to reach USD 1466.63 million by 2032, with a CAGR of 5.82% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Utility Locator Market Trends

“Increasing Adoption of Smart Utility Locators”

One notable trend in the utility locator market is the increasing adoption of smart utility locators that integrate real-time data and GPS technology for more accurate and efficient underground utility mapping. These advanced locators, such as Leica Geosystems’ DD300 CONNECT, offer seamless integration with software platforms to provide real-time updates and precise tracking of utility locations. For instance, Radiodetection Ltd.’s RD8000 series features advanced GPS integration, allowing users to generate high-accuracy underground utility maps during field activities. This trend is driven by the need for more efficient workflows and improved safety in industries such as telecommunication, oil and gas, and construction. As urbanization accelerates and infrastructure projects become more complex, the demand for smart locators is expected to grow, enabling quicker detection, reducing operational costs, and minimizing potential hazards. These innovations are transforming utility detection into a more streamlined, data-driven process, significantly enhancing the efficiency of utility mapping and maintenance tasks.

Report Scope and Utility Locator Market Segmentation

|

Attributes |

Utility Locator Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Radiodetection Ltd. (U.K.), Vivax-Metrotech Corp. (U.S.), Guideline Geo. (Sweden), Emerson Electric Co. (U.S.), Charles Machine Inc. (U.S.), Sensors & Software Inc. (Canada), Leica Geosystems AG (Switzerland), 3M (U.S.), USIC LLC (U.S.), Multiview, Inc. (U.S.), OnTarget Group (U.S.), GSSI Geophysical Survey Systems, Inc. (U.S.), RHD Services. (U.S.), OneVision Utility Services. (U.S.), Sidewinder Utility Locators. (U.S.), US Radar (U.S.), and Olameter (Canada) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Utility Locator Market Definition

A utility locator is a device or system used to detect and map underground utilities, such as water pipes, gas lines, electrical cables, and telecommunications infrastructure. These tools help identify the location of these utilities to prevent accidental damage during construction, excavation, or maintenance activities.

Utility Locator Market Dynamics

Drivers

- Increasing Infrastructure Development

The continuous expansion of urban infrastructure, including roads, bridges, and utilities, is creating a strong demand for utility locators. As cities grow and new buildings, highways, and infrastructure are developed, it is crucial to accurately detect and protect existing underground utilities such as water pipes, gas lines, and electrical cables. For instance, large-scale construction projects such as highway expansions or subway constructions in major cities require precise utility location tools to prevent accidental damage to vital utilities. Without effective utility locators, construction teams risk cutting through power lines, damaging gas pipelines, or disrupting water systems, resulting in costly repairs, project delays, and safety hazards. Therefore, the growing demand for urban infrastructure is directly driving the utility locator market, as these technologies play a crucial role in ensuring safe and efficient construction processes.

- Rising Demand for Smart Utility Locators

The increasing adoption of smart utility locators is revolutionizing the market by enhancing the accuracy, efficiency, and usability of underground utility detection. These locators are equipped with advanced features such as GPS technology, real-time data collection, and software integration, making it easier for professionals to track the exact location of utilities and make data-driven decisions. For instance, Leica Geosystems’ DD300 CONNECT system integrates GPS and real-time tracking, enabling the creation of high-accuracy underground utility maps in just a few field activities. As industries such as telecommunications, construction, and oil and gas require more advanced utility detection systems, the growing popularity of smart locators that offer higher precision and better workflow integration is fueling the demand for utility locators, making them a key driver of the market.

Opportunities

- Increasing Government Regulations and Safety Standards

Stringent government regulations around public safety and infrastructure protection are pushing industries to adopt utility locators. Regulations mandate that construction activities must be conducted in ways that protect existing underground utilities from damage, which in turn ensures public safety and minimizes service interruptions. For instance, in the United States, the One-Call System requires contractors to use utility locator tools to mark out the positions of underground utilities before digging, helping avoid accidents such as gas explosions or electrical disruptions. These legal requirements force contractors and construction companies to rely on utility locators, ensuring that their operations are compliant with safety standards and regulations. The increased implementation of such regulations worldwide is acting as a key driver for the utility locator market, spurring both demand and innovation in utility detection technology.

- Growing Complexity of Utility Networks

As urban infrastructure becomes increasingly complex, particularly with the expansion of 5G networks and other advanced broadband systems, the need for utility locators is more important than ever. Underground utility networks now include a diverse array of services, such as water, electricity, telecommunications, and gas, often running in close proximity. In cities where the demand for faster internet speeds and broader connectivity is driving the installation of new fiber optic cables and 5G infrastructure, precision utility locators are crucial to avoid conflicts between new and existing lines. For instance, utility locators are essential in areas such as Silicon Valley, where the need to map out fiber optic networks and ensure that no damage is done to existing utilities while installing new systems is a complex and highly sensitive task. As the complexity of utility networks increases globally, so does the reliance on accurate utility locators to ensure seamless operations and prevent costly mistakes.

Restraints/Challenges

- High Equipment Costs

The utility locator market faces a significant challenge due to the high costs of advanced equipment required for accurate detection, such as ground-penetrating radar (GPR) and electromagnetic locators. For instance, a high-quality GPR system can cost tens of thousands of dollars, which may be a financial strain for small to medium-sized businesses or contractors working in industries with limited budgets. These high upfront costs make it difficult for many companies to adopt the latest technology, despite the clear benefits of precision and efficiency. As a result, many businesses rely on older, less accurate equipment or manual methods, which can lead to slower work processes and increased risks of errors. The high cost of these devices, combined with ongoing maintenance and training expenses, limits the overall market penetration, making it a key challenge for the utility locator industry.

- Skilled Workforce Shortage

Utility locating equipment is highly specialized and requires a trained workforce to operate effectively. For instance, using a ground-penetrating radar or electromagnetic locator effectively demands knowledge of how to operate the device and how to interpret complex data from underground utilities. The shortage of skilled professionals in this field is a major market challenge, as it directly impacts the ability to deliver accurate and timely results. Many utility locator companies struggle to find and retain trained staff, leading to delays and potentially increased costs due to the need for additional training or outsourcing work. Furthermore, the lack of proper training programs in some regions exacerbates the problem, as businesses must invest additional resources into upskilling their workforce. The shortage of qualified personnel restricts the industry's ability to scale up and meet the growing demand for utility locating services, further hindering market growth.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Utility Locator Market Scope

The market is segmented on the basis of techniques, offering, target, and end-user industry. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Technique

- Electromagnetic Field

- Ground Penetrating Radar

- Others

Offering

- Equipment

- Services

Target

- Metallic

- Non-Metallic

End User Industry

- Telecommunication

- Electricity

- Water and Sewage

- Oil and Gas

- Transportation

- Others

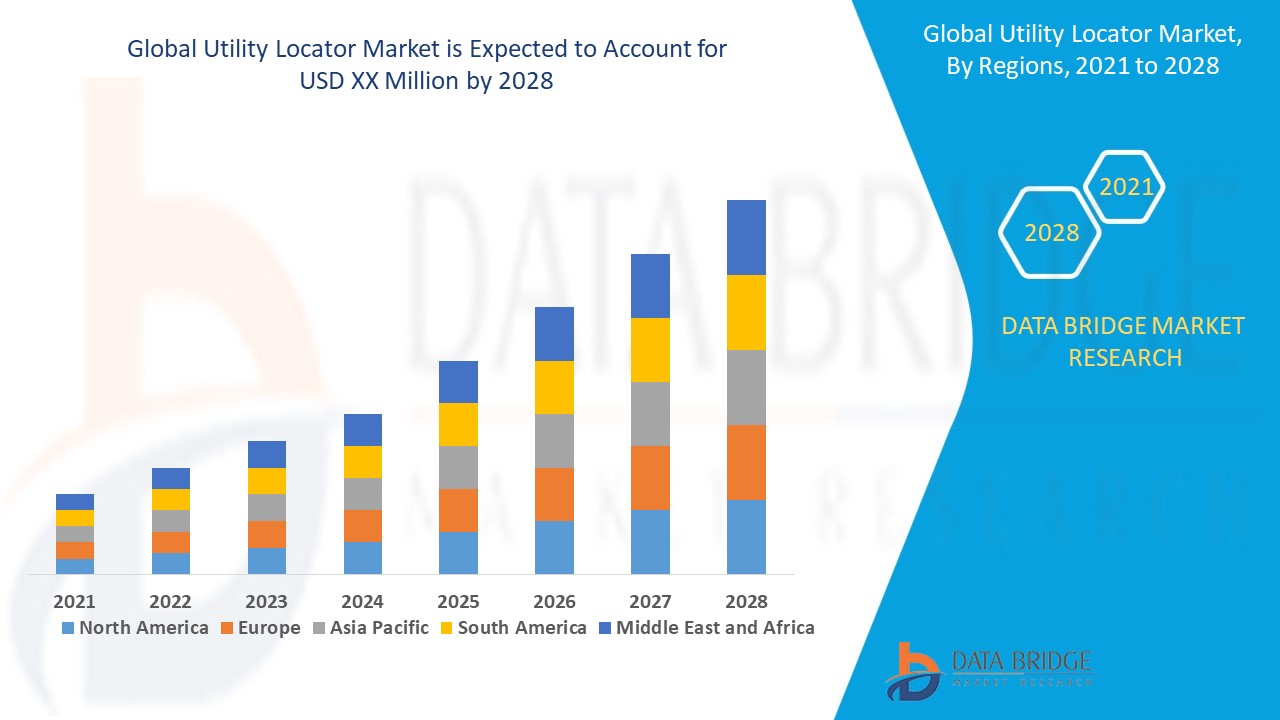

Utility Locator Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, techniques, offering, target, and end-user industry as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the utility locator market, primarily due to government initiatives focused on minimizing damage to pipelines and other utilities during infrastructure projects and remodeling efforts. The region’s strong emphasis on preventing costly and dangerous utility disruptions is driving the adoption of advanced utility locator technologies. In addition, growing concerns about public safety and the need for secure, efficient utility management are further fueling market growth. As urban development and infrastructure projects continue to expand, the demand for precise utility detection will remain a key driver in the region during the forecast period.

Asia-Pacific is expected to experience fastest growth in the utility locator market driven by the rapid pace of infrastructure development and ongoing construction activities across the region. With numerous countries investing heavily in modernizing infrastructure, the need for efficient utility detection technologies has become more critical. Furthermore, the increasing adoption of 5G technology in several nations will further boost the demand for precise utility location tools to support the installation and maintenance of 5G networks. As the region continues to expand its urban landscape and technological advancements, the utility locator market is poised for significant growth in the coming years.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Utility Locator Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Utility Locator Market Leaders Operating in the Market Are:

- Radiodetection Ltd. (U.K.)

- Vivax-Metrotech Corp. (U.S.)

- Guideline Geo. (Sweden)

- Emerson Electric Co. (U.S.)

- Charles Machine Inc. (U.S.)

- Sensors & Software Inc. (Canada)

- Leica Geosystems AG (Switzerland)

- 3M (U.S.)

- USIC LLC (U.S.)

- Multiview, Inc. (U.S.)

- OnTarget Group (U.S.)

- GSSI Geophysical Survey Systems, Inc. (U.S.)

- RHD Services. (U.S.)

- OneVision Utility Services. (U.S.)

- Sidewinder Utility Locators. (U.S.)

- US Radar (U.S.)

- Olameter (Canada)

Latest Developments in Utility Locator Market

- In July 2024, Leica Geosystems AG introduced the Leica DD300 CONNECT utility locator and Leica DA300 signal transmitter, offering a comprehensive and adaptable solution for utility locating. This advanced system is designed to integrate seamlessly with the Leica DX Shield software, providing advanced tracking capabilities and creating a unified platform for managing on-site activities and multiple devices

- In March 2024, Radiodetection Ltd. collaborated with Trimble Inc., a software and services company, to enhance the precision of utility workflows. The integration of Radiodetection’s RD Map application and high-precision locator products, combined with the Trimble Catalyst DA2 GNSS system, introduces an innovative software and hardware solution that optimizes utility locating, ensuring advanced measurement accuracy and facilitating the creation of detailed underground utility maps in a single field activity

- In October 2023, USIC, LLC partnered with broadband authorities and internet service providers (ISP) to secure the necessary utility locating support for the nationwide broadband rollout. Supported by USD 42.45 million from the Broadband Equity, Access, and Deployment (BEAD) Program over the next five years, USIC, LLC is working closely with broadband leaders to align utility locators with broadband expansion efforts and build a skilled workforce to meet the project goals

- In April 2022, Radiodetection Ltd. launched the 120CXB Metallic Cable Analyzer TDR, a high-precision time domain reflectometer (TDR) designed for quickly and efficiently identifying cable faults

- In September 2021, Guideline Geo launched the MALA Easy Locator Core, an efficient utility locating GPR solution that enables real-time data interpretation. The product helps locate and mark objects beneath the surface while also measuring their position

- In February 2021, Rigid Tool Company introduced the RIGID Seek Tech ST-305R, a powerful and flexible multi-frequency transmitter compatible with any RIGID SeekTech or NaviTrack receiver, designed for finding buried conductors

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Utility Locator Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Utility Locator Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Utility Locator Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.