Global Vegan Cosmetics Market

Market Size in USD Billion

CAGR :

%

USD

11.13 Billion

USD

19.12 Billion

2024

2032

USD

11.13 Billion

USD

19.12 Billion

2024

2032

| 2025 –2032 | |

| USD 11.13 Billion | |

| USD 19.12 Billion | |

|

|

|

|

Vegan Cosmetics Market Size

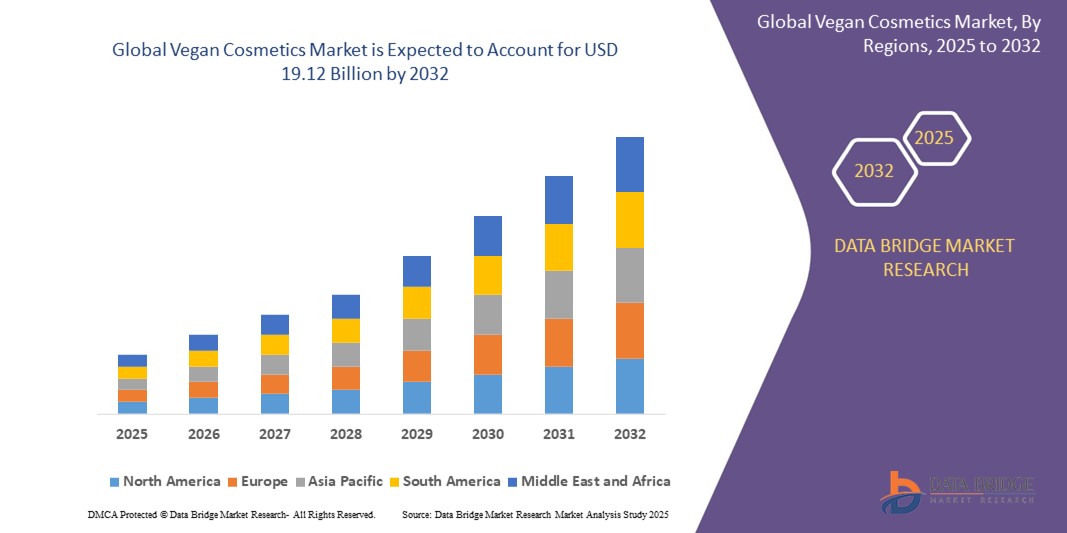

- The global vegan cosmetics market was valued at USD 11.13 billion in 2024 and is expected to reach USD 19.12 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 7.00%, primarily driven by increasing millennial and gen Z preferences

- This growth is driven by factors such as focus on health, sustainability, and ethical values

Vegan Cosmetics Market Analysis

- Vegan cosmetics are products formulated without animal-derived ingredients, catering to consumers who prioritize ethical, cruelty-free, and eco-friendly beauty solutions

- Market growth is driven by increasing consumer demand for natural beauty products, rising awareness of environmental sustainability, and a shift towards cruelty-free beauty standards

- Innovations in formulation, packaging, and sustainability practices are enhancing the appeal and effectiveness of vegan cosmetics, attracting a broader consumer base

- For instance, brands such as Fenty Beauty and Tarte Cosmetics are incorporating plant-based ingredients and eco-conscious packaging to cater to the growing vegan consumer market

- The vegan cosmetics market is expected to experience robust growth through 2025-2032, fueled by increasing consumer preference for ethical beauty products and a rise in environmental and health-conscious trends

Report Scope and Vegan Cosmetics Market Segmentation

|

Attributes |

Vegan Cosmetics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Vegan Cosmetics Market Trends

“Increasing Demand for Clean and Sustainable Ingredients”

- One prominent trend in the global vegan cosmetics market is the increasing demand for clean and sustainable ingredients

- This trend is driven by the rising consumer awareness of harmful chemicals in traditional beauty products, environmental concerns, and a shift towards healthier, ethical lifestyles

- For instance, brands such as Lush and Drunk Elephant are increasingly using plant-based, organic ingredients while ensuring their sourcing practices are environmentally friendly and sustainable

- The demand for clean and sustainable ingredients is also accelerating innovations in eco-friendly packaging, ingredient transparency, and plant-based formulations

- As consumers continue to prioritize sustainability and ingredient integrity, the focus on clean beauty is expected to remain a dominant trend, shaping product development and market growth

Vegan Cosmetics Market Dynamics

Driver

“Increasing Veganism and Plant-Based Lifestyles”

- The rise in veganism and plant-based lifestyles is a major driver of growth in the vegan cosmetics market, as more consumers seek beauty products that align with their ethical and dietary choices

- This shift is particularly strong in regions such as North America, Europe, and parts of Asia, where plant-based diets and cruelty-free values are becoming mainstream due to health, environmental, and animal rights concerns

- With growing awareness of the environmental impact of animal-derived ingredients and the benefits of plant-based alternatives, consumers are increasingly opting for vegan beauty products to support sustainability and ethical practices

- Innovations in plant-based formulations, sustainable sourcing, and eco-friendly packaging are further propelling the market, as brands aim to meet the demand for clean, ethical, and effective cosmetics

- Leading companies in the beauty industry are investing heavily in vegan formulations to cater to this growing trend

For instance,

- Fenty Beauty and Too Faced have expanded their vegan product lines to offer a wider range of makeup options without animal-derived ingredients

- The Body Shop and Kat Von D Beauty continue to emphasize their commitment to cruelty-free, vegan products, enhancing their market presence among conscious consumers

- As plant-based and vegan lifestyles continue to grow globally, this trend is expected to remain a key driver of the vegan cosmetics market in the coming years

Opportunity

“Rising Influencer and Celebrity Endorsements”

- The growing influence of social media influencers and celebrity endorsements presents a significant opportunity for the vegan cosmetics market. As public figures increasingly promote ethical, cruelty-free, and sustainable beauty products, the demand for vegan cosmetics is rapidly rising

- Influencers and celebrities are helping to shape consumer preferences, making vegan beauty products more mainstream and accessible to a wider audience. Their reach and credibility boost awareness of cruelty-free brands, encouraging consumers to choose products that align with their values

- This opportunity aligns with the increasing demand for transparency and authenticity in consumer products, with celebrities using their platforms to promote clean and ethical beauty alternatives

For instance,

- Rihanna's Fenty Beauty and Kim Kardashian's KKW Beauty have expanded their vegan product lines, gaining significant traction through social media engagement

- Emma Watson and Zoë Kravitz have been key advocates for cruelty-free and sustainable brands, further influencing their followers to embrace vegan beauty products

- As social media continues to drive trends and amplify celebrity endorsements, this opportunity is expected to support the ongoing growth of the vegan cosmetics market, creating new avenues for brand visibility and consumer loyalty

Restraint/Challenge

“Limited Ingredient Availability”

- Limited availability of certain plant-based ingredients poses a significant challenge in the vegan cosmetics market. As demand for vegan beauty products grows, the supply of high-quality, sustainable, and ethically sourced ingredients may struggle to keep pace

- Challenges such as the scarcity of rare or exotic plant extracts, fluctuating crop yields due to environmental factors, and the difficulty in scaling up production can impact the formulation of vegan cosmetics. This issue is especially critical for brands relying on unique ingredients to differentiate their products.

- This challenge is particularly pressing as the market for vegan beauty continues to expand, where continuous innovation in product development and formulation demands a consistent and reliable supply of ingredients

For instance,

- Companies such as Lush and RMS Beauty, which rely on organic plant-based oils and botanicals, face sourcing difficulties as demand for these materials increases globally

- If these ingredient supply challenges are not addressed through sustainable farming practices, innovation in sourcing, and partnerships with ethical suppliers, they could hinder market growth and limit the availability of vegan products in the long term

Vegan Cosmetics Market Scope

The market is segmented on the basis of product, packaging type, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Packaging Type |

|

|

By Distribution Channel |

|

Vegan Cosmetics Market Regional Analysis

“North America is the Dominant Region in the Vegan Cosmetics Market”

- North America dominates the vegan cosmetics market, driven by the increasing demand for ethical and cruelty-free products, especially among younger consumers

- U.S. holds a significant share due to its strong consumer base, advanced retail infrastructure, and growing preference for sustainable and vegan beauty products. In addition, the rising influence of social media and celebrity endorsements further boosts the demand for vegan cosmetics in the region

- With increasing investments in sustainable beauty and the expansion of vegan product lines by major brands, companies in North America are focusing on innovation in plant-based formulations, eco-friendly packaging, and cruelty-free certifications

- As North America continues to lead in consumer demand, influencer-driven marketing, and technological advancements in beauty formulations, the region is expected to maintain its dominant position in the vegan cosmetics market through the forecast period of 2025 to 2032

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia-Pacific is expected to witness the highest growth rate in the vegan cosmetics market, driven by increasing consumer awareness of ethical beauty and growing demand for sustainable products

- Countries such as China, Japan, South Korea, and India are at the forefront of regional growth, with a significant shift toward plant-based and cruelty-free beauty products, supported by rapid urbanization and rising disposable incomes

- The demand for vegan cosmetics is expanding as consumers in emerging markets such as Vietnam, Indonesia, and the Philippines embrace plant-based lifestyles and prioritize health-conscious beauty solutions

- With a focus on sustainable product sourcing, eco-friendly packaging, and expanding retail networks, Asia-Pacific is expected to experience rapid market growth and become a key player in the vegan cosmetics sector from 2025 to 2032

Vegan Cosmetics Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Gabriel Cosmetics (U.S.)

- MO MI BEAUTY (U.S.)

- Urban Decay (U.S.)

- Pacifica Beauty (U.S.)

- Beauty Without Cruelty (U.S.)

- Unilever (U.K.)

- Cover FX (U.S.)

- LVMH (France)

- PHB Ethical Beauty Ltd (U.K.)

- ColourPop Cosmetics (U.S.)

- Nutriglow Cosmetics (India)

- Emami Limited (India)

- MOSSA Certified Skincare (Latvia)

- Coty Inc. (U.S.)

- Debenhams (U.K.)

- KOSÉ Corporation (Japan)

- Natura&Co (Brazil)

- Shiseido Co, Limited (Japan)

Latest Developments in Global Vegan Cosmetics Market

- In March 2023, Fruit Works launched an innovative product line featuring vegan bath, body, and skincare product. This collection is distinguished by its use of a 100% natural fruit complex sourced from sugarcane, lemon, and orange, promising nourishing benefits. The brand emphasizes sustainability and health, appealing to environmentally conscious consumers seeking effective skincare solutions that harness the power of nature while avoiding synthetic ingredients

- In September 2022, Stella by Stella McCartney, a new beauty line created in collaboration with LVMH, debuted with a strong focus on eco-friendly principles. The collection features three primary products: Reset Cleanser, Alter-Care Serum, and Restore Cream, each reflecting McCartney's ethos of minimalism and sustainability. The brand emphasizes the use of essential ingredients, making it ideal for consumers seeking effective vegan skincare that aligns with their ecological values

- In September 2022, Raw Beauty Wellness, a U.S.-based beauty brand, introduced an exciting line of vegan skincare and haircare products. This range includes innovative items such as eye serum, antioxidant serum, exfoliating serum, and a prebiotic gel deodorant, along with a nourishing lip oil. The brand aims to offer luxurious, effective solutions for consumers looking to enhance their beauty routines with natural, cruelty-free alternatives that promote overall wellness

- In August 2022, Ashunta Sheriff, a prominent figure in the beauty industry, launched Ashunta Sheriff Beauty, a Black-owned brand dedicated to offering a cruelty-free and vegan beauty line. The collection features a variety of unique products, including browzing brow gel freeze and unicorn multichrome glitter shadow palette. This initiative aims to empower consumers with conscious beauty choices along with champions diversity and inclusivity within the cosmetics landscape

- In June 2022, in a strategic move to enhance its appeal among younger consumers, Plum, a well-known Indian cosmetics and skincare brand, appointed South Indian actress Rashmika Mandana as their brand ambassador. This partnership aims to strengthen Plum's presence in the Indian market, particularly among Gen Z and millennial demographics, while expanding its reach through various sales channels, thereby enhancing brand visibility and consumer engagement

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.