Industry 4.0, often referred to as the fourth industrial revolution, emphasizes the integration of digital technologies, automation, and data exchange into manufacturing processes. This transformation has led to smarter, more efficient, and highly automated systems, which directly impact grinding machinery. As manufacturing operations increasingly rely on smart technologies such as the Internet of Things (IoT), big data analytics, Artificial Intelligence (AI), and machine learning, the demand for grinding machinery that can seamlessly integrate with these systems has risen. Smart manufacturing allows for real-time monitoring, predictive maintenance, and continuous process optimization, ensuring that grinding machines operate at peak performance with minimal downtime.

IoT-enabled grinding machines can collect and transmit data on machine performance, enabling manufacturers to track variables such as temperature, vibration, and tool wear. This data can be analyzed to predict potential issues before they cause failures, leading to improved operational efficiency and reduced maintenance costs. Additionally, AI and machine learning algorithms can optimize grinding parameters, such as speed, pressure, and feed rates, ensuring that the machines operate within the most efficient parameters for each specific task.

Industry 4.0 also promotes greater flexibility and customization in manufacturing. Grinding machines are increasingly designed to be adaptive, allowing manufacturers to produce a wider range of components without needing extensive retooling or setup changes. This is particularly valuable for industries that require high levels of customization, such as aerospace and medical devices.

Access Full Report @ https://www.databridgemarketresearch.com/reports/global-grinding-machinery-market

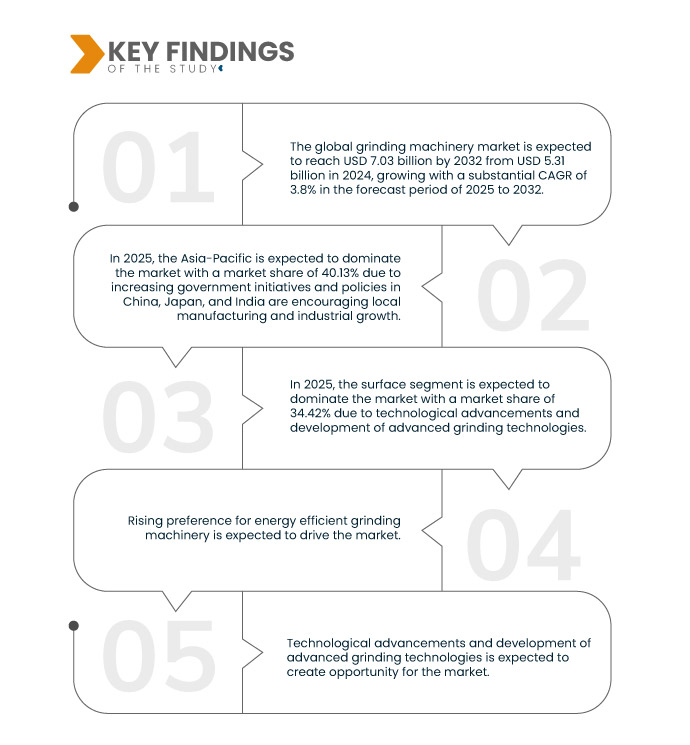

Data Bridge Market Research analyzes that Global Grinding Machinery Market is expected to reach USD 7.03 billion by 2032 from USD 5.31 billion in 2024, growing with a substantial CAGR of 3.8% in the forecast period of 2025 to 2032.

Key Findings of the Study

Rising Demand for High-Precision Tools

As industries such as aerospace, automotive, medical devices, and electronics push the boundaries of design and performance, the need for tools that can achieve extreme accuracy and tight tolerances has become increasingly crucial. This growing demand for high-precision tools directly impacts the grinding machinery market, as grinding is one of the primary methods used to achieve these exacting standards. In industries like aerospace, components such as turbine blades, engine parts, and structural elements require exceptional precision due to their complex shapes and critical performance requirements. Even the smallest deviation in size or surface finish can lead to failure, compromising safety and functionality. Grinding machinery is essential in these industries, providing the accuracy needed to produce parts that meet stringent specifications.

Similarly, the automotive sector demands high-precision components for advanced systems such as Electric Vehicles (EVs), transmissions, and high-performance engines. The trend towards miniaturization and the development of lightweight yet highly durable components further intensify the need for grinding technology capable of producing small, intricate parts with superior surface finishes. The medical device industry is another key contributor to the rising demand for high-precision tools. Surgical instruments, implants, and prosthetics require precise dimensions, smooth surfaces, and biocompatibility. Grinding machinery’s ability to work with various materials, including specialized alloys, and achieve fine finishes makes it an indispensable tool for manufacturers in this sector.

Report Scope and Market Segmentation

Report Metric

|

Details

|

Forecast Period

|

2025 to 2032

|

Base Year

|

2024

|

Historic Years

|

2018-2023 (Customizable from 2013 - 2017)

|

Quantitative Units

|

Revenue in USD Billion

|

Segments Covered

|

Type (Surface, Cylindrical, Gear, Tools & Cutter, and Other Grinding Machinery), Application (Automotive, Aerospace & Defense, Electrical & Electronics, Shipbuilding and Others), Distribution Channel (Offline and Online)

|

Countries Covered

|

U.S., Canada, Mexico, U.K., France, Germany, Spain, Italy, Netherlands, Turkey, Belgium, Russia, Switzerland, Rest of Europe, China, India, Japan, South Korea, Indonesia, Thailand, Philippines, Australia, Malaysia, Singapore, Rest of Asia-Pacific, Brazil, Argentina, Rest of South America, South Africa, Saudi Arabia, U.A.E, Egypt, Israel, Rest of Middle East and Africa

|

Market Players Covered

|

Rieter (Switzerland), AMADA MACHINERY CO., LTD. (Japan), Danobat (Spain), ANCA (Australia) , JAINNHER MACHINE CO., LTD. (Taiwan), KLINGELNBERG (Germany), EMAG Systems GmbH (Germany), Gleason Corporation (U.S.), KANZAKI KOKYUKOKI MFG. CO., LTD. (Jpan), Walter Maschinenbau GmbH(Germany), Kent Industrial USA, Inc.(U.S.), KNUTH Werkzeugmaschinen GmbH (Germany).

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

|

Segment Analysis

The global grinding machinery market is segmented into three segments based on type, application, and distribution channel.

- On the basis of type, the market is segmented into surface, cylindrical, gear, tools & cutter and other grinding machinery

In 2025, the surface segment is expected to dominate the global grinding machinery market

In 2025, the surface segment is expected to dominate the market with the market share of 34.42% due to the increasing demand for high-precision and smooth surface finishes in various industries, including automotive, aerospace, and manufacturing.

- On the basis of application, the market is segmented into automotive, aerospace & defense, electrical & electronics, shipbuilding, and other. In 2025, the automotive segment is expected to dominate the market with the market share of 33.79%

- On the basis of distribution channel, the market is segmented into offline and online

In 2025, the offline segment is expected to dominate the global grinding machinery market

In 2025, the offline segment is expected to dominate the market with the market share of 95.97% due to the established preference for direct purchasing experiences, where customers can physically inspect and test grinding machinery before deciding.

Major Players

Data Bridge Market Research Analyzes Rieter (Switzerland), AMADA MACHINERY CO., LTD. (Japan), Danobat (Spain), EMAG Systems GmbH (Germany), Gleason Corporation (U.S.), as the major players operating in the market.

Market Developments

- In January 2024, Rieter Group acquired Petit Spare Parts SAS, a French supplier of spare parts, yarn guides, spindles, and belts. This acquisition strengthens Rieter's after-sales business and enhances global service offerings through its extensive repair network

- In April 2022, Rieter completed the acquisition of three Saurer businesses on April 1, 2022, including the automatic winding machine business, Accotex, and Temco. The acquisition strengthens Rieter's position in the staple fiber market and enhances its product offerings

- In April 2024, the EMAG Group inaugurated a new plant in the San Isidro Business Park in Querétaro, Mexico. This expansion marks a significant milestone in EMAG's 20-year presence in the Mexican market, reinforcing the company's regional commitment

- In February 2024, The EMAG Group has launched its new sales company, EMAG Middle East, in collaboration with the International Free Zone Authority (IFZA) in Dubai. This expansion marks a significant move into the rapidly growing markets of Central Asia and the Middle East

- In October 2024, AMADA showcased new fiber laser machines with high-power oscillators At JIMTOF, EuroBLECH, and FABTECH 2024, expanding into new sectors. They also displayed advanced technologies in cutting, welding, grinding, and automation, demonstrating integrated solutions for future manufacturing

As per Data Bridge Market Research analysis:

Asia-Pacific is the dominating region in the global grinding machinery market

The Asia-Pacific region is currently dominating the global grinding machinery market. This leadership is primarily driven by significant industrial growth in countries such as China, India, and Japan. The expansion of the construction and automotive sectors in these nations has led to increased demand for grinding machinery across various industries, including aerospace and construction.

North America is the fastest growing region in the global grinding machinery market

The North America region is expected to be the fastest-growing market for the grinding machinery market. This growth is driven due to rising demand from industries such as automotive, aerospace, and electronics. Technological advancements, automation integration, and the need for high-precision components are driving growth. Additionally, strong investments in manufacturing and R&D further fuel market expansion.

For more detailed information about global grinding machinery market report, click here – https://www.databridgemarketresearch.com/reports/global-grinding-machinery-market