The growing global emphasis on sustainability and environmental responsibility is a major driver in the automated container terminal market. Ports and terminal operators are increasingly investing in automation technologies that reduce carbon emissions, improve energy efficiency, and support long-term environmental goals. Automated equipment such as electric Automated Guided Vehicles (AGVs), hybrid cranes, and smart energy management systems are replacing conventional diesel-powered machinery, significantly cutting fuel consumption and greenhouse gas emissions.

Furthermore, integration of digital monitoring tools and AI-driven analytics enables real-time optimization of equipment usage, minimizing idle time and energy waste. Global initiatives such as the International Maritime Organization’s (IMO) decarbonization targets and national green port programs are accelerating the adoption of clean technologies across terminal operations. As ports strive to align with net-zero objectives, the deployment of automated and electrified systems not only enhances operational efficiency but also strengthens compliance with environmental regulations—positioning sustainability as a key growth catalyst for the automated container terminal market.

Access Full Report @ https://www.databridgemarketresearch.com/reports/global-automated-container-terminal-market

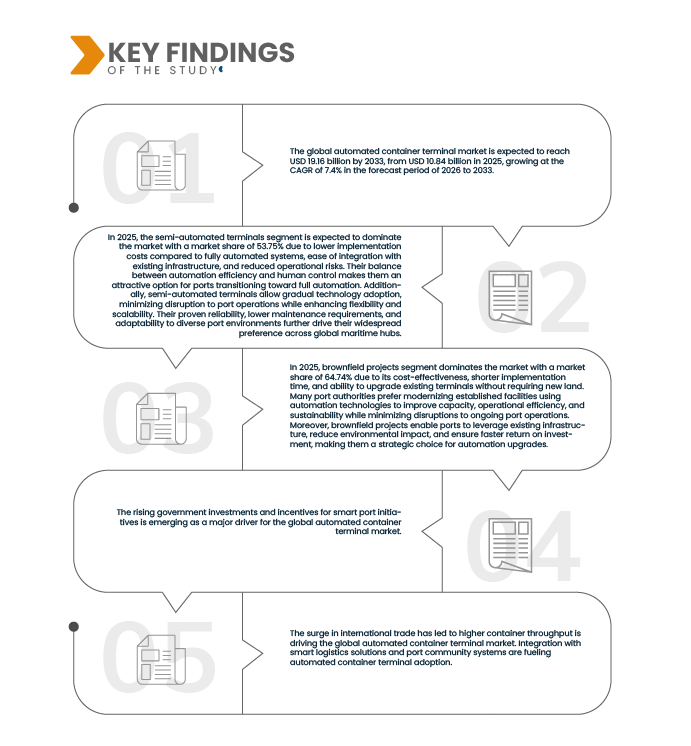

Data Bridge market research analyzes that Global Automated Container Terminal Market is expected to reach USD 19.16 billion by 2033 from USD 10.84 billion in 2025, growing with a substantial CAGR of 7.4% in the forecast period of 2026 to 2033.

Key Findings of the Study

Proliferation of Automation, Robotics, and AI in Port Operations

The global container-terminal industry is undergoing a significant technological transformation, driven by rising investments in automation, robotics, and Artificial Intelligence (AI). Port operators are increasingly deploying automated guided vehicles (AGVs), robotic stacking cranes, digital twin simulations, and AI-driven scheduling systems to improve precision, reduce manual intervention, and optimize throughput amid higher cargo volumes and greater operational complexity. These technologies help terminals streamline workflows, enable 24/7 operations, reduce labor-related disruptions, and enhance safety and environmental performance.

Thus, the proliferation of automation, robotics, and AI in port operations is fundamentally reshaping container terminals worldwide. By enabling higher throughput, reducing human error, improving safety, and supporting 24/7 operations, these technologies allow ports to handle growing trade volumes while optimising resource use and sustainability. Consequently, automation and AI are becoming indispensable components of modern port infrastructure, driving competitiveness, operational resilience, and the future of global maritime logistics.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2026 to 2033

|

|

Base Year

|

2025

|

|

Historic Years

|

2023 (Customizable to 2018-2022)

|

|

Quantitative Units

|

Revenue in USD Million

|

|

Segments Covered

|

By Degree of Automation (Semi-Automated Terminals, Fully Automated

Terminals), Project Type (Brownfield Projects, Greenfields Projects), Offering (Equipment, Software, Services), End-User (Public, Private), Distribution Channel (Direct Channel, Indirect Channel)

|

|

Countries Covered

|

U.S., Canada, Mexico, Germany, Netherlands, Belgium, United Kingdom, France, Italy, Spain, Russia, Turkey, Switzerland, Rest of Europe, China, Singapore, South Korea, Japan, India, Australia, Malaysia, Indonesia, Thailand, Philippines, Rest of Asia Pacific, Brazil, Argentina, Rest of South America, U.A.E., Saudi Arabia, South Africa, Egypt, Israel, Rest of Middle East & Africa

|

|

Market Players Covered

|

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, industry analysis & futuristic scenario, penetration and growth prospect mapping, competitor key pricing strategies, and technology analysis

|

Segment Analysis

The Global Automated Container Terminal Market is segmented into five notable segments based on degree of automation, project type, offering, end use ad distribution channel.

- On the basis of degree of automation, the market is segmented into semi-automated terminals, fully-automated terminals.

In 2025, the semi-automated terminals segment is expected to dominate the market

In 2025, the semi-automated terminals segment is expected to dominate the market with a market share of 53.75% due to lower implementation costs compared to fully automated systems, ease of integration with existing infrastructure, and reduced operational risks. Their balance between automation efficiency and human control makes them an attractive option for ports transitioning toward full automation. Additionally, semi-automated terminals allow gradual technology adoption, minimizing disruption to port operations while enhancing flexibility and scalability. Their proven reliability, lower maintenance requirements, and adaptability to diverse port environments further drive their widespread preference across global maritime hubs.

- On the basis of project type, the market is segmented into brownfield projects, greenfield projects.

In 2025, the brownfield projects segment is expected to dominate the market

In 2025, brownfield projects segment dominates the market with a market share of 64.74% due to its cost-effectiveness, shorter implementation time, and ability to upgrade existing terminals without requiring new land. Many port authorities prefer modernizing established facilities using automation technologies to improve capacity, operational efficiency, and sustainability while minimizing disruptions to ongoing port operations. Moreover, brownfield projects enable ports to leverage existing infrastructure, reduce environmental impact, and ensure faster return on investment, making them a strategic choice for automation upgrades.

- On the basis of offering, the market is segmented into equipment, software and services.

In 2025, the equipment segment is expected to dominate the market with a market share of 54.87% as increasing demand for automated cranes, guided vehicles, and stacking systems drives investments in advanced handling solutions. The focus on improving operational accuracy, reducing turnaround times, and minimizing labor dependency further accelerates equipment adoption in automated container terminals worldwide. Furthermore, continuous technological advancements, integration of AI and IoT for real-time monitoring, and growing emphasis on sustainability and energy-efficient machinery bolster the segment’s dominance.

- On the basis of end user, the market is segmented into public and private.

In 2025, the public segment is expected to dominate the market with a market share of 56.36% due to their role as national and regional trade gateways, handling the highest volumes of import–export cargo. These ports receive strong government backing and public funding, enabling large-scale capacity expansion and early adoption of automation and digital port technologies. Their open-access model attracts multiple shipping lines, logistics providers, and freight forwarders, driving higher throughput compared to private terminals. Additionally, public ports are often integrated into strategic trade corridors, making them central to global and intra-regional containerized trade flows.

- On the basis of distribution channel, the market is segmented into direct channel and indirect channel.

In 2025, the direct channel segment is expected to dominate the market

In 2025, the direct channel segment is expected to dominate the market with a market share of 68.41% because ports primarily engage directly with shipping lines, terminal operators, and logistics providers without intermediaries. This model enables better control over pricing, service customization, and long-term contractual agreements. Direct engagement also improves operational efficiency through real-time coordination, digital port community systems, and faster decision-making. Additionally, high infrastructure intensity and regulatory oversight naturally favor direct partnerships over third-party distribution structures.

Major Players

LIEBHERR Group, BECKHOFF AUTOMATION GMBH & CO. KG, Shanghai Zhenhua Heavy Industries Co., Ltd., Konecranes Plc, Kalmar Corporation, among others.

Market Developments

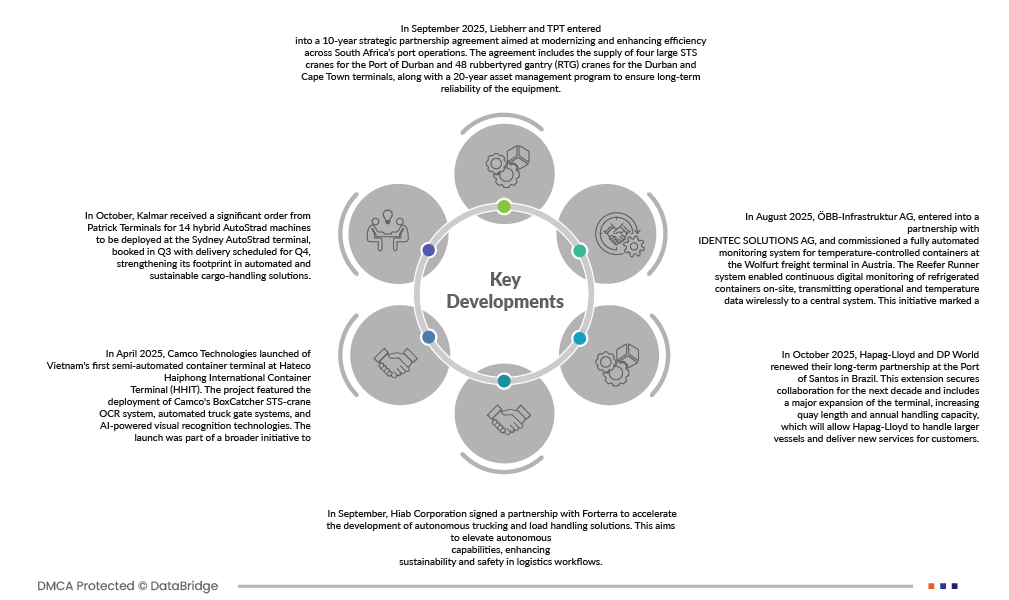

- In September 2025, Liebherr and TPT entered into a 10-year strategic partnership agreement aimed at modernizing and enhancing efficiency across South Africa’s port operations. The agreement includes the supply of four large STS cranes for the Port of Durban and 48 rubber tyred gantry (RTG) cranes for the Durban and Cape Town terminals, along with a 20-year asset management program to ensure long-term reliability of the equipment.

- In October, Kalmar secured a three-year Kalmar Care service contract with Noatum Ports Malaga Terminal in Spain, covering preventive and corrective maintenance for cranes, terminal tractors, and mobile equipment. The contract, booked in Q3 2025, began in September 2025, reinforcing Kalmar’s position in comprehensive terminal service solutions.

- In April 2025, Camco Technologies launched of Vietnam's first semi-automated container terminal at Hateco Haiphong International Container Terminal (HHIT). The project featured the deployment of Camco's BoxCatcher STS-crane OCR system, automated truck gate systems, and AI-powered visual recognition technologies. The launch was part of a broader initiative to modernize Vietnam's port infrastructure, with Camco's involvement highlighted during a state visit by the Belgian King and Queen.

- In September 2025, Hiab Corporation signed a partnership with Forterra to accelerate the development of autonomous trucking and load handling solutions. This aims to elevate autonomous capabilities, enhancing sustainability and safety in logistics workflows.

- In October 2025, Hapag-Lloyd and DP World renewed their long-term partnership at the Port of Santos in Brazil. This extension secures collaboration for the next decade and includes a major expansion of the terminal, increasing quay length and annual handling capacity, which will allow Hapag-Lloyd to handle larger vessels and deliver new services for customers.

- In November 2024, Shanghai Zhenhua Heavy Industries Co., Ltd. (ZPMC) entered into a strategic cooperation agreement with Cavotec SA, marking a significant step toward advancing sustainability and innovation in port and terminal infrastructure globally. This partnership combines ZPMC’s expertise in manufacturing heavy-duty port equipment with Cavotec’s specialized technologies in automation and electrification. Together, they aim to develop cutting-edge solutions that improve the efficiency and environmental performance of ports, such as reducing emissions through electrified equipment and enhancing operational automation. By leveraging the strengths of both companies, the collaboration seeks to support the global maritime industry’s transition toward greener, smarter, and more sustainable port operations.

- In December 2024, Konecranes completed the acquisition of Rotterdam-based Peinemann Port Services BV and Peinemann Container Handling BV after receiving approval from the Dutch competition authority. The acquisition, valued at an undisclosed amount, added approximately 100 employees and strengthened Konecranes' position in the Netherlands, particularly in the Rotterdam area.

Regional Analysis

Geographically, the countries covered in the Global Automated Container Terminal Market report are (U.S., Canada, Mexico, Germany, Netherlands, Belgium, United Kingdom, France, Italy, Spain, Russia, Turkey, Switzerland, Rest of Europe, China, Singapore, South Korea, Japan, India, Australia, Malaysia, Indonesia, Thailand, Philippines, Rest of Asia Pacific, Brazil, Argentina, Rest of South America, U.A.E., Saudi Arabia, South Africa, Egypt, Israel, Rest of Middle East & Africa).

As per Data Bridge Market Research analysis:

Asia-Pacific is the dominant region in the Global Automated Container Terminal Market during the forecast period of 2026 to 2033

Asia-Pacific is expected to dominate the market due to rapid expansion of port infrastructure, strong government investments in smart port technologies, increasing international trade volumes, and the presence of major economies such as China, Japan, and South Korea. Advanced automation adoption and rising maritime logistics demand further strengthen regional leadership. Additionally, supportive regulatory frameworks, rising focus on operational efficiency, and increasing private sector participation in port modernization projects further enhance Asia-Pacific’s dominance in the automated container terminal market.

Furthermore, Asia-Pacific is expected to grow fastest during the forecast period due to owing to surging containerized trade, digital transformation initiatives in port operations, increasing deployment of AI and IoT-based automation systems, and growing collaborations between technology providers and port authorities. Rising e-commerce activities and strategic coastal development projects also accelerate market expansion across the region.

Europe is anticipated to witness growth after Asia-Pacific in the Global Automated Container Terminal Market

Europe growth in the global automated container terminal market is driven by the increasing adoption of advanced port automation technologies, rising labor costs encouraging automation, and strong investments in upgrading aging port infrastructure. Additionally, the presence of key technology providers, growing trade activities, and emphasis on enhancing port efficiency and sustainability support market.

For more detailed information about the Global Automated Container Terminal Market report, click here – https://www.databridgemarketresearch.com/reports/global-automated-container-terminal-market