The rapid global shift toward renewable energy generation—encompassing solar, wind, hydropower, and emerging hybrid clean-energy systems—has become a critical catalyst propelling the demand for heavy-duty connectors. As utility operators, energy developers, and governments accelerate clean-energy capacity expansions, the need for high-reliability electrical interconnections has intensified across generation, transmission, storage, and power-conditioning infrastructure. Heavy-duty connectors play a pivotal role in ensuring safe, uninterrupted power transfer, signal communication, and equipment integration within environments exposed to extreme temperatures, vibration, moisture, UV radiation, and mechanical stress.

Across solar PV plants, connectors are essential for linking inverters, combiner boxes, monitoring systems, pitch control motors, and power distribution units. In wind energy systems, heavy-duty connectors support turbine nacelles, yaw drives, generators, control cabinets, lift systems, and condition-monitoring sensors—where robust IP-rated, vibration-resistant interconnects are indispensable. The rising deployment of offshore wind farms further strengthens the need for corrosion-resistant, high-current connectors engineered to meet marine-grade requirements. Likewise, grid-scale energy storage systems, battery management systems (BMS), and hybrid renewable microgrids increasingly rely on rugged connectors to maintain power stability and operational continuity.

For Instance,

- In January 2024, according to the International Energy Agency (IEA) reported that global renewable energy capacity additions grew by nearly 50% in 2023, the fastest rate seen in two decades, driven primarily by large-scale solar PV and wind installations.

- In February 2024, according to pv magazine, BloombergNEF projected those global solar installations would reach 627 GW in 2025, significantly increasing the demand for safe and efficient electrical interconnections within utility-scale solar parks.

- In March 2024, according to the Global Wind Energy Council (GWEC)’s global wind report 2024 announced that over 117 GW of new wind energy capacity was added worldwide in 2023, marking the strongest year on record and reinforcing high requirements for durable connectors in turbine systems.

- In February 2024, the U.S. Department of Energy highlighted that grid-scale energy storage capacity in the United States alone expanded by 81% year-on-year, necessitating more high-power connector interfaces for battery banks, inverters, and thermal management units.

- In November 2023, the European Commission confirmed EUR 60 billion in investments toward hybrid renewable energy systems and offshore wind infrastructure, further driving demand for corrosion-proof industrial connectors designed for maritime environments.

In addition, the global push for energy transition policies, decarbonization targets, and net-zero commitments is prompting unprecedented investment in renewable generation assets. As projects become larger and more technologically complex, operators require heavy-duty connectors that offer modularity, fast installation, improved serviceability, and compliance with stringent safety standards such as IEC, UL, and EN directives.

Thus, the accelerating expansion of renewable energy projects—across solar, wind, storage, and hybrid clean-energy systems—is substantially increasing the adoption of heavy-duty connectors globally. These connectors remain mission-critical for ensuring reliability, operational efficiency, and long-term durability in renewable energy infrastructures, positioning them as indispensable components in the world’s transition toward sustainable power generation.

Access Full Report @ https://www.databridgemarketresearch.com/reports/global-heavy-duty-connector-market

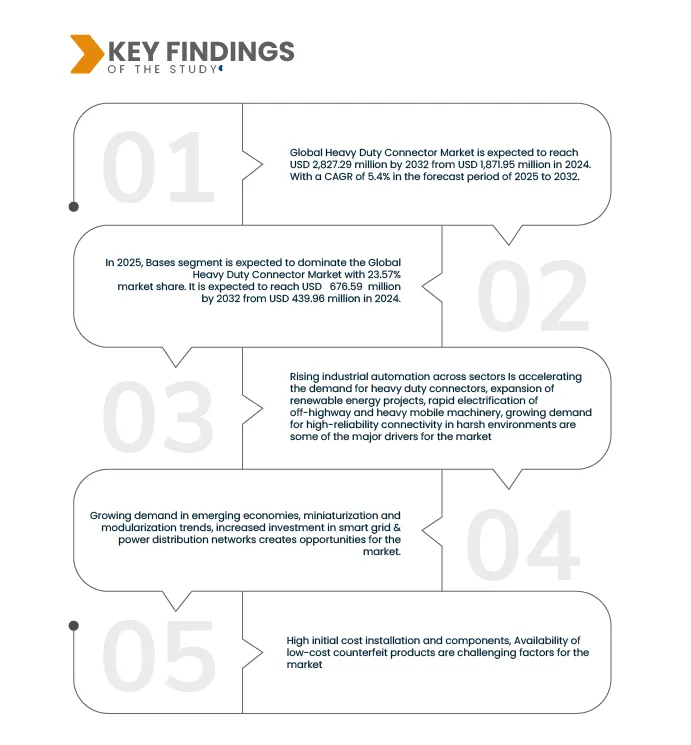

Data Bridge market research analyzes that Global Heavy Duty Connector Market is expected to reach USD 2.82 billion by 2032 from USD 1.87 billion in 2024, growing with a substantial CAGR of 5.4% in the forecast period of 2025 to 2032.

Key Findings of the Study

Miniaturization and Modularization Trends

The global shift toward miniaturization and modularization in industrial, transportation, and energy systems is creating significant opportunities for the heavy-duty connector market. As modern machinery and automation platforms become more compact, efficient, and performance-dense, manufacturers are increasingly demanding connectors that offer high power and signal integrity within smaller form factors. This trend is especially visible in robotics, factory automation, electric mobility, and compact power distribution units, where space-saving electrical architectures are becoming essential.

Modular heavy-duty connectors—designed with interchangeable inserts, mixed-signal capabilities, and flexible configuration options—allow OEMs to consolidate multiple electrical interfaces (power, data, pneumatic, fiber) into a single connection point. This reduces assembly time, improves space utilization, simplifies maintenance, and enhances design flexibility. Rapid adoption of Industry 4.0 systems, collaborative robots (cobots), compact EV platforms, and distributed renewable energy architectures is accelerating the demand for such highly customizable connector solutions.

Miniaturized heavy-duty connectors also enable higher circuit density without compromising durability. With advanced materials such as high-temperature thermoplastics, miniaturized contacts, high-density signal pins, and IP65–IP69K sealing technologies, manufacturers can integrate robust connectivity into increasingly compact industrial designs. These innovations help end users optimize equipment layout, reduce wiring complexity, and improve overall electrical efficiency in harsh or space-limited environments.

Modularization further supports scalability—allowing system integrators to upgrade, expand, or reconfigure machinery with minimal downtime. This makes modular connectors particularly attractive in sectors such as packaging machinery, industrial robots, rail signaling systems, telecom infrastructure, and offshore renewable installations. As industries move toward intelligent, compact, plug-and-play solutions, connector suppliers offering small, modular, and mixed-technology interfaces are positioned to see substantial demand growth.

For Instance,

- In September 2025, according to Amphenol, Amphenol’s heavy|mate® connector line (for automation & robotics) includes modular power + signal inserts, with up to 280 poles per connector, and rugged, compact thermoplastic or alloy housings rated for IP67/69K.

- In October 2025, according to a Wevolver article, TE’s H3A-TIC-LOQ system offers a high-density modular architecture (32 contacts) and a "twist-in" locking mechanism that is faster and more compact, helping reduce space and simplify assembly in robotic applications.

- In August 2024, according to MachineBuilding.net, Phoenix Contact’s push-in contact inserts for HEAVYCON (up to 100A) support a highly compact interface when combined with other modules (power + signal + data), implementing a space-saving modular connector.

- In November 2024, according to industrial production, an article reports that Phoenix Contact’s HC-M-MWF modular contact insert has a “function slot” for disconnecting or bridging circuits in the field, enabling control or protection functions via modular inserts rather than external hardware.

As miniaturization and modularization continue to reshape industrial connectivity, heavy-duty connectors that combine compact design with versatile, high-performance functionality are becoming critical enablers of next-generation systems. By delivering scalable, space-efficient, and robust solutions tailored to evolving automation, mobility, and energy needs, these connector innovations not only optimize equipment design and operational efficiency but also future-proof applications across diverse sectors. Consequently, manufacturers and suppliers embracing these trends are well-positioned to drive substantial growth and technological advancement in the heavy-duty connector market.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2025 to 2032

|

|

Base Year

|

2024

|

|

Historic Years

|

2023 (Customizable to 2018-2022)

|

|

Quantitative Units

|

Revenue in USD billion

|

|

Segments Covered

|

By Component (Bases, Hood, Female Insert, Male Insert, Housing, Cable Clamp, Cable Gland, Accessories, Others); Type (Rectangular Connector, Modular Connector); Material (Metal, Plastic); Termination Method (Crimping, Screw Termination, Soldering, IDC, Terminal Blocks, Push-In Connections, Clamp, Hybrid, Heat-Shrink Tubing Insulation, Wire-Wrapping); Voltage (Up To 500 V, 500-1000 V, Above 1000 V); Mounting Type (Surface/Panel Mount, Bulkhead Mount); Current (Up To 50 A, 50-100 A, 100-200 A, Above 200 A); Rating (IP Rating, NEMA Rating); Application (Production, Device and Systems Manufacturing, Power, Process Industry, Infrastructure, Construction Machinery, E-Mobility, Logistics, Medical / Healthcare, Agriculture, Semiconductor, Others), Distribution Channel (OEM, Aftermarket)

|

|

Countries Covered

|

North America

Europe

Asia-Pacific

Middle East And Africa

South America

|

|

Market Players Covered

|

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include Porter’s five forces analysis, brand comparative analysis, company evaluation quadrant, consumer behavior, funding details, industry analysis and futuristic scenario, inhouse implementation/outsourced implementation, new business & emerging business-revenue opportunities, penetration and growth prospect mapping, technology analysis, tariffs & impact, regulation coverage

|

Segment Analysis

Global Heavy Duty Connector market is categorized into ten notable segments which are based on component, type, material, termination method, voltage, mounting type, current, rating, application, distribution channel.

- On the basis of component, the global heavy duty connector market is segmented into bases, hood, female insert, male insert, housing, cable clamp, cable gland, accessories, others.

In 2025, the bases segment is expected to dominate the market

In 2025, the bases segment is expected to dominate the global Heavy Duty Connector market share of 23.57% due to its rising integration in industrial automation systems, growing adoption in harsh-environment applications, and increasing demand for durable interface solutions that enable secure mechanical support, stable connection architecture, and efficient modular assembly across manufacturing, automotive, and energy sectors.

- On the basis of type, the global heavy duty connector market is segmented into rectangular connector and modular connector.

In 2025, the rectangular connector segment is expected to dominate the market

In 2025, rectangular connector segment is expected to dominate the global Heavy Duty Connector market share of 63.69% due to its widespread compatibility with modular designs, superior space utilization, and high durability—making it ideal for applications requiring quick installation, high pin density, and reliable connectivity in industrial automation, transportation, robotics, and smart manufacturing environments.

- On the basis of material, the global heavy duty connector market is segmented into metal and plastic.

In 2025, the metal segment is expected to dominate the market

In 2025, the metal segment is anticipated to dominate the global Heavy Duty Connector market share of 66.41% due to its superior mechanical strength, resistance to extreme temperatures and corrosion, and high shielding capabilities against electromagnetic interference—making it the preferred choice for demanding applications in automotive, industrial automation, construction machinery, energy, and heavy equipment sectors.

- On the basis of termination method, the global heavy duty connector market is segmented into crimping, screw termination, soldering, IDC, terminal blocks, push-in connections, clamp, hybrid, heat-shrink tubing insulation, wire-wrapping.

In 2025, the crimping segment is expected to dominate the market

In 2025, the crimping segment is anticipated to dominate the global Heavy Duty Connector market share of 37.98% due to its high reliability, secure electrical contact, ease of installation, and suitability for mass production—making it a preferred termination method for automotive systems, industrial machinery, aerospace applications, and other high-vibration environments requiring robust and long-lasting connections.

- On the basis of voltage, the global heavy duty connector market is segmented into up to 500 V, 500-1000 V, above 1000 V.

In 2025, the up to 500 V segment is expected to dominate the market

In 2025, the up to 500 V segment is anticipated to dominate the global Heavy Duty Connector market share of 60.01% due to its suitability for a wide range of low- to medium-power industrial applications, increased demand for reliable power distribution in automation systems, and growing usage in machinery, robotics, material handling equipment, and energy-efficient manufacturing environments.

- On the basis of mounting type, the global heavy duty connector market is segmented into surface/panel mount, bulkhead mount.

In 2025, the surface/panel mount segment is expected to dominate the market

In 2025, the surface/panel mount segment is anticipated to dominate the global Heavy Duty Connector market share of 69.04% due to In 2025, the surface/panel mount segment is anticipated to dominate the global Heavy Duty Connector market with a 69.04% share due to its ease of installation, high structural stability, compatibility with compact device designs, and growing use in control panels, industrial machinery, transportation systems, and harsh-environment equipment requiring secure, fixed mounting configurations.

- On the basis of current, the global heavy duty connector market is segmented into up to 50 A, 50-100 A, 100-200 A, above 200 A.

In 2025, the up to 50 A segment is expected to dominate the market

In 2025, the up to 50 A segment is anticipated to dominate the global Heavy Duty Connector market share of 48.35% due to its extensive use in mid-power industrial applications, increased demand for compact and energy-efficient connectors, and suitability for machinery, automation equipment, and robotics that require dependable current transmission without excessive heat buildup.

- On the basis of rating, the global heavy duty connector market is segmented into IP rating and NEMA rating.

In 2025, the IP rating segment is expected to dominate the market

In 2025, the IP rating segment is anticipated to dominate the global Heavy Duty Connector market share of 69.06% due to the rising need for dustproof and waterproof connectors in harsh operating environments, increasing safety and regulatory requirements, and growing adoption across sectors such as manufacturing, transportation, energy, and construction where reliable protection against moisture, debris, and mechanical impact is critical for long-term performance.

- On the basis of application, the global heavy duty connector market is segmented into production, device and systems manufacturing, power, process industry, infrastructure, construction machinery, e-mobility, logistics, medical / healthcare, agriculture, semiconductor, others.

In 2025, the production, device and systems manufacturing segment is expected to dominate the market

In 2025, the production, device and systems manufacturing segment is anticipated to dominate the global Heavy Duty Connector market share of 32.77% due to the increasing deployment of automated production lines, rising demand for modular and high-performance connectors in machinery assembly, and the growing need for reliable connectivity solutions to support Industry 4.0 technologies, robotics, and smart factory operations.

- On the basis of distribution channel, the global heavy duty connector market is segmented into OEM, aftermarket.

In 2025, the OEM segment is expected to dominate the market

In 2025, the OEM segment is anticipated to dominate the global Heavy Duty Connector market share of 69.13% due to the increasing demand for customized connector solutions, rising investment in industrial automation by original equipment manufacturers, and the need for high-quality, durable components that ensure operational reliability, reduce downtime, and support scalable manufacturing processes.

Major Players

TE CONNECTIVITY (Ireland), MOLEX (U.S), HARTING Technology Group (Germany), Phoenix Contact (Germany), Amphenol Corporation (U.S.) among others.

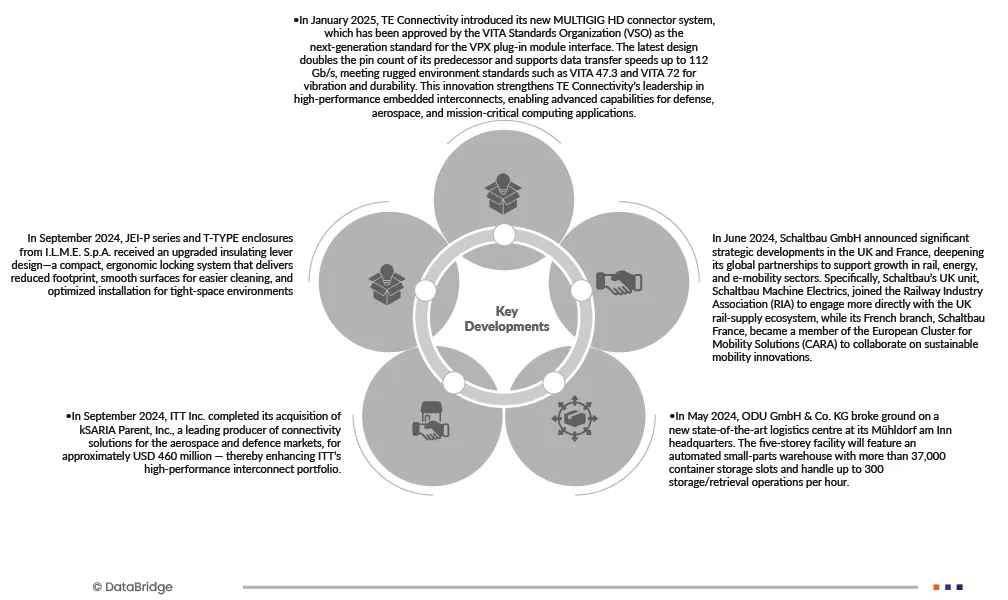

Latest Developments in Global Heavy Duty Connector Market

- In January 2025, TE Connectivity introduced its new MULTIGIG HD connector system, which has been approved by the VITA Standards Organization (VSO) as the next-generation standard for the VPX plug-in module interface. The latest design doubles the pin count of its predecessor and supports data transfer speeds up to 112 Gb/s, meeting rugged environment standards such as VITA 47.3 and VITA 72 for vibration and durability. This innovation strengthens TE Connectivity’s leadership in high-performance embedded interconnects, enabling advanced capabilities for defense, aerospace, and mission-critical computing applications.

- In March 2025, HARTING Technology Group introduced its new Han-Modular Domino modules, featuring a vibration-proof USB-C interface and supporting data transfer rates up to 20 Gbit/s, designed for compact industrial installations with improved space efficiency.

- In October 2025, Phoenix Contact introduced its new Click-in Modular Frames for heavy-duty connectors, featuring a tool-free assembly design that allows modules to be quickly and securely installed. The innovation enhances installation efficiency, flexibility, and reliability in industrial connection systems.

- In May 2024, Bulgin Limited announced the launch of its Standard Vitalis Buccaneer range — a sustainable evolution of its flagship Standard Buccaneer connectors. Built with up to 86% bio-based materials, the new connectors deliver the same rugged performance (IP68/IP69K sealing, up to 12A and 277V ratings) while reducing environmental impact. This development reflects Bulgin’s ongoing commitment to sustainability and innovation in eco-friendly connector technology.

- In September 2024, JEI®‑P series and T‑TYPE enclosures from I.L.M.E. S.p.A. received an upgraded insulating lever design—a compact, ergonomic locking system that delivers reduced footprint, smooth surfaces for easier cleaning, and optimized installation for tight‑space environments

As per Data Bridge Market Research analysis:

Geographically, the countries covered in the Global Heavy Duty Connector Market report are North America, Europe, Asia-Pacific, Middle East and Africa, South America. Europe is further segmented into Germany, U.K., France, Italy, Spain, Russia, Netherlands, Switzerland, Turkey, Belgium, Sweden, Poland, Denmark, Norway, Finland, Rest of Europe. The Asia-Pacific is further segmented into China, India, Japan, South Korea, Australia, Thailand, Indonesia, Malaysia, Philippines, Singapore, New Zealand, Taiwan, Hong Kong, Rest of Asia-Pacific. The North America is further segmented into U.S., Canada, and Mexico. The South America is further segmented into Brazil, Argentina, Colombia, Chile, Peru, Ecuador, Venezuela, Bolivia, Paraguay, Uruguay, Rest of South America. The Middle East and Africa is further segmented into Saudi Arabia, United Arab Emirates, South Africa, Egypt, Kuwait, Qatar, Oman, Israel, Bahrain, Rest of Middle East and Africa.

Asia-Pacific is the dominating country in Global Heavy Duty Connector Market

Asia-Pacific is the Global Heavy Duty Connector Market, driven by rapid industrialization, expanding manufacturing and automotive sectors, increasing investment in automation and smart factory technologies, and strong government support for infrastructure development and electrification initiatives.

Asia-Pacific is expected to be the fastest growing country in Global Heavy Duty Connector Market

Asia-Pacific is expected to witness significant growth in the Global Heavy Duty Connector Market, driven by rapid industrialization, urban expansion, increasing electricity consumption, and the flourishing production of electric vehicles and consumer electronics. Strong government initiatives to modernize power infrastructure, rising adoption of automation in manufacturing facilities, and substantial investments in renewable energy projects are creating robust demand for reliable connectivity solutions. Moreover, the presence of leading industrial, automotive, and steel manufacturing hubs in countries such as China, India, Japan, and South Korea further strengthens the region’s growth outlook and positions Asia-Pacific as a major contributor to the global heavy-duty connector market.

For more detailed information about the Global Heavy Duty Connector Market report, click here – https://www.databridgemarketresearch.com/reports/global-heavy-duty-connector-market