India has been actively positioning energy efficiency and building electrification as core levers in its efforts to reduce emissions, manage rising energy demand, and meet its climate pledges. Buildings, both residential and commercial, are increasingly seen not merely as static consumers of electricity and fuel but as dynamic systems whose design, envelope, services (HVAC, lighting, hot water, etc.), and controls can deliver substantial efficiency gains. With rapid urbanization, rising cooling loads, and increasing appliance ownership, the operational energy use of buildings has become a major driver of electricity demand growth. Policy, regulatory, and institutional reforms are now aligning in India to drive electrification of end‐uses (especially cooling, water heating, etc.), stricter building codes, mandatory energy performance standards, deployment of renewables in buildings, and smart controls building management systems. These trends are creating fertile conditions for growth in the building management system market, as efficiency gains depend heavily on instrumentation, monitoring, control, and optimization, which are often enabled only through digital or automated systems.

Access Full Report @ https://www.databridgemarketresearch.com/reports/india-building-management-system-market

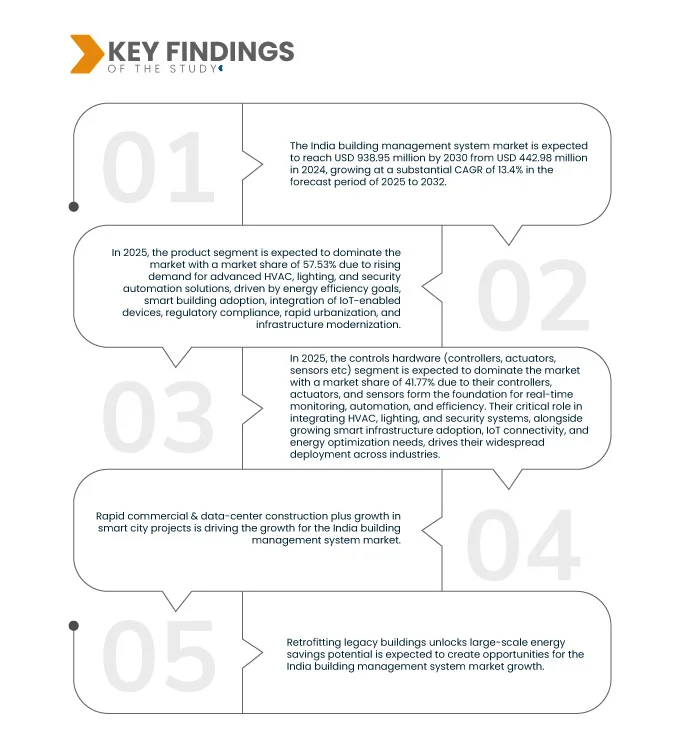

Data Bridge Market Research analyzes that the India Building Management System Market is expected to reach USD 938.95 million by 2030 from USD 442.98 million in 2024, growing at a substantial CAGR of 13.4% in the forecast period of 2025 to 2030.

Key Findings of the Study

Increasing Government Incentives and Building Codes for Green Buildings

India’s green building movement has been gaining unprecedented momentum as policymakers recognize the dual benefits of reducing carbon emissions and enhancing energy security. Government initiatives are now heavily focused on expanding green-building incentives, subsidies, and mandatory codes that encourage adoption of eco-friendly design, renewable integration, and energy-efficient technologies. From the enforcement of the Energy Conservation Building Code (ECBC) and Eco Niwas Samhita (ENS) to new schemes rewarding net-zero performance, these measures are reshaping how residential, commercial, and institutional buildings are designed and operated. By mandating compliance with green codes and incentivizing adoption through financial and recognition schemes, the government is stimulating demand for advanced digital controls, monitoring, and automation—key functions delivered through Building Management Systems (BMS), acting as a key growth driver for the building management market.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2025 to 2030

|

|

Base Year

|

2024

|

|

Historic Year

|

2023 (Customizable 2017-2023)

|

|

Quantitative Units

|

Revenue in USD Million

|

|

Segments Covered

|

Solution Type (Products, Services), Offering Type (Controls Hardware (Controllers, Actuators, Sensors Etc.), Installation & Commissioning, Services & Warranty / Managed Services, Software (Licenses & Development), Cabling & Networking), Project Type (Green Field and Retrofit), Control System Type (DDC and PLC)

|

|

Countries Covered

|

India

|

|

Market Players Covered

|

Honeywell International Inc. (U.S.), Siemens (Germany), Johnson Controls (Ireland), Schneider Electric (France), Delta Electronics, Inc. (Taiwan), ABB (Switzerland), Carrier (U.S.), Trane (Ireland), Azbil Corporation (Japan) among others

|

|

Data Points Covered in the Report

|

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and PESTLE analysis.

|

Segment Analysis

India building management system market is segmented into three notable segments which are based on solution type, offering type, project type, control system type.

- On the basis of solution type, the market is segmented into products, services

In 2025, the product segment is expected to dominate the India building management system Market

In 2025, the product segment is expected to dominate the market with a market share of 84.78% due to rising demand for advanced HVAC, lighting, and security automation solutions, driven by energy efficiency goals, smart building adoption, integration of IoT-enabled devices, regulatory compliance, rapid urbanization, and infrastructure modernization.

- On the basis of offering type, the market is segmented into controls hardware (controllers, actuators, sensors etc), installation & commissioning, services & warranty / managed services, software (licenses & development), cabling & networking

In 2025, the controls hardware (controllers, actuators, sensors etc) segment is expected to dominate the India building management system Market

In 2025, the controls hardware (controllers, actuators, sensors etc) segment is expected to dominate the market with a market share of 61.91% due to their controllers, actuators, and sensors form the foundation for real-time monitoring, automation, and efficiency. Their critical role in integrating HVAC, lighting, and security systems, alongside growing smart infrastructure adoption, IoT connectivity, and energy optimization needs, drives their widespread deployment across industries.

- On the basis of project type, the market is segmented into green field, retrofit. In 2025, the green field segment is expected to dominate the market with a market share of 77.11%

- On the basis of control system type, the market is segmented into DDC, PLC. In 2025, the DDC segment is expected to dominate the market with a market share of 57.31%

Major Players

Data Bridge Market Research analyzes Honeywell International Inc. (U.S.), Siemens (Germany), Johnson Controls (Ireland), Schneider Electric (France), Delta Electronics, Inc. (Taiwan) among others as the major market players of the India building management system market.

Market Developments

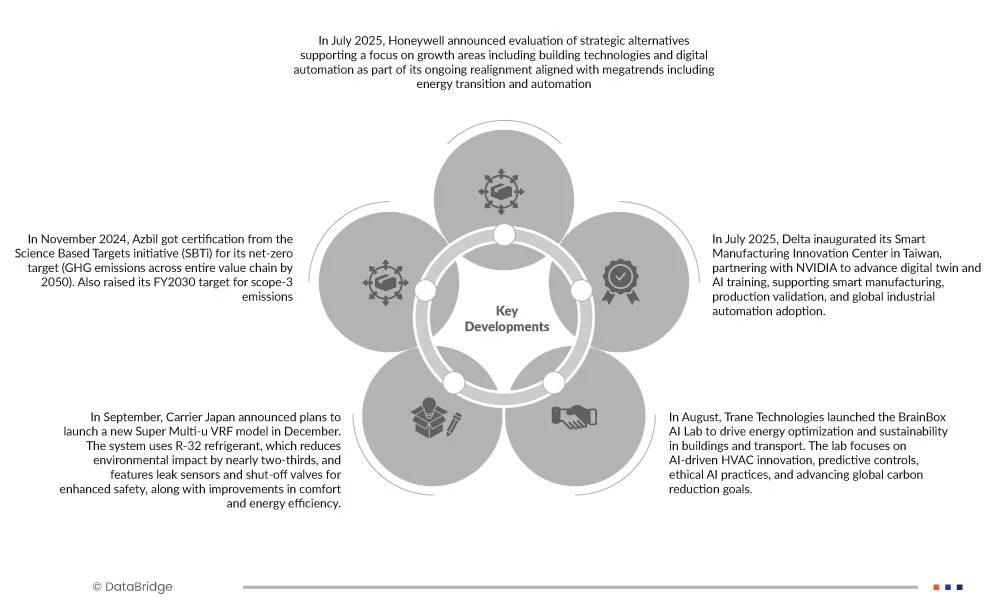

- In July 2025, Honeywell announced evaluation of strategic alternatives supporting a focus on growth areas including building technologies and digital automation as part of its ongoing realignment aligned with megatrends including energy transition and automation.

- In January 2024, Honeywell launched a ground breaking platform called Advance Control for Buildings that uses a building’s existing wiring for automation, cybersecurity, and faster network speeds, significantly enhancing operational efficiency and occupant experience. This marked a substantial leap in building controls innovation

- In May 2025, Siemens has released a comprehensive modernization roadmap for the Desigo building automation family, including Desigo Building Management, Pro Automation, and Room Automation systems. The guide outlines lifecycle phases, product updates, and migration strategies towards newer generations of controllers such as PXC 3rd Gen and emphasizes cloud connectivity and cybersecurity enhancements

- In September 2025, Johnson Controls released Metasys 14.0, a significant update to its industry-leading Building Automation System (BAS). This new version enhances user experience, network efficiency, flexibility, security, and energy management. It introduces a continual release model for deploying new features and supports IPv6 and seamless BACnet communications. This update is aimed at elevating building performance, sustainability, occupant comfort, health, and safety

- In July 2025, Delta inaugurated its Smart Manufacturing Innovation Center in Taiwan, partnering with NVIDIA to advance digital twin and AI training, supporting smart manufacturing, production validation, and global industrial automation adoption

As per Data Bridge Market Research analysis:

For more detailed information about the India building management system Market report, click here – https://www.databridgemarketresearch.com/reports/india-building-management-system-market